Forecast Period | 2026-2030 |

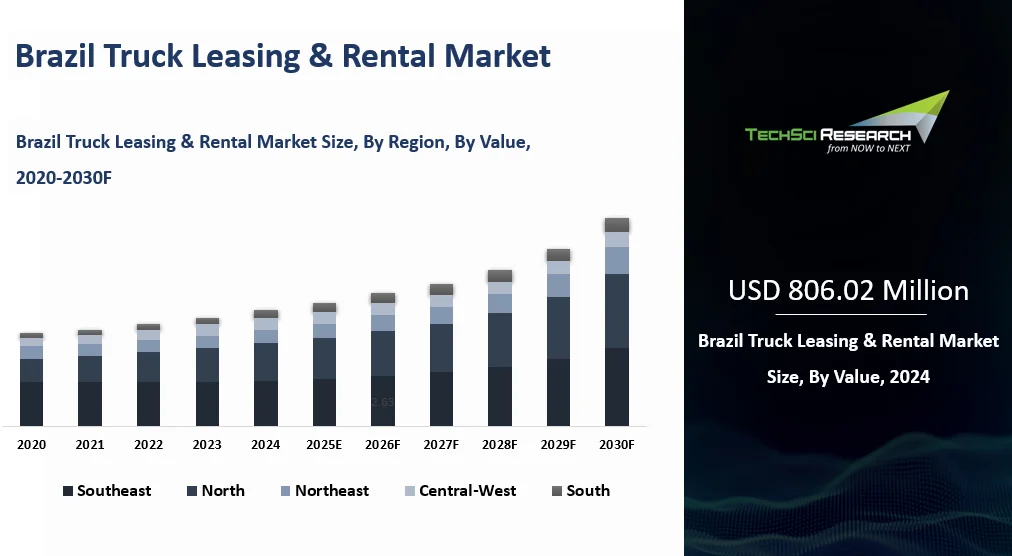

Market Size (2024) | USD 806.02 Million |

CAGR (2025-2030) | 5.10% |

Fastest Growing Segment | Operational |

Largest Market | Southeast |

Market Size (2030) | USD 1086.33 Million |

Market Overview

Brazil Truck Leasing & Rental Market was valued at USD 806.02 Million in 2024 and is expected to reach USD 1086.33 Million by 2030 with a CAGR of 5.10% during the forecast period. The truck leasing and rental market in Brazil is positioned to experience remarkable potential and substantial growth in the coming years. This upward trend can be attributed to various factors, including the expanding logistics and transportation sector in Brazil. With the rise of the e-commerce industry and the increasing demand for efficient goods transportation, the truck leasing and rental market is expected to witness significant growth and opportunities. According to Brazil’s National Traffic Department (DENATRAN), the country had around 3.8 million trucks in operation in 2023, with only about 2% available for rental, up from 1% in 2021.

As companies strive to optimize their supply chain operations and meet the growing demands of consumers, the need for reliable and flexible truck leasing and rental services becomes crucial. By offering a wide range of vehicles, flexible rental options, and value-added services, companies operating in this market can cater to the diverse needs of businesses across various industries. With the continuous advancements in technology and the increasing focus on sustainability, the truck leasing and rental market in Brazil is poised to play a vital role in shaping the future of the transportation industry in the region. According to ANFAVEA (Brazilian Motor Vehicle Manufacturers Association), truck registrations for rental purposes accounted for 10% of new sales in 2023, compared with 6.5% in 2022, and are projected to reach 14–15% in 2024.

Key Market Drivers

Economic Growth and Infrastructure Development

Economic growth in Brazil has been a significant driver of the truck leasing and rental market. As the country experiences economic expansion, various sectors, including manufacturing, agriculture, and e-commerce, rely heavily on road transportation for the movement of goods. According to IBGE (Brazilian Institute of Geography and Statistics), road freight accounts for over 60% of cargo transport in Brazil, making trucks a vital logistics backbone and influencing rental demand. This increased economic activity fuels demand for a flexible and scalable truck fleet, making leasing and rental options more attractive for businesses. Furthermore, infrastructure development initiatives, such as the expansion and improvement of highways, ports, and logistics hubs, require reliable and diverse truck fleets to support construction and transportation needs. Truck leasing and rental services offer companies the agility to adapt to the dynamic economic landscape and tap into new opportunities without the burden of upfront capital investments.

Flexibility and Scalability

The demand for flexibility and scalability is a driving force behind the truck leasing and rental market in Brazil. Companies in various sectors require the ability to quickly adjust their fleet sizes to accommodate changing market conditions. According to Volvo Group, Volvo Rental in Brazil offers contracts between 24–60 months, including maintenance, reducing fleet downtime by up to 15% compared with non-covered fleets. Leasing and rental agreements offer the flexibility to scale up or down based on seasonal variations, project requirements, or market fluctuations. This agility is particularly valuable in industries like agriculture, where harvest seasons demand a larger fleet for a limited time, or in e-commerce, where surges in online shopping necessitate more delivery vehicles during peak periods. Leasing and rental companies provide access to a wide range of truck models, allowing businesses to choose the right vehicles for specific tasks and durations.

Reduced Financial Risk and Capital Preservation

Mitigating financial risk and preserving capital is another critical driver in the Brazil Truck Leasing & Rental Market. When companies purchase trucks outright, they commit substantial capital to an asset that depreciates overtime. According to BNDES (Brazilian Development Bank), average interest rates for commercial vehicle financing exceeded 20% annually in 2023, pushing many operators toward rental over ownership. Leasing or renting trucks eliminates the depreciation risk, allowing businesses to allocate their resources to other strategic areas. This approach is particularly beneficial for startups and small to medium-sized enterprises looking to grow their operations without being burdened by a significant upfront investment in a fleet. By preserving capital, companies have more financial flexibility to invest in core business activities, such as marketing, technology, and personnel, ultimately contributing to their overall competitiveness and sustainability in the market.

Key Market Challenges

Infrastructure and Road Conditions

Brazil's vast and diverse geography, while offering opportunities for the transportation industry, also presents significant challenges. The quality of the road infrastructure varies widely across the country, with well-developed highways in some regions and inadequate or poorly maintained roads in others. This inconsistency can lead to increased maintenance costs, vehicle wear and tear, and even delays in deliveries. Truck leasing and rental companies may have to invest in more robust and versatile vehicles to navigate Brazil's diverse road conditions, which can be costly. The state of infrastructure also affects transportation efficiency and safety, which are key considerations for businesses looking to lease or rent trucks.

High Operating Costs

The high operating costs associated with maintaining a truck fleet are a significant challenge for truck leasing and rental companies in Brazil. Fuel costs, maintenance expenses, and labor costs are substantial components of the total cost of ownership for trucks. Fluctuating fuel prices can impact the profitability of the trucking business and make it difficult for leasing and rental companies to offer competitive pricing. Additionally, maintenance and repair costs can be elevated due to Brazil's challenging road conditions, further affecting the cost-effectiveness of leasing and rental services. In some cases, companies are required to provide additional services, such as maintenance and repair, which can increase operational complexity and costs.

Key Market Trends

Growth in E-commerce and Last-Mile Delivery

The exponential growth of e-commerce in Brazil is driving a significant trend in the Truck Leasing & Rental Market. With consumers increasingly turning to online shopping, there is a growing demand for efficient last-mile delivery solutions. E-commerce companies are increasingly relying on leased and rented trucks to meet this surge in demand, particularly during peak shopping seasons. These vehicles are often equipped with advanced telematics systems, ensuring the real-time tracking and monitoring of deliveries. The trend of e-commerce is likely to continue, and this sector will play a pivotal role in shaping the future of truck leasing and rental services in Brazil.

Advanced Fleet Management and Telematics

Advanced fleet management and telematics solutions are rapidly gaining traction in the Brazil Truck Leasing & Rental Market. These technologies offer several benefits, including improved vehicle safety, route optimization, and better fuel efficiency. They also provide valuable insights into vehicle health, maintenance schedules, and driver behavior. Leasing and rental companies are incorporating telematics systems into their vehicles to enhance the services they offer to clients. These systems not only improve operational efficiency but also provide customers with real-time visibility into their leased or rented fleets, helping them make data-driven decisions. The adoption of advanced fleet management and telematics is expected to continue its upward trajectory in the market.

Rise of Short-Term Rentals and Flexibility

The demand for short-term rentals and flexibility in leasing terms is a growing trend in the Brazil Truck Leasing & Rental Market. Businesses are increasingly looking for solutions that allow them to scale their fleets up or down to meet varying demand. This is particularly relevant for seasonal businesses, event logistics, and construction projects. Short-term rentals provide the flexibility to meet these fluctuating needs without the long-term commitment of a lease. Leasing companies are responding by offering more versatile rental options with competitive pricing, ultimately enhancing their value proposition for customers. The ability to adapt to shifting market dynamics is a key driver of this trend.

Digitalization and Online Booking Platforms

The digitalization of business processes, including online booking platforms, is transforming the Brazil Truck Leasing & Rental Market. Companies are increasingly moving towards digital solutions for booking and managing their leased or rented fleets. These online platforms offer convenience, transparency, and accessibility for customers, enabling them to browse available vehicles, check pricing, and schedule rentals or leases with ease. Additionally, digital solutions allow for efficient fleet management, maintenance scheduling, and reporting. Customers can access real-time data and manage their accounts remotely, streamlining the administrative aspects of truck leasing and rental. The industry's growing adoption of digitalization reflects the broader trend of businesses leveraging technology for operational efficiency.

Segmental Insights

Type Insights

In 2024, leasing remains the dominant segment due to its structural advantages for large businesses seeking stable fleet solutions, while rentals continue to grow as an essential support mechanism for fluctuating logistics needs across industries. Leasing has gained traction across logistics providers, construction contractors, and agricultural operators who require trucks for extended durations while benefiting from predictable monthly costs, maintenance packages, and tax benefits. The segment is further supported by rising demand for fleet modernization, where companies are opting to lease new vehicles rather than purchase, thereby improving operational efficiency and reducing downtime. The shift toward asset-light business models in the transportation sector has strengthened leasing as a preferred choice, as it allows firms to scale fleets based on demand while avoiding the risks of ownership such as depreciation and resale value concerns. The growing focus on sustainability is also playing a role, with leasing firms offering access to more fuel-efficient and technologically advanced trucks, enabling businesses to align with stricter environmental standards without incurring large upfront investments.

The rental segment, while smaller in comparison, is witnessing steady growth driven by short-term logistics needs, seasonal agricultural demand, and project-based construction activities. Rentals are highly valued by companies requiring trucks on a temporary basis to manage peak load requirements or to cover specific transportation contracts. The flexibility of daily, weekly, or monthly agreements provides a strong advantage for businesses looking to maintain agility in their operations. Rentals also serve as a strategic option for small and medium-sized enterprises that may not have the financial capacity to commit to long-term leases, but still require modern and well-maintained trucks to remain competitive. Another contributing factor to the rise in rentals is the expansion of e-commerce and last-mile delivery services, where operators often turn to rented vehicles to handle surges in order volumes, particularly during festive or promotional periods.

Regional Insights

The Southeast region was the leading contributor to Brazil’s truck leasing and rental market in 2024, supported by its role as the country’s economic powerhouse and its extensive industrial base. The region’s dense concentration of manufacturing units, distribution centers, and ports generates sustained demand for reliable trucking services, particularly through leasing, which allows businesses to operate modern fleets without the financial burden of ownership. Large logistics operators favor long-term agreements to ensure stability, efficiency, and compliance with regulatory standards while benefiting from cost predictability and maintenance support. Rental services also play a role, especially in response to e-commerce expansion and seasonal demand surges, where companies rely on short-term access to vehicles to manage delivery peaks and ensure smooth urban logistics.

The South region also represents a dominant share of the market, driven by its strong agricultural and industrial activities. Commodities such as grains, poultry, and processed foods require uninterrupted transport across long distances, making leasing the preferred choice for companies that need dependable fleet solutions. Ports and cross-border trade further stimulate demand for modern leased trucks that support efficiency and reliability. Rentals, while smaller in scale, are vital in the South during harvest seasons when agribusiness faces spikes in logistics demand, often requiring short-term contracts to transport perishable goods quickly. The region’s industrial base, including machinery and textiles, adds to rental demand, as manufacturers frequently turn to flexible agreements to address fluctuations in production and distribution.

Recent Developments

- Daimler Truck is entering Brazil’s growing truck rental market with its first such venture, launching an initial fleet of 100 Mercedes-Benz trucks and targeting 200 by year-end. The USD 40 million investment comes amid high new truck prices and costly financing, making rentals more attractive. Brazil’s rental share of new trucks rose from 6.5% in 2022 to about 10% in 2023, with 2024 projections reaching 14–15%. The company will compete with Vamos, Localiza, Volvo, Scania, and VWCO in a market of 3.8 million trucks.

- In 2022, Volvo Financial Services has launched “Volvo Rental” in Brazil, offering long-term rental options for Volvo trucks, buses, and construction equipment with terms from 24 to 60 months. The service provides customized plans based on mileage, hours, or subscription, allowing lower upfront investment and predictable monthly costs. Rentals include Volvo maintenance and service plans, ensuring maximum uptime and operational reliability. Initially available at select dealers, the program will expand nationwide, aligning with Brazil’s shift toward flexible rental and leasing solutions.

- In September 2021, Enterprise Holdings announced a partnership with Microsoft to equip the fleets of the former company's car rental, commercial truck, and exotic vehicle rental businesses in the US and soon, the UK and Canada, with connected car technology. Enterprise Holding anticipates that this partnership will enhance the modernized renting process.

- The Enterprise Holdings affiliate disclosed an agreement to buy Walker Vehicle Rentals, a provider of commercial vehicle rentals, in October 2021. Enterprise has a foothold in the Irish market for commercial vehicle rentals, and the acquisition helped the company expand the variety and quality of the vehicles and services it offers to businesses.

Key Market Players

- Enterprise Holdings, Inc.

- Penske Truck Leasing Co.

- Idealease, Inc.

- Rush Enterprises, Inc.

- Mendon Trucks Leasing and Rental

- PACCAR Leasing Company

- Ryder System, Inc.

- Wyatt Leasing, LLC

By Truck Type | By Type | By Lease Type | By End User | By Region |

- Light Duty

- Medium Duty

- Heavy Duty

| | - Financial

- Operational

- Third Party

| - Oil & Gas

- FMCG

- E-Commerce

- Mining

- Construction

- Others

| - North

- Northeast

- Central-West

- Southeast

- South

|

Report Scope:

In this report, Brazil Truck Leasing & Rental Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

- Brazil Truck Leasing & Rental Market, By Truck Type:

o Light Duty

o Medium duty

o Heavy duty

- Brazil Truck Leasing & Rental Market, By Type:

o Lease

o Rental

- Brazil Truck Leasing & Rental Market, By Lease Type:

o Financial

o Operational

o Third Party

- Brazil Truck Leasing & Rental Market, By End User:

o Oil & Gas

o FMCG

o E-Commerce

o Mining

o Construction

o Others

- Brazil Truck Leasing & Rental Market, By Region:

o North

o Northeast

o Central-West

o Southeast

o South

Competitive Landscape

Company Profiles: Detailed analysis of the major companies presents in Brazil Truck Leasing & Rental Market.

Available Customizations:

Brazil Truck Leasing & Rental Market report with the given market data, TechSci Research offers customizations according to a company's specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five).

Brazil Truck Leasing & Rental Market is an upcoming report to be released soon. If you wish an early delivery of this report or want to confirm the date of release, please contact us at [email protected]