Looking for Success in India: Select the right target company for Merger & Acquisitions

By the benefits of working with clients across different industries, including the number of Indian companies – family owned, privately held and public – we have been able to gather understanding the details of implementing transactions or Merger & Acquisitions partnerships in India. Our main goal is ensuring that our clients can get a better deal. With a strong team of highly knowledgeable and skilled Merger & Acquisition (M&A) specialists, TechSci Research has effectively helped many companies in structuring and implementing a wide range of complex Merger & Acquisitions or deals.

Our advantages:

On ground knowledge of working with Indian clients – Mostly Indian companies are family owned – TechSci understands the importance of developing a long-term engagement and being their trustworthy partner.

Low risk – As a company, we have had the practice – over a period-of-time in dealing with post closure issues.

Significant emphasis on incoming deals – We have over 10 years of experience in helping international companies for Merger & Acquisitions with Indian companies.

We work as single transaction consultants to companies – from identifying, qualifying targets to structure and closing deals, and post-transaction integration.

Merger & Acquisition with a company across countries contains a substantial level of difficulty. TechSci’s transaction (Merger & Acquisitions) services have extremely skilled specialists with a successful track record for closing cross countries deal in Consumer Durables, Industrial, Pharma, Engineering, Auto Components, and many other business sectors.

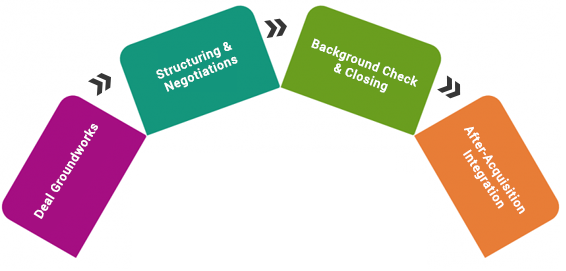

Our transaction process consists of 4 major steps:

Merger & Acquisitions /Joint Ventures process in detail:

- Understanding the business objectives of the planned transaction

- Establishing criteria for short-listing potential targets for Merger & Acquisitions / JV

- Early discussions with possible targets to check the willingness

- Preparing documents for investor

- Business valuation

- Negotiation & signing of the term sheet

- A representative of client interest while dealing with Intermediaries

- Coordinating background check/due diligence (legal, financial, cultural, Environmental etc.)

- Facilitating funding arrangement (if any)

- Negotiations between parties & signing SPA / SHA

- Closing of deals (Merger & Acquisitions)

- Post-closing integration issues