Forecast Period | 2026-2030 |

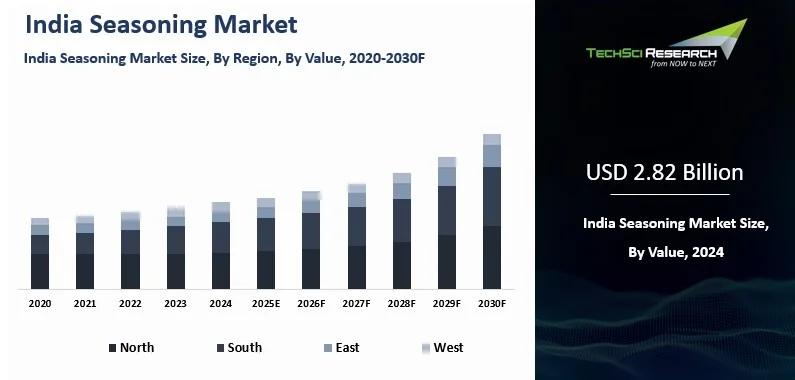

Market Size (2024) | USD 2.82 Billion |

CAGR (2025-2030) | 6.32% |

Fastest Growing Segment | Online |

Largest Market | North |

Market Size (2030) | USD 4.06 Billion |

Market Overview

India Seasoning Market was valued at USD

2.82 billion in 2024 and is anticipated to grow USD 4.06 billion by 2030 with a CAGR of 6.32% during the forecast period.

The India seasoning market has witnessed significant growth in recent years,

driven by evolving consumer preferences, urbanization, and changing lifestyles.

Seasonings play a crucial role in enhancing the flavor and aroma of food, catering

to a diverse range of culinary traditions across India.

Key factors contributing to the market's

expansion include increasing disposable incomes, which have led to higher

spending on convenient and ready-to-use seasoning products. Urbanization has

also played a pivotal role by influencing dietary habits and encouraging the

adoption of international cuisines, thereby boosting the demand for a variety

of seasonings. Ethnic and regional flavors remain

prominent in the market, with consumers showing a preference for spices and

blends that reflect India's rich culinary heritage. This trend has spurred

innovation among seasoning manufacturers, who are introducing new products

tailored to local tastes while also incorporating global trends.

Key Market Drivers

Changing

Consumer Preferences and Culinary Diversity

India's diverse culinary landscape, characterized by a

rich tapestry of regional cuisines and flavors, plays a pivotal role in driving

the demand for seasonings. Consumers in different parts of the country have

distinct preferences for spices, blends, and seasonings that enhance the flavor

profiles of traditional dishes. The production of various spices in India has

experienced rapid growth in recent years, reaching 10.87 million tonnes in the

2021-22 period.

The market's growth is fueled by a shift towards

convenience and ready-to-use products among urban consumers. Busy lifestyles

and increasing disposable incomes have led to a rising preference for pre-mixed

seasonings and spice blends that simplify cooking processes while maintaining

authentic tastes. This trend is particularly evident among millennials and

dual-income households seeking quick, flavorful meal solutions without

compromising on taste.

Urbanization

and Lifestyle Changes

Urbanization in India has profoundly influenced

dietary habits and consumption patterns, contributing significantly to the

growth of the seasoning market. As more people migrate to cities and adopt

modern lifestyles, there is a greater demand for packaged, processed, and

convenience foods. Seasonings play a crucial role in enhancing the taste and

appeal of these foods, catering to the preferences of urban dwellers who often

seek variety and international flavors in their meals.

Urban consumers are increasingly influenced by global

cuisines through dining experiences, travel, and digital media exposure. This

exposure stimulates curiosity and drives the adoption of international

seasoning profiles such as Mediterranean, East Asian, and Mexican flavors,

alongside traditional Indian spices. Seasoning manufacturers are leveraging

this trend by introducing fusion blends that cater to cosmopolitan tastes while

preserving the essence of local culinary traditions. According to the Household

Consumption Expenditure Survey released in February 2024, average monthly

spending per person in rural areas rose to USD 45.54, while urban areas saw an

increase to USD 77.95.

Health

and Wellness Trends

Growing health consciousness among Indian consumers is

another significant driver shaping the seasoning market. There is a heightened

awareness of the role spices and seasonings play not only in enhancing flavor

but also in offering potential health benefits. Many traditional Indian spices

are known for their medicinal properties and antioxidant-rich profiles,

contributing to their popularity as functional ingredients in culinary

applications.

As a result, there is a rising demand for natural,

organic, and clean-label seasonings that are free from artificial additives,

preservatives, and excessive salt. Manufacturers are responding by

reformulating their products to meet these preferences, thereby appealing to

health-conscious consumers who prioritize wholesome ingredients and

transparency in food labeling.

Download Free Sample Report

Key Market Challenges

Supply

Chain Complexity and Raw Material Sourcing

One of the primary challenges faced by

seasoning manufacturers in India is the complexity of the supply chain and

sourcing of raw materials. India is renowned for its diverse array of spices

and herbs, which form the backbone of many seasoning blends. However, ensuring

a consistent supply of high-quality raw materials can be challenging due to

factors such as climatic conditions, seasonal variations, and agricultural

practices.

Furthermore, the volatility in prices

and availability of key spices like black pepper, cardamom, and turmeric can

impact production costs and pricing strategies. Manufacturers often need to

maintain robust relationships with farmers, cooperatives, and suppliers to

secure a steady supply of raw materials while navigating logistical challenges

and quality control measures.

Quality

Control and Food Safety Standards

Maintaining stringent quality control

measures and adhering to food safety standards is crucial but challenging for

seasoning manufacturers in India. With increasing consumer awareness about food

safety and hygiene, there is a growing demand for products that meet

international quality benchmarks and regulatory requirements.

Ensuring consistency in flavor profiles,

purity of ingredients, and absence of contaminants or adulterants is essential

to building consumer trust and brand reputation. However, achieving these

standards across diverse production scales, especially for small and

medium-sized enterprises (SMEs), can be resource-intensive and requires

investments in testing facilities, training, and compliance with evolving

regulatory frameworks.

Consumer

Education and Market Penetration

Despite the rich culinary heritage and

widespread use of spices in Indian cuisine, there exists a need for consumer

education and awareness regarding the benefits and usage of seasoning products.

Many consumers, particularly in semi-urban and rural areas, may be unfamiliar

with packaged seasoning mixes or may prefer traditional methods of spice

preparation.

Educating consumers about the

convenience, consistency, and flavor-enhancing properties of seasoning products

is crucial for market penetration and expanding consumer base. This includes

demonstrating the versatility of seasonings in different cuisines, providing

recipe ideas, and highlighting the nutritional advantages of using certain

spices and blends.

Moreover, addressing regional

preferences and taste sensitivities requires targeted marketing strategies and

product localization efforts to resonate with diverse consumer segments across

India's vast geographic and cultural landscape.

Competitive

Pricing and Margin Pressures

The India seasoning market is

characterized by intense competition among domestic and international brands,

leading to price sensitivity and margin pressures. Price volatility in raw

materials, coupled with rising production and distribution costs, can impact

pricing strategies and profitability for manufacturers.

Balancing competitive pricing with

maintaining product quality and meeting consumer expectations poses a

significant challenge, especially in a market where consumers are increasingly

value-conscious. Seasoning manufacturers must continually innovate to offer

cost-effective solutions without compromising on taste, quality, or nutritional

value.

Key Market Trends

Demand

for Convenience and Ready-to-Use Products

Urbanization and changing lifestyles

have fueled demand for convenience foods, including ready-to-use seasoning

mixes and spice blends. Busy consumers, particularly millennials and

dual-income households, seek quick and easy meal solutions without compromising

on taste or nutrition.

Ready-to-use seasoning mixes tailored

for popular dishes like biryani, curry, pasta, and barbecue have gained

popularity due to their convenience and time-saving benefits. These products

offer pre-measured portions of spices and herbs, ensuring consistent flavor

profiles and simplifying cooking processes for home cooks and amateur chefs

alike.

Exploration

of Global and Fusion Flavors

India's exposure to global cuisines

through travel, digital media, and international dining experiences has sparked

a growing interest in global and fusion flavors within the seasoning market.

Consumers are increasingly experimenting with Mediterranean, East Asian,

Mexican, and Middle Eastern seasoning profiles, alongside traditional Indian

spices.

Manufacturers are capitalizing on this

trend by introducing fusion blends that combine traditional Indian spices with

international ingredients and flavor profiles. These innovative products cater

to cosmopolitan tastes while retaining the authenticity and versatility of

Indian culinary traditions.

Premiumization

and Gourmet Offerings

There is a noticeable trend towards

premiumization within the India seasoning market, driven by rising disposable

incomes and a burgeoning middle-class segment with a penchant for gourmet and

high-quality culinary experiences. Consumers are willing to pay a premium for

premium seasonings made from high-quality ingredients, offering superior flavor

profiles and distinctive taste experiences.

Gourmet seasonings crafted from exotic

spices, rare herbs, and artisanal blends are gaining traction among discerning

consumers seeking elevated culinary experiences at home. These products often

emphasize unique flavor combinations, regional authenticity, and ethical

sourcing practices, appealing to food enthusiasts and culinary connoisseurs.

Segmental Insights

Product

Type Insights

Pepper is emerging as the

fastest-growing segment in the India seasoning market, driven by its versatile

culinary applications, health benefits, and increasing consumer preference for

bold flavors. As a staple spice in Indian cuisine and a key ingredient in

international dishes, pepper's demand is rising across urban and rural markets

alike.

One significant factor contributing to

pepper's growth is its perceived health benefits. Pepper is known for its

antioxidant properties, digestive aid qualities, and potential

anti-inflammatory effects, aligning with the growing trend towards health-conscious

eating habits among Indian consumers. This awareness has spurred the demand for

pepper as a functional ingredient in seasoning blends and standalone products.

Furthermore, pepper's popularity extends

beyond traditional uses in curries and spice mixes to include innovative

applications in snacks, ready-to-eat meals, and gourmet preparations.

Manufacturers are responding to this trend by introducing premium pepper

varieties, organic options, and value-added products like pre-ground pepper and

pepper blends tailored to specific culinary preferences.

The expansion of retail channels,

including supermarkets, specialty stores, and e-commerce platforms, has also

facilitated easier access to a wide range of pepper products, driving market

penetration and consumption. Overall, pepper's growth trajectory in the India

seasoning market underscores its enduring appeal and adaptability in meeting

diverse consumer needs and preferences.

Download Free Sample Report

Regional Insights

The North region of India stands out as

a dominant force in the India seasoning market, driven by its rich culinary

traditions, diverse consumer preferences, and robust economic activity. States

such as Punjab, Delhi, Uttar Pradesh, Haryana, and Rajasthan are key

contributors to the region's prominence in the seasoning market. One of the primary factors contributing

to the North region's dominance is its cultural affinity towards spices and

seasonings, integral to the preparation of iconic dishes like butter chicken,

kebabs, and various regional curries. The demand for authentic spices and

blends tailored to local tastes fuels market growth, with consumers valuing

quality and authenticity in their culinary experiences.

The urbanization and

increasing disposable incomes in cities like Delhi-NCR and Chandigarh have led

to a growing preference for convenience foods, including ready-to-use seasoning

mixes and gourmet blends. This trend further boosts the market demand in the

region, as urban consumers seek flavorful and time-saving solutions for their

everyday cooking needs.

Recent Developments

- In June 2023, Vasant, a spice

manufacturer, introduced Awadhi Garam Masala, tailored to capture the

distinctive taste and aroma of Awadh cuisine. This new offering aims to meet

the growing demand for authentic regional flavors among Indian consumers. The

Awadhi Garam Masala is available in convenient packaging sizes including 10Rs.,

20Rs., and 100g, 200g, and 500g quantities, widely distributed across retail

markets.

- In April 2023, McCormick and Tabitha

Brown announced an expansion of their partnership to introduce five new

salt-free, vegan seasoning products in grocery stores nationwide. The products

include two seasoning blends scheduled for release on shelves and Amazon this

spring, followed by three recipe mixes slated for launch.

Key Market Players

- MDH Pvt. Ltd.

- ITC Limited (Sunrise Pure)

- Dharampal Satyapal Ltd

- EVEREST Food Products Pvt. Ltd.

- Badshah Masala Private Limited

- Aachi Masala Foods (P) Ltd

- Pushp Brand (India) Pvt. Ltd.

- Ramdev Food Products Private Limited

- MTR Foods Pvt. Ltd.

- Gokul Foods Pvt Ltd

|

By Product Type

|

By Sales Channel

|

By Region

|

- Salt

- Pepper

- Sugar and light flavored sweeteners

- Acids

- Others

|

- Supermarket/Hypermarket

- Departmental Stores

- Online

- Others

|

|

Report Scope:

In this report, the India Seasoning Market has been

segmented into the following categories, in addition to the industry trends

which have also been detailed below:

- India Seasoning Market, By Product

Type:

o Salt

o Pepper

o Sugar and light flavored sweeteners

o Acids

o Others

- India Seasoning Market, By

Sales Channel:

o Supermarket/Hypermarket

o Departmental Stores

o Online

o Others

- India Seasoning Market, By Region:

o North

o South

o East

o West

Competitive Landscape

Company Profiles: Detailed analysis of the major companies presents

in the India Seasoning Market.

Available Customizations:

India Seasoning Market report with the given market

data, TechSci Research offers customizations according to a company's specific

needs. The following customization options are available for the report:

Company Information

- Detailed analysis and

profiling of additional market players (up to five).

India Seasoning

Market is an upcoming report to be released soon. If you wish an early delivery

of this report or want to confirm the date of release, please contact us at [email protected]