|

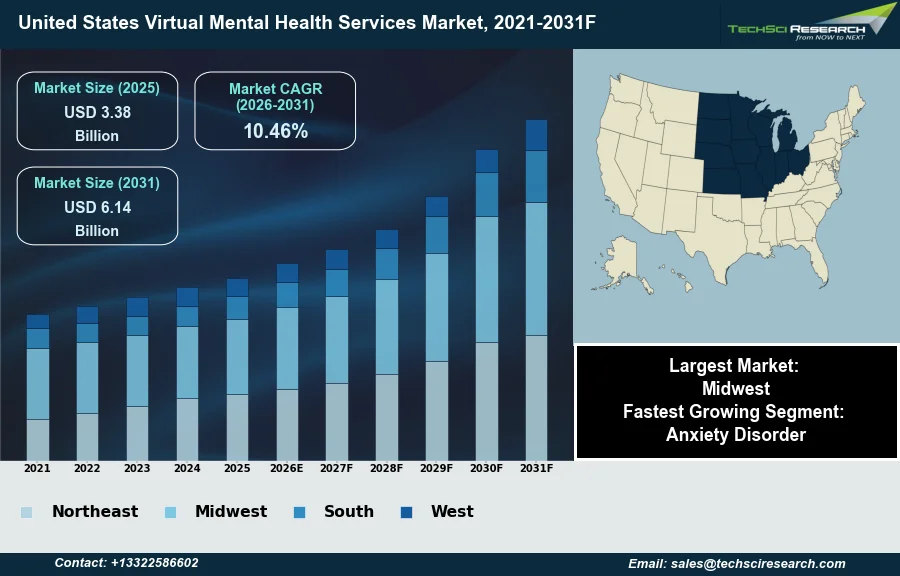

Forecast Period

|

2027-2031

|

|

Market Size (2025)

|

USD 3.38 Billion

|

|

CAGR (2026-2031)

|

10.46%

|

|

Fastest Growing Segment

|

Anxiety Disorder

|

|

Largest Market

|

Midwest

|

|

Market Size (2031)

|

USD 6.14 Billion

|

Market Overview

The United States Virtual Mental Health Services Market will grow from USD 3.38 Billion in 2025 to USD 6.14 Billion by 2031 at a 10.46% CAGR. Virtual mental health services encompass the delivery of psychiatric assessment, therapy, and behavioral health support through digital communication technologies including video conferencing, mobile applications, and remote monitoring systems. The rapid expansion of this sector is primarily driven by the critical shortage of in-person mental health professionals relative to the escalating prevalence of behavioral disorders across the country. Furthermore, favorable regulatory advancements and expanded insurance reimbursement policies for tele-behavioral health have structurally increased accessibility which encourages healthcare providers to integrate hybrid care models into their standard practice.

Despite this robust growth trajectory, the market faces a significant challenge regarding the complex regulatory landscape of cross-state practitioner licensing that restricts providers from treating patients located outside their primary jurisdiction. This fragmentation creates administrative burdens that can disrupt continuity of care for mobile populations and limit the scalability of national telehealth platforms. However, demand from the corporate payer sector remains resilient as organizations prioritize employee wellness. According to the American Telemedicine Association, in 2025, 81% of employers intended to offer their workforce access to low or no cost mental health support through tele-mental health providers.

Key Market Drivers

The escalating prevalence of mental health conditions serves as the primary catalyst propelling the United States Virtual Mental Health Services Market. As the burden of behavioral disorders intensifies across the population, traditional in-person care models are struggling to meet the surge in patient volume, thereby necessitating scalable digital interventions to ensure continuity of care. This rising demand creates a direct pipeline for virtual platforms that can offer immediate, remote access to psychiatric evaluations and therapy for diverse demographic groups. According to Mental Health America, October 2024, in the 'State of Mental Health in America 2025' report, 23.40% of adults in the U.S. experienced a mental illness in the past year, representing over 60 million individuals potentially seeking care. Consequently, digital health providers are rapidly expanding their clinical networks to accommodate this influx of patients who require consistent, long-term management of conditions such as anxiety and depression.

Concurrently, the critical shortage of qualified mental health professionals acts as a powerful structural driver, compelling the market toward tele-behavioral solutions to bridge the supply-demand gap. Geographic disparities and workforce limitations often leave vast regions underserved, making virtual care an essential mechanism for maximizing the reach of available clinicians and reducing wait times. According to the American Psychological Association, May 2024, in the '2024 Practitioner Pulse Survey', 53% of practicing psychologists reported having no openings for new patients, highlighting the severe capacity constraints within the traditional system. To mitigate these access barriers, commercial payers and organizations are aggressively integrating telehealth options into benefit designs to support their members. According to the Kaiser Family Foundation, in 2024, 29% of large employers with at least 200 workers specifically increased access to telehealth mental health providers to support their workforce, ensuring that virtual modalities remain a vital component of the national healthcare delivery infrastructure.

Download Free Sample Report

Key Market Challenges

The complex regulatory landscape of cross-state practitioner licensing constitutes a substantial barrier to the scalability of the United States Virtual Mental Health Services Market. Because mental health providers are typically licensed on a state-by-state basis, they are legally prohibited from treating patients across borders without obtaining additional, often costly, credentials. This fragmentation disrupts the efficient distribution of the workforce, preventing available therapists in one region from addressing patient surpluses in another. Consequently, telehealth platforms face significant administrative overhead and legal risks when attempting to offer a standardized national service, directly stalling their ability to expand rapidly and meet rising demand.

This regulatory patchwork creates a volatile operating environment that complicates compliance and strategic planning for market participants. The lack of uniformity forces organizations to dedicate extensive resources to monitoring disparate and evolving legal requirements rather than patient care innovation. According to the Federation of State Medical Boards, in 2025, the association was monitoring 92 bills across 34 states related to telemedicine regulations and licensure changes. This high volume of legislative activity underscores the persistent instability and fragmentation that hampers the market's trajectory toward a unified, accessible care delivery model.

Key Market Trends

The integration of AI-enabled diagnostic and therapeutic tools is fundamentally reshaping the market by enhancing clinical decision-making and operational efficiency. As demand outstrips supply, providers are deploying artificial intelligence to automate administrative burdens like documentation and to offer predictive analytics that personalize patient treatment plans. This technological shift is not merely experimental but is being rapidly operationalized to support the strained workforce and improve diagnostic precision without increasing clinician burnout. According to the American Psychological Association, December 2025, in the '2025 Practitioner Pulse Survey', 56% of psychologists reported using AI tools in their practice, a substantial increase from 29% in the prior year, underscoring the aggressive adoption of these technologies to augment care delivery.

Strategic market consolidation through mergers and acquisitions is accelerating as organizations seek to create comprehensive, end-to-end behavioral health platforms. Fragmented point solutions are increasingly merging to offer broader provider networks and integrated care pathways that appeal to large enterprise payers and health systems. This consolidation wave is driven by the need to achieve economies of scale and navigate the complex regulatory environment more effectively by pooling resources and clinical capabilities. According to Behavioral Health Business, April 2025, in the report 'Behavioral Health Deal Volume Up 53% in Early 2025', behavioral health deal volume increased by 53% in the first quarter of 2025 compared to the preceding quarter, indicating a decisive shift toward large-scale platform aggregation and market maturity.

Segmental Insights

The Anxiety Disorder segment currently represents the fastest-growing category in the United States virtual mental health services market, driven by escalating prevalence rates highlighted by the National Institute of Mental Health. This rapid expansion is primarily fueled by the inherent suitability of telepsychiatry for managing anxiety, as remote consultations provide immediate access while minimizing the social apprehension often associated with in-person therapy. Additionally, continued support for telehealth reimbursement by federal programs ensures consistent patient access to care. Consequently, digital platforms are increasingly prioritizing anxiety management solutions to address this critical public health need.

Regional Insights

The Midwest region currently maintains a dominant position in the United States Virtual Mental Health Services Market, primarily due to the critical need to bridge the gap between rising patient demand and limited provider availability in rural communities. This geographic disparity has accelerated the adoption of telepsychiatry and remote counseling as essential service delivery models. Furthermore, the expansion of supportive reimbursement policies, aligned with standards from the Centers for Medicare & Medicaid Services, has significantly enhanced accessibility for underserved populations. Consequently, the region exhibits high utilization rates for digital behavioral health platforms compared to other national territories.

Recent Developments

-

In October 2024, Headspace introduced "Ebb," an AI-powered companion feature designed to assist users in processing their emotions and navigating daily stressors. The tool utilized motivational interviewing techniques to encourage user self-reflection and provided personalized recommendations for relevant content, such as meditation exercises or educational resources. Headspace released this feature to bridge the gap between self-guided wellness content and clinical services, offering an immediate resource for members between therapy sessions. This product launch represented a strategic move to integrate artificial intelligence into the company's care model, aiming to increase user engagement and provide scalable emotional support.

-

In September 2024, Talkspace entered into a strategic partnership with Amazon Health Services to improve the discoverability of mental health benefits for consumers. Through this collaboration, Talkspace became the first virtual behavioral health provider to participate in Amazon's Health Conditions Program, allowing shoppers to verify their insurance eligibility and enroll in therapy services directly via the Amazon platform. The initiative was designed to address the gap in benefit awareness, ensuring that more insured individuals could utilize their existing coverage for mental healthcare. This arrangement expanded access to Talkspace’s network of licensed therapists to millions of potential patients across the United States.

-

In July 2024, Teladoc Health expanded its virtual care portfolio by launching a comprehensive mental healthcare service for children, adolescents, and their families. Developed in collaboration with Brightline, a provider specializing in pediatric behavioral health, this offering was designed to meet the rising demand for youth mental health support. The service enabled members to access Brightline’s network of coaches and therapists through Teladoc Health’s existing interface, creating a unified entry point for family care. This integration allowed the company to support individuals under eighteen with age-appropriate interventions while facilitating continuity of care for young adults transitioning to adult services.

-

In June 2024, Spring Health launched "Community Care," a new solution aimed at addressing social determinants of health to advance mental health equity. This initiative integrated a database of over 500,000 verified community resources, including food banks, housing assistance, and government programs, directly into the company’s platform. By facilitating connections to local support services, the company sought to mitigate non-medical factors that adversely affect mental well-being. The launch emphasized a holistic approach to care, ensuring that health plan members and employees could access essential social support alongside the company's existing clinical therapy and medication management services.

Key Market Players

- Talkspace

- BetterHelp

- Cerebral

- Headspace Health

- Lyra Health

- Ginger

- Teladoc Health

- AbleTo

- Spring Health

- Modern Health

|

By Region

|

- Northeast

- Midwest

- South

- West

|

Report Scope:

In this report, the United States Virtual Mental Health Services Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

-

United States Virtual Mental Health Services Market, By Region:

-

Northeast

-

Midwest

-

South

-

West

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the United States Virtual Mental Health Services Market.

Available Customizations:

United States Virtual Mental Health Services Market report with the given market data, TechSci Research offers customizations according to a company's specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five).

United States Virtual Mental Health Services Market is an upcoming report to be released soon. If you wish an early delivery of this report or want to confirm the date of release, please contact us at [email protected]