|

Forecast

Period

|

2026-2030

|

|

Market

Size (2024)

|

USD

961.21 Million

|

|

Market

Size (2030)

|

USD

1491.85 Million

|

|

CAGR

(2025-2030)

|

7.80%

|

|

Fastest

Growing Segment

|

ICSI

IVF

|

|

Largest

Market

|

West India

|

Market Overview

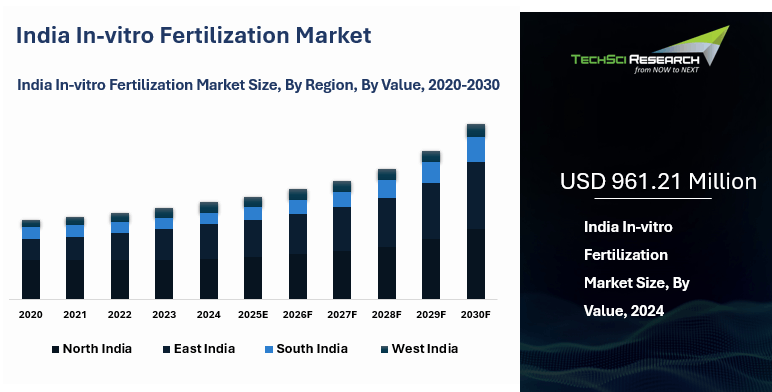

India’s In-vitro Fertilization (IVF) market was valued at USD 961.21 million in 2024 and is projected to reach USD 1,491.85 million by 2030, growing at a CAGR of 7.80% during the forecast period.

In vitro fertilization (IVF), a form of assisted reproductive technology (ART), has transformed infertility treatment by offering new possibilities for couples struggling to conceive. The process involves the extraction and fertilization of eggs and sperm in a specialized laboratory, followed by the implantation of viable embryos into the uterus. Although the procedure can be physically and emotionally demanding, it has enabled countless individuals to fulfill their dreams of parenthood, particularly those affected by blocked fallopian tubes, diminished ovarian reserve, or male infertility.

The India IVF market is witnessing strong growth driven by rising infertility rates, increasing awareness, delayed marriages, lifestyle changes, and improved societal acceptance of assisted reproductive technologies. Technological advancements such as embryo freezing, preimplantation genetic testing, and intracytoplasmic sperm injection have significantly improved success rates and patient confidence.

In June 2025, Archish Fertility & IVF partnered with Amaha Health to enhance patient support and mental well-being, offering holistic fertility care that integrates emotional and psychological support throughout treatment.

India has also become a major destination for fertility tourism, offering high-quality IVF procedures at a fraction of Western costs. Fertility clinics are rapidly expanding across both urban centers and tier-2 cities, supported by private investments and favorable government initiatives. Despite challenges such as affordability for lower-income populations and the need for regulatory standardization, the outlook for India’s IVF market remains highly promising, with sustained growth expected over the coming years.

Download Free Sample Report

Key Market Drivers

Growing Success Rate of IVF Technology

The growing success rate of in-vitro fertilization IVF technology is driving a significant increase in the demand for IVF procedures in India, as IVF continues to expand access to fertility care for couples facing infertility through more standardized and technology-enabled protocols. The Assisted Reproductive Technology Regulation Act 2021 mandates registration and maintenance of registration details for ART clinics and banks, strengthening confidence in formal, quality-controlled IVF delivery. Reflecting this shift toward regulated care and wider accessibility, the National ART and Surrogacy Registry dashboard shows 2,717 ART clinic applications received and 180 ART clinics registered, alongside 656 ART bank applications received and 77 ART banks registered. For instance, in June 2025, SafeTree launched India’s first maternity insurance tailored for IVF couples with a reduced waiting period of seven months, aimed at improving affordability and inclusivity for couples undergoing assisted reproductive procedures.

Increased awareness and accessibility are also being reinforced as more patients can verify clinic status through the national registry framework, while improved laboratory protocols, cryopreservation, and genetic screening technologies continue to raise patient confidence in outcomes. Societal shifts such as delayed marriages and childbearing are increasing the incidence of age-related infertility, and as more success stories become visible, stigma reduces and more individuals seek timely treatment. With ongoing technological progress and strengthening regulation, IVF utilization is expected to keep rising across India as patients increasingly prefer documented, standardized, and supportive care pathways.

Increasing Awareness About IVF Technology

Rising awareness of in vitro fertilization or IVF is a major factor fueling the growing demand for fertility treatments in India, and this is increasingly visible in large-scale provider expansion plans as well as higher engagement with formal, regulated ART services. For instance, in June 2025 Yellow Fertility announced a plan to scale up to 100 IVF centres by 2030, underscoring growing acceptance and intent to expand access beyond major metros into wider regions.

This awareness-led shift is also reflected in government-run registration activity under the National ART and Surrogacy Registry, which reports 2,717 ART clinic applications received and 180 ART clinics registered, along with 656 ART bank applications received and 77 ART banks registered, indicating that more facilities are entering regulated pathways and more patients can identify registered providers.

As societal attitudes evolve, infertility is increasingly treated as a medical condition rather than a stigma, and delayed marriages and later pregnancies are widening the pool of couples seeking timely clinical options. India’s NFHS-5 insights summarized by UNFPA show the median age of first marriage for women aged 20–49 rose from 17.2 in 2005–06 to 19.2 in 2019–21, a shift that aligns with later family formation and higher awareness of age-related fertility challenges that can push couples toward IVF. With sustained public discourse, clinic-led education, and expanding registered service availability, IVF consideration is expected to remain elevated across India.

Delayed Onset of Pregnancies

The delayed onset of pregnancies in India is significantly contributing to the rising demand for IVF. A March 2025 incident, involving a film about fertility clinics, disrupted Indira IVF’s ₹3,500 crore IPO plans by triggering temporary public scrutiny. Despite this, the episode highlighted a broader social trend—many couples are postponing parenthood due to evolving career goals and lifestyle choices, which is increasing demand for fertility assistance.

As people pursue higher education and professional ambitions, they tend to marry and start families later in life. However, fertility declines with age, particularly for women as ovarian reserve diminishes. This demographic shift has made IVF an essential solution for achieving pregnancy when natural conception becomes more difficult.

IVF offers a viable alternative for couples facing age-related fertility issues, providing hope even in challenging biological circumstances. Improved success rates and growing awareness of IVF have also encouraged more people to consider this technology as a realistic path to parenthood. Thus, delayed pregnancies—driven by societal and lifestyle factors are playing a central role in the expansion of India’s IVF market.

Increasing Cases of Infertility

Rising infertility cases across India are fueling a sharp surge in IVF demand. Infertility has become a growing concern, affecting a substantial portion of the population and prompting more individuals to seek assisted reproductive solutions.

Lifestyle changes, environmental factors, and stress are major contributors. Obesity, smoking, poor diet, and exposure to pollution negatively impact reproductive health, while career priorities and delayed childbearing further exacerbate the issue. As a result, infertility rates are increasing nationwide.

Advanced IVF techniques such as intracytoplasmic sperm injection (ICSI) and preimplantation genetic testing (PGT) have improved success rates, making IVF effective for a broader range of cases. Increased awareness through medical professionals, social media, and online platforms has made fertility information more accessible than ever.

Couples from both urban and remote regions are now proactively seeking IVF treatments, recognizing them as practical and hopeful solutions. With infertility rates expected to continue rising, the demand for affordable, high-quality IVF services will remain strong, positioning IVF as a cornerstone of modern reproductive healthcare in India.

Key Market Challenges

Complications Associated with In-Vitro Fertilization

While the demand for in-vitro fertilization (IVF) in India continues to rise, concerns about complications associated with the procedure have created certain challenges for its wider adoption. Although IVF is one of the most effective treatments for infertility, it is not without risks, leading to a cautious approach among potential patients.

One of the common complications is multiple pregnancies, such as twins or triplets, which occur when multiple embryos are transferred to increase success rates. While some couples consider this desirable, multiple pregnancies carry higher risks, including preterm birth and low birth weight, potentially impacting both maternal and infant health. To manage this risk, fertility specialists and patients must carefully decide how many embryos to transfer.

Ovarian Hyperstimulation Syndrome (OHSS) is another IVF-related complication that generates concern. It results from the hormonal stimulation used during the procedure and can cause mild to severe symptoms such as abdominal pain, fluid retention, and, in rare cases, blood clotting issues. The possibility of OHSS may cause hesitation among couples considering IVF.

Additionally, the cost and emotional strain of IVF can act as barriers. The treatment’s financial burden, combined with the physical invasiveness and emotional toll of repeated unsuccessful attempts, can discourage potential patients.

To address these challenges, fertility clinics and healthcare providers must emphasize patient education, counseling, and risk mitigation. Clear communication about potential risks, realistic outcomes, and individualized treatment plans can increase confidence among patients and help them make more informed decisions. By improving transparency and support, the IVF industry in India can build greater trust and reduce apprehension around the procedure.

Social Stigma, Ethical, and Legal Issues Associated with In-Vitro Fertilization

Social stigma, ethical debates, and legal uncertainties also affect the demand for IVF in India. Despite its effectiveness, these factors often discourage individuals and couples from seeking fertility treatments.

Social stigma remains one of the most significant barriers. In many Indian communities, infertility is still perceived as a taboo subject, leading to societal pressure, isolation, and discrimination. Couples experiencing infertility may avoid pursuing IVF out of fear of judgment or negative social perception.

Ethical concerns further complicate IVF adoption. Issues surrounding embryo selection, storage, and disposal raise moral questions that can make patients hesitant. The potential for multiple pregnancies and debates over the moral status of embryos intensify these ethical dilemmas for both patients and physicians.

Compounding these challenges are legal ambiguities in India’s regulatory framework. Although certain guidelines exist, the absence of comprehensive, enforceable legislation creates confusion among patients and providers. This uncertainty can foster mistrust and limit adoption of IVF treatments, particularly among those seeking clear legal and ethical assurances.

Overcoming these obstacles will require stronger regulatory standards, public education campaigns, and community awareness initiatives. As legal frameworks strengthen and social acceptance grows, IVF in India is expected to become more widely embraced as a legitimate and compassionate solution for infertility.

Key Market Trends

Increasing Government Support

The Indian government is playing a central role in strengthening the in-vitro fertilization (IVF) market. Around 25 to 30 million couples in India face infertility, and policies aimed at expanding access to affordable reproductive care are driving growth.

Two landmark legislations, the Assisted Reproductive Technology (Regulation) Act, 2021, and the Surrogacy (Regulation) Act, 2021, have introduced strict ethical and safety standards. These laws have reinforced India’s reputation as a regulated and patient-friendly IVF destination.

Access to IVF is widening as government hospitals open specialized fertility centers, many offering subsidized or free services. Examples include:

- Goa Medical College and Hospital, which launched a free infertility treatment center in August 2023

- AIIMS Delhi, offering low-cost IVF treatment

- Lok Nayak Hospital, which opened Delhi’s first government-run IVF center

Affordability is further supported by Pradhan Mantri Bhartiya Jan Aushadhi Kendras (PMBJK), expected to expand to 10,500 centers by March 2025, providing low-cost fertility medicines. IVF treatment in India costs between USD 2,000 and 5,000 per cycle compared to USD 15,000 to 20,000 in the U.S. or Europe. This cost advantage positions India as a leading hub for reproductive tourism.

Government schemes such as the Production Linked Incentive (PLI) are also promoting local manufacturing of IVF drugs and devices, reducing import dependency. Public-Private Partnerships (PPPs) are channeling investment and expanding fertility services into Tier-II and Tier-III cities.

Emergence of Fertility Tourism

India is now a major destination for fertility treatments, with more than 2,500 clinics offering services like IVF, intracytoplasmic sperm injection (ICSI), egg donation, and advanced technologies, including AI-assisted embryo selection and improved cryopreservation.

Specialists in India combine technical expertise with patient-centered care, addressing the challenges of infertility that affect one in six couples worldwide.

A major driver of international demand is cost. IVF treatment in India costs less per cycle compared to the U.S. and Canada, while maintaining success rates of 40-50% for younger women, consistent with global averages.

Fertility tourism is growing rapidly, with international patient inflow more than doubling in recent years and around 200,000 to 250,000 IVF cycles performed annually. India’s mix of affordability, advanced technology, and quality care continues to strengthen its standing as a global fertility hub.

Segmental Insights

Donor Insights

Based on donor,

in the year 2024, the segment of fresh non-donor IVF cycles emerged as the

dominant force in the India In-vitro Fertilization Market. This can be

attributed to the remarkable success rate associated with fresh non-donor IVF

cycles, which have shown consistent positive outcomes in helping couples

achieve their dream of parenthood. With their high success rate and the ease of

implantation they offer, fresh non-donor IVF cycles have become the preferred

choice for both patients and medical professionals. The effectiveness and

efficiency of this approach have not only provided hope and happiness to

countless individuals and families but have also significantly advanced the

field of fertility treatment. By continuously improving and refining the

techniques involved, fresh non-donor IVF cycles have set a new standard for

reproductive medicine, ensuring a brighter future for those seeking assisted

reproductive technologies.

End User Insights

Based on end

user, in 2024, the fertility clinics segment emerged as the dominant force in

the market, capturing the largest market share. This remarkable achievement can

be primarily attributed to the unprecedented global expansion of fertility

clinics, which have witnessed substantial growth in recent years. The

increasing awareness and acceptance of assisted reproductive technologies,

particularly in vitro fertilization (IVF), have played a pivotal role in

shaping consumers' decisions to pursue IVF treatment at these clinics.

The

availability of advanced reproductive technologies, such as preimplantation

genetic testing and embryo cryopreservation, has further enhanced the appeal of

fertility clinics. These cutting-edge techniques offer improved success rates

and higher chances of positive outcomes, instilling confidence in individuals

and couples seeking fertility treatments. With the continuous advancements in

medical research and technology, fertility clinics have become a beacon of hope

for those longing to start or expand their families.

As a

result, the demand for IVF services has been steadily increasing, propelling

the growth of fertility clinics worldwide. The comprehensive range of services

offered, including personalized treatment plans, state-of-the-art laboratory

facilities, and experienced medical professionals, further contribute to the

rising popularity of these clinics. With their unwavering commitment to patient

care and success, fertility clinics continue to revolutionize the field of

reproductive medicine and provide new opportunities for individuals and couples

striving to fulfill their dreams of parenthood.

Download Free Sample Report

Regional Insights

The

western region of India, particularly Maharashtra and Gujarat, is expected to

have a strong and influential presence in the Indian In-vitro Fertilization

(IVF) market. This dominance can be attributed to a combination of factors that

contribute to the region's remarkable growth in this field. One of the key

factors is the high per capita income in Maharashtra and Gujarat, which enables

a significant portion of the population to afford IVF procedures. This

financial capability, coupled with increasing awareness about the benefits and

success rates of IVF treatments, has led to a surge in demand for such

procedures in the region.

The western region is home to several reputable fertility clinics that have

established a strong reputation for providing high-quality IVF services. These

clinics offer state-of-the-art treatment facilities, advanced medical

technologies, and experienced fertility specialists who are dedicated to

helping couples achieve their dream of parenthood. Mumbai, the bustling

metropolis in Maharashtra, stands out as a hub for IVF centers, with a significant

number of clinics offering comprehensive and personalized treatment options. The

combination of these factors has created a favorable environment for the growth

of the Indian IVF market in the western region. As more individuals and couples

turn to IVF as a viable solution for their fertility challenges, the market is

poised for further expansion and advancements in the years to come.

Recent Development

- In Sep 2025, Nova IVF continued promoting AI-enabled embryo selection via Vita Embryo as a network-wide lab capability, positioning it as a standardized decision-support layer for embryologists.

- In Aug 2025, Nova IVF Fertility announced it would deploy Vita Embryo (AI-based embryo assessment) across its network via a partnership with South Korea’s Kai Health, with an initial rollout in select locations and broader rollout planned.

- In May 2025, Fortis owner IHH Healthcare, along with other investors in the fertility space, entered advanced discussions to acquire a stake in a prominent South India-based IVF hospital. The move reflected growing investor interest in India’s expanding fertility market, driven by rising infertility rates and delayed pregnancies. The potential deal underscored the sector’s increasing attractiveness and the strategic efforts to consolidate and scale fertility services across the region.

- In June 2025, concerns about India’s declining birth rate—often referred to as the “baby bust”—became more prominent, highlighting the growing reliance on IVF as a solution. With more couples delaying parenthood and facing fertility challenges, IVF emerged as a vital option. Experts and stakeholders called for stronger government support and regulatory frameworks to align with the increasing role of assisted reproduction in addressing India’s demographic shifts.

- In June 2025, Indira IVF acquired Banker IVF, strengthening its position as a leading fertility service provider in India. The acquisition expanded Indira IVF’s clinical network and enhanced its expertise in assisted reproductive technologies, enabling broader access to advanced fertility care across the country. This move also reflected the company’s continued growth amid rising demand for IVF services.

- In February 2025, Birla Fertility & IVF announced plans for global expansion while aiming to double its centres in India from 50 to 100. This ambitious growth strategy is supported by a ₹500 crore investment, reflecting the company’s commitment to scaling its presence both domestically and internationally in the rapidly growing fertility care sector.

- In June 2025, SpOvum Technologies and Khushi Fertility formed a strategic alliance to redefine IVF care in India. The partnership aimed to integrate advanced reproductive technologies with specialised clinical expertise to enhance patient outcomes. Together, they planned to streamline IVF procedures, improve diagnostic accuracy, and personalise treatment protocols. This collaboration was seen as a significant step toward expanding access to quality fertility care across the country, with both organisations committed to innovation, affordability, and improved success rates in assisted reproductive treatments.

- In May 2025, the launch of a new saliva-based genetic test to personalise hormone therapy during IVF treatment highlighted a key driver of growth in the Indian IVF market: the advancement of precision medicine and personalised fertility care. By leveraging genetic insights from a simple saliva sample, this innovation allows clinicians to tailor hormone regimens to each patient’s unique profile, thereby reducing side effects and improving pregnancy outcomes. Such personalised approaches enhance treatment safety, increase success rates, and boost patient confidence in IVF procedures. This shift toward precision fertility care is a major growth catalyst for the Indian IVF market, as it reflects both technological progress and a commitment to improving patient experience and outcomes.

Key Market Players

• CK Birla Healthcare Pvt. Ltd.

• Nova IVF

• Indira IVF Hospital Private Limited.

• Apollo Fertility (Apollo Specialty Hospitals Pvt. Ltd.)

• Max Healthcare

• Manipal Health Enterprises Pvt. Ltd.

• Bloom Fertility Centre

• BACC Healthcare Private Limited

• Cloudnine Hospitals

• Morpheus IVF

• Babies and Us Fertility and IVF Centre (Ind) Pvt. Ltd.

|

By Technique

|

By Product

|

By Donor

|

By Infertility

|

By Embryo

|

By End User

|

By Region

|

- ICSI IVF

- Non-ICSI/ Traditional

IVF

|

- IVF Culture Media

- ICSI Machine

- IVF Incubators

- Cryosystem

- Others

|

- Fresh Non-donor

- Frozen Non-donor

- Fresh Donor

- Frozen Donor

|

|

- Fresh Embryo

- Frozen-thawed Embryo

|

- Fertility Clinics

- Hospitals

- Others

|

|

Report Scope:

In this report, the India In-vitro Fertilization

Market has been segmented into the following categories, in addition to the

industry trends which have also been detailed below:

- India In-vitro Fertilization

Market, By

Technique:

o ICSI IVF

o Non-ICSI/ Traditional IVF

- India In-vitro Fertilization

Market, By

Product:

o IVF Culture Media

o ICSI Machine

o IVF Incubators

o Cryosystem

o Others

- India In-vitro Fertilization

Market, By

Donor:

o Fresh Non-donor

o Frozen Non-donor

o Fresh Donor

o Frozen Donor

- India In-vitro Fertilization

Market, By InFertility:

o Male

o Female

- India In-vitro Fertilization

Market, By

Embryo:

o Fresh Embryo

o Frozen-thawed Embryo

- India In-vitro Fertilization

Market, By

End User:

o Fertility Clinics

o Hospitals

o Others

- India In-vitro Fertilization

Market, By

Region:

o North

o South

o West

o East

Competitive Landscape

Company Profiles: Detailed analysis of the major companies

present in the India In-vitro Fertilization Market.

Available Customizations:

India In-vitro Fertilization Market report with

the given market data, TechSci Research offers customizations according to a

company's specific needs. The following customization options are available for

the report:

Company Information

- Detailed analysis and

profiling of additional market players (up to five).

India In-vitro Fertilization Market is an upcoming

report to be released soon. If you wish an early delivery of this report or

want to confirm the date of release, please contact us at [email protected]