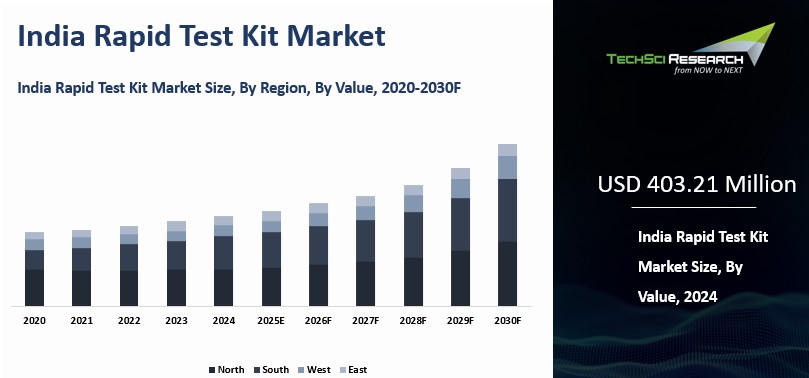

Forecast Period | 2026-2030 |

Market Size (2024) | USD 403.21 Million |

Market Size (2030) | USD 604.78 Million |

CAGR (2025-2030) | 6.84% |

Fastest Growing Segment | Over the Counter (OTC) |

Largest Market | South India |

Market Overview

India Rapid Test Kit Market was valued

at USD 403.21 Million in 2024 and is expected to

reach USD 604.78 Million by 2030 with a CAGR of 6.84% during the forecast

period.

The India Rapid Test Kit Market has witnessed substantial growth in

recent years, driven by the increasing demand for quick and accurate diagnostic

solutions, particularly in response to public health needs during and after the

COVID-19 pandemic. According to the Indian Council of Medical Research

(ICMR) report dated May 18, 2023, a total of 169 antigen-based rapid test kits

have been validated, including 34 revalidations, with the following

demonstrating satisfactory performance. Rapid test kits, which offer timely

results for various diseases such as infectious diseases, diabetes, and

cardiovascular conditions, have become essential tools in both clinical and

home settings. The market is characterized by a diverse range of products,

including antigen tests, antibody tests, and molecular diagnostic kits,

catering to various healthcare applications. Key factors propelling the market

include the rising prevalence of infectious diseases, growing health awareness

among the population, and the government’s initiatives to enhance healthcare

accessibility.

Regulatory support from the Indian

government, along with the establishment of stringent quality control measures,

has also contributed to market growth. However, challenges such as the lack of

awareness in rural areas, regulatory hurdles, and the presence of counterfeit

products pose significant risks to market expansion. Nonetheless, the outlook remains

positive, with ongoing research and development aimed at enhancing test

accuracy and expanding the range of diseases that can be diagnosed using rapid

test kits. As healthcare continues to evolve in India, the rapid test kit

market is expected to play a pivotal role in facilitating early diagnosis and

improving patient outcomes, ultimately contributing to the overall efficiency

of the healthcare system.

Download Free Sample Report

Key Market Drivers

Increasing

Demand for Quick Diagnostics

The India Rapid Test Kit Market is driven by the rising need for quick and reliable diagnostics. With a population exceeding 1.4 billion, the country continues to face major public health challenges such as tuberculosis, malaria, HIV/AIDS, and viral hepatitis. In many northern states, diarrheal diseases, lower respiratory infections, iron-deficiency anemia, neonatal disorders, and tuberculosis remain persistent issues.

The growing prevalence of these diseases highlights the importance of rapid testing solutions that can deliver accurate results in minutes. Rapid test kits allow healthcare professionals to make timely decisions, helping manage outbreaks and prevent transmission. According to the WHO World Malaria Report 2024, India recorded a 69% decline in malaria cases and a 68% drop in deaths. Between 2015 and 2023, tuberculosis incidence fell by 17.7% and mortality by 21.4%, showing progress in disease control efforts.

Rapid diagnostics play a crucial role during outbreaks where early detection determines containment success. During the COVID-19 pandemic, quick identification of infections enabled faster tracing and isolation, preventing wider spread. This experience reinforced the importance of fast and accessible diagnostics, leading healthcare systems to adopt rapid test kits for broader disease management.

Ease of use and accessibility have further boosted adoption. Point-of-care kits can be used in hospitals, clinics, or even at home, reducing dependence on laboratory facilities. As people become more health-aware, they are increasingly using these tools for routine monitoring. Beyond infectious diseases, the rise in chronic conditions such as diabetes and cardiovascular disorders has expanded the scope of rapid diagnostics.

Non-communicable diseases and injuries have overtaken infectious illnesses in disease burden across states. Cardiovascular, respiratory, metabolic, neurological, and renal disorders contribute significantly. Early detection through rapid testing helps prevent complications and supports better patient outcomes. As preventive healthcare awareness grows, the demand for quick, reliable diagnostics continues to strengthen across India.

Technological

Advancements

Technological progress is a key factor propelling the India Rapid Test Kit Market, reshaping diagnostics by improving accuracy, usability, and affordability. Ongoing research and development have produced test kits with faster turnaround times, greater sensitivity, and higher specificity. These innovations are vital for a country where timely diagnosis can shape public health outcomes.

Microfluidic technology is one of the most significant advancements. It allows manipulation of tiny fluid volumes in microchannels, combining multiple diagnostic steps into one compact device. This enables faster results using smaller samples, reducing costs and improving accessibility. Because of their portability, microfluidic-based kits are ideal for point-of-care use, especially in remote regions with limited lab infrastructure.

Nanotechnology has also transformed rapid testing. Nanoparticles enhance signal detection and strengthen antibody binding, leading to improved test sensitivity. Gold nanoparticles, widely used in lateral flow assays, deliver more accurate results even at low analyte concentrations. As more manufacturers integrate nanotechnology, kit reliability continues to improve. In October 2024, the ICMR-NIV developed a rapid Monkeypox test using LAMP technology that provides results within an hour with 100% accuracy. As of May 2023, 169 antigen-based rapid kits had been validated by ICMR, including 34 revalidations.

Advances in antigen-antibody detection methods, such as ELISA and lateral flow immunoassays, have also raised accuracy and speed. These methods now detect a wider range of pathogens, improving response times during disease outbreaks. Indian producers have enhanced precision using refined reagents and modern detection techniques to minimize false results.

The integration of digital technology has further elevated diagnostic efficiency. Mobile apps and AI-driven data systems now allow users and clinicians to monitor results in real time. Smartphone-based DNA diagnostic kits with AI support offer quick and automated readings, improving access to reliable testing. In September 2024, Mankind Pharma launched RAPID NEWS self-test kits for dengue, UTIs, and early menopause, giving users simple and private testing options at home. These advancements are strengthening India’s rapid diagnostics ecosystem and expanding its reach.

Growing

Health Awareness

The increasing health awareness among the Indian population is significantly influencing the demand for rapid test kits, marking a transformative shift in how individuals approach their health and wellness. Over the past decade, there has been a notable rise in health literacy across various demographics, driven by factors such as urbanization, access to information, and an increased focus on preventive healthcare. As people become more conscious of their health and the importance of early diagnosis, the acceptance and utilization of rapid testing technologies are steadily on the rise. This trend is crucial for the growth of the rapid test kit market, as it reflects a fundamental change in the health-seeking behavior of the population.

Educational campaigns, health seminars, and community outreach programs have played a pivotal role in promoting awareness about various diseases and the advantages of rapid testing. Public health initiatives led by government agencies, NGOs, and healthcare organizations have successfully disseminated information about the early signs and symptoms of infectious diseases, the importance of regular health check-ups, and the benefits of timely diagnosis. These programs not only educate individuals about the diseases prevalent in their communities but also emphasize the role of rapid test kits in facilitating prompt diagnosis and treatment. For instance, campaigns targeting tuberculosis, malaria, and sexually transmitted infections have led to increased testing rates, as people become more aware of the available diagnostic options.

The rising awareness of the importance of preventive healthcare is another key factor influencing the market for rapid test kits. As people recognize the significance of early detection in preventing serious health complications, there is a growing willingness to undergo testing, even in the absence of symptoms. Preventive health measures, such as regular screenings for diabetes, hypertension, and infectious diseases, are gaining traction, particularly among younger populations who prioritize health and well-being. This proactive approach to healthcare aligns with the capabilities of rapid test kits, which provide convenient and timely diagnostic solutions that facilitate early intervention.

The COVID-19 pandemic has further accelerated health awareness and prompted a cultural shift towards preventive healthcare measures. The pandemic highlighted the importance of regular testing and monitoring of health status, leading individuals to seek out rapid test kits for not only COVID-19 but also other health conditions. This heightened awareness of personal health and the role of diagnostics in managing diseases has resulted in a surge in demand for rapid testing technologies, as individuals look for accessible and efficient ways to monitor their health.

Key Market Challenges

Complex

Regulatory Environment

One of the primary challenges facing the

rapid test kit market in India is the complex regulatory environment. The

approval process for diagnostic products can be lengthy and cumbersome, often

resulting in significant delays in bringing innovative testing solutions to

market. In India, the Central Drugs Standard Control Organization (CDSCO)

serves as the regulatory authority for medical devices, including rapid test

kits. However, the regulatory framework governing these products is still

evolving, leading to a lack of clarity and consistency in the enforcement of

guidelines.

Manufacturers frequently face challenges

in navigating the intricate landscape of regulatory requirements, which can

vary based on the type of test kit and its intended use. These complexities may

include extensive documentation, clinical trials, and compliance with quality

assurance standards. As a result, many companies may find themselves spending

considerable time and resources to fulfill regulatory obligations, which can

stifle innovation and deter new entrants from investing in the market. This situation

is particularly problematic in a fast-paced industry where rapid advancements

in technology necessitate swift approval processes to keep pace with global

competitors.

The disparities in the

interpretation of regulations by different regulatory officials can lead to

inconsistencies, creating uncertainty for manufacturers. This unpredictability

may discourage companies from pursuing the development of new rapid test kits,

ultimately limiting the variety of diagnostic options available to consumers.

To foster growth in the market, it is crucial to streamline the regulatory

process by establishing clear, consistent guidelines for rapid test kits.

Simplifying the approval pathway and enhancing communication between regulators

and manufacturers can facilitate faster market entry for new products,

promoting innovation and improving healthcare access for the population.

Market

Competition

Market competition is another

significant challenge impacting the rapid test kit landscape in India. The

influx of numerous manufacturers, including established players and new

entrants, has intensified the competition for market share. This fierce rivalry

can lead to aggressive pricing strategies, often resulting in price wars that

drive down the cost of rapid test kits. While lower prices may benefit

consumers in the short term, they can also compromise product quality. In a

market where accuracy and reliability are paramount, any decline in quality can

undermine consumer trust and adversely affect health outcomes.

The prevalence of counterfeit

and substandard products further complicates the competitive landscape. As the

demand for rapid test kits rises, unscrupulous manufacturers may introduce

ineffective or dangerous products to the market. Consumers, often unaware of

the differences in quality, may inadvertently purchase these substandard kits,

leading to inaccurate results and potential health risks. This situation not

only jeopardizes individual health but also damages the reputation of the

entire rapid test kit market, making it crucial for legitimate manufacturers to

distinguish their products from these inferior offerings.

To effectively navigate this competitive

environment, manufacturers must prioritize differentiation strategies. Focusing

on innovation in product design, technology, and features can set a company

apart from its competitors. Maintaining rigorous quality

assurance practices ensures that the products meet high standards of accuracy

and reliability, which is essential for building consumer confidence.

Effective branding is also critical in a

crowded market. Clear communication about the quality and effectiveness of a

product, combined with targeted marketing efforts, can help establish a strong

brand presence. Educating consumers about the risks associated

with counterfeit products is essential. By providing information on how to

identify genuine rapid test kits and the importance of purchasing from

reputable sources, manufacturers can empower consumers to make informed

decisions, ultimately contributing to a more trustworthy market for rapid test

kits.

Key Market Trends

Growing

Adoption in Home Testing

The rise of home testing is a major driver of the India Rapid Test Kit Market, aligning with the shift toward personalized healthcare that empowers individuals to manage their health. The government has played a strong role in promoting decentralized diagnostics. The ICMR introduced the National Essential Diagnostics List (NEDL) in 2019 and released its second edition in 2025 to ensure standardized access to rapid tests. As of July 2025, over 1,78,000 Ayushman Arogya Mandirs are operational across India, offering basic diagnostics at the community level. The Free Diagnostics Service Initiative (FDSI) under the National Health Mission has expanded free testing, with 14 essential tests at Sub-Centres and 63 at Primary Health Centres.

The COVID-19 pandemic accelerated this trend, expanding India’s testing infrastructure from two COVID-19 labs in January 2020 to about 1,500 certified labs by September 2021. The need to avoid crowded hospitals led many consumers to adopt home testing as a safer, more convenient option. Home kits for diabetes, pregnancy, and infections allow users to monitor their health independently. India, with one of the largest diabetes populations worldwide, is expected to exceed 100 million cases in the next decade. The Research Society for the Study of Diabetes in India recommends continuous glucose monitoring for better control. Pregnancy test kits, on the other hand, give women privacy and quick results.

In September 2024, Mankind Pharma launched RAPID NEWS self-test kits for dengue, UTIs, and early menopause. Earlier, in May 2021, ICMR approved MyLab’s CoviSelf™ India’s first home-use COVID-19 self-test kit, designed for accessibility across languages and literacy levels. The privacy of home testing helps overcome social stigma, encouraging individuals to get tested earlier. Under the National AIDS and STD Control Programme (NACP) Phase-V, the government established Sampoorna Suraksha Kendras and launched HIV self-testing with counseling support at pharmacies and clinics.

Improved accessibility continues to drive adoption. Many rural residents face long distances and limited healthcare access. The updated 2025 NEDL mandates six essential diagnostic tests at village-level facilities, including rapid tests for Hepatitis B, syphilis, and sickle cell anemia. Through the FDSI, these services are free at public health centers, lowering cost barriers. Home testing bridges remaining gaps by allowing convenient, private, and early health monitoring—empowering people to take charge of their well-being.

Emergence

of E-commerce Platforms

The emergence of e-commerce platforms is

significantly transforming the distribution landscape for rapid test kits in

India, fundamentally altering how consumers access healthcare products. The

shift towards online shopping has gained immense popularity, especially during

the pandemic, as individuals sought convenient and safe ways to obtain

essential items without the need for physical store visits. E-commerce

platforms have become vital in meeting this demand, providing a wide range of

rapid test kits that allow consumers to purchase products from the comfort of

their homes. One of the key advantages of e-commerce platforms is their ability

to offer a vast array of rapid test kits for various health conditions, ranging

from infectious diseases to chronic illnesses. Consumers can easily compare

different products, read detailed descriptions, and access essential

information about each kit's efficacy and usage. This abundance of options not

only facilitates informed purchasing decisions but also enhances the overall

shopping experience. The ease of ordering these products online

eliminates the need for individuals to navigate the often complicated logistics

of finding specialized healthcare products in physical stores.

The accessibility of e-commerce

platforms extends beyond urban populations, reaching remote areas where

traditional retail outlets may be limited or nonexistent. In India, many rural

regions lack adequate healthcare infrastructure and access to diagnostic

products. E-commerce serves as a crucial lifeline, enabling individuals in

these areas to obtain rapid test kits without having to travel long distances

to urban centers. This increased accessibility contributes to a more equitable

distribution of healthcare resources, ensuring that even underserved

populations can benefit from rapid testing solutions.

In addition to expanding access,

e-commerce platforms often offer competitive pricing for rapid test kits. The

online marketplace allows consumers to compare prices from different sellers,

ensuring they find the best deals available. This price competitiveness is

particularly important in a price-sensitive market like India, where

affordability can significantly influence purchasing decisions. Many e-commerce platforms run promotions and discounts, making healthcare

products more financially accessible to a broader audience. Customer reviews

and ratings on e-commerce platforms also enhance consumer confidence in their

purchases. As individuals navigate the online marketplace, they can read

firsthand accounts from other users regarding the reliability and effectiveness

of specific rapid test kits.

Segmental Insights

Type Insights

The Rapid

Antigen Test segment was the dominated segment in the India Rapid Test Kit

Market, primarily due to its ability to deliver results within a short

timeframe of 15 to 30 minutes. This quick turnaround makes rapid antigen tests

highly appealing to both consumers and healthcare providers, facilitating timely

decision-making in critical environments such as hospitals, clinics, and public

health initiatives. Their effectiveness in detecting active infections,

especially in the context of infectious diseases like COVID-19, has further

solidified their popularity. Immediate diagnosis is crucial during outbreaks,

as it plays a vital role in controlling transmission.

Rapid antigen tests are generally more cost-effective to produce and purchase

compared to rapid antibody tests. This affordability enhances their

accessibility, particularly in resource-limited settings, thereby driving wider

adoption among diverse populations. The Indian government has actively

supported the use of rapid antigen tests as part of its broader strategy to

combat infectious diseases, especially during the COVID-19 pandemic. This

regulatory backing has resulted in increased availability and utilization

across various healthcare settings, further entrenching rapid antigen tests as

the preferred diagnostic tool. Overall, the combination of rapid results,

cost-effectiveness, and strong governmental support has positioned the rapid antigen

test segment as a leader in the India Rapid Test Kit Market, underscoring its

essential role in public health initiatives.

Product Type Insights

Based on Product

Type, In the India Rapid Test Kit Market, the Over the Counter (OTC) segment dominated the Rapid Test Kit segment in dominance due to several key

factors. One of the primary drivers is consumer accessibility, as OTC rapid

test kits can be purchased without a prescription, allowing individuals to

perform self-testing for various health conditions such as pregnancy, glucose

monitoring, and infectious diseases from the comfort of their homes. This

convenience aligns with the growing health awareness among the Indian

population, prompting more individuals to proactively monitor their health. The

OTC segment effectively meets this demand by offering easy-to-use testing

solutions that empower consumers to take charge of their well-being.

OTC rapid test kits provide the advantage of conducting tests in private

settings, which is particularly appealing for sensitive conditions like

sexually transmitted infections (STIs). This aspect of privacy encourages more

people to seek testing, further contributing to the growth of the OTC segment.

The trend of home testing has also gained momentum, particularly during the

COVID-19 pandemic, as consumers increasingly prefer OTC rapid test kits to

minimize potential exposure in healthcare environments. The OTC

segment boasts a diverse range of products, catering to various health

conditions, which attracts consumers seeking specific testing solutions and

drives the segment's growth. Collectively, these factors highlight the significant

impact of the OTC segment in shaping the landscape of the India Rapid Test Kit

Market.

Download Free Sample Report

Regional Insights

The

southern region of India, particularly states like Tamil Nadu, Karnataka, and

Andhra Pradesh, is the most dominant region in the India Rapid Test Kit Market,

driven by several key factors. One significant contributor is the advanced

healthcare infrastructure in Southern India, which includes well-established

hospitals, diagnostic centers, and research institutions. This robust

foundation allows for quicker adoption and implementation of rapid test kits,

as healthcare providers are well-equipped to integrate these solutions into

their practices. The region has faced substantial challenges with

infectious diseases such as dengue, tuberculosis, and malaria, creating a

heightened demand for quick diagnostic tools and establishing the southern

region as a crucial market for rapid test kits.

Government

initiatives further bolster this demand, as state governments have actively

promoted healthcare programs aimed at improving disease detection and

management, particularly during outbreaks, which has increased the need for

rapid test kits in rural and underserved areas. Growing health

awareness among the population has led to greater acceptance and proactive use

of rapid diagnostic tests for self-monitoring and early diagnosis.

Recent Developments

- In January 2025, SD BIOSENSOR’s Ultra Covi-Catch COVID-19 rapid antigen self-test became available on a leading Indian e-commerce pharmacy platform, indicating sustained retail channel access for self-testing kits in early 2025.

- In February 2025, the Indian Council of Medical Research (ICMR) and Central Drugs Standard Control Organisation (CDSCO) closed the public consultation period for national draft standard performance evaluation protocols for dengue and chikungunya rapid diagnostic tests (RDTs), marking a key step toward standardized performance benchmarks for India’s RDT sector.

- In February 2025, government communications under the National AIDS Control Programme Phase V (NACP-V) highlighted the ongoing deployment of HIV self-testing initiatives in regions such as Mizoram, reinforcing the policy-level integration of rapid self-testing within India’s public health framework.

- In September 2024, Mankind Pharma launched the “RAPID NEWS” self-test kit portfolio targeting common conditions such as dengue and urinary tract infections (UTIs), expanding consumer access to affordable, at-home rapid testing solutions across India.

- In December 2024, ICMR and CDSCO jointly issued draft national standard performance evaluation protocols for dengue NS1 and IgM RDTs (including combo formats) and chikungunya RDTs, initiating stakeholder consultations aimed at harmonizing licensure and regulatory compliance under the Medical Devices Rules.

Key Market Players

- SD Biosensor Healthcare Pvt. Ltd

- J. Mitra & Co. Pvt. Ltd.

- Meril Life Sciences Pvt. Ltd

- Tulip Diagnostics (P) Ltd

- Oscar Medicare Pvt. Ltd.

- Angstrom Biotech Pvt. Ltd.

- Ubio Biotechnology Systems Pvt Ltd

- Mylab Discovery Solutions Pvt. Ltd.

- Alpine Biomedicals Pvt. Ltd.

- Abbott India Limited

|

By Type

|

By Product Type

|

By Technology

|

By Application

|

By Region

|

- Rapid Antigen Test

- Rapid Antibody Test

|

- Over the counter (OTC)

- Rapid Test Kit

|

- Lateral Flow Assays

- Solid Phase

- Agglutination

- Immunospot Assay

|

- Infectious Disease

- Glucose Monitoring

- Pregnancy & Fertility

- Toxicology

- Cardiology

- Oncology

- Others

|

|

Report Scope:

In

this report, the India Rapid Test Kit Market has been segmented into the following

categories, in addition to the industry trends which have also been detailed

below:

- India Rapid Test Kit Market, By

Type:

o

Rapid Antigen Test

o

Rapid Antibody Test

- India Rapid Test Kit Market, By

Product Type:

o

Over the counter (OTC)

o

Rapid Test Kit

- India Rapid Test Kit Market, By

Technology:

o

Lateral Flow Assays

o

Solid Phase

o

Agglutination

o

Immunospot Assay

- India Rapid Test Kit Market, By

Application:

o

Infectious Disease

o

Glucose Monitoring

o

Pregnancy & Fertility

o

Toxicology

o

Cardiology

o

Oncology

o

Others

- India Rapid Test Kit Market, By

Region:

o

North

o

South

o

West

o

East

Competitive

Landscape

Company

Profiles: Detailed analysis of the major companies present

in the India Rapid Test Kit Market.

Available

Customizations:

India

Rapid Test Kit Market report with the given market data, TechSci

Research offers customizations according to a company's specific needs. The

following customization options are available for the report:

Company

Information

- Detailed

analysis and profiling of additional market players (up to five).

India

Rapid Test Kit Market is an upcoming report to be released soon. If you wish an

early delivery of this report or want to confirm the date of release, please

contact us at [email protected]