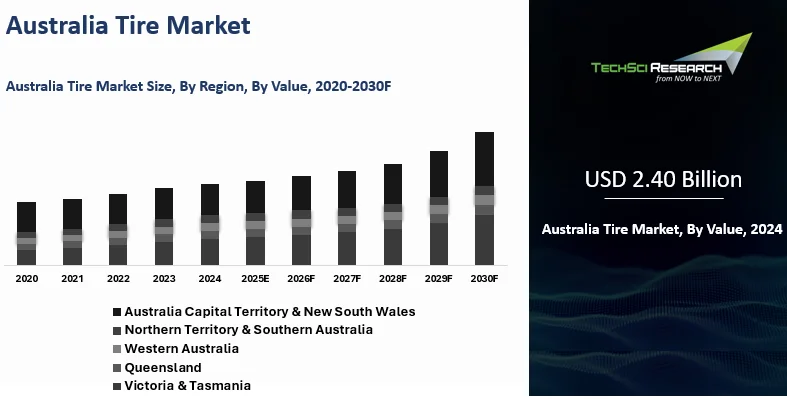

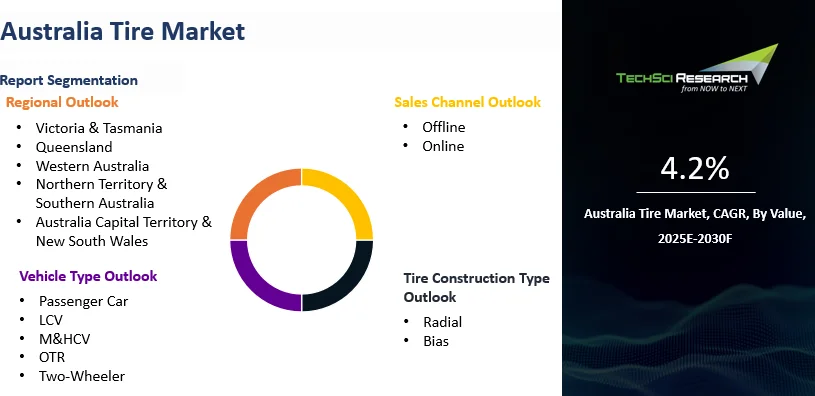

Forecast Period | 2026-2030 |

Market Size (2024) | USD 2.40 Billion |

CAGR (2025-2030) | 4.2% |

Fastest Growing Segment | Online |

Largest Market | Australia Capital Territory & New South Wales |

Market Size (2030) | USD 3.08 Billion |

Market Overview

The Australia Tire Market was valued at USD 2.40 Billion in 2024 and is

expected to reach USD 3.08 Billion by 2030 with a CAGR of 4.2% during the

forecast period. The Australia Tire Market is experiencing robust growth due to a combination

of economic factors and rising consumer demand for high-quality tires. With the

continuous increase in vehicle sales, tire manufacturers are seeing a steady

rise in demand, especially for passenger cars and commercial vehicles. The tire

market in Australia is also benefiting from strong government regulations that

prioritize road safety and environmental sustainability. These regulations

require manufacturers to meet certain standards, pushing the demand for

high-performance and eco-friendly tires.

Furthermore, as the automotive

industry embraces electric vehicles (EVs), the need for tires specifically

designed for EVs is on the rise, contributing to market growth. Manufacturers

are now focusing on developing tires that offer improved durability, lower

rolling resistance, and enhanced performance to meet the growing demand from

the EV segment.

In terms of market opportunities, the increasing trend of

vehicle customization and the demand for premium tires are providing new growth

avenues for tire manufacturers. The Australian government's "Future Made in Australia" policy, introduced in April 2024, aims to promote domestic manufacturing, including the tire industry. This initiative is underpinned by a Y22.7 billion investment over a decade. Such policies are expected to enhance the competitiveness of local tire manufacturers and encourage investment in sustainable production practices. The tire market is thus

poised for steady growth, driven by advancements in tire technology and

evolving consumer demands.

Market

Drivers

Increase in Vehicle Ownership

Australia has witnessed a steady

increase in vehicle ownership in recent years. The growth of the automotive

sector, alongside improved economic conditions and rising disposable incomes,

has led to more Australians purchasing personal vehicles. As the vehicle fleet

expands, the demand for both new and replacement tires continue to rise. Car

ownership is increasingly seen as a necessity, and this trend is expected to

continue, fueling the need for tires in the coming years. Additionally, a

growing urban population and suburban expansion contribute to the rise in

vehicles on the road, further driving tire consumption. Australia's automotive sector experienced robust growth in 2024, with new vehicle sales reaching 1.24 million units, marking a 9% year-on-year increase . This surge in vehicle ownership has directly amplified demand for replacement tires, particularly as the average tire replacement cycle shortens to 3.2 years, down from 3.8 years in 2020.

Government Regulations on Road Safety

Tire safety regulations have played a significant role in the market's

expansion. In Australia, stringent safety standards are enforced to ensure that

tires meet certain performance benchmarks, particularly for wet conditions and

tread depth. These regulations require manufacturers to continually innovate

and produce tires that offer enhanced safety and meet regulatory standards. As

a result, there is a consistent demand for tires that align with these

requirements, helping to maintain public safety on Australian roads. The

increased focus on road safety continues to drive consumer preference toward

high-quality, compliant tires.

Growing Commercial Vehicle Fleet

Australia’s growing commercial vehicle fleet significantly impacts tire

demand, particularly for light commercial vehicles (LCVs), medium and heavy

commercial vehicles (M&HCVs), and off-the-road (OTR) vehicles. The

expansion of e-commerce, logistics, and transportation industries has increased

the need for reliable tires that can withstand the wear and tear associated

with long-haul and heavy-duty use. Companies rely on robust tires to ensure

their fleets are operational and can handle various terrains and loads. The

increasing volume of freight and transport activities has thus stimulated the

demand for specialized commercial tires. Digital platforms are revolutionizing tire procurement in Australia. Online sales now constitute 27% of the aftermarket, with platforms like Tyroola and Tempe Tires leveraging AI-driven fitment tools to match tires to over 35,000 vehicle models . Additionally, services like JAX Tires' same-day mobile fitting in Sydney and Melbourne have boosted online passenger tire sales to 19% of total volume, reflecting a shift towards convenience and digital engagement in the tire retail sector.

Download Free Sample Report

Key

Market Challenges

Intense Competition in the Market

The tire industry in Australia

is highly competitive, with numerous domestic and international players vying

for market share. Established global tire manufacturers, along with local

companies, offer a wide range of products, which makes it challenging for any

single brand to dominate the market. The competition is particularly intense in

the budget tire segment, where consumers are often more price sensitive.

Companies must continuously innovate and find ways to reduce costs while

maintaining product quality in order to stay competitive in a crowded market.

Supply Chain Disruptions

Tire manufacturers in Australia,

like many industries, are vulnerable to disruptions in their supply chains.

Issues such as transportation delays, geopolitical tensions, or labor shortages

can interfere with the timely delivery of raw materials or finished products.

These disruptions not only affect production schedules but also impact the

availability of tires in the market, leading to shortages and delayed

deliveries. The reliance on global supply chains means that Australian

manufacturers are susceptible to external factors that can negatively impact

the overall tire market.

Key

Market Trends

Growing Demand for Eco-Friendly

Tires

The demand for environmentally

friendly tires is growing in Australia as consumers become more conscious of

their environmental impact. Tires made from sustainable materials, such as

natural rubber and bio-based compounds, are becoming increasingly popular. Manufacturers

are responding to this trend by incorporating recycled materials and reducing

the carbon footprint of their production processes. As the market shifts toward

sustainability, companies are focusing on developing tires that are not only

eco-friendly but also maintain high-performance standards, giving

environmentally conscious consumers a viable option without compromising

safety.

Rise of Smart Tires

The integration of smart

technology into tires is another emerging trend in Australia’s tire market.

Smart tires, which feature embedded sensors that track tire pressure,

temperature, wear, and other performance metrics, are gaining traction. These

sensors provide valuable data to drivers and fleet managers, helping them

monitor tire health and prevent issues before they lead to breakdowns. As the

automotive industry moves toward more connected and automated systems, the

demand for smart tires is expected to rise, offering increased safety,

efficiency, and convenience.

Growth in Electric Vehicle (EV)

Tire Segment

The rise of electric vehicles

(EVs) is driving significant changes in the tire market. EVs require tires

designed to accommodate their unique characteristics, such as heavier weight

and different torque distribution. Tires for EVs must provide enhanced durability,

lower rolling resistance, and greater energy efficiency to maximize battery

range. Manufacturers are focusing on producing tires specifically tailored to

the needs of electric vehicles, contributing to the growth of the EV tire

segment. As more Australians adopt EVs, this trend is expected to accelerate. The growing popularity of electric vehicles (EVs), which accounted for 8.4% of total vehicle sales in Q1 2024, has further skewed demand toward premium products, with EV-specific tires experiencing an 18% year-to-date sales increase

Segmental

Insights

Vehicle Type Insights

The Australian tire market is

diverse, catering to different vehicle types, including passenger cars, light

commercial vehicles (LCVs), medium and heavy commercial vehicles (M&HCVs),

off-the-road (OTR) vehicles, and two-wheelers. The demand for passenger car

tires remains high due to the large number of private vehicles in the country.

These tires are primarily designed to offer a balance of performance, safety,

and comfort. The market for light commercial vehicles is growing steadily,

driven by increased commercial activities and transportation needs across the

country. These vehicles require tires that offer durability and performance

under various road conditions, especially for businesses involved in logistics

and transportation. In the medium and heavy

commercial vehicle segment, tires are designed to withstand the high demands of

freight transportation and long-distance travel. These tires need to be

durable, have a longer lifespan, and provide stability under heavy loads. Off-the-road

vehicles, such as those used in mining, agriculture, and construction, require

tires designed for extreme conditions. These tires are built to handle rough

terrains and heavy machinery. Two-wheelers, including motorcycles and scooters,

also represent a significant portion of the tire market in Australia. These

tires are smaller and designed for better maneuverability, fuel efficiency, and

safety in urban environments.

Download Free Sample Report

Regional

Insights

New South Wales

New South Wales, paired with the ACT, remains the largest market for tires in Australia. This dominance stems from the high concentration of population and urban centers such as Sydney and Canberra, which fuel both passenger and commercial vehicle usage. The region’s well-developed road infrastructure supports a vast network of passenger vehicles, trucks, and commercial fleets requiring consistent tire replacements and upgrades. The growing adoption of electric vehicles in urban zones has further stimulated demand for specialized tires designed for improved performance and energy efficiency. In addition to private vehicle use, New South Wales & ACT benefit from government initiatives focused on infrastructure expansion, including road upgrades and public transport projects, which increase the demand for heavy-duty and commercial tires. The combination of dense population and ongoing infrastructure investment has ensured that this region captures a significant share of tire sales and replacement activity in 2024.

Queensland

Queensland has emerged as the second dominant region in the Australian tire market, driven largely by its expansive geographic size and economic activities centered around mining, agriculture, and tourism. The state's commercial and industrial sectors require durable tires suited for heavy machinery and off-road vehicles, creating a strong demand for specialized tire products. Queensland’s tourism industry also contributes to the passenger tire market, with substantial traffic in coastal cities and regional hubs. Urban growth in Brisbane and surrounding areas supports an increase in vehicle ownership, leading to higher tire replacement rates. Queensland’s warm climate conditions influence tire preferences, with consumers often opting for all-season or performance tires suited to local driving environments. Investment in regional road infrastructure and government programs aimed at improving transport connectivity within the state further stimulate tire demand, particularly in rural and mining areas. These economic and demographic factors position Queensland as a vital market, contributing significantly to Australia’s overall tire industry performance in 2024.

Recent

Developments

- In 2023, Bridgestone's Investment in Sustainable Tire Technology

Bridgestone Corporation has committed to a major investment in eco-friendly

tire technologies aimed at reducing the environmental impact of tire

production. The company announced plans to expand the use of sustainable

materials, such as renewable natural rubber and synthetic rubber alternatives,

in its tire manufacturing process. This development is in line with

Bridgestone's long-term sustainability goals and is expected to drive growth in

the eco-friendly tire segment.

- In 2023, Michelin's Strategic Partnership with Tesla Michelin Group

signed a strategic partnership agreement with Tesla in 2023 to supply tires

specifically designed for Tesla's growing electric vehicle fleet. These tires,

designed for performance and energy efficiency, help enhance the range and

safety of Tesla’s electric cars. The collaboration underscores Michelin’s focus

on the expanding electric vehicle market and strengthens its position in the

tire market for EVs.

- October 2023, ROH Wheels, a prominent Australian wheel manufacturer,

announced strategic partnerships with emerging electric vehicle manufacturers

in the region. The move aims to produce custom-designed Tire optimized for EVs,

considering weight, torque, and aerodynamics.

- In 2024, Beaurepaires, a subsidiary of Goodyear and Dunlop Tyres Australia, began rebranding some of its 100 retail locations to Goodyear Auto Service centers as part of a consolidation strategy. Negotiations with Bob Jane T-Marts to acquire the Beaurepaires chain took place in mid-2024 but ended with Bob Jane acquiring only select profitable locations.

Key

Market Players

- Bridgestone Corporation

- Michelin

Group

- Goodyear Tire & Rubber Company

- Continental AG

- Pirelli & C. S.p.A.

- Toyo Tire Corporation

- Hankook Tire & Technology Co., Ltd.

- Cooper Tire & Rubber Company

- Yokohama Rubber Company

- Sumitomo Rubber Industries, Ltd.

|

By Vehicle Type

|

By Tire Construction

|

By Sales

Channel

|

By

Region

|

- Passenger car

- LCV

- M&HCV

- Two-Wheeler

- OTR

|

|

|

- Victoria & Tasmania

- Queensland

- Western Australia

- Northern Territory & Southern Australia

- Australia Capital Territory & New South Wales

|

Report

Scope:

In this

report, the Australia Tire Market has been segmented into the following

categories, in addition to the industry trends which have also been detailed

below:

·

Australia Tire Market, By Vehicle Type:

o

Passenger car

o

LCV

o

M&HCV

o

Two-Wheeler

o

OTR

·

Australia Tire Market, By Tire Construction:

o

Radial

o

Bias

·

Australia Tire Market, By Sales Channel:

o

Offline

o

Online

·

Australia Tire Market, By Region:

o

Victoria & Tasmania

o

Queensland

o

Western Australia

o

Northern Territory & Southern Australia

o

Australia Capital Territory & New South Wales

Competitive

Landscape

Company

Profiles: Detailed

analysis of the major companies presents in the Australia Tire Market.

Available

Customizations:

Australia

Tire Market report with the given market data, Tech Sci Research

offers customizations according to the company’s specific needs. The following

customization options are available for the report:

Company

Information

- Detailed analysis and profiling of additional

market players (up to five).

Australia

Tire Market is an upcoming report to be released soon. If you wish an early

delivery of this report or want to confirm the date of release, please contact

us at [email protected]