|

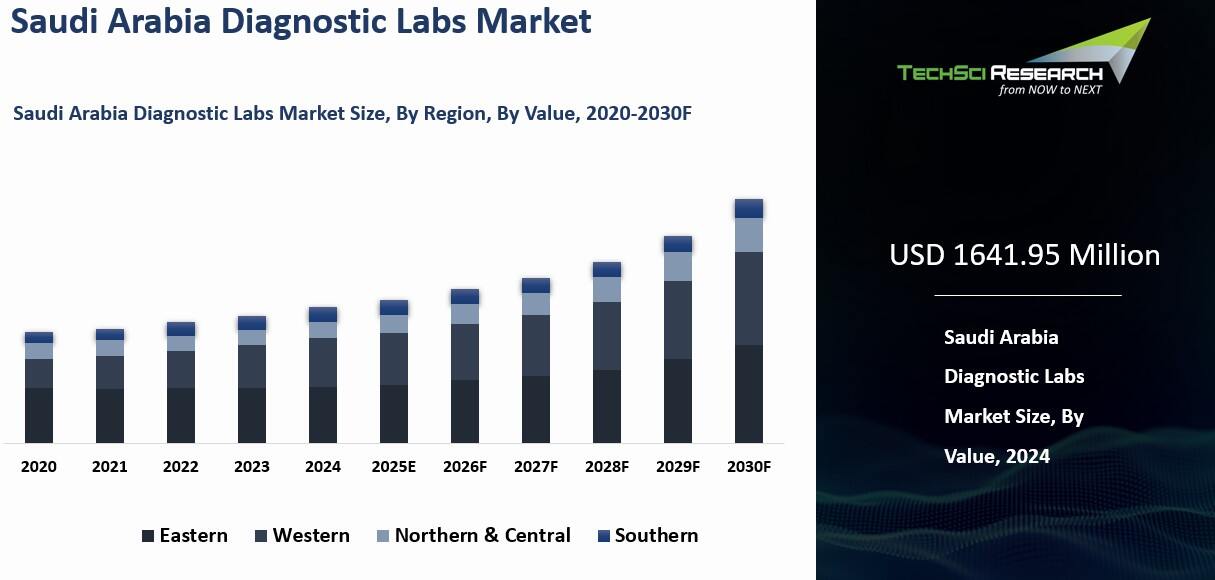

Forecast

Period

|

2026-2030

|

|

Market

Size (2024)

|

USD

1641.95 Million

|

|

Market

Size (2030)

|

USD

2367.75 Million

|

|

CAGR

(2025-2030)

|

6.25%

|

|

Fastest

Growing Segment

|

Stand

Alone

|

|

Largest

Market

|

Northern

& Central

|

Market Overview

The Saudi Arabia Diagnostic Labs Market was valued at USD 1641.95 Million in 2024 and is expected to reach USD 2367.75 Million by 2030 with a CAGR of 6.25% during the forecast period.

Diagnostic labs, also known as clinical or medical laboratories, are facilities where medical tests and analyses are performed on patient samples to aid in the diagnosis, monitoring, and treatment of diseases. These labs play a crucial role in healthcare by providing essential information to professionals assessing patient health status.

Diagnostic labs perform a wide variety of tests on biological samples such as blood, urine, tissue, and other body fluids. These tests span multiple disciplines, including clinical chemistry, hematology, microbiology, pathology, immunology, and molecular diagnostics. Some advanced labs also offer imaging services such as X-rays, CT scans, MRI scans, and ultrasounds. These imaging methods help visualize internal structures and support the detection and evaluation of conditions affecting organs and tissues.

The primary function of diagnostic labs is to detect the presence of diseases, assess their severity, and monitor progression or response to treatment. This includes diagnosing infectious diseases, chronic illnesses, genetic disorders, and cancers. Growing awareness of the importance of regular health check-ups and early disease detection has significantly increased demand for diagnostic services within the Saudi healthcare ecosystem.

Technological advances, including molecular diagnostics, digital pathology, and point-of-care testing, are boosting market growth by enhancing speed, accuracy, and efficiency. The shift toward preventive healthcare encourages individuals to undergo frequent diagnostic screenings. At the same time, the integration of artificial intelligence (AI) and machine learning has further improved diagnostic efficiency and accuracy. Rising patient involvement and the trend toward personalized medicine also drive the demand for a wider range of tailored diagnostic tests.

Download Free Sample Report

Key Market Drivers

Technological Advancements

The digitization of pathology slides has enabled the storage, retrieval, and analysis of pathology images in digital format. This advancement, as seen in centers like King Faisal Specialist Hospital & Research Centre (KFSHRC) which reduced diagnostic turnaround times to as little as one day, improves workflow efficiency while facilitating remote access and collaborative consultations among pathologists. Portable and rapid diagnostic devices also support testing at or near the point of care, delivering immediate results in emergencies or chronic disease monitoring.

Molecular biology techniques have transformed diagnostics by enabling the detection of genetic markers, mutations, and infectious agents, a key part of Saudi Arabia's Vision 2030 healthcare modernization goals. Technologies such as Polymerase Chain Reaction (PCR) and nucleic acid sequencing play a critical role. Next-Generation Sequencing (NGS) further extends genetic testing capabilities by sequencing entire genomes, supporting personalized medicine, cancer genomics, and rare disease diagnosis at research centers like King Abdullah University of Science and Technology (KAUST).

Microfluidic devices, or lab-on-a-chip technologies developed at institutions like KAUST, allow miniaturized diagnostic testing, reducing required sample volumes while improving speed and affordability. Alongside this, advanced imaging systems such as MRI, CT, and PET scans provide comprehensive insights into organ structures and functions. The integration of AI and machine learning enhances image analysis, with implementations like an AI system for mammogram analysis at King Faisal Specialist Hospital improving accuracy and efficiency.

Telepathology has emerged as another significant advancement, allowing pathologists to remotely view and interpret slides. This innovation supports consultations and second opinions, with KFSHRC's virtual pathology service collaborating with international institutions like the Cleveland Clinic. Studies show a prominent level of knowledge and endorsement for telepathology among Saudi healthcare workers and the general population, thereby helping to bridge geographic gaps in healthcare access.

Rising Healthcare Awareness

Growing awareness about preventive healthcare has encouraged more people to undergo regular health check-ups and screenings. In Saudi Arabia, government initiatives under the Health Sector Transformation Program, part of Saudi Vision 2030, extend beyond service provision to focus on elderly care awareness. Efforts include promoting healthy nutrition for older adults, addressing mental health in later life, and sharing elderly health practices.

Diagnostic labs are integral to detecting health issues such as cancer, diabetes, and cardiovascular conditions. Early detection enables timely intervention and better treatment outcomes. As a result, healthcare authorities, supported by the more than 2,000 hospitals and medical centers across the Kingdom, regularly promote screening programs, encouraging individuals to visit diagnostic labs for comprehensive assessments. Public health campaigns further highlight prevalent community health challenges while emphasizing the value of early testing.

Events, workshops, and outreach programs organized by healthcare providers and diagnostic labs also educate the public. These initiatives often include free or discounted tests that increase participation. In addition, widespread access to health information through the internet, television, and print media, which has high penetration in the Kingdom, makes individuals better informed about the importance of diagnostic testing.

As healthcare providers emphasize regular check-ups as part of routine care, patient compliance improves due to increased awareness of health benefits. A cultural shift towards prioritizing health and wellness is emerging, with people actively pursuing preventive measures. This trend, reinforced by experiences of global health crises such as COVID-19, has intensified demand for diagnostic testing in Saudi Arabia. Growing information accessibility ensures individuals are increasingly equipped to recognize the role of diagnostic labs in managing and monitoring health, thereby accelerating the adoption of these services.

Increasing Focus on Preventive Healthcare

Preventive healthcare emphasizes routine check-ups and screenings that enable early identification of health risks. Saudi Arabia leads healthcare expenditure in the Gulf Cooperation Council (GCC), accounting for 60% of the region’s total. In 2023, the government allocated USD 50.4 billion, representing 16.96% of the national budget, to healthcare and social development. This investment ranked as the second-largest budget item after education. The Saudi Government is also advancing privatization initiatives within the sector to improve efficiency and increase private sector participation.

Diagnostic labs are central to preventive healthcare, offering tests that identify conditions before symptoms appear. These labs assess health risks and monitor indicators, supporting early interventions and lifestyle changes to prevent chronic diseases. Personalized screenings based on age, gender, family history, and lifestyle factors are also becoming more prevalent, providing a targeted approach to preventive measures. Many labs now offer structured preventive health packages that encourage individuals to undergo thorough assessments.

Aligned with Vision 2030, Saudi Arabia plans to invest over USD 65 billion in healthcare transformation. The strategy includes restructuring services, expanding insurance privatization, developing 21 health clusters nationwide, and expanding e-health initiatives. These efforts are expected to modernize infrastructure, improve accessibility, and strengthen long-term innovation in the healthcare system. Additionally, companies are implementing wellness programs that include regular health check-ups for employees, boosting workforce health and reducing costs.

Public and private entities are also increasing awareness campaigns that highlight the role of screenings in preventing diseases. Diagnostic labs are vital for identifying risk factors for chronic conditions such as diabetes, cardiovascular diseases, and cancers. Cardiovascular disease remains the leading cause of non-communicable disease deaths in Saudi Arabia, responsible for 28% of all fatalities, followed by cancer, diabetes, and chronic respiratory diseases. Collectively, these contribute to around 22,000 deaths annually, with a 16% risk of premature death between ages 30 and 70.

Educational initiatives are raising awareness about the importance of diagnostic tests and empowering individuals to actively manage their health. Advances in telehealth and remote monitoring allow preventive consultations from home, increasing convenience and access. Insurance programs offering incentives or coverage for screenings further encourage regular visits to diagnostic labs. These combined factors are expected to accelerate the demand for diagnostic labs across Saudi Arabia.

Key Market Challenges

Cost Pressures

Diagnostic labs face significant operational costs associated with equipment maintenance, consumables, personnel, and facility management. Balancing these expenses while maintaining high-quality services remains a challenge. To stay competitive, labs must invest in advanced technologies, but the high upfront and ongoing maintenance costs strain financial resources. Recruiting and retaining skilled professionals such as pathologists, laboratory technicians, and support staff also contributes substantially to operating expenses, making workforce management a key cost driver.

Ensuring compliance with regulatory standards further adds to financial burdens. Investments are required in staff training, quality control processes, and documentation to maintain certifications and meet strict healthcare standards. In addition, regular updating and maintenance of diagnostic equipment and IT systems are vital for improving efficiency and accuracy, but they impose recurring costs. Labs that depend on high test volumes for revenue may also face significant risks when demand fluctuates, making it harder to cover fixed expenses consistently.

Market Competition

Intense competition among diagnostic labs often leads to price wars, lowering service costs for consumers but shrinking profit margins for labs. Reduced profitability limits the ability of labs to invest in cutting-edge technologies or maintain stringent quality standards. Competition is also heightened because many providers offer similar services, making differentiation difficult and client retention more challenging. Labs must rely on strategies like personalized care, superior service, or faster turnaround times to stand out.

Frequent technology upgrades are essential to remain competitive, but costly for smaller laboratories. The need to keep up with industry innovations and offer new services increases financial and workforce pressures. Market saturation also restricts growth opportunities, as expansion into untapped regions or niches becomes limited. The highly competitive environment makes it harder for labs to achieve sustainable profitability while simultaneously advancing services to meet patient and healthcare industry demands.

Key Market Trends

Digital Pathology

Digital pathology allows for the efficient

management of pathology slides in a digital format. Instead of using

traditional glass slides, pathology images are digitized and stored

electronically. Pathologists can access digital pathology images remotely,

enabling them to review cases from different locations. This is particularly

beneficial for consultations, second opinions, and collaboration among

pathologists. Digital pathology facilitates collaboration among healthcare

professionals by enabling the sharing of pathology images in real-time. This is

valuable for multidisciplinary team meetings and consultations with experts

located in different geographic areas. Digital pathology solutions contribute

to the optimization of workflow in diagnostic labs. The digitization of slides

streamlines the process of slide preparation, storage, retrieval, and analysis,

leading to improved efficiency. Digital pathology is used for educational

purposes, allowing medical students, residents, and pathologists to access a vast

repository of digital pathology images for learning and training. Digital

pathology platforms often incorporate image analysis tools that assist

pathologists in quantifying and analyzing pathology images. This can enhance

the accuracy and objectivity of diagnostic assessments. Digital pathology

solutions can be integrated with Laboratory Information Systems, allowing for

seamless data exchange between different components of the diagnostic workflow.

Segmental Insights

Provider Type Insights

In 2024, the Saudi Arabia

Diagnostic Labs Market largest share was held by Stand Alone segment and is

predicted to continue expanding over the coming years. Stand-alone diagnostic

labs operate independently, allowing them to focus solely on diagnostic

services without being tied to specific healthcare institutions. This autonomy

can contribute to agility and flexibility in responding to market demands. Stand-alone

labs often specialize types of diagnostic tests or services, such as pathology,

imaging, or specialized screenings.

This specialization can attract a specific

clientele seeking expertise in a particular area. Stand-alone labs provide

quick and direct access to diagnostic services without the need for navigating

through a hospital setting. This convenience is particularly appealing to

individuals seeking rapid and hassle-free testing. Stand-alone labs may have

competitive pricing models, offering cost-effective diagnostic solutions

compared to larger hospital-based labs. This affordability can attract a

broader range of customers. Stand-alone labs may invest in the latest diagnostic

technologies and equipment, staying at the forefront of advancements. This

commitment to technological innovation can enhance the quality and accuracy of

diagnostic services.

Test Type Insights

In 2024, the Saudi Arabia

Diagnostic Labs Market largest share was held by Pathology segment and is

predicted to continue expanding over the coming years. Pathology is a crucial

branch of medicine that plays a fundamental role in diagnosing diseases,

especially cancer. Pathological examinations of tissues and cells provide

valuable insights for determining the nature and extent of diseases. Pathology

is central to cancer diagnostics, and with the increasing prevalence of cancer

globally, there's a growing demand for pathology services. Pathological

assessments help in confirming cancer diagnoses, determining the stage of

cancer, and guiding treatment decisions.

Advances in molecular pathology

techniques, such as molecular diagnostics and genetic testing, have expanded

the scope of pathology services. These advancements allow for more precise and

personalized diagnostics, contributing to the segment's growth. Pathology

services provide comprehensive profiling of diseases, allowing healthcare

professionals to understand the underlying mechanisms and tailor treatment

plans accordingly. This holistic approach to diagnostics is increasingly valued

in healthcare. The integration of digital pathology solutions allows for the

digitization of pathology slides, enabling easier storage, retrieval, and

sharing of pathology images. This technological advancement enhances the

efficiency and accessibility of pathology services.

Download Free Sample Report

Regional Insights

The Northern & Central region dominated the

Saudi Arabia Diagnostic Labs Market in 2024. The Northern and Central regions, particularly cities like Riyadh

(Central region) and Jeddah (considered part of both regions), have higher

population densities compared to other parts of the country. Higher population

density often correlates with increased demand for healthcare services,

including diagnostic testing. These regions are more urbanized and developed,

leading to better healthcare infrastructure and accessibility. Urban areas tend

to have a higher concentration of healthcare facilities, including diagnostic

labs, to cater to the healthcare needs of the population. Major cities in the

Northern and Central regions often attract medical tourists seeking advanced

healthcare services. The demand for diagnostic testing is higher in areas with

a significant influx of both local and international patients. The Northern and

Central regions are economic hubs with thriving business activities. The

economic prosperity in these regions contributes to higher healthcare spending,

including diagnostic services. These regions may house specialized medical

centers, research institutions, and tertiary care hospitals that require

advanced diagnostic capabilities. This concentration of specialized facilities

can drive the demand for sophisticated diagnostic tests.

Recent Developments

- April 2024: Bioniq Health-Tech Solutions entered the Saudi market through a strategic partnership with Al Borg Diagnostics. This collaboration aims to provide personalized supplements based on blood test results across 28 cities.

- 2025 IPO: Almoosa Health completed a major initial public offering (IPO), raising $450 million, signaling strong investor confidence in the region's healthcare sector.

- June 2025: Alphaiota expanded its partnership with PMcardio to launch the first AI-powered diagnostic platform for heart attacks in Saudi Arabia.

- May 2025: Synyi AI launched its "Dr Hua" clinic, which uses artificial intelligence to assist in diagnosis and prescriptions, reportedly reducing turnaround times by 30%.

- December 2024: King Faisal Specialist Hospital and Research Centre (KFSH&RC) launched the first advanced hematology diagnostics laboratory in the Middle East and North Africa. The lab features the region's largest automated hematology track and uses AI for analysis.

- 2024: King Abdullah University of Science and Technology (KAUST) and the Saudi Data and AI Authority (SDAIA) introduced MiniGPT-Med, a vision-language AI model designed to enhance diagnostics by analyzing images alongside clinical text for various conditions.

- In October 2024, Al-Borg Diagnostics, one of the largest private diagnostic networks in the Middle East and North Africa, participated in the Global Health Forum held in Riyadh from October 21-23. The event provided a platform to showcase and raise awareness about the latest innovations and advancements in laboratory services and healthcare, highlighting Al-Borg Diagnostics' commitment to driving progress and excellence in the medical field.

- In October 2024, The Chief Executive Officer of the Saudi Food and Drug Authority (SFDA) launched a new initiative on Wednesday focused on advancing diagnostic laboratory equipment and promoting the use of 3D printing in hospitals. The initiative was unveiled at the SFDA's pavilion during the Global Health Exhibition 2024 in Riyadh, marking a significant step toward enhancing healthcare technologies and improving medical capabilities within the kingdom.

Key

Market Players

- Al Borg Medical

Laboratories

- Delta Medical Laboratories

- Alfa Medical Laboratories

- Roya Specialized Medical

Laboratories

- Tibyana Medical

Laboratories

- Al Hyatt Medical Laboratory

Company

- Advanced Cell Laboratory

for Medical Analysis Company

- Al-Arab Medical

Laboratories

|

By

Provider Type

|

By

Test Type

|

By

End User

|

By

Region

|

- Hospital

Based

- Stand-Alone

|

|

- Referrals

- Walk-ins

- Corporate

Clients

|

- Eastern

- Western

- Northern

& Central

- Southern

|

Report Scope:

In this report, the Saudi Arabia Diagnostic Labs Market

has been segmented into the following categories, in addition to the industry

trends which have also been detailed below:

- Saudi Arabia Diagnostic Labs

Market, By

Provider Type:

o Hospital Based

o Stand Alone

- Saudi Arabia Diagnostic Labs

Market, By

Test Type:

o Radiology

o Pathology

- Saudi Arabia Diagnostic Labs

Market, By End-User:

o Referrals

o Walk-ins

o Corporate Clients

- Saudi Arabia Diagnostic Labs Market, By region:

o Eastern

o

Western

o

Northern

& Central

o

Southern

Competitive Landscape

Company Profiles: Detailed analysis of the major companies presents in the Saudi

Arabia Diagnostic Labs Market.

Available Customizations:

Saudi Arabia Diagnostic Labs Market report

with the given market data, TechSci Research offers customizations according

to a company's specific needs. The following customization options are

available for the report:

Company Information

- Detailed analysis and profiling of additional

market players (up to five).

Saudi Arabia Diagnostic Labs Market is an upcoming report to be released

soon. If you wish an early delivery of this report or want to confirm the date

of release, please contact us at [email protected]