|

Forecast

Period

|

2026-2030

|

|

Market

Size (2024)

|

USD

583.39 Million

|

|

Market

Size (2030)

|

USD

834.64 Million

|

|

CAGR

(2025-2030)

|

6.11%

|

|

Fastest

Growing Segment

|

Diagnostic

|

|

Largest

Market

|

North

India

|

Market Overview

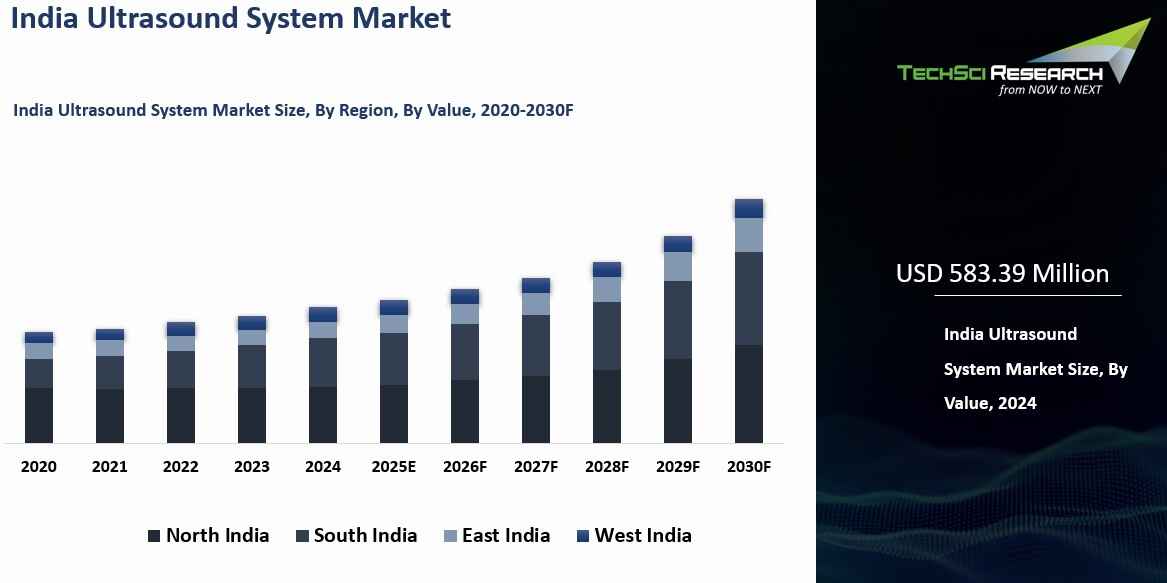

The Ultrasound System Market in India was valued at USD 583.39 Million in 2024 and is expected to reach USD 834.64 Million by 2030 with a CAGR of 6.11% during the forecast period.

An ultrasound system, also known as an ultrasound machine or scanner, is a pivotal medical imaging tool that uses high-frequency sound waves to produce real-time images of internal body structures. It serves

as a non-invasive, adaptable diagnostic instrument used across various

medical domains. At the heart of this system lies the transducer, a handheld

device that emits high-frequency ultrasound waves into the body and captures returning echoes. Fitted with piezoelectric crystals, the transducer both

generates and receives these waves. Typically coated with gel for optimal wave

transmission, it is placed on the skin over the target area.

India's growing population has spurred increased demand for healthcare services,

including diagnostic imaging. Ongoing advancements in ultrasound technology, including enhanced image resolution, 3D/4D imaging, and AI integration, have driven the adoption of newer ultrasound systems. Particularly in prenatal care

and obstetrics, where India has a notable birth rate, ultrasound is widely used, driving market growth. Furthermore, increased public awareness

regarding early disease detection and routine health screenings has further

propelled demand for ultrasound examinations. The proliferation of

telemedicine has also necessitated ultrasound systems with telemedicine

capabilities, facilitating remote consultations and diagnostics. This trend

underscores the evolving landscape of healthcare delivery, with a growing

emphasis on accessibility and remote patient care.

Download Free Sample Report

Key Market Drivers

Technological Advancements

The ultrasound systems market in India is evolving rapidly, driven by advances in transducer technology, imaging software, and digital integration. The development of high-frequency probes has significantly improved image resolution, particularly for superficial and musculoskeletal applications. At the same time, three-dimensional (3D) and four-dimensional (4D) imaging are enhancing anatomical visualization, with adoption accelerating across Indian diagnostic centers.

Doppler ultrasound has become indispensable in cardiology and obstetrics, with innovations in color and power Doppler improving sensitivity and diagnostic accuracy. Contrast-Enhanced Ultrasound (CEUS) is gaining traction in liver and cardiac diagnostics, especially for evaluating conditions such as hepatocellular carcinoma. Elastography is emerging as a critical tool for assessing tissue stiffness and differentiating between normal and pathological tissues, while strain imaging is enhancing clinical insights through analysis of tissue deformation.

Artificial intelligence (AI) and machine learning (ML) are increasingly embedded in ultrasound platforms to optimize image quality and workflow efficiency, with around 57% of Indian healthcare providers already using AI-enabled tools. Recent innovations include AI-powered ultrasound systems from Wipro GE and Philips, highlighting India’s growing role as both a manufacturing and innovation hub.

The adoption of compact, wireless, and portable ultrasound devices is expanding point-of-care imaging, particularly in emergency care, ICUs, and rural settings. The handheld ultrasound segment is expected to see steady growth through 2030. In parallel, ultrasound fusion technologies such as MRI-ultrasound fusion are improving procedural accuracy for biopsies and interventional diagnostics.

Telemedicine integration is further strengthening access to care, with collaboration platforms from GE HealthCare enabling real-time remote consultations between rural clinicians and urban specialists. Tissue Harmonic Imaging (THI) and advanced beamforming techniques are reducing artifacts and improving image clarity, while ultrasound-guided procedures are becoming more precise and widely accessible.

Collectively, these innovations are accelerating technological sophistication, accessibility, and clinical adoption driving sustained growth in the ultrasound systems market in India.

Rising Demand of Obstetrics and Gynecology Services

Ultrasound technology remains a cornerstone of prenatal and women’s healthcare, playing a critical role in the growth of the ultrasound systems market in India. In prenatal care, ultrasound enables continuous monitoring of fetal development, accurate gestational age estimation, and early detection of abnormalities. As a routine diagnostic tool used in approximately 62.8% of pregnancies, ultrasound maintains consistently high demand across both urban and semi-urban healthcare settings.

The growing preference among expectant parents to visualize fetal development has significantly increased the adoption of 3D and 4D ultrasound in obstetrics and gynecology (OBGYN), fostering stronger emotional engagement and improving clinical communication. Ultrasound’s ability to detect high-risk conditions such as ectopic pregnancies at early stages enables timely intervention, reinforcing its importance in prenatal diagnostics.

In gynecology, ultrasound is essential for diagnosing and monitoring ovarian cysts, uterine fibroids, and endometriosis. It also plays a central role in infertility assessment, where 3D ultrasound demonstrates diagnostic accuracy of 88-100% in identifying uterine anomalies, compared with 60–82% for conventional techniques. Additionally, ultrasound is widely used as a screening tool for gynecological cancers, where early detection substantially improves treatment outcomes.

Ultrasound is indispensable in fertility treatments, including in vitro fertilization (IVF), supporting follicular monitoring and image-guided procedures such as egg retrieval. It is also increasingly used to plan and guide minimally invasive gynecological surgeries, improving procedural precision and patient safety. Sustained patient volumes in OBGYN services supported by clinical training initiatives from organizations such as Federation of Obstetric and Gynaecological Societies of India continue to drive consistent utilization of ultrasound systems.

The non-invasive and radiation-free nature of ultrasound makes it the preferred imaging modality for women’s health. Ongoing technological advancements, including enhanced image resolution and widespread adoption of 3D and 4D imaging, are further strengthening ultrasound’s clinical value. Its ability to improve pregnancy monitoring and overall patient engagement is a key factor accelerating growth in the ultrasound systems market in India.

Increased Awareness

The rising awareness of preventive healthcare has driven demand for regular health check-ups, with ultrasound emerging as a key tool for health screening and early disease detection; in India, for example, a single diagnostic clinic may perform up to 40 ultrasounds daily. As patients become more informed, they increasingly request specific diagnostic tests, such as ultrasounds, when presenting with symptoms or concerns, driving patient-driven demand. Health awareness campaigns, particularly those focused on diseases like breast cancer and cardiovascular conditions, emphasize the importance of diagnostic imaging, further fueling demand for such services. Additionally, the growing emphasis on prenatal care has resulted in expectant mothers seeking regular ultrasound exams, maintaining a strong demand for obstetric ultrasound services.

The widespread use of media platforms, such as television, the internet, and social media, has played a pivotal role in educating both patients and healthcare providers about the benefits and effectiveness of ultrasound, including innovations like AI-assisted systems, a market segment valued at USD 3.53 billion in 2025. Cultural shifts towards proactive healthcare, along with endorsements from influential public figures, have further enhanced ultrasound's visibility as a vital diagnostic tool. Government-backed healthcare initiatives and community screening programs featuring ultrasound, often utilizing portable point-of-care (POCUS) devices from a market worth USD 5.71 billion, also help increase public awareness and access to these services.

The understanding that early diagnosis can significantly improve quality of life has motivated more individuals to seek diagnostic imaging, driving demand for ultrasound services in India’s healthcare market and contributing to a global market estimated at USD 12.4 billion in 2025.

Key Market Challenges

Affordability

and Accessibility

High-quality

ultrasound machines can be expensive, making them inaccessible to many smaller

healthcare facilities, clinics, and hospitals, particularly in rural areas. The

initial capital cost of acquiring ultrasound equipment can be a barrier to

entry. In addition to the purchase cost, there are ongoing operational costs,

including maintenance, training, and the purchase of consumables (such as

ultrasound gels).

These costs can strain healthcare providers' budgets.

Affordability is also a concern for patients. Many people in India pay for

healthcare out of pocket, and the cost of ultrasound examinations can be a

financial burden. This can deter individuals from seeking necessary diagnostic

services. In rural and remote areas of India, healthcare facilities may lack

the necessary infrastructure and resources to acquire and maintain advanced

ultrasound equipment. This leads to disparities in healthcare access. Operating

ultrasound equipment requires trained and skilled personnel, including

radiologists and sonographers. The shortage of such professionals in some areas

can limit access to ultrasound services.

Competition

and Market Saturation

The

market for ultrasound systems in India is highly competitive, with numerous

global and local manufacturers vying for market share. This intense competition

can result in pricing pressures and reduced profit margins for companies. To

gain a competitive edge, some manufacturers may engage in price wars, lowering

the cost of ultrasound systems. While this can benefit customers, it can make

it difficult for manufacturers to maintain profitability and invest in research

and development. The market is fragmented, with various manufacturers offering

a wide range of ultrasound systems, from basic models to advanced, specialized

machines.

This fragmentation can lead to market confusion and saturation,

making it challenging for customers to choose the most suitable system. In

major urban centers with well-established healthcare infrastructure, the

ultrasound market may be saturated. This can limit manufacturers' growth opportunities, as most healthcare providers already have the necessary

equipment. Many healthcare facilities have already invested in ultrasound

systems, and their replacement cycle can be longer than that of other medical equipment. This can slow down the adoption of newer models and

technology.

Key Market Trends

Preventive Healthcare

There is growing awareness among the Indian population of the importance of preventive healthcare measures.

People are proactively seeking ways to maintain their health and detect

potential medical issues early. The Indian government has launched

various health and wellness programs that promote preventive healthcare. These

initiatives often include recommendations for regular health check-ups and

screenings, in which ultrasound plays a crucial role. The availability of

health insurance plans in India has increased, and many policies now cover preventive healthcare services, including diagnostic procedures such as ultrasound examinations. This encourages individuals to undergo regular

check-ups.

Many companies in India have introduced corporate wellness programs

as part of their employee benefits. These programs often include health

check-ups, driving the demand for preventive diagnostic services. Healthcare

providers and diagnostic centers offer comprehensive health check-up packages that

include various diagnostic tests, including ultrasound scans. These packages

are designed to detect potential health issues before they become severe. Preventive

healthcare for women is a significant focus in India. This includes regular

gynecological check-ups, prenatal care, and breast health screenings, all of

which may involve an ultrasound.

Segmental Insights

Technology Insights

In 2024, the Diagnostic segment held the largest share of the India Ultrasound System Market and is expected to continue expanding over the coming years. Diagnostic ultrasound systems are used across various

medical specialties, including radiology, cardiology, obstetrics, gynecology, and internal medicine. Their versatility allows for a broad range of

diagnostic applications. Diagnostic ultrasound is a common tool for routine

health check-ups and early disease detection. It is often used for screening

purposes, contributing to a substantial volume of examinations. Diagnostic

ultrasound is used at the point of care in hospitals and clinics, enabling immediate, on-site assessment of various medical conditions.

This

on-the-spot diagnostic capability is valuable for quick decision-making. Diagnostic

ultrasound systems play a fundamental role in general healthcare services. They

are used to assess a wide range of medical conditions, making them

essential for healthcare providers in both urban and rural areas. These systems

are often more cost-effective compared to highly specialized ultrasound

equipment. This cost advantage makes them an attractive option for healthcare

institutions looking to provide comprehensive diagnostic services without substantial

investments. Many healthcare professionals across different medical specialties

are trained to use diagnostic ultrasound. This familiarity and ease of use

contribute to its widespread adoption.

Application Insights

In 2024, the largest share of the India Ultrasound System Market was held by the General Imaging segment, and it is expected to continue expanding in the coming years. General

imaging ultrasound systems are highly versatile and can be used for a wide

range of diagnostic applications. They are not limited to a specific medical

specialty, making them widely applicable for various clinical needs. General ultrasound imaging is used across multiple medical specialties, including

cardiology, radiology, internal medicine, and general practice. It is employed

for abdominal, pelvic, vascular, musculoskeletal, and other diagnostic

purposes. General imaging ultrasound is frequently used for routine health

check-ups and screenings, contributing to a substantial patient volume.

Many

health check-up packages include ultrasound examinations. General ultrasound imaging systems are often used at the point of care, in hospitals and clinics, for quick, preliminary assessments of various medical conditions.

This on-the-spot diagnostic capability is valuable. General imaging systems,

while offering a wide range of diagnostic capabilities, are often more

cost-effective than specialized ultrasound systems. This cost advantage makes

them attractive to healthcare providers.

Download Free Sample Report

Regional Insights

The North

India region dominated the India ultrasound system market in 2024. North India,

particularly Delhi, the NCR (National Capital Region), and Chandigarh,

is home to some of the country's most advanced healthcare infrastructure. These

areas have a high concentration of well-established hospitals, healthcare

facilities, and medical institutions, making them a primary market for ultrasound systems. The northern states of India, including Uttar Pradesh,

Haryana, and Punjab, have higher population densities than many other regions. This results in greater demand for healthcare services, including diagnostic imaging such as ultrasound, to serve a larger population.

The

northern states, especially Delhi and its surrounding regions, tend to have

higher economic prosperity and greater capacity for healthcare spending. This

economic advantage allows healthcare institutions to invest in advanced medical

equipment, including ultrasound systems. North India is home to prestigious medical colleges and research institutions that often offer advanced diagnostic

facilities. These institutions are more likely to adopt the latest medical

technologies, which include modern ultrasound systems. The North Indian states

are popular destinations for medical tourism due to their advanced healthcare

facilities. This has led to an increased demand for high-quality medical

services, including diagnostic procedures such as ultrasound.

Recent Developments

- In March 2025, Wipro GE Healthcare introduced the Versana Premier R3, an AI-enabled ultrasound system manufactured in India. The system features VisionBoost architecture, 8-million-channel digital processing, and supports 23 different probes for dynamic organ scanning.

- In April 2025, Philips launched its AI-enabled Elevate Platform upgrade on the EPIQ Elite ultrasound imaging platform at UltraFest 2025 in India.

- In March 2025, Apollo Hospitals and Siemens Healthineers formalized a Master Research Agreement to develop AI-enabled diagnostic and imaging solutions for liver disease management. The collaboration focuses on quantitative ultrasound imaging and AI-driven clinical tools for early detection and monitoring of Metabolic Dysfunction-Associated Steatotic Liver Disease (MASLD).

- In July 2025, Apollo Hospitals and Siemens Healthineers signed an addendum to their Master Research Agreement in Hyderabad, establishing collaborative research in diagnostic and interventional ultrasound imaging for liver care.

- In February 2025, FUJIFILM SonoSite expanded its software development operations in Noida, focusing on AI applications and considering local manufacturing of ultrasound devices as part of its 'Make in India' strategy.

- In February 2024, Fujifilm India launched the ALOKA ARIETTA 850 Diagnostic Ultrasound System with its first installation at Fortis Hospital in Bengaluru, Karnataka. The advanced endoscopic ultrasound system features 7 million digital channels for exceptional image quality and is designed to enhance diagnostic precision for gastrointestinal diseases.

Key Market Players

- Koninklijke Philips N.V.

- Wipro GE Healthcare Private Limited

- Trivitron Healthcare Private Limited

- Hitachi India Private Limited

- Konica Minolta Healthcare India Private Limited

- Siemens Healthcare Private Limited

- FUJIFILM Sonosite, Inc

- Erbis Engineering Company Limited

- Mindray Medical India Private Limited

- BPL Medical Technologies

|

By

Technology

|

By

Display Type

|

By

Mobility

|

By

Equipment Type

|

By

Application

|

By

End User

|

By

Region

|

|

|

|

|

|

- Obstetrics/Gynecology

- General

Imaging

- Cardiology

- Urology

|

|

- North

India

- West

India

- East

India

- South

India

|

Report

Scope:

In this report, the India Ultrasound

System Market has been segmented into the following categories, in addition to

the industry trends which have also been detailed below:

- India Ultrasound

System Market,

By Technology:

o Diagnostic

o Therapeutic

- India Ultrasound

System Market,

By Display Type:

o Black

& White

o Colored

- India Ultrasound System Market, By Mobility:

o Fixed

o Mobile

- India Ultrasound System Market, By Equipment Type:

o Refurbished

o New

- India Ultrasound System Market, By Application:

o Obstetrics/Gynecology

o General

Imaging

o Cardiology

o Urology

- India Ultrasound System Market, By End User:

o Hospitals

& Clinics

o Diagnostic

Centers

o Others

- India Ultrasound System Market, By Region:

o North India

o South

India

o East

India

o West

India

Competitive

Landscape

Company

Profiles: Detailed analysis of the major companies presents

in the India Ultrasound System Market.

Available

Customizations:

India Ultrasound System

Market report with the given market data, TechSci Research offers

customizations according to a company's specific needs. The following

customization options are available for the report:

Company

Information

- Detailed

analysis and profiling of additional market players (up to five).

India Ultrasound

System Market is an upcoming report to be released soon. If you wish an early

delivery of this report or want to confirm the date of release, please contact

us at [email protected]