|

Forecast Period

|

2026-2030

|

|

Market Size (2024)

|

USD 12.18 Billion

|

|

CAGR (2025-2030)

|

13.5%

|

|

Fastest Growing Segment

|

Residential

|

|

Largest Market

|

North

|

|

Market Size (2030)

|

USD 26.03 Billion

|

Market Overview

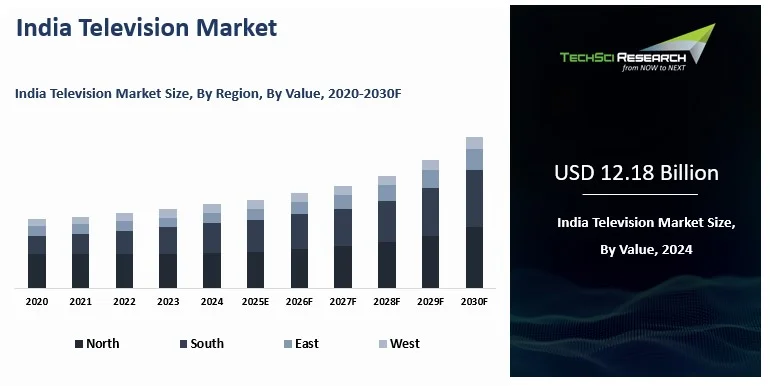

Television Market Size in India valued at USD 12.18 billion in 2024, is expected to grow to USD 26.03 billion by 2030, reflecting a robust compound annual growth rate (CAGR) of 13.5% from 2025 to 2030.

The television industry has undergone a remarkable transformation, shifting from bulky CRT units to sleek, high-definition smart TVs with immersive sound and advanced connectivity. In 2025-2026, the market enters a "premiumization" phase, driven by the rising demand for high-end display technologies such as QLED, Mini-LED, and OLED. Smart TV shipments grew 8.6% year over year in 2024, reaching 12.1 million units, with Samsung leading the market at 16.1%, followed by LG at 15.1%. As consumers increasingly opt for premium global brands, budget manufacturers like Xiaomi are losing their dominance.

A significant shift in consumer preferences is also evident, with larger screens gaining popularity. The once-dominant 32-inch and 43-inch segments are gradually being overtaken by larger panels, with shipments of 55-inch and larger screens rising 43% in 2024 and 65-inch models surging 75%. The growing "home cinema" trend has made 4K resolution the standard for more than 50% of new sales. Despite e-commerce's dominance, offline retail shipments rose 20% in 2024 as consumers returned to physical stores for hands-on demonstrations of advanced AI-integrated panels, while online-only sales declined by 8%.

The broader Media and Entertainment sector in India, valued at approximately USD 30 billion in 2024, is expected to reach USD 100 billion by 2030. While television has traditionally been the primary revenue driver, digital media is set to surpass linear television in revenue by the end of 2026. This shift is reflected in changing viewer habits, as traditional pay-TV households decline, while Connected TV households grow rapidly, surpassing 30 million. As affluent audiences flock to OTT platforms and 5G-enabled streaming, traditional broadcasters are increasingly reliant on regional and lower-income viewers, with linear television experiencing a modest increase in viewing time but a decline in high-value advertising revenue.

Key Report Takeaways

- The 50''–59'' screen size segment dominates the India television market, offering consumers an ideal balance of immersive viewing, practicality for most living spaces, and affordability, making it the preferred choice for movies, sports, and gaming.

- Manufacturers enhance this segment with advanced features such as 4K Ultra HD, HDR, and smart TV capabilities, while competitive pricing and promotional offers from leading brands further boost adoption.

- Supermarkets and hypermarkets lead distribution, providing wide product selections, interactive displays, knowledgeable staff, and bundled offers, enabling consumers to compare features and prices conveniently while benefiting from strategic urban and semi-urban locations.

- North India dominates the regional market, with states such as Delhi, Uttar Pradesh, and Rajasthan driving demand due to high urbanization, disposable incomes, strong retail infrastructure, and growing interest in smart TVs; key players include Samsung India Electronics Pvt Ltd., LG Electronics India Private Limited, Xiaomi Technology India Private Limited, Sony India Private Limited, and Panasonic Life Solutions India Private Limited.

Download Free Sample Report

Key Market Drivers

Premiumization of Consumer Preferences:

In recent years, a notable trend in the Indian television market has been a shift towards premium, feature-rich products, with consumers increasingly seeking enhanced viewing through advanced display technologies such as QLED, Mini-LED, and OLED. For instance, IDC reported that India shipped 12.1 million smart TV units in 2024, indicating scale in upgrade-driven purchasing rather than first-time adoption alone. As disposable incomes rise and home entertainment becomes a higher priority, demand is growing for premium models that combine top-tier picture quality with sleek design and smarter functionality, encouraging brands to compete more aggressively on differentiated panels and performance.

Growth in Large Screen Demand:

The demand for larger televisions in India is rising as more households aim to create home cinema experiences with immersive, high-definition viewing. For instance, IDC noted that in 2024 the 55-inch and 65-inch smart TV segments recorded strong year-on-year growth and together accounted for meaningful shipment shares, reflecting a structural move beyond 32-inch and 43-inch as the default upgrade size. This large-screen shift is reinforced by the rising availability of 4K content and premium audio-visual formats, which are better appreciated on bigger displays and are increasingly bundled with smart TV ecosystems.

4K Resolution Becoming the Standard:

The growing preference for 4K resolution in new televisions marks a major shift in the Indian television market as buyers increasingly prioritize sharper picture quality, especially on larger screens. For instance, 4K smart TV shipments increased year-on-year in Q3 2024 and made up nearly 52 percent of total smart TV shipments during that quarter, showing how 4K has moved into the mainstream purchase set rather than remaining a premium niche. With streaming platforms and connected TV usage rising, 4K is increasingly viewed as the baseline for a future-ready viewing experience in many upgrade decisions.

Technological Advancements in Connectivity:

A key factor driving India’s TV upgrade cycle is the integration of smart connectivity, where televisions function as connected entertainment hubs with direct access to OTT apps, streaming services, and digital platforms. For instance, TRAI reported 969.10 million internet subscribers in India as of 31 March 2025, strengthening the underlying broadband base that enables higher-frequency streaming on connected TVs. Network upgrades further support high-quality streaming; the Government of India reported that as of 31 December 2025, telecom service providers had installed 5G base transceiver stations in 1.12 lakh villages, widening the footprint for faster mobile backhaul and last-mile broadband experiences that can complement home Wi‑Fi usage.

Media and Entertainment Growth:

India’s broader media and entertainment consumption shift toward digital video is closely linked to demand for televisions that support OTT services, high-definition displays, and seamless app integration. For instance, the Government of India highlighted that India has over 230 million TV households reaching around 900 million viewers, while also noting OTT platforms serving over 600 million users, underscoring why smart TVs are increasingly positioned as the primary screen for both broadcast and streaming. As pay TV, free DTH, and OTT coexist, consumers are increasingly choosing televisions that can bridge live channels and app-based content in a single, connected experience, keeping smart premium models central to the category’s evolution.

Key Market Challenges

Price Sensitivity and Affordability

Price sensitivity is a significant challenge in the Indian television market, particularly in a country where a large portion of the population belongs to middle and lower-income groups. While demand for televisions with advanced features such as smart capabilities and high-definition displays is increasing, affordability remains a critical factor. Basic 32-inch HD Smart LED TVs start at ₹15,000, while 43-inch 4K Ultra HD Smart TVs range from ₹33,000 to ₹39,000. In contrast, premium OLED televisions from brands like LG and Samsung range from ₹1,24,299 for a 48-inch model to over ₹15,66,999 for a 97-inch variant. Many consumers are constrained by budget limitations, which restrict their ability to purchase higher-end models with the latest technologies.

Manufacturers and retailers are continually pressured to offer competitive pricing while balancing the costs of importing components, upgrading technology, and distributing products. This challenge is exacerbated by fluctuations in exchange rates, import duties, and regulatory policies that affect the final retail prices of televisions.

Diverse Consumer Preferences and Regional Variances

India is a diverse country with varied consumer preferences and regional differences. Preferences for screen sizes, features, and brands can vary significantly across different states and cities. According to Bain & Company research, in the North, brands are often associated with status, while in the South, shoppers view brands as markers of quality, leading to more branded searches for electronics. While urban areas generally exhibit higher demand for larger screen sizes and smart TVs, rural markets may prioritize affordability and basic functionality. Rural TV penetration is approximately 61% of total rural households, compared with significantly higher rates in urban areas.

Navigating these diverse preferences requires tailored marketing strategies, localized product offerings, and distribution channels that cater to specific regional requirements. By 2029, Tier 2 and Tier 3 cities are expected to see over 25 million square feet of new retail space, with the northern region accounting for 44% of upcoming retail supply and the southern region contributing 30%. Growth of premium products and high-ticket items in smaller towns is 5-7 percentage points higher than urban areas due to the availability of finance. This complexity adds operational challenges for manufacturers and retailers seeking to penetrate and expand their market share across diverse demographic and geographic segments.

Intense Competition and Market Saturation

The television market in India is highly competitive, with both domestic and international brands offering a wide range of products across various price points. Established players like Samsung, LG, Sony, and Panasonic compete with emerging brands and local manufacturers vying for market dominance. The Indian smart TV market features major players including Samsung Electronics, Sony India, LG Electronics India, Xiaomi, OnePlus, Realme, Haier, TCL, Vu Televisions, and Thomson. In 2024, Samsung India overtook Xiaomi to become the top smart TV brand in India, while LG follows closely behind. LG and Samsung emerged as growth leaders in 2024, while the "others" category still holds a significant 40% share of the overall market, underscoring a competitive niche.

Intense competition contributes to price wars, reducing profit margins for manufacturers and limiting opportunities for new entrants to gain traction. Market saturation in urban areas, where television penetration rates are relatively high, further intensifies competition as brands strive to differentiate themselves through innovation, product quality, and after-sales service.

Technological Obsolescence and Rapid Advancements

Technological obsolescence poses a challenge for both consumers and manufacturers in the television market. The rapid pace of technological advancements, such as the transition from LCD to OLED screens or the integration of AI-driven smart features, can render older models obsolete within a short span of time. Samsung launched its 2025 Neo QLED 8K, Neo QLED 4K, OLED, QLED TVs with Samsung Vision AI technology in May 2025, while LG introduced its evo AI G5 and C5 series with α9 AI Processor 4K Gen7. Sony continues to innovate with its BRAVIA XR Master Series featuring cognitive processor technology.

Consumers often face the dilemma of choosing between investing in new technologies that promise enhanced viewing experiences and sticking with existing models that may become outdated. Manufacturers, on the other hand, must continually innovate and upgrade their product offerings to stay competitive and meet evolving consumer expectations.

Infrastructure and Connectivity Issues

Infrastructure and connectivity challenges in certain parts of India, particularly in rural and remote areas, hinder the adoption of advanced television technologies. According to the Ministry of Power, the average electricity supply in rural areas has increased from 12.5 hours in 2014 to 22.6 hours in 2025, while urban areas receive 23.4 hours. Under the SAUBHAGYA Scheme, 2.86 crore households have been electrified, and an additional 6.84 lakh unelectrified households have been sanctioned under the Revamped Distribution Sector Scheme (RDSS). The government has invested ₹1.85 lakh crore in strengthening distribution infrastructure under the DDUGJY/IPDS/SAUBHAGYA schemes, adding 2,927 new substations and installing 6,92,200 distribution transformers.

On connectivity, as of March 2024, 6.12 lakh of 6.44 lakh villages have 3G/4G mobile coverage, meaning 95.15% of villages have internet access. Out of India's 954.40 million internet subscribers, 398.35 million are rural subscribers. Under BharatNet, 2.13 lakh Gram Panchayats have been made service-ready, with plans to provide optical fibre connectivity to 42,000 uncovered GPs and 3.84 lakh villages on a demand basis, along with 1.5 crore rural home fibre connections. Improving connectivity and accessibility to digital services are essential for expanding the reach of television manufacturers and ensuring equitable access to modern entertainment technologies across the country.

Key Market Trends

Shift

towards Larger Screen Sizes and Higher Resolutions

One of the prominent trends in the

Indian television market is the increasing preference for larger screen sizes

and higher resolutions. As disposable incomes rise and consumers seek enhanced

viewing experiences, there is growing demand for televisions with screens 55 inches or larger. Larger screens provide a more immersive

viewing experience, making them ideal for watching high-definition content,

sports events, and movies.

Simultaneously, there is a shift towards higher-resolution displays, particularly 4K Ultra HD and 8K. These technologies offer sharper images, vibrant colors, and greater clarity,

catering to the discerning preferences of Indian consumers who prioritize

visual quality in their home entertainment setups.

Adoption

of Smart TVs and Connected Features

Smart TVs have gained significant

traction in the Indian market, driven by the increasing availability of

high-speed internet connectivity and the growing popularity of digital

streaming services. Smart TVs offer built-in Wi-Fi capabilities, app stores, and

compatibility with popular streaming platforms such as Netflix, Amazon Prime

Video, and Disney+ Hotstar.

Consumers are increasingly seeking

televisions that not only provide traditional broadcast content but also offer interactive features, voice control, and access to a wide

array of on-demand content. This trend is reshaping viewing habits as households embrace the convenience of streaming their favorite shows, movies, and live sports directly on their TVs.

Rise

of OLED and QLED Technologies

OLED (organic light-emitting diode) and

QLED (quantum dot LED) technologies represent a significant advancement in

television displays, offering superior picture quality and enhanced viewing

experiences. OLED TVs, known for their deep blacks, rich colors, and wide

viewing angles, have attracted consumer attention for their premium viewing experience.

Similarly, QLED TVs use quantum dots to enhance brightness, color accuracy, and overall image clarity. These

technologies are increasingly integrated into high-end televisions from leading brands, meeting consumers' demand for superior visual performance and advanced display capabilities.

Expansion

of Content and Streaming Services

The expansion of digital content and

streaming services has transformed the television landscape in India. OTT

(over-the-top) platforms such as Netflix, Amazon Prime Video, Disney+ Hotstar,

and others have witnessed rapid growth, offering a diverse range of content

including original series, movies, documentaries, and live sports.

This trend has fueled demand for smart TVs that seamlessly access and stream content from multiple

platforms. Manufacturers and content providers are forging partnerships and

licensing agreements to deliver exclusive content to smart TV users, enhancing

the appeal of these devices among tech-savvy consumers.

Emphasis

on Energy Efficiency and Sustainability

Energy efficiency and sustainability

have emerged as important considerations in the Indian television market. With

increasing awareness of environmental impact and energy consumption, consumers are prioritizing energy-efficient models that meet international standards, such as Energy Star ratings.

Manufacturers are responding by

developing televisions with advanced power-saving features, LED backlighting

systems, and eco-friendly materials. This trend not only appeals to

environmentally conscious consumers but also aligns with regulatory initiatives

aimed at reducing carbon footprints and promoting sustainable manufacturing

practices.

Segmental Insights

Screen

Size Insights

In the India Television Market, the

50''-59'' screen size segment has emerged as the dominant choice among

consumers. This segment appeals to a wide range of households seeking a balance

between screen size, viewing comfort, and affordability. Consumers are increasingly opting for larger

screen sizes within this range to enjoy an immersive viewing experience for

movies, sports, and gaming. The 50''-59'' category strikes a balance between

providing a cinematic feel while still being practical for most living room

sizes in urban and suburban homes across India.

Manufacturers have responded by offering

a diverse array of models in this segment, incorporating advanced technologies

such as 4K Ultra HD resolution, HDR (high dynamic range), and smart TV

capabilities. These features enhance the viewing experience by delivering

vibrant colors, sharp details, and seamless access to streaming content and

applications. Additionally, competitive pricing strategies and promotional

offers from leading brands and retailers have contributed to the popularity of

the 50''-59'' segment, making it a preferred choice for consumers looking to

upgrade their home entertainment setups without compromising on quality or

budget.

Distribution

Channel Insights

Supermarkets and hypermarkets have

emerged as the dominating distribution segment in the India television market.

These retail formats offer significant advantages such as wide product

selections, competitive pricing, and convenient shopping experiences,

attracting a large number of consumers looking to purchase televisions. One of

the key factors driving growth in supermarkets and hypermarkets is their

ability to showcase a diverse range of television brands and models under a

single roof. This allows consumers to compare features, screen sizes, prices,

and customer reviews before making a purchase decision. The availability of

knowledgeable staff and interactive displays further enhances the shopping

experience, helping consumers make informed choices based on their specific

preferences and requirements.

Moreover, supermarkets and hypermarkets

often run promotional campaigns, discounts, and bundled offers on televisions,

attracting price-sensitive consumers seeking value for money. These retail

formats also benefit from their strategic locations in urban and semi-urban

areas, catering to a wide demographic of consumers who prefer the convenience

of one-stop shopping for electronics. As consumer preferences evolve and demand

for televisions continues to grow, supermarkets and hypermarkets are poised to

play a pivotal role in shaping the distribution landscape of the Indian

television market, offering both accessibility and competitive pricing to meet

the diverse needs of consumers across the country.

Download Free Sample Report

Regional Insights

In the India Television Market, the

North region has emerged as the dominant and fastest-growing segment.

Comprising states such as Delhi, Uttar Pradesh, Rajasthan, Haryana, and Punjab, among others, the North region has seen robust growth in television sales, driven by

several factors.

One of the primary reasons for the North's dominance is its high population density and urbanization

rate. Metropolitan cities like Delhi and the NCR (National Capital Region) have a large concentration of affluent consumers with disposable income who are strongly inclined to purchase consumer electronics, including

televisions. The presence of a burgeoning middle class also significantly increases demand for televisions in urban and semi-urban areas

across the region. Furthermore, the North region benefits from extensive retail

infrastructure, including modern retail chains, electronics stores, and

hypermarkets that cater to diverse consumer preferences. These retail

outlets offer a wide range of television brands, sizes, and features, along with competitive pricing and promotional offers, attracting consumers

seeking value and quality.

Additionally, the North region

experiences a high demand for smart TVs and advanced technologies due to

increasing digital literacy and connectivity. Consumers in urban centers are

keen to access streaming services, online content, and interactive features on smart televisions, further driving growth in this segment in the

North Indian market. Overall, the North region's dominance in the India television market is underscored by its economic vibrancy, consumer preference for premium home entertainment, and robust retail infrastructure,

making it a pivotal growth driver in the national television industry.

Recent Developments

- In February 2026, Xiaomi announced the upcoming launch of the Xiaomi X Pro QLED (2026) 75-inch smart TV in India, set for February 19. The TV will be available for purchase through the Xiaomi India online store.

- In January 2026, Samsung revealed its 2026 TV lineup at CES 2026. The lineup will support HDR10+ ADVANCED and introduce Vision AI Companion (VAC) experiences across multiple TV categories.

- In May 2025, TCL announced the launch of its Q6C Premium QD Mini LED Google TV lineup in India as part of its television portfolio expansion.

- In April 2025, Videotex introduced 4K QD Mini LED Smart TVs, positioning the launch as an India-based ODM/OEM initiative aimed at bringing premium display technology to domestic TV brands.

- In September 2025, the National Company Law Tribunal (NCLT) approved the merger of Star Television Productions with JioStar, a transaction designed to simplify the holding structure, optimize capital, and reduce costs.

- In December 2025, Reliance completed the merger of Star Television Productions with JioStar, finalizing the Reliance–Disney India media consolidation.

- In May 2025, Sony India launched the BRAVIA 2 II series, featuring 4K Ultra HD LED TVs with Google TV, available in sizes from 43 to 75 inches, starting at Rs 50,990. The series features the X1 4K Processor and gaming enhancements.

- In May 2025, TCL launched its QD Mini-LED C6K and C6KS series, as well as QLED P8K, P7K, and 4K HDR P6K TVs in India. The C6K series starts at Rs 53,990 and features the AiPQ Engine, HVA panels, and Google TV integration.

- In July 2025, LG India unveiled its 2025 OLED evo (G5, C5, B5) and QNED evo TV lineup, powered by the Alpha 11 AI Processor Gen2, AI Magic Remote, and AI-powered features such as AI Concierge and AI Voice ID. Prices start at Rs 149,990 for the OLED C5, reaching up to Rs 24,99,990 for the 97-inch G5.

Key Market Players

- Samsung India Electronics Pvt Ltd.

- LG Electronics India Private Limited

- Xiaomi Technology India Private Limited

- Oneplus Technology India Private Limited

- Sony India Private Limited

- Hisense India Private Limited

- TCL-India Holdings Private Limited

- Intex Technologies (India) Limited

- Panasonic Life Solutions India Private

Limited

- Haier Appliances India Pvt Ltd

|

By Screen Size

|

By Display Type

|

By Distribution

Channel

|

By Region

|

- 39'' and Below

- 40''-49''

- 50''-59''

- Above 59''

|

|

- Multi-Branded Stores

- Supermarkets & Hypermarkets

- Online

- Exclusive Stores

- Others

|

|

Report Scope:

In this report, the India Television Market has

been segmented into the following categories, in addition to the industry

trends which have also been detailed below:

- India Television Market, By Screen

Size:

o 39'' and Below

o 40''-49''

o 50''-59''

o Above 59''

- India Television Market, By Display

Type:

o LED

o OLED

o Others

- India Television Market, By Distribution

Channel:

o Multi-Branded Stores

o Supermarkets & Hypermarkets

o Online

o Exclusive Stores

o Others

- India Television Market, By

Region:

o North

o South

o East

o West

Competitive Landscape

Company Profiles: Detailed analysis of the major companies presents

in the India Television Market.

Available Customizations:

India Television Market report with the given

market data, TechSci Research offers customizations according to a company's

specific needs. The following customization options are available for the

report:

Company Information

- Detailed analysis and

profiling of additional market players (up to five).

India Television

Market is an upcoming report to be released soon. If you wish an early delivery

of this report or want to confirm the date of release, please contact us at [email protected]