Market Overview

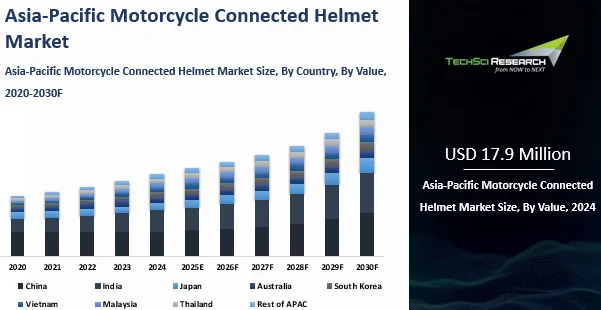

The APAC Motorcycle Connected Helmet Market was valued at USD 17.9 Million in 2024 and is expected to reach USD 25.6 Million by 2030 with a CAGR of 6.2% during the forecast period. The global motorcycle connected helmet market is witnessing substantial growth due to the integration of advanced technologies aimed at enhancing rider safety and communication. Smart helmets equipped with features like GPS navigation, Bluetooth connectivity, and real-time accident detection are becoming increasingly popular among riders seeking improved safety and convenience. These helmets allow for hands-free communication, music streaming, and navigation, reducing distractions and promoting safer riding practices.

Technological advancements play a pivotal role in the market's expansion. The development of lightweight materials, improved battery life, and enhanced sensor technologies contribute to the creation of more efficient and comfortable smart helmets. Additionally, the integration of artificial intelligence and machine learning algorithms enables helmets to detect accidents in real-time and alert emergency services, potentially saving lives. These innovations are attracting consumers and manufacturers alike, further fueling market growth. Government regulations and safety standards are also influencing the market dynamics. In many regions, authorities are implementing stricter helmet laws and promoting the adoption of smart helmets to reduce road fatalities. These regulatory measures are encouraging manufacturers to develop helmets that comply with safety standards while incorporating advanced features. As a result, the market is experiencing increased demand for connected helmets that offer enhanced protection and functionality.

Market Drivers

Technological Advancements

The continuous evolution of technology is a significant driver of the motorcycle connected helmet market. Innovations such as improved Bluetooth connectivity, advanced sensors, and augmented reality displays are being integrated into helmets, providing riders with enhanced features like navigation assistance, real-time traffic updates, and hands-free communication. These technological advancements not only improve rider convenience but also contribute to overall safety by minimizing distractions and enabling quicker response times in emergency situations. For example, in March 2024, Samsung Electronics unveiled AI-powered smart helmets in South Korea, incorporating 5G connectivity and safety alerts. These innovations are attracting tech-savvy riders seeking enhanced safety and connectivity features.

Rising Safety Concerns

Increasing awareness about road safety and the high incidence of motorcycle accidents are prompting both riders and manufacturers to prioritize safety features in helmets. Connected helmets equipped with features like crash detection, emergency alerts, and real-time health monitoring are gaining popularity as they offer added protection and peace of mind to riders. This heightened focus on safety is driving the demand for advanced helmet technologies in the market. According to the World Health Organization, motorcyclist fatalities have risen by 30% over the past decade. Motorcyclists now account for nearly one-third of the approximately 1.2 million annual road deaths worldwide. This global trend underscores the critical need for enhanced motorcycle safety initiatives. Indonesia's road safety profile indicates a high reliance on motorcycles, which constitute 84% of the vehicle fleet. Despite this, only 32% of road infrastructure meets safety standards for motorcyclists. The country experiences approximately 25 fatalities per thousand kilometers of road, highlighting the urgent need for improved infrastructure and safety measures.

Government Regulations and Incentives

Governments worldwide are implementing stricter helmet laws and offering incentives for adopting smart helmets to enhance road safety. These regulations not only mandate the use of helmets but also encourage the adoption of connected helmets by providing subsidies or tax benefits. Such policies are accelerating the market growth by making smart helmets more accessible and appealing to consumers. Vietnam enacted a comprehensive motorcycle helmet law in 2007, increasing helmet use from about 30% to approximately 93% among riders.

Download Free Sample Report

Key Market Challenges

High Cost of Smart Helmets

The integration of advanced technologies into helmets increases their manufacturing costs, making smart helmets more expensive than traditional ones. This higher price point can deter price-sensitive consumers from adopting connected helmets, limiting market growth. Manufacturers need to find ways to reduce production costs without compromising on quality to make smart helmets more affordable and accessible to a broader audience.

Regulatory Hurdles

The evolving nature of technology often outpaces regulatory frameworks, leading to uncertainties regarding the approval and certification of connected helmets. Inconsistent regulations across different regions can create challenges for manufacturers in ensuring compliance and entering new markets. Collaborating with regulatory bodies to establish clear standards and guidelines is vital to navigate these hurdles and facilitate market expansion. The Indian government has directed district authorities to launch campaigns against substandard helmet sales and manufacturing. As of October 2024, 162 licenses of helmet manufacturers were canceled, and 27 searches and seizures were conducted.

Key Market Trends

Integration of Augmented Reality

Augmented reality (AR) is being integrated into connected helmets to provide riders with real-time information overlays, such as navigation directions, speed, and hazard alerts. This immersive experience enhances situational awareness and aids in decision-making, contributing to improved safety and convenience. The adoption of AR technology is a growing trend in the motorcycle helmet market, catering to tech-savvy riders seeking advanced features.

Health Monitoring Features

Health monitoring capabilities are becoming a key feature in motorcycle connected helmets as riders seek more comprehensive safety and wellness support during their journeys. These helmets now often include embedded biometric sensors that track vital signs such as heart rate, body temperature, and blood oxygen levels. Some models go further by detecting signs of fatigue or drowsiness using built-in accelerometers and motion tracking, triggering alerts to prompt the rider to rest. This integration of health monitoring is particularly beneficial during long-distance travel or in extreme weather conditions, where rider health can directly impact reaction time and decision-making. The data collected can be stored in cloud systems or synced with mobile health apps, giving riders the ability to monitor long-term health trends and receive personalized recommendations.

Segmental Insights

Helmet Type Insights

The motorcycle connected helmet market is segmented by helmet type into full face, half face, and open face categories, each serving distinct preferences and usage scenarios. Full face helmets are designed to provide comprehensive coverage to the head and chin areas, integrating features such as HUD displays, voice command modules, crash sensors, and rear-view cameras. They cater to riders seeking higher protection and advanced functionalities in both urban and long-distance settings. These helmets often come equipped with larger battery capacities to support the embedded tech features, along with internal speaker systems for hands-free communication. Half face helmets are preferred for their lightweight build and enhanced airflow, offering moderate protection while maintaining comfort in warmer climates. Despite their more open design, many models in this category integrate essential connected features such as Bluetooth intercom, turn-by-turn navigation, and mobile integration.

Open face helmets, covering the top and sides of the head without a chin guard, focus on rider visibility and comfort. They are often adopted for short-distance commutes or low-speed travel. While these helmets offer limited structural coverage, they are being adapted to incorporate core smart features like call management, music streaming, and location tracking. Across all helmet types, connectivity components are being refined to balance weight, ventilation, and safety. Embedded microphones, speakers, and control units are being streamlined to improve rider ergonomics.

Helmet design trends show a movement towards modular integration where technology is seamlessly embedded into the helmet shell or padding without interfering with aesthetics or comfort. Manufacturers are also emphasizing noise-cancellation features across all helmet types to enable clearer voice commands and communication during high-speed rides. As consumer awareness grows, buyers across all categories are showing interest in smart helmets that offer a blend of comfort, safety, and digital connectivity. Compatibility with third-party apps, firmware updates, and remote diagnostics are influencing buying decisions. Each helmet type presents a specific set of use cases and adoption factors that vary by rider preference, geography, and technological acceptance, shaping the market's product development strategies and customization efforts.

Download Free Sample Report

Country Insights

China

In 2024, China and Japan emerged as the two dominant countries in the Asia-Pacific motorcycle connected helmet market, driven by technological innovation, regulatory enforcement, and evolving consumer preferences. China leads the regional market due to its expansive manufacturing base and widespread adoption of electric two-wheelers. The government’s enforcement of helmet regulations, particularly targeting e-bike riders under the national road traffic safety law, has significantly increased helmet usage. This legislative pressure, combined with urban population growth and concerns over traffic safety, has pushed consumers to seek helmets with advanced safety features. The rise of smart cities and integration of 5G networks have also created a favorable environment for connected devices, including helmets with navigation, communication, and health monitoring capabilities. In urban areas such as Shanghai, Guangzhou, and Beijing, riders are adopting connected helmets equipped with voice control and real-time traffic alerts, aligning with broader national goals of enhancing road safety through digital infrastructure.

Japan

Japan plays a critical role in the market with its emphasis on product quality, innovation, and a high-value consumer base. The country’s focus on rider safety and technological advancement has supported the development and uptake of smart helmets. With a relatively mature two-wheeler market, Japan’s consumers tend to prioritize premium products with integrated features like Bluetooth communication, GPS navigation, and fatigue monitoring systems. Aging demographics have further influenced the demand for health monitoring features within connected helmets, helping riders stay alert and responsive on the road. Government-led initiatives on vehicle safety, including the promotion of intelligent transport systems (ITS), have indirectly boosted the motorcycle connected helmet segment by aligning with broader efforts to digitize transportation safety. Japan’s expertise in electronics and sensor technology has also facilitated the production of lightweight, durable, and smart-enabled helmets tailored for both city commuters and long-distance riders.

India

Additionally, India has witnessed a substantial rise in motorcycle ownership, particularly in urban areas where motorcycles are increasingly used for daily commuting. This surge in motorcycle usage has led to a heightened demand for helmets, including connected variants that offer advanced safety features. In 2024, India achieved a record-breaking 20.5 million two-wheeler sales, marking a 16.6% increase compared to the previous year. The premium motorcycle segment, defined by engine capacities of 125cc and above, experienced robust growth. This segment grew by 19-21% in 2024, driven by rising disposable incomes and a growing preference for high-performance motorcycles. The government's implementation of stricter regulations regarding helmet usage has further contributed to this increased demand. For instance, legislation mandating helmet use in second and third-tier cities aims to reduce traffic-related fatalities and promote road safety.

Recent Developments

- Sena Technologies, a leader in Bluetooth communication devices, expanded its product range by launching a new series of smart helmets in 2024. These helmets feature built-in Bluetooth communication systems, allowing riders to communicate with others, listen to music, or navigate using voice commands. The integration of smart technology addresses the growing consumer demand for helmets that combine safety with connectivity. Sena's move represents a significant step towards meeting the evolving needs of tech-savvy riders who seek helmets with more than just basic protection.

- Jarvish introduced its X and X-AR smart helmets through a crowdfunding campaign, offering features such as voice control via Amazon Alexa, Google Assistant, and Siri. The X-AR model includes an augmented reality (AR) heads-up display, providing riders with real-time navigation and performance data. These helmets aim to enhance rider safety and convenience by integrating advanced technology into a sleek design.

- GoPro announced its acquisition of Forcite Helmet Systems, a company specializing in smart helmets with integrated cameras and communication systems. This acquisition aims to enhance GoPro’s product offerings in the motorcycling sector by combining Forcite’s innovative helmet technology with GoPro’s expertise in action cameras and content creation. The collaboration is expected to lead to the development of advanced smart helmets that cater to the growing demand for connected riding experiences.

- In May 2024, Japanese startup Kopin Corporation partnered with Fujitsu to create next-generation smart helmets with augmented reality capabilities for the construction and manufacturing industries. Such partnerships are expanding the market reach and technological capabilities of connected helmets. These collaborations are fostering innovation and competition, leading to the introduction of helmets with advanced features that cater to the evolving needs of riders.

Key Market Players

- Sena Technologies, Inc.

- Daqri, LLC

- Jarvish Inc.

- Fusar Technologies Inc.

- LiveMap LLC

- Skully Technologies LLC

- Nand Logic Corporation

- Forcite Helmet Systems Pty Ltd

- Reevu Ltd.

- Bell Sports, Inc.

By Helmet Type | By Distribution Channel | By Country |

- Full Face

- Half Face

- Open Face

| | - China

- India

- Japan

- Australia

- South Korea

- Vietnam

- Malaysia

- Thailand

- Rest of APAC

|

| | |

Report Scope:

In this report, the APAC Motorcycle Connected Helmet Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

· APAC Motorcycle Connected Helmet Market, By Helmet Type:

o Full Face

o Half Face

o Open Face

· APAC Motorcycle Connected Helmet Market, By Distribution Channel:

o Offline

o Online

· APAC Motorcycle Connected Helmet Market, By Country:

o China

o India

o Japan

o Australia

o South Korea

o Vietnam

o Malaysia

o Thailand

o Rest of APAC

Competitive Landscape

Company Profiles: Detailed analysis of the major companies presents in the APAC Motorcycle Connected Helmet Market.

Available Customizations:

APAC Motorcycle Connected Helmet Market report with the given market data, TechSci Research, offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five).

APAC Motorcycle Connected Helmet Market is an upcoming report to be released soon. If you wish an early delivery of this report or want to confirm the date of release, please contact us at [email protected]