|

Forecast

Period

|

2026-2030

|

|

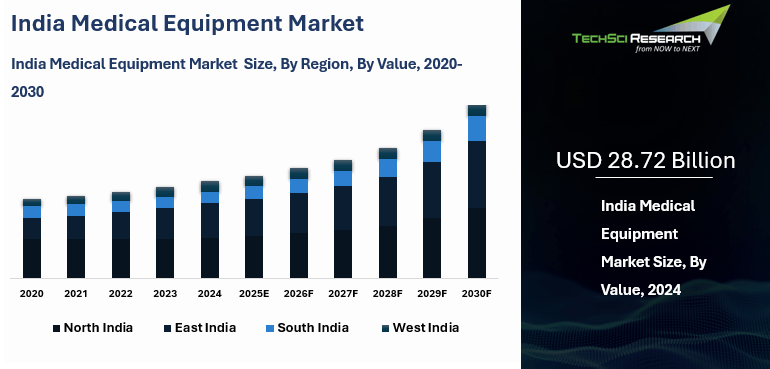

Market

Size (2024)

|

USD

28.72 Billion

|

|

Market

Size (2030)

|

USD

46.87 Billion

|

|

CAGR

(2025-2030)

|

8.65%

|

|

Fastest

Growing Segment

|

Hospitals

& Clinics

|

|

Largest

Market

|

West India

|

Market Overview

India Medical Equipment Market was valued at USD 28.72 Billion in 2024 and is

anticipated to project impressive growth in the forecast period with a CAGR of 8.65%

through 2030.

Medical equipment, also known as medical devices, refers to any

apparatus, appliance, software, material, or other articles whether used alone

or in combination, including the software intended by its manufacturer to be

used specifically for diagnostic and/or therapeutic purposes that are used to

identify, prevent, monitor, treat, or alleviate diseases or injuries. It

encompasses a vast range of items, from simple bandages or thermometers to

complex MRI machines or pacemakers. The Medical Equipment market is a expanding sector

that encompasses the sales, production, and distribution of various devices and

technologies used in healthcare.

The Medical Equipment market is a rapidly

growing and expanding sector that encompasses the sales, production, and

distribution of a wide range of devices and technologies used in healthcare.

These include advanced diagnostic equipment, life-saving surgical instruments,

cutting-edge imaging technologies, and innovative therapeutic devices. With the

constant advancements in medical technology, the demand for medical equipment

continues to rise, driven by the need for improved patient care and enhanced

medical outcomes. The Medical Equipment market plays a crucial role in

supporting healthcare professionals in their mission to provide effective and

efficient medical treatments, ultimately contributing to the well-being and

quality of life for people.

Download Free Sample Report

Key Market Drivers

Growing Geriatric Population

India’s growing geriatric population is a major driver of

demand for medical devices. As people age, their healthcare needs increase,

leading to higher demand for medical care, interventions, and assistive

technologies. India’s demographic shift makes this trend especially significant

— about 10.5% of the population is currently aged 60 years or older, and this

share is projected to exceed 20% by 2050. The rapid aging of the population,

fueled by rising life expectancy and declining birth rates, has wide-ranging

implications for healthcare infrastructure, social security, and elderly care

systems.

India’s strong healthcare network and advances in medical

technology, combined with a thriving medical tourism sector, make it

well-positioned to cater to this growing demand. The country’s hospitals and

healthcare facilities have expanded rapidly, providing a supportive environment

for the medical device industry to flourish.

Medical device manufacturers are responding to these

demographic shifts by developing products tailored to the needs of older

adults. This includes innovations in orthopedic implants, cardiac devices, and

home healthcare equipment each designed

to address mobility challenges, chronic conditions, and the need for

independent living among the elderly.

Given these trends, the Indian medical device industry holds

strong potential for continued expansion. The combination of a rapidly aging

population, improving healthcare infrastructure, and growing private sector

investment is expected to drive sustained growth and innovation. This creates

significant opportunities for manufacturers to enhance the quality of life for

millions of elderly individuals while contributing to the overall advancement

of India’s healthcare ecosystem.

Rising Prevalence of Chronic Diseases

The rising prevalence of chronic diseases such as

cardiovascular disorders, diabetes, and cancer is a major driver of growth in

India’s medical device market. These conditions require long-term monitoring,

diagnosis, and treatment, creating sustained demand for advanced medical

technologies. According to a February 2025 report by the Department of

Biotechnology, chronic or non-communicable diseases (NCDs) now account for 73%

of deaths globally. In India specifically, NCDs contribute to 53% of total deaths

and 44% of disability-adjusted life years (DALYs) lost, highlighting a

significant public health burden.

As India undergoes a rapid epidemiological transition from

communicable to non-communicable diseases due to socio-economic development and

lifestyle changes, the need for sophisticated diagnostic and therapeutic

devices continues to rise. Devices such as glucose monitors, insulin pumps,

pacemakers, and advanced imaging systems are witnessing growing adoption as

healthcare facilities aim to deliver accurate, efficient, and early-stage care.

This trend is expected to intensify with India’s aging

population and urban lifestyle patterns, both contributing to higher chronic

disease incidence. Consequently, the demand for technologically advanced and

reliable medical devices is set to increase, presenting lucrative opportunities

for both domestic and global manufacturers. As healthcare providers prioritize

improved patient outcomes and quality of life, innovation and investment in the

medical device sector will remain essential to meeting India’s expanding

healthcare needs.

Increased Demand for High-Quality Patient Care

The rising demand for high-quality patient care in India is

driving rapid growth in the medical devices market. Patients increasingly seek

advanced, reliable, and efficient treatments that enhance well-being and

deliver better clinical outcomes. This shift toward patient-centric healthcare

has spurred investments and innovation in both domestic manufacturing and the

import of cutting-edge medical equipment.

Official data from the Madhya Pradesh Industrial Development

Corporation (MPIDC) highlight this momentum. Medqverse Private Ltd., one of

five firms approved for investment, announced plans to invest INR 1 billion

(US$12.02 million) to establish a facility for manufacturing radiation cancer

treatment equipment. This project is expected to create around 300 jobs while

strengthening regional healthcare infrastructure and boosting India’s medical

device manufacturing capabilities.

Government initiatives are also catalyzing industry growth.

The Andhra Pradesh Medtech Zone Ltd. (AMTZ) project received financial

assistance of INR 250 million (US$3 million) in 2022 from the Department of

Pharmaceuticals under the “Assistance to Medical Device Industry for Common

Facility Center” scheme. The funds were allocated to build a facility for

testing and studying superconducting magnetic coils. In total, the Department

of Pharmaceuticals granted INR 2,249 million (US$27 million) to support AMTZ’s

expansion a move aimed at enhancing India’s capacity for medical device

research, innovation, and quality assurance.

India’s expanding population and growing awareness of health

and wellness continue to propel market demand. The focus on accessible,

high-quality care has created opportunities for manufacturing diagnostic

equipment, precision surgical tools, and innovative therapeutic devices to meet

diverse patient needs.

With sustained growth and technological advancement, the

medical devices sector is set to transform India’s healthcare landscape. The

increased availability of high-tech, patient-focused medical devices will not

only improve the quality of care and treatment efficiency within India but also

strengthen the country’s position as a global hub for healthcare innovation.

Need For Early Disease Detection and Prevention

The growing emphasis on early disease detection and

prevention in India is fueling strong demand for advanced medical devices.

Non-communicable diseases (NCDs) now account for a significantly larger share

of total deaths in the country rising from 37.9% in 1990 to 61.8% in 2016.

India bears a heavy burden of chronic illnesses, including diabetes,

cardiovascular diseases, and respiratory disorders, exacerbated by its aging

population. The country accounts for one-fifth of global cardiovascular disease

(CVD) deaths, with a death rate of 272 per 100,000 people, surpassing the

global average of 235. Among adults and the elderly, the prevalence of at least

one chronic disease stands at 41.73%, with hypertension affecting 26.82% and

diabetes 12.24%. By the end of 2025, India’s population aged over 60 is

projected to reach 143 million, intensifying the need for effective healthcare

interventions.

Advanced medical devices are pivotal to early diagnosis,

immediate intervention, and prevention of disease progression. Over 70% of

innovations from Indian MedTech startups are digitally integrated, utilizing AI

and IoT technologies to create portable, remote monitoring solutions. Portable

ECG monitors, blood glucose meters, and spirometers allow individuals to

actively track and manage health conditions, leading to better patient outcomes

and enhanced quality of life.

Government policies are reinforcing this transition toward

preventive care. The National Health Policy 2017 aims to raise healthcare

spending from 1.4% to 2.5% of GDP, with a strong focus on prevention. The

National Medical Devices Policy 2023, along with Production Linked Incentive

(PLI) schemes offering a 5% incentive on incremental sales, and 100% Foreign

Direct Investment (FDI) allowances, are designed to promote adoption of

advanced medical equipment. These initiatives encourage regular health check-ups

and early intervention, helping reduce the overall healthcare burden.

Rising public health awareness is another catalyst for

market growth. Surveys show that 75% of Indian consumers consider the quality

of medical devices critical for patient safety. Empowered by wider availability

of advanced medical technologies, more people are proactively managing their

health, creating a favorable environment for market expansion. This convergence

of technology innovation, policy support, and proactive health practices

positions India’s medical device sector for significant growth in the coming

years.

Key Market Challenges

Strict Regulatory Policies

Strict regulatory frameworks in India remain a major hurdle for the medical devices market. While these policies are designed to ensure patient safety and product quality, they often result in a complex, lengthy, and costly approval process that limits market growth. Both domestic and international companies face delays in obtaining product clearances, slowing their entry and expansion.

India’s regulatory environment is also marked by inconsistent interpretation and enforcement, which creates uncertainty for manufacturers. Navigating the fragmented approval procedures requires significant investment in compliance and documentation, discouraging smaller firms and startups from participating.

Government hospital procurement one of the key demand channels for medical devices—is further constrained by bureaucratic procedures. Lengthy tendering, review, and approval cycles delay the adoption of innovative technologies. This ultimately restricts patients’ access to advanced, life-saving medical devices and limits the overall competitiveness of India’s healthcare ecosystem.

Uncertainty in Reimbursement

Unclear and inconsistent reimbursement policies present another major challenge for the Indian medical equipment market. Delayed payments and frequent claim denials from insurance providers place financial pressure on hospitals and clinics, making it harder for them to maintain high-quality care standards.

These constraints discourage healthcare providers from investing in advanced equipment and modern technologies, slowing the pace of innovation adoption. The resulting under-investment affects both patient outcomes and operational efficiency within healthcare facilities.

Manufacturers also feel the impact of reimbursement uncertainty. The lack of clear, predictable reimbursement frameworks makes it difficult for medical device companies to forecast returns, plan pricing strategies, or commit to long-term investments in India. This uncertainty reduces the incentive to launch new technologies in the local market.

To foster sustained growth, India must implement transparent and stable reimbursement systems that ensure timely payments and financial clarity for healthcare providers. A predictable reimbursement environment would encourage both domestic and foreign manufacturers to invest in innovation, expand product availability, and strengthen India’s position as a growing hub for advanced medical technologies.

Key Market Trends

Increasing Acceptance of Refurbished Medical

Equipment

The increasing acceptance of refurbished medical

equipment in India is significantly driving the growth of the country's medical

equipment market. This trend is largely influenced by factors such as high

equipment costs and budget constraints, which make refurbished equipment an

appealing alternative for healthcare providers. It's not just about cost

savings; refurbished equipment also aligns with India's sustainability goals, as

it contributes to waste reduction and resource conservation.

The

refurbishment process often involves rigorous testing and certification,

ensuring that the refurbished equipment meets the same quality and performance

standards as new equipment. This level of reliability and performance, along

with the cost-effectiveness, makes refurbished medical equipment a viable and

practical choice for healthcare facilities across India. As a result, the

healthcare sector in India is witnessing a notable shift in mindset towards the

acceptance and utilization of refurbished equipment, which in turn is

propelling the growth of the medical equipment market in the country.

Increase Accessibility in Rural Areas

The increase in accessibility in rural areas is significantly

driving the demand for medical equipment in the Indian market. With the

government's proactive initiation of infrastructural development and healthcare

accessibility in these regions, the need for primary and specialised medical

equipment is on a steady rise. This includes everything from basic diagnostic

tools to more specialized apparatus used for specific treatments, ensuring that

healthcare services reach even the remotest corners of the country.

The rapid rise of telemedicine, facilitated

by improved internet connectivity, has further escalated the demand for medical

equipment. As remote diagnostics become more prevalent, it becomes imperative

to equip patients with the necessary tools for accurate monitoring and

diagnosis at their end. This entails a wide range of medical equipment, from

telehealth devices to portable diagnostic instruments, all facilitating

seamless healthcare delivery from a distance.

The growing awareness and education

initiatives about health and wellness have played a significant role in driving

the demand for medical equipment. As more individuals embrace preventative

healthcare measures, there is an increasing need for home-based monitoring

devices, fitness trackers, and other tools that empower individuals to take

charge of their own health. The combination of increased accessibility,

telemedicine advancements, and a growing focus on preventative healthcare

measures has fueled the demand for medical equipment in the Indian market. As

the healthcare landscape continues to evolve, manufacturers and providers must

adapt to meet the diverse needs of patients and healthcare professionals alike.

Segmental Insights

Type Insights

Based on type, in India’s medical equipment market, diagnostic

imaging equipment dominates due to rising demand for early and accurate

disease detection. The growing prevalence of chronic conditions such as

cardiovascular diseases, cancer, and respiratory disorders has intensified the

need for advanced diagnostic tools.

An aging population further drives the segment, as

early detection and monitoring of age-related diseases become essential. Technological

innovations including 3D imaging, artificial intelligence, and molecular

imaging have improved diagnostic precision, patient comfort, and efficiency.

Additionally, government initiatives and funding to

enhance early disease detection and equip healthcare facilities with modern

imaging systems have strengthened market growth. Overall, diagnostic imaging

remains the leading segment, supported by technological progress, demographic

trends, and government support.

End User Insights

Based on End User, Hospitals and clinics represent

the fastest-growing end-user segment in India’s medical equipment market. The

surge in chronic diseases, coupled with rapid urbanization and expanding

healthcare infrastructure in major cities, has increased the need for advanced

diagnostic and treatment equipment.

Government programs such as the National Health Mission and Ayushman

Bharat have improved access to modern equipment, especially in rural and

underserved regions. The rapid expansion of private healthcare, rising

disposable incomes, and growing public-private collaborations further

accelerate equipment adoption.

These factors collectively position hospitals and clinics as

the key growth drivers of India’s medical equipment market.

Download Free Sample Report

Regional Insights

The West region of India, with a particular focus

on Mumbai and its surrounding areas, has emerged as a dominant force in the

Indian Medical Equipment Market. The western region of India, particularly Mumbai and its adjoining areas, has established itself as a major hub in the Indian medical equipment market. This prominence is largely driven by the region's strong healthcare infrastructure, which includes advanced hospitals, cutting-edge research centers, and a pool of skilled medical professionals. Also, the high patient density in the area has created sustained demand for modern medical technologies and equipment. Both government and private sector investments have further accelerated growth, making the region a hotspot for healthcare innovation. Mumbai, being a financial and commercial capital, also provides strategic advantages such as connectivity, logistics, and access to capital, enhancing its appeal to domestic and global players. As a result, the western region not only supports the growing healthcare needs of the population but also plays a key role in shaping the future of India's medical technology landscape.

Recent Developments

- In September 2025, the India MedTech Expo 2025, held in New Delhi, showcased the nation's advancements in medical technology, bringing together startups, manufacturers, and innovators. During the expo, the Indian Council of Medical Research (ICMR) licensed nine new technologies to industry partners, including innovations in diagnostics and vaccine development.

- In March 2025, the "Medical Innovations – Patent Mitra" initiative was launched to streamline the patenting process and accelerate the commercialization of homegrown medical technologies.

- In November 2024, the Ministry of Chemicals and Fertilisers launched the "Scheme for Promotion of Medical Device Parks" worth INR 500 crore (USD 59.24 million) to boost the domestic manufacturing of key medical device components and support skill development.

- In September 2024, the Indian government introduced a new risk-based strategy to monitor the quality of imported medical devices, aiming to enhance safety and regulatory oversight. In the same month, the Production-Linked Incentive (PLI) scheme attracted investments totaling INR 1,057.47 crore, facilitating the domestic manufacturing of high-end equipment like MRI and CT scanners.

- In 2024, India progressed rapidly due to urbanization, improved healthcare infrastructure, and rising household incomes. Healthcare spending increased nationwide, driven by government policies promoting access and expanding health insurance coverage. The growing number of chronic disease patients across the country led to a surge in demand for advanced medical devices. Pacemakers, defibrillators, and diagnostic imaging equipment were purchased and utilized at a significantly higher rate than in previous years.

Key Market Players

- Philips India Ltd.

- India

Medtronic Pvt. Ltd.

- Wipro GE

Health Care Limited

- Johnson

and Johnson Ltd

- B. Braun

India

- Baxter

Inia Pvt Ltd

- Becton

Dickinson India Pvt Ltd.

- Abbott

India Ltd

- Robert

Bosch India Limited

- 3M India

Limited

|

By Type

|

By End User

|

By Region

|

- Cardiovascular

Devices

- Diagnostic

Imaging equipment

- In-vitro

Diagnostic Devices

- Ophthalmic

Devices

- Diabetes

Care Devices

- Dental Care

Devices

- Surgical

Equipment

- Patient

Monitoring Devices

- Orthopedic

Devices

- Nephrology

& Urology Devices

- Others

|

- Hospitals

& Clinics

- Diagnostic

Centers

- Others

|

|

Report Scope:

In this report, the India Medical Equipment Market has

been segmented into the following categories, in addition to the industry

trends which have also been detailed below:

- India Medical Equipment Market, By Type:

o Cardiovascular Devices

o Diagnostic Imaging

equipment

o In-vitro Diagnostic Devices

o Ophthalmic Devices

o Diabetes Care Devices

o Dental Care Devices

o Surgical Equipment

o Patient Monitoring Devices

o Orthopedic Devices

o Nephrology & Urology

Devices

o Others

- India Medical Equipment Market, By End User:

o Hospitals & Clinics

o Diagnostic Centers

o Others

- India Medical Equipment Market, By Region:

o North

o South

o West

o East

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Medical

Equipment Market.

Available Customizations:

India Medical Equipment Market report with

the given market data, TechSci Research offers customizations according to a

company's specific needs. The following customization options are available for

the report:

Company Information

- Detailed analysis and profiling of additional

market players (up to five).

India Medical Equipment Market is an upcoming

report to be released soon. If you wish an early delivery of this report or

want to confirm the date of release, please contact us at [email protected]