|

Forecast

Period

|

2026-2030

|

|

Market

Size (2024)

|

USD

1.02 billion

|

|

CAGR

(2025-2030)

|

7.8%

|

|

Fastest

Growing Segment

|

Electric

|

|

Largest

Market

|

Doha

|

|

Market

Size (2030)

|

USD

1.12 billion

|

Market

Overview

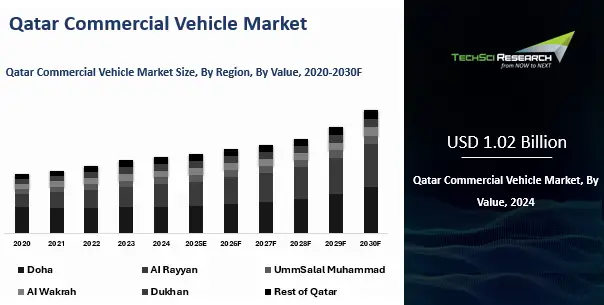

Qatar Commercial Vehicle

Market was valued at USD 1.02 billion in 2024 and is expected to reach USD 1.12

billion by 2030 with a CAGR of 7.8% during the forecast period. The Qatar

Commercial Vehicle Market is witnessing significant growth due to the country's

focus on economic diversification and infrastructure development. In

preparation for major global events and ongoing projects, there is an

increasing demand for commercial vehicles across various sectors. This includes

construction, logistics, and retail, where commercial vehicles play a crucial

role in transporting goods and materials. Heavy commercial vehicles, in

particular, are in high demand to support large-scale construction projects.

Technological innovation is

another key driver, with electric and hybrid commercial vehicles gaining

traction in the market. These vehicles are becoming more attractive due to

their fuel efficiency and lower environmental impact. The Qatar government’s support

for green technologies, including tax incentives for electric vehicles, has

further stimulated the market. With growing awareness of sustainability,

businesses are increasingly transitioning to electric and hybrid commercial

fleets, contributing to cleaner air and reduced emissions. Despite the

favorable market conditions, challenges such as high import costs, limited

local manufacturing, and regulatory hurdles exist. The heavy reliance on

imports leads to higher costs for commercial vehicles, which can be a barrier

for some businesses. Additionally, although there is increasing demand for

eco-friendly vehicles, the cost of these models and the infrastructure to

support them remain challenges. However, advancements in autonomous vehicles

and telematics offer opportunities for improved fleet management, which could

enhance efficiency and reduce operating costs.

Market

Drivers

Economic Diversification

Qatar's ongoing efforts to

diversify its economy beyond oil and gas have resulted in significant

investments in infrastructure and construction. This has directly impacted the

demand for commercial vehicles, particularly in sectors such as logistics and construction.

The need to transport materials, equipment, and personnel for ongoing and

upcoming projects in various sectors drives the commercial vehicle

market. The commercial vehicle industry in Qatar is undergoing significant

technological transformation, including the adoption of electric, hybrid, and

autonomous vehicles. These advancements are driving market growth by offering

enhanced fuel efficiency, lower maintenance costs, and environmental benefits.

Technological improvements, such as advanced telematics and connectivity

features, are also helping fleet operators improve efficiency and reduce

downtime.

Infrastructure Development

Qatar’s ambitious infrastructure

projects, including the construction of roads, bridges, and airports, are

driving the demand for heavy commercial vehicles. These vehicles are essential

for transporting materials, machinery, and equipment to construction sites. The

ongoing development of transportation networks further fuels the demand for a

diverse range of commercial vehicles, from trucks to buses. The Qatari

government offers various incentives for adopting green vehicles, including

electric and hybrid commercial vehicles. Regulations that promote

sustainability and energy efficiency are also pushing the market toward cleaner

alternatives. These government initiatives are encouraging businesses to switch

to more fuel-efficient and eco-friendly fleets, helping to drive growth in the

commercial vehicle market.

Population Growth and

Urbanization

Qatar’s increasing population

and rapid urbanization are creating a greater demand for goods and services,

resulting in an increased need for commercial transportation. The expansion of

cities and the development of new residential and commercial areas drive demand

for light and medium commercial vehicles for last-mile delivery, logistics, and

urban transport.

Download Free Sample Report

Key Market Challenges

High Import Costs

Qatar’s commercial vehicle

market faces challenges related to high import costs. Vehicles must be imported

from international manufacturers, which adds to their overall cost due to

shipping fees, tariffs, and other logistical expenses. This affects the affordability

of vehicles for businesses and may create barriers to market entry for smaller

companies. Qatar lacks a large-scale local vehicle manufacturing industry,

meaning the country relies heavily on imports to meet demand. This reliance on

external sources can lead to supply chain disruptions, delays, and price

volatility. Additionally, without local production, Qatar misses out on

potential benefits such as job creation and reduced dependency on foreign

suppliers.

Regulatory Compliance

The commercial vehicle market in

Qatar must comply with stringent emission standards and safety regulations.

Meeting these regulatory requirements can increase the costs associated with

vehicle production, importation, and operation. Companies may face difficulties

in adhering to these regulations, which can hinder the growth of the

market. Qatar’s fuel prices, while relatively low compared to global

standards, are still subject to fluctuations in the international market.

Volatility in fuel prices can affect operating costs for businesses, especially

those relying heavily on fuel for transportation. This creates uncertainty for

fleet operators, particularly for long-term planning and cost forecasting.

Environmental Concerns

While Qatar has made progress in

adopting green technologies, the adoption of electric commercial vehicles

remains slow due to the high initial cost and limited charging infrastructure.

This can deter fleet operators from transitioning to more environmentally

friendly options. The need for better infrastructure and more affordable

solutions remains a challenge for widespread adoption.

Key Market Trends

Electrification of Commercial

Fleets

The trend of electrifying

commercial vehicle fleets is gaining momentum in Qatar. Driven by both

regulatory pressure and environmental concerns, fleet operators are

increasingly turning to electric and hybrid vehicles. The government’s

incentives for green vehicles further encourage businesses to adopt more

sustainable transportation solutions, making this trend crucial for the future

of the market.

Integration of Telematics and

Connectivity

The use of telematics and

connected vehicle technologies is becoming more prevalent in Qatar's commercial

vehicle market. These technologies allow fleet managers to monitor vehicle

performance in real-time, optimize routes, and improve fuel efficiency. By

collecting data on vehicle usage, maintenance needs, and driver behavior,

businesses can reduce operational costs and improve safety. Autonomous

commercial vehicles, particularly in the logistics and transportation sectors,

are becoming a key trend in Qatar. The development of self-driving trucks and

delivery vehicles is expected to reduce labor costs, improve efficiency, and

enhance safety on the roads. While still in early stages, autonomous vehicles

are anticipated to revolutionize the commercial vehicle market in the future.

Fleet Management Solutions

Fleet management technologies

are transforming how commercial vehicles are operated in Qatar. These solutions

enable fleet operators to track vehicle performance, manage maintenance

schedules, and ensure compliance with regulations. With the growing demand for

efficient and cost-effective operations, fleet management solutions are

becoming an essential part of commercial vehicle operations. Commercial

vehicle safety is a growing trend in Qatar. The increasing adoption of advanced

safety features such as collision detection, lane-keeping assist, and automatic

braking systems is improving safety standards in the commercial vehicle market.

These technologies help reduce accidents, enhance driver safety, and prevent

costly damage to vehicles and cargo.

Segmental Insights

Vehicle Type Insights

The Qatar Commercial Vehicle

Market is divided into four main segments: light commercial vehicles (LCVs),

medium commercial vehicles (MCVs), heavy commercial vehicles (HCVs), and buses.

Light commercial vehicles are commonly used for smaller cargo transportation

and urban logistics, where flexibility and maneuverability are important.

Medium commercial vehicles serve businesses that require more capacity for

transporting goods over longer distances. Heavy commercial vehicles, including

trucks and tractors, are essential for large-scale industrial operations, such

as construction and mining, where substantial payloads need to be transported.

Buses play a vital role in passenger transportation, both for public transit

and tourism. As Qatar’s economy continues to grow, there is an increased demand

for each of these vehicle types, particularly in construction and logistics.

Heavy vehicles are particularly sought after in sectors requiring the

transportation of large loads, while buses are essential for urban transportation,

especially with an increasing population. Medium and light vehicles are also

crucial in urban areas for goods transportation, last-mile delivery services,

and daily logistics.

Download Free Sample Report

Regional

Insights

In 2024, the dominant region in

the Qatar Commercial Vehicle Market is Doha. As the capital and the country’s

primary economic center, Doha leads in demand for commercial vehicles. The city

is experiencing rapid infrastructure development, with numerous construction

projects underway, which increases the need for heavy-duty vehicles.

Additionally, Doha’s role as a hub for business, trade, and tourism fuels

demand for light and medium commercial vehicles, particularly for logistics and

transportation services. This makes Doha the focal point for the majority of

commercial vehicle activity in Qatar. The expansion of roads, ports, and

public transportation networks further drives the need for commercial vehicles.

Businesses in Doha require a range of vehicles to meet logistical demands, from

large trucks for construction projects to smaller vehicles for urban

deliveries. This growth in infrastructure, combined with Doha's economic

importance, ensures its position as the dominant region for commercial vehicles

in Qatar in 2024.

Recent

Developments

- In 2023, Isuzu Motors Limited introduced

a new range of compressed natural gas (CNG)-powered commercial trucks in

Qatar through its regional distributor. This move aligns with Qatar’s

vision for reducing vehicular emissions and promoting cleaner transportation.

The launch was specifically targeted at fleet operators in the logistics

and delivery sectors, offering them a more cost-effective and

eco-friendlier alternative to diesel-powered vehicles. The CNG trucks were

well received by operators looking to comply with stricter environmental

regulations and benefit from lower fuel costs.

- In 2024, Tata Motors Limited unveiled a

series of medium-duty trucks designed specifically for the Gulf

Cooperation Council (GCC) region, including Qatar. These vehicles feature

reinforced chassis, upgraded cooling systems, and sand-resistant

components tailored for harsh desert conditions. With Qatar’s heavy

investment in infrastructure projects and expanding logistics networks,

these customizations provide operators with enhanced performance and

reliability under demanding local conditions.

- Also in 2024, Ford Motor Company

partnered with a Qatari logistics firm to launch a pilot program involving

a fleet of electric delivery vans in Doha. This collaboration marks a

significant step towards the electrification of commercial fleets in the

country. The pilot aims to test the operational feasibility of electric

vehicles (EVs) in high-temperature environments and evaluate the required

charging infrastructure. The program supports Qatar’s sustainability

initiatives under its National Vision 2030, focusing on reducing the

carbon footprint of its transport sector.

Key

Market Players

- Toyota Motor Corporation

- Isuzu Motors Limited

- Ford Motor Company

- Mercedes-Benz Group AG

- Tata Motors Limited

- MAN Truck & Bus SE

- Scania AB

- Hyundai Motor Company

- Hino Motors, Ltd.

- Ashok Leyland Limited

|

By Vehicle

Type

|

By

Propulsion Type

|

By

Region

|

|

·

Light

Commercial Vehicle

·

Medium

Commercial Vehicle

·

Heavy

Commercial Vehicle

·

Bus

|

·

ICE

·

Electric

|

·

Doha

·

AI Rayyan

·

UmmSalal

Muhammad

·

AI Wakrah

·

Dukhan

·

Rest of

Qatar

|

Report

Scope:

In this

report, the Qatar Commercial Vehicle Market has been segmented into the

following categories, in addition to the industry trends which have also been

detailed below:

· Qatar Commercial Vehicle

Market, By Vehicle Type:

o Light

Commercial Vehicle

o Medium

Commercial Vehicle

o Heavy

Commercial Vehicle

o Bus

· Qatar Commercial Vehicle

Market, By Propulsion Type:

o ICE

o Electric

· Qatar Commercial Vehicle

Market, By Region:

o Doha

o AI Rayyan

o UmmSalal Muhammad

o AI Wakrah

o Dukhan

o Rest of Qatar

Competitive

Landscape

Company

Profiles: Detailed

analysis of the major companies presents in the Qatar Commercial Vehicle

Market.

Available

Customizations:

Qatar

Commercial Vehicle Market report with the given market data,

TechSci Research offers customizations according to the company’s specific

needs. The following customization options are available for the report:

Company

Information

- Detailed analysis and profiling of additional

market players (up to five).

Qatar

Commercial Vehicle Market is an upcoming report to be released soon. If you

wish an early delivery of this report or want to confirm the date of release,

please contact us at [email protected]