|

Forecast Period

|

2026-2030

|

|

Market Size (2024)

|

USD 140.46 Million

|

|

Market Size (2030)

|

USD 214.48 Million

|

|

CAGR (2025-2030)

|

7.27%

|

|

Fastest Growing Segment

|

Vitamin

|

|

Largest Market

|

Abu Dhabi

|

Market Overview

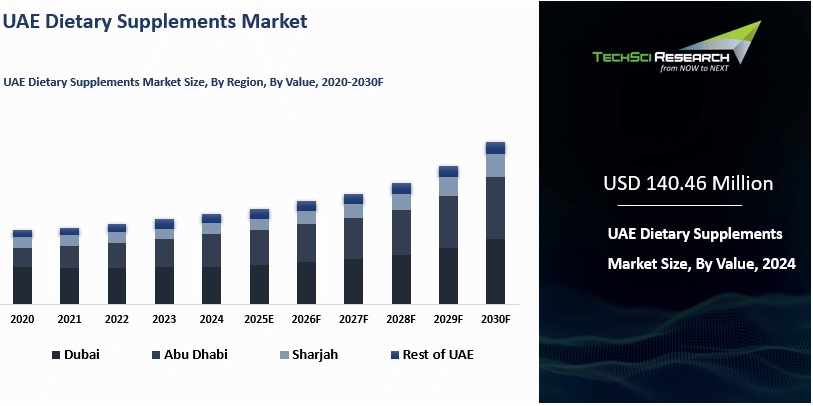

UAE Dietary Supplements Market was valued at USD 140.46 Million in 2024 and is anticipated to reach USD 214.48 Million by 2030, with a CAGR of 7.27% during 2025-2030.

The UAE Dietary Supplements Market is

primarily driven by factors such as increasing health consciousness among

consumers, rising disposable incomes, and growing awareness of preventive

healthcare measures. As individuals become more proactive about managing their

health and well-being, there is a growing demand for dietary supplements to

complement their diets and address specific health concerns. Lifestyle factors

such as hectic schedules, stress, and inadequate nutrition contribute to the

need for dietary supplements to bridge nutritional gaps and support overall

health. Endorsements from healthcare professionals, celebrity influencers, and

the availability of a diverse range of products further fuel market growth.

Download Free Sample Report

Key Market Drivers

Increasing Health Awareness

The UAE Dietary Supplements Market is propelled by a fundamental factor: the escalating awareness of health and wellness among consumers, best evidenced by the record-breaking 2,735,158 individuals who actively participated in the 2024 Dubai Fitness Challenge. This burgeoning consciousness stems from a collective recognition of the importance of maintaining optimal health, where initiatives like the "30x30" campaign encourage residents to complete 30 minutes of daily activity.

With individuals increasingly prioritizing their well-being, there is a notable shift towards proactive health management strategies. This paradigmatic change encourages consumers to explore various avenues to augment their overall health, including the incorporation of dietary supplements into their daily routines.

As consumers become more discerning about their health, they actively seek out solutions that align with their wellness objectives, particularly to address widespread concerns like vitamin D deficiency, which was identified in thousands of individuals across a major Abu Dhabi study involving 12,346 participants. Dietary supplements emerge as a viable option due to their accessibility, ease of use, and perceived benefits in supporting health goals.

Whether aiming to boost immunity, improve energy levels, or address specific nutritional deficiencies, consumers perceive dietary supplements as convenient tools to enhance their overall well-being. The pervasive availability of information through various channels contributes to this, while the physical expansion of retail giants like Life Pharmacy to over 500 outlets and the introduction of 25 new wellness-focused Zest Pharmacy locations across the region ensure these products are always within reach.

Rising Disposable Incomes

The UAE's economic prosperity and the concurrent

increase in disposable incomes have significantly reshaped consumer behavior,

particularly in the realm of health and wellness. In 2024, the per capita household disposable income in the United Arab Emirates is projected to reach USD 28,180 whereas total consumer spending in the United Arab Emirates is expected to amount to USD 210 billion in 2024. This newfound affluence has

empowered individuals with greater purchasing power, affording them the means

to prioritize their health and well-being like never before. As a result,

consumers are increasingly inclined to allocate a portion of their

discretionary income towards products and services that contribute to their

overall health and vitality.

Against this backdrop, dietary supplements have

emerged as a focal point for investment in personal health management. With

heightened awareness of the importance of preventive healthcare and proactive

lifestyle choices, consumers recognize the value of dietary supplements as

adjuncts to their wellness regimens. These supplements are viewed as

accessible, convenient, and effective tools for supporting various health

goals, ranging from bolstering immunity to enhancing energy levels and

addressing specific nutritional deficiencies.

The growing emphasis on

preventive healthcare practices encourages consumers to adopt a

forward-thinking approach to their well-being. Rather than waiting for health

issues to manifest, individuals are increasingly proactive in safeguarding

their health through measures such as regular exercise, balanced nutrition, and

dietary supplementation. In this context, dietary supplements serve as

proactive investments in long-term health, reflecting a shift towards a more

holistic and preventive approach to healthcare management.

Preventive Healthcare Trends

The transition towards preventive healthcare practices represents a fundamental shift in the way individuals approach their well-being in the UAE. Rather than adopting a reactive stance towards health management, consumers are embracing a proactive approach centered around preventive measures aimed at averting health issues before they arise, exemplified by the Department of Health – Abu Dhabi’s "Ifhas" program, which offers comprehensive periodic screenings for chronic conditions to Emiratis aged 18 and above. At the forefront of this paradigm shift is the growing recognition of the role that lifestyle modifications and dietary supplementation play in safeguarding and optimizing health outcomes, a necessity driven by national data indicating that approximately 74% of adults in the UAE are overweight and nearly 16% currently live with type 2 diabetes.

Central to this shift is the escalating demand for dietary supplements as integral components of preventive healthcare regimens. Dietary supplements are perceived as accessible and convenient tools for fortifying the body with essential nutrients, addressing potential nutritional gaps, most notably vitamin D deficiency, which affects over 80% of healthy adults according to a 2025 UAE meta-analysis, and supporting overall health and vitality. By proactively incorporating dietary supplements into their daily routines, consumers aim to bolster their immune systems, enhance energy levels, and optimize their physiological functions to ward off potential illnesses and maintain peak wellness, a trend supported by major healthcare platforms like PureHealth, which recorded 52 million clinical encounters in 2024 while shifting its strategic focus towards longevity and preventive care.

The emphasis on preventive healthcare practices reflects a broader societal awareness of the importance of holistic well-being and disease prevention. Consumers are increasingly cognizant of the impact of lifestyle factors such as diet, exercise, stress management, and sleep hygiene on their health outcomes. In response, they are taking proactive steps to cultivate healthy habits and mitigate risk factors associated with chronic diseases and lifestyle-related conditions, further encouraged by initiatives like the "Future Health" global program launched in November 2025 to advance longevity medicine and precision diagnostics..

Urbanization and Changing Lifestyles

Urbanization and shifting lifestyles in the UAE

herald a new era of health challenges characterized by sedentary routines,

bustling schedules, and a rapid pace of life. Amidst this urban landscape,

dietary imbalances and nutritional deficiencies have become increasingly

prevalent, posing significant health concerns for individuals across the

country. In the UAE, protein supplements are the most commonly used dietary supplements, followed by multivitamins. According to studies, between 37.8% and 51.3% of the UAE population uses dietary supplements. The transition towards urban living often entails a departure from traditional

dietary patterns, with convenience often trumping nutritional quality in food

choices.

Sedentary habits compounded by desk-bound jobs and

limited physical activity contribute to a decline in overall metabolic health

and increase the risk of chronic diseases. According to a study on the prevalence of chronic diseases among United Arab Emirates University students, 23.0% of the students reported having chronic conditions. The most common chronic diseases were obesity (12.5%), diabetes (4.2%), and asthma/allergies (3.2%). On the other hand, 11.8% of the UAE's population was affected by diabetes in 2021. Similarly, hectic schedules leave

little time for meal preparation and mindful eating, leading to reliance on

fast food and processed meals that are often lacking in essential nutrients. 34.8% of the students were either overweight or obese according to a study on the prevalence of chronic diseases among United Arab Emirates University students.

The

ubiquity of convenience foods and pre-packaged meals further exacerbates

dietary imbalances, as these offerings are typically high in calories, sugars,

and unhealthy fats while lacking in vital vitamins and minerals. In response to

these challenges, consumers in the UAE are increasingly turning to dietary supplements

as a means of addressing nutritional gaps and ensuring adequate intake of

essential nutrients. Dietary supplements offer a convenient and practical

solution to supplement diets that may fall short in meeting daily nutritional

requirements. Whether in the form of multivitamins, mineral supplements, or

specialized formulations targeting specific health needs, dietary supplements

provide a valuable source of essential nutrients that may be lacking in the

diet.

Key Market Challenges

Regulatory Compliance and Standards

One of the primary challenges in the UAE Dietary

Supplements Market revolves around regulatory compliance and adherence to

stringent standards. The market is governed by regulations set forth by regulatory

bodies such as the Emirates Authority for Standardization and Metrology (ESMA)

and the Ministry of Health and Prevention (MOHAP). Compliance with these

regulations, including product registration, labeling requirements, and

ingredient specifications, can pose challenges for manufacturers and

distributors. Ensuring that dietary supplements meet the necessary regulatory

requirements while maintaining product efficacy and quality standards requires

substantial investments in compliance infrastructure and expertise.

Consumer Awareness and Education

Despite the growing popularity of dietary

supplements in the UAE, there remains a significant gap in consumer awareness

and education regarding their appropriate usage, safety, and efficacy. Many

consumers may lack understanding about the role of dietary supplements in

supporting overall health and wellness, leading to misconceptions or misuse of

these products. Educating consumers about the benefits, potential risks, and

proper usage of dietary supplements is essential for fostering informed

decision-making and promoting responsible consumption. However, achieving

widespread consumer education requires concerted efforts from regulatory

authorities, industry stakeholders, healthcare professionals, and consumer advocacy

groups.

Key Market Trends

Expansion of Retail Channels

The proliferation of retail channels in the UAE, spanning pharmacies, supermarkets, health food stores, and online platforms, has significantly transformed the accessibility landscape of dietary supplements for consumers across the country. This expansion represents a pivotal development in the market dynamics, democratizing access to dietary supplements and empowering consumers with unprecedented choice and convenience.

Pharmacies, long regarded as trusted sources of healthcare products and services, have emerged as key retail destinations for dietary supplements, with Life Pharmacy targeting 1,500 operational outlets by the end of 2025 to solidify its leadership, while Aster Pharmacy continues to expand its network of over 300 locations and 2,025 knowledgeable pharmacists across the region. With their widespread presence in urban centers and communities, pharmacies provide a convenient avenue for consumers to access a diverse range of dietary supplements under one roof. The presence of knowledgeable pharmacists facilitates informed decision-making, enabling consumers to seek guidance on product selection and usage.

Supermarkets, renowned for their extensive product offerings and competitive pricing, have also emerged as prominent players in the dietary supplements market. The inclusion of thousands of dietary supplements, with Lulu Hypermarket now listing over 7,900 beauty and wellness products alongside groceries and household essentials, enhances the visibility and accessibility of these products, catering to the needs of consumers seeking convenience and variety during their shopping trips.

Health food stores, specializing in natural and organic products, cater to the preferences of health-conscious consumers seeking premium-quality dietary supplements. These specialized outlets, led by Dr. Nutrition’s network of over 250 branches and Holland & Barrett’s ongoing expansion of 50 new stores in 2025, offer a curated selection of supplements tailored to specific health goals and dietary preferences, catering to niche segments of the market seeking alternative and holistic wellness solutions.

Health and Wellness Trends

The burgeoning emphasis on health and wellness in

the UAE has been propelled by a multifaceted cultural shift, bolstered by the

pervasive influence of social media influencers, wellness bloggers, and

celebrity endorsements. This convergence of factors has fostered a seismic

transformation in consumer attitudes towards health, catalyzing a paradigm

shift where prioritizing well-being has become an intrinsic component of

lifestyle choices.

Social media platforms serve as powerful catalysts

for disseminating health and wellness-related content, shaping consumer

perceptions, and influencing purchasing decisions. Wellness influencers and

bloggers leverage their digital platforms to share personal narratives,

wellness tips, and product recommendations, garnering a loyal following of

health-conscious individuals seeking guidance and inspiration on their wellness

journey. Similarly, celebrity endorsements lend credibility and visibility to

dietary supplements, positioning them as coveted lifestyle accessories endorsed

by trusted personalities. In this dynamic landscape, health and wellness have

transcended mere trends to become entrenched aspects of modern living.

Consumers aspire to embody the ideals of holistic well-being, encompassing

physical, mental, and emotional dimensions of health. Against this backdrop,

dietary supplements have emerged as indispensable tools for supporting and

enhancing wellness goals, serving as conduits for optimizing health outcomes

and achieving peak vitality.

Segmental Insights

Product Type Insights

Based on the Product Type, Vitamins

hold a paramount position in the UAE Dietary Supplements Market, commanding

dominance and exerting a profound influence on consumer choices and industry

dynamics. This dominance can be attributed to several key factors that

underscore the essential role of vitamins in supporting overall health and

wellness in the UAE. Vitamins are

indispensable micronutrients that play fundamental roles in various

physiological functions, ranging from immune support and energy metabolism to

skin health and cognitive function. These essential nutrients are required in

small quantities but are crucial for maintaining optimal health and vitality.

In a fast-paced and increasingly urbanized society like the UAE, where hectic

lifestyles and dietary imbalances are prevalent, the need for supplemental

vitamins becomes paramount.

The UAE's multicultural

population encompasses individuals with diverse dietary habits, lifestyles, and

nutritional needs. Despite the abundance of food options in the UAE, dietary

patterns may not always provide adequate amounts of essential vitamins, leading

to potential nutrient deficiencies. Factors such as busy schedules, reliance on

convenience foods, and cultural dietary practices may contribute to gaps in

nutrient intake, necessitating the supplementation of vitamins to bridge these

nutritional gaps.

End User Insights

Based on the End User segment,

Adults dominated the UAE Dietary Supplements Market for a multitude of reasons,

reflecting their diverse health needs, proactive approach to wellness, and

cultural influences shaping consumption patterns. Several factors contribute to

the prominence of adults in driving demand and shaping trends within the

market. Adults constitute the largest and most diverse demographic segment in

the UAE, encompassing individuals across a wide age range, from young adults to

seniors. This demographic diversity translates into varied health needs and

preferences, driving demand for a broad spectrum of dietary supplements

tailored to address specific concerns and goals. Whether seeking to support

immune health, boost energy levels, or manage chronic conditions, adults rely

on dietary supplements as integral components of their health and wellness

regimens.

Adults in the UAE exhibit a

heightened awareness of health and wellness issues, driven by factors such as

increasing education levels, access to information through digital platforms,

and exposure to global health trends. With a growing emphasis on preventive

healthcare and self-care practices, adults proactively seek out dietary

supplements as part of their holistic approach to maintaining optimal health

and vitality. This proactive mindset is particularly pronounced among

urban-dwelling adults, who prioritize wellness-enhancing strategies amidst the

demands of modern life.

The dietary supplement preferences of adults are

influenced by lifestyle factors such as diet quality, physical activity levels,

and environmental stressors. Despite the abundance of food options in the UAE,

dietary patterns may not always provide adequate amounts of essential

nutrients, leading adults to turn to supplements to fill nutritional gaps and

ensure comprehensive health support. Whether adopting plant-based diets,

following restrictive eating patterns, or facing dietary restrictions due to

health conditions, adults seek out supplements to complement their dietary

choices and optimize nutritional intake.

.png)

Download Free Sample Report

Regional Insights

Abu Dhabi emerged as a dominant force in the UAE

Dietary Supplements Market, propelled by several key factors that underscore

its unique position and influence within the market landscape. From its robust

healthcare infrastructure to its affluent consumer base and strategic geographic

location, Abu Dhabi possesses distinct advantages that contribute to its

dominance in driving demand and shaping trends within the dietary supplements

sector.

Abu Dhabi boasts a world-class healthcare

infrastructure characterized by state-of-the-art medical facilities, renowned

healthcare institutions, and advanced healthcare services. As the capital city

of the UAE, Abu Dhabi is home to leading hospitals, clinics, and wellness

centers equipped with cutting-edge technologies and staffed by highly skilled

healthcare professionals. This comprehensive healthcare ecosystem fosters a

conducive environment for the promotion and distribution of dietary

supplements, with healthcare providers often recommending and prescribing

supplements as adjuncts to conventional medical treatments. Abu Dhabi's

affluent consumer base and high purchasing power position it as a lucrative

market for dietary supplements. With a significant portion of the population

comprising affluent residents, expatriates, and international visitors, Abu

Dhabi residents have the financial means to invest in their health and

wellness. This demographic profile translates into a strong demand for

premium-quality supplements, organic and natural products, and innovative

formulations catering to diverse health needs and lifestyle preferences.

Recent Developments

- In July 2024, Bioniq closed a USD 15 million Series B round to support growth in the UAE and the Middle East. The funding, led by HV Capital and Unbound, valued the company at USD 75 million. The capital will support global reach, product development with expanded lab integrations, operations and staffing in the US and the Middle East, and a corporate platform for medical, wellness, and athletic partners. The move builds on partnerships with Abu Dhabi’s Department of Culture and Tourism, Metabolic, and Al Borg Diagnostics.

- In June 2024, KEZAD Group and Astha Biotech signed a AED 44 million agreement to build a microalgae production facility in Al Ain. The 38,000 square meter site will capture up to 1,000 metric tonnes of CO2 each year to cultivate Spirulina, Haematococcus pluvialis, and Chlorella using closed culture systems and photobioreactors. The project will support dietary supplements, health, cosmetics, food, and aquaculture applications and employ 30 skilled workers. Early production will focus on supplements using methods with higher carbon absorption than forests or corn fields.

- In December 2024, BiOkuris signed an exclusive agreement with Amdis Health Sciences for UAE distribution of BK001. The gastrointestinal product combines fungal chitin-glucan with simethicone and will launch under a private label targeting more than 3 million patients. Market entry is planned for Q4 2025, supporting BiOkuris’ plan to expand its reach with the UAE acting as a base for wider international growth.

- In July 2024, Bioniq, an AI-driven personalised supplements company with a strong presence in the UAE, raised $15 million in a Series B funding round. The funding aimed to support the company’s global expansion, including growth across the UAE and the Middle East.

- In November 2024, MIRAILAB BIOSCIENCE Inc., a Tokyo-based biotechnology firm renowned for pioneering the commercialization of β-Nicotinamide Mononucleotide (β-NMN) supplements, announced the launch of its “MIRAI LAB” brand in the United Arab Emirates (UAE). This strategic expansion introduces a range of high-purity NMN supplements and cosmetics to the UAE market, catering to the growing demand for anti-aging and wellness products.

- In June 2024, Khalifa Economic Zones Abu Dhabi (KEZAD Group) and UAE-based Astha Biotech signed a lease agreement to establish a pioneering microalgae production facility in KEZAD Al Ain. This initiative marks the launch of the UAE's first company dedicated to producing microalgae with applications across health, cosmetics, food, and aquaculture industries.

Key Market Players

- Bayer Middle East FZE

- Nestlé Middle East FZE

- New Country Healthcare LLC

- Abbott Laboratories S.A.

- Ultramade Nutrition and

beverages Factory

- Quest Vitamins Middle East FZE

- MicroSynergy Pharmaceuticals

FZCO

- Geltec Pharmacare FZCO

- Pharmatrade LLC

- Medysinal FZCO

|

By Product Type

|

By Form

|

By Distribution Channel

|

By Application

|

By End User

|

By Region

|

- Vitamin

- Combination Dietary Supplement

- Herbal Supplement

- Fish Oil & Omega Fatty Acid

- Protein

- Others

|

- Tablets

- Capsules

- Powder

- Liquids

- Soft Gels

|

- Pharmacies and Drug Stores

- Supermarkets and Hypermarkets

- Online

- Others

|

- Energy & Weight Management

- General Health

- Bone & Joint Health

- Immunity

- Others

|

- Infants

- Children

- Adults

- Pregnant Females

- Geriatric

|

- Abu Dhabi

- Dubai

- Sharjah

- Rest of UAE

|

Report Scope:

In this report, the UAE Dietary Supplements Market has

been segmented into the following categories, in addition to the industry

trends which have also been detailed below:

- UAE Dietary Supplements Market, By Product Type:

o Vitamin

o Combination Dietary Supplement

o Herbal Supplement

o Fish Oil & Omega Fatty Acid

o Protein

o Others

- UAE Dietary Supplements Market, By Form:

o Tablets

o Capsules

o Powder

o Liquids

o Soft Gels

- UAE Dietary Supplements

Market, By

Distribution Channel:

o Pharmacies and Drug Stores

o Supermarkets and Hypermarkets

o Online

o Others

- UAE Dietary Supplements

Market, By

Application:

o Energy & Weight Management

o General Health

o Bone & Joint Health

o Immunity

o Others

- UAE Dietary Supplements

Market, By

End User:

o Infants

o Children

o Adults

o Pregnant Females

o Geriatric

- UAE Dietary Supplements Market,

By Region:

o Abu Dhabi

o Dubai

o Sharjah

o Rest of UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies

present in the UAE Dietary Supplements Market.

Available Customizations:

UAE Dietary Supplements Market report with

the given market data, TechSci Research offers customizations according to a

company's specific needs. The following customization options are available for

the report:

Company Information

- Detailed analysis and

profiling of additional market players (up to five).

UAE Dietary Supplements Market is an upcoming

report to be released soon. If you wish an early delivery of this report or

want to confirm the date of release, please contact us at [email protected]