Customer Satisfaction Surveys & Research: How to Measure CSAT

Measuring customer satisfaction (CSAT) levels is no longer a choice, it is an imperative. In an increasingly competitive world, businesses can no longer afford to lose customers due to low level of satisfaction levels.

Studies reveal that the cost of acquiring a new customer is way higher than the cost of retaining an existing customer. A satisfied customer is a key to the survival and success of an enterprise. If a customer is satisfied, he will bring in more referrals and help build your brand in the market.

Incidentally, a large number of businesses today fail to measure the customer satisfaction levels. Most organisations understand the significance of this activity but somehow due to some reasons they tend to miss out on this critical aspect.

The customer satisfaction survey is intended to understand customers’ satisfaction levels with offered products, services, or experiences. High levels of customer satisfaction reflect why customer or client relish their experience to recreate those experiences in the future to boost sales and increase revenue. Customer satisfaction surveys are the best way to gauge how your customers feel and what has caused them to feel the same. However, customer feedback can be a nebulous task, but providing a framework for feedback can help you contrast and compare answers over time.

Why to measure customer satisfaction level?

Interacting with a customer gets you insights that can help improve your products and services to a great extent.

There may be a product or a service which you think is great but how will you know whether it makes a difference to an end-user or not. Often times, companies launch products that are not developed keeping an end-user in mind. They are packaged well, advertised aggressively but fail to survive in the markets. Why? Most times, the companies don’t even know how their target customer base perceives their products.

Keeping track of customer satisfaction levels, in such a scenario, should sit high atop the list of priorities for every organisation.

Over time, many organizations have become successful by utilizing the consumer database, which provides a pool of constant feedback to keep making progress. The products and services must align with consumer expectations for which customer satisfaction research is performed. This type of research provides insights about consumer demographics such as age, gender, income, purchasing behavior, etc. Besides, the consumer satisfaction research can also help marketers know the factors that prompt consumers to make a purchase and detect awareness about the organization’s products compared to others in the market.

How to do it?

When it comes to measuring customer satisfaction levels, the first thing that comes to our mind is to conduct a survey. Conducting a survey is undoubtedly a central activity and therefore it should not be just about some standard questionnaires.

AA holistic customer satisfaction program should cover all possible aspects of customer experience – the whole journey with each and every milestone that may have added value to a customer’s purpose of buying the specific product or service.

In order to develop a well-thought customer satisfaction programme, you should decide on the following aspects:

- What is the purpose of rolling-out the programme?

- How will the interviews be conducted?

- What all aspects will be covered?

- How will satisfaction be measured?

What is the purpose of rolling-out the programme?

Rolling-out a customer satisfaction programme is just one part of the whole process. However, before doing a launch, it is very important that the end objectives are defined clearly and well in advance.

A well-thought customer satisfaction programme incorporates a framework for not only the entire process of executing the plan but the possible ways through which customer feedback will be handled.

Who will be interviewed?

While there are some products and services which are chosen by individuals with little influence from others, there are things which are used by multiple members in a family or a group.

For instance, you can determine who should be interviewed to gauge satisfaction level on using a smart phone, but what about fruit jam? Who will you interview for the kind of commodities that are used by multiple people? The scenario in B2B companies will be even more different. There are several such questions on which TechSci Research can assist you in finding the answer.

How will the interviews be conducted?

Once the questionnaire is finalized, the next step should be to zero-in the various modes through which the interview could be conducted. Primarily, it boils down to three ways: telephonic, email or face-to-face. All the modes have their own pros and cons.

| Mode |

Ideal Applications |

Advantages |

Disadvantages |

| eMail Surveys |

- Where the customer base is spread out in a vast area

- Where users feel obliged to fill it in (e.g. research on public services such as transportation, utilities, etc.)

|

- Low cost

- Respondents have flexibility to fill out the survey in a given period

- Responses can be captured, collated and analysed easily

|

- Low response rates

- Unsatisfactory response to open-ended questions

- Attracts responses from outliers

|

| Face to face interviews |

- When the company seeks responses from key clients/customers

- Where customers are available in a select area

- Where the subject is relatively complex

|

-

Better responses

- Direct interaction with customers

- Desirable response to open-ended questions

|

- Cost is comparatively much higher than all the other modes

- Takes a longer time duration to complete

- The company may also have to face challenges in transcribing and collating the data

|

| Telephonic interviews |

- More prevalent for B2B industry

|

- Low cost

- Provides advantages of direct interaction

- Works for subjective questions as well

- Quick turnaround

|

- Respondents may not get all the instructions

- Chances of errors in interpretation

- Many people are not open for telephonic interviews

|

What all aspects will be covered?

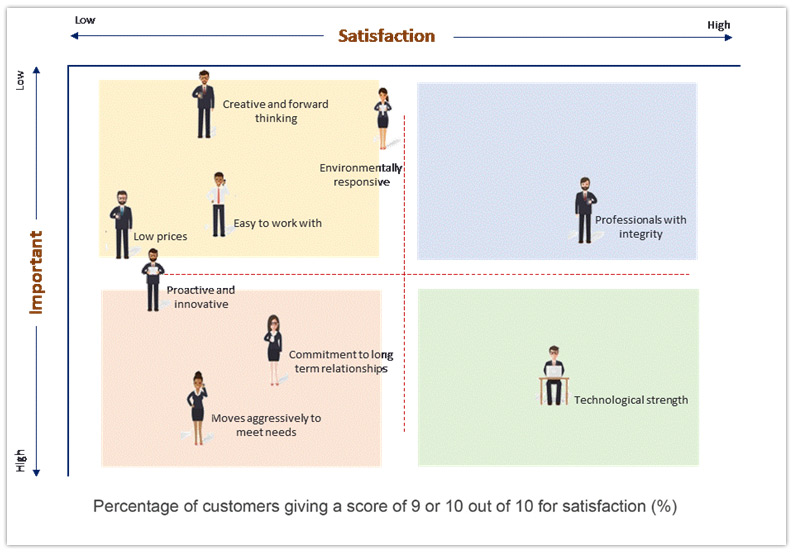

Depending upon the purpose of the customer satisfaction programme, the interviews should cover the key milestones in the customer journey: the product, the service, delivery, performance, pricing and company.

In order to execute a holistic customer satisfaction programme, it is vital for a company to cover all the major customer touchpoints.

| The product |

The service |

Delivery |

Performance |

Pricing |

The company |

- Quality & reliability

- Lifecycle

- Design

- Range

|

- Behaviour of sales and service staff

- Reliability of returning calls

- Friendliness of the sales staff

- Resolution of complaints

- Responsiveness to enquiries

- After sales service

|

|

- Performance of the product/service

|

- Market price

- Total cost of use

- Value for money

|

- Reputation of the company

- Ease of doing business

- Invoice clarity

- Invoices on time

|

How will satisfaction be measured?

Once the survey and interview results are acquired, the biggest question comes to the fore: how will satisfaction be measured?

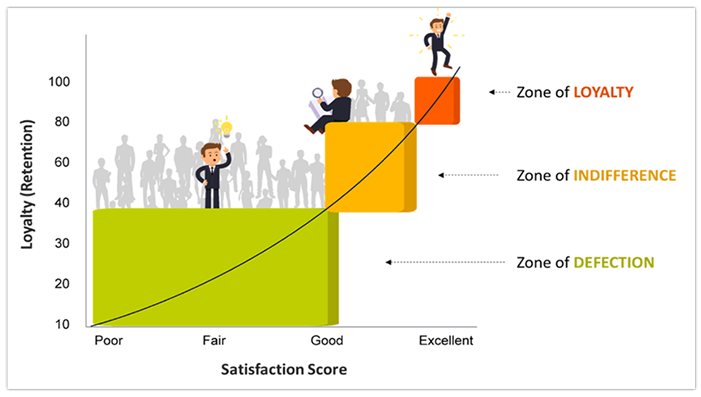

Customers express their satisfaction/ dissatisfaction in myriad ways. Often a happy customer may not post a positive feedback but come back to buy the same product/service again and again. Recurring purchases therefore indicate towards customer satisfaction.

However, many times it becomes troublesome to quantify the level of satisfaction. This is why, you may witness companies using a numeric scale to translate the results into meaningful analysis.

At TechSci we assist companies measure customer satisfaction in a comprehensive manner covering all possible aspects of a customer’s journey and his or her behaviour.

The scores derived from customer satisfaction surveys are utilised to create a Customer Satisfaction Index or CSI, which the company can evolve over a period of time. The whole approach takes long-term implications into account.

An example of how scores can be treated to derive objective conclusions

| Scores |

What This Means |

| Mean scores of over 8 out of 10 |

Market leader, excellent level of customer satisfaction |

| Mean scores of 7 to 8 out of 10 |

Adequate but needs improvement |

| Mean scores of below 7 out of 10 |

Calls for urgent attention and action. The company will almost certainly be losing market share to its competition |

Customer Satisfaction Questionnaire

Some of the common questions involved in customer feedback surveys are as follows.

- How often do you use our products/services?

- Which are the most valuable features of our products/services?

- How easy do you find our products/services to use?

- Do our products/services provide value for money?

- What are the new features that you would like to see in our products/services?

- What are the problems that you are trying to solve using products/services?

- How long have you been using the product/service?

- Which alternatives did you consider before purchasing this product?

- Did the product help you achieve your goals?

- What would you like to improve in the product?

Some of the demographic questions that you can add to the customer feedback survey are:

- What is your age?

- What is your gender?

- How old are you?

- What is your educational qualification?

- What is your employment status?

- What is your approximate household income?

- What is your marital status?

- What is your ethnicity?

- Where are you located?

- Where do you work, and what is your job title?

Psychographic customer feedback survey includes questions focused on psychological behaviors that cover inquiries related to:

- Attitudes towards a particular product/service

- Religious belief

- Political affiliations

- Likes and dislikes towards specific topics

- Personal reasons behind purchases

Customer convenience question examples include

- What are the features that you are looking for in a product?

- What benefits do you wish the product should offer?

- What requirements does the product accomplish?

- Does the product usage add convenience to your life in more than one way?

Questions asked to determine the purchasing pattern of the product include

- Who makes purchasing decisions in your household?

- Which channel do you prefer for purchasing the product?

- How frequently do you buy the product?

- How frequently do you buy the product?