Forecast Period | 2026-2030 |

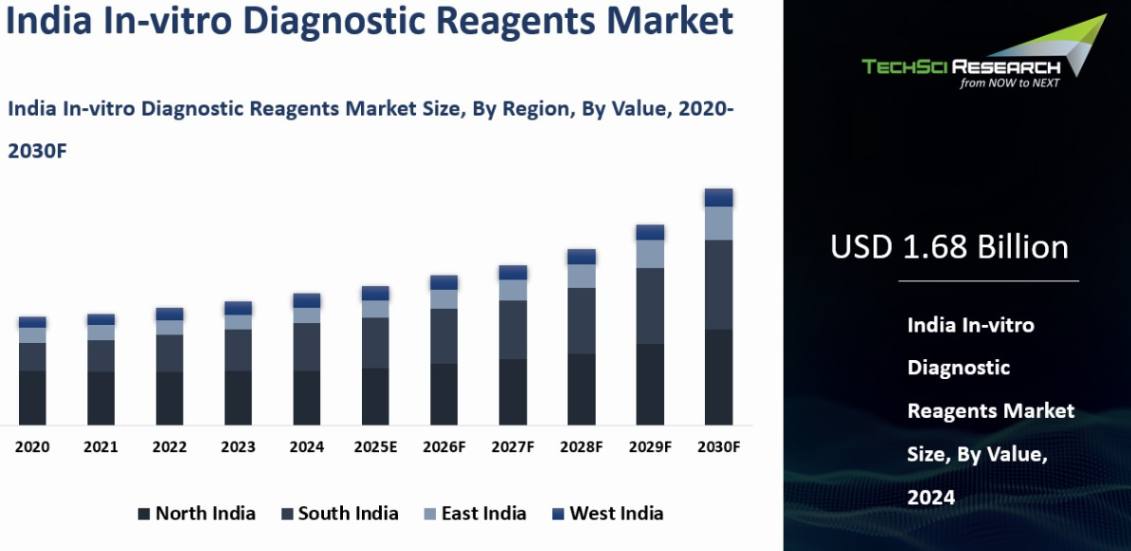

Market Size (2024) | USD 1.68 Billion |

Market Size (2030) | USD 2.30 Billion |

CAGR (2025-2030) | 6.55% |

Fastest Growing Segment | Clinical Chemistry |

Largest Market | North India |

Market Overview

India In-vitro Diagnostic Reagents Market was valued at USD 1.68 billion in 2024 and is anticipated to reach USD 2.30 Billion by 2030, with a CAGR of 6.55% during 2025-2030. The Indian In-vitro Diagnostic (IVD) Reagents market is witnessing substantial growth and evolution, propelled by technological advancements, heightened healthcare awareness, and a surge in chronic disease cases. The market's future appears bright, with continuous innovations in diagnostic technologies and escalating healthcare investments. The increasing emphasis on personalized medicine and the emergence of novel biomarkers are poised to unlock new growth opportunities. Furthermore, the COVID-19 pandemic has underscored the critical role of diagnostics, paving the way for sustained investment and innovation in this sector.

Key Market Drivers

Technological Advancements

Technological advancements are a major catalyst for the growth of the Indian In-vitro Diagnostic (IVD) Reagents market. These innovations are transforming diagnostic procedures, improving accuracy, reducing turnaround times, and expanding the range of detectable conditions.

Molecular diagnostic techniques, such as PCR (Polymerase Chain Reaction) and next-generation sequencing, offer unparalleled precision and sensitivity in detecting genetic, infectious, and oncological diseases. These technologies enable early and accurate diagnosis, which is crucial for effective treatment and management. The advent of molecular diagnostics has paved the way for personalized medicine, where treatments are tailored to the genetic profile of individual patients. This customization improves patient outcomes and drives the demand for specific IVD reagents used in these tests. Automated systems in diagnostic laboratories streamline processes, from sample preparation to result analysis. Automation reduces human error, increases throughput, and ensures consistent results, making diagnostics more reliable and efficient. High-throughput systems allow laboratories to process large volumes of samples quickly. This scalability is essential in a country like India, with its large population and high demand for diagnostic services, particularly in urban centers.

Technological advancements have led to the development of portable and easy-to-use point-of-care testing devices. These devices bring diagnostic capabilities to the patient’s bedside, rural areas, and remote locations, expanding the reach of healthcare services. POCT devices provide quick results, which is critical in emergency situations and for timely medical interventions. The immediate availability of diagnostic data enhances patient care and drives the adoption of these technologies. Data Management and Analysis: Digital diagnostics leverage AI and machine learning to analyze vast amounts of diagnostic data efficiently. These technologies can identify patterns and anomalies that might be missed by human analysts, improving diagnostic accuracy and speed.

Rising Prevalence of Chronic Diseases

The increasing prevalence of chronic diseases is a significant driver of growth in the Indian In-vitro Diagnostic (IVD) Reagents market. Chronic diseases, including diabetes, cardiovascular diseases, cancer, and respiratory disorders, demand continuous monitoring and management, leading to a heightened need for reliable and frequent diagnostic testing.

India is often referred to as the diabetes capital of the world, with an estimated 77 million adults living with diabetes. This number is projected to increase, driving the need for regular glucose monitoring and diagnostic testing to manage the condition effectively. Glycated hemoglobin (HbA1c) tests are essential for long-term glucose monitoring and management in diabetic patients. The rising number of diabetic patients directly increases the demand for HbA1c IVD reagents, contributing to market growth.

Cardiovascular diseases (CVD) are the leading cause of mortality in India. With an aging population and lifestyle changes, the prevalence of CVD is rising, necessitating frequent diagnostic testing for early detection and management. Routine lipid profiling and the detection of cardiac markers (such as troponins) are critical for diagnosing and monitoring CVD. The demand for these tests drives the need for specific IVD reagents used in lipid panels and cardiac marker assays. The incidence of various cancers is on the rise in India, driven by factors such as aging, lifestyle changes, and environmental influences. Early detection and continuous monitoring are crucial for effective cancer treatment and management. Advanced diagnostic tests for detecting cancer biomarkers (e.g., PSA for prostate cancer, CA-125 for ovarian cancer) are becoming increasingly important. The demand for such specialized tests boosts the market for IVD reagents designed for cancer diagnostics.

Chronic respiratory diseases, including chronic obstructive pulmonary disease (COPD) and asthma, are prevalent in India due to factors like air pollution and smoking. Managing these conditions requires regular diagnostic testing. Diagnostic tests such as spirometry and specific biomarker assays are essential for diagnosing and monitoring respiratory disorders. The increasing prevalence of these diseases drives the demand for corresponding IVD reagents. Chronic kidney disease (CKD) is becoming more common in India, often linked to diabetes and hypertension. Regular monitoring of kidney function is critical for managing CKD. Tests for creatinine, urea, and other kidney function markers are vital for diagnosing and managing CKD. The increasing number of CKD patients drives the demand for these specific IVD reagents.

Growing Healthcare Awareness

Growing healthcare awareness in India is a significant factor driving the expansion of the In-vitro Diagnostic (IVD) Reagents market. Increased awareness leads to proactive health management, higher demand for diagnostic tests, and a more informed patient population.

As awareness about the importance of early diagnosis and prevention rises, more individuals are opting for regular health check-ups and screenings. This shift towards preventive healthcare significantly increases the demand for various diagnostic tests, driving the need for IVD reagents. Regular screenings for common conditions such as diabetes, hypertension, and cancer are becoming standard practice. These routine tests require a consistent supply of IVD reagents, thereby boosting market growth. Awareness campaigns highlighting the benefits of early disease detection are encouraging people to seek diagnostic tests at the first sign of symptoms. Early diagnosis improves treatment outcomes and increases the utilization of IVD reagents. For patients with chronic conditions, regular monitoring is essential. Increased awareness about the importance of continuous monitoring leads to higher demand for diagnostic tests, particularly those requiring IVD reagents.

Government initiatives and non-governmental organizations are actively conducting health awareness campaigns. Programs like the National Health Mission (NHM) and various disease-specific awareness drives educate the public about the importance of regular health check-ups and early diagnosis, thereby increasing the demand for diagnostic tests. Free health camps organized by government bodies and NGOs provide diagnostic services to underserved populations. These camps raise awareness and demonstrate the benefits of regular diagnostics, increasing the overall demand for IVD reagents. The media plays a crucial role in disseminating health-related information. Educational programs, news articles, and social media campaigns about health and wellness reach a wide audience, raising awareness and driving the demand for diagnostic tests. Stories of individuals who have benefited from early diagnosis and treatment are often highlighted in the media. These success stories motivate others to prioritize their health and undergo regular diagnostic testing, thereby increasing the market for IVD reagents.

Download Free Sample Report

Key Market Challenges

Regulatory Hurdles and Compliance Issues

The regulatory landscape for IVD reagents in India is intricate and often perceived as cumbersome. The Central Drugs Standard Control Organization (CDSCO) is the primary regulatory body, and obtaining approvals for new diagnostic products can be a lengthy and complicated process. This complexity can delay the introduction of innovative diagnostic reagents into the market.

Regulatory standards in the IVD sector are continuously evolving to keep pace with advancements in technology and international best practices. While this is necessary for ensuring safety and efficacy, it can pose challenges for manufacturers who must constantly adapt to new regulations. Keeping up with these changes requires significant resources and can be particularly challenging for smaller companies.

Meeting stringent regulatory requirements entails substantial compliance costs. These include expenses related to clinical trials, documentation, and quality assurance. For many local manufacturers, especially small and medium-sized enterprises (SMEs), these costs can be prohibitive, limiting their ability to compete with larger, well-funded multinational companies.

High Costs of Advanced Diagnostic Technologies

Advanced diagnostic technologies, such as molecular diagnostics, next-generation sequencing, and high-throughput automated systems, involve high capital and operational expenditures. The costs associated with acquiring and maintaining sophisticated diagnostic equipment and reagents are significant barriers, particularly for healthcare providers in rural and semi-urban areas.

A large segment of the Indian population cannot afford the high costs associated with advanced diagnostic tests. Despite rising incomes and increased healthcare spending, many patients still opt for basic diagnostic services due to financial constraints. This limits the market penetration of high-cost IVD reagents.

In India, the reimbursement landscape for diagnostic tests is not as well-developed as in some Western countries. The lack of comprehensive insurance coverage for advanced diagnostic tests means that patients often have to pay out-of-pocket, further restricting the demand for expensive IVD reagents. Without sufficient reimbursement mechanisms, the uptake of advanced diagnostic technologies remains limited.

Limited Skilled Workforce and Infrastructure

The operation of advanced diagnostic equipment and the interpretation of complex test results require specialized skills. India faces a significant shortage of trained laboratory technicians, pathologists, and other healthcare professionals capable of handling sophisticated IVD technologies. This skills gap hinders the adoption and effective use of advanced diagnostic reagents.

While urban areas may have access to state-of-the-art diagnostic laboratories, rural and semi-urban regions often lack adequate infrastructure. Many laboratories in these areas are not equipped with the necessary technology to perform advanced diagnostic tests, limiting the reach and effectiveness of IVD reagents.

Ensuring consistent quality and standardization across diagnostic laboratories is a significant challenge. Variations in laboratory practices, equipment calibration, and reagent quality can lead to discrepancies in test results. This lack of standardization can undermine trust in diagnostic tests and restrict market growth.

Key Market Trends

Integration of Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) technologies are being increasingly integrated into diagnostic processes to enhance accuracy and efficiency. AI algorithms can analyze large datasets to identify patterns and anomalies that may be missed by human analysts. This capability is particularly useful in complex diagnostic areas such as oncology and genomics, where precision is critical.

AI and ML can also be used for predictive analytics, enabling the early detection of diseases based on patient data trends. Predictive models can help in identifying individuals at high risk of developing certain conditions, thereby facilitating early intervention and better disease management. This proactive approach to healthcare is expected to drive the demand for IVD reagents used in predictive diagnostics.

The integration of AI and ML in laboratory operations can streamline workflows, reduce turnaround times, and optimize resource utilization. Automated data analysis and reporting can free up healthcare professionals to focus on more complex tasks, improving overall efficiency and increasing the throughput of diagnostic tests. This operational efficiency can boost the demand for IVD reagents as laboratories become capable of handling higher volumes of tests.

Expansion of Point-of-Care Testing (POCT)

Point-of-care testing (POCT) offers rapid diagnostic results at or near the site of patient care, such as in clinics, homes, or remote locations. The convenience and accessibility of POCT make it a valuable tool for improving healthcare delivery, especially in rural and underserved areas. The expansion of POCT is expected to drive the demand for portable and easy-to-use IVD reagents.

POCT allows for immediate clinical decision-making, which is crucial in emergency and critical care settings. The ability to quickly diagnose conditions such as infections, cardiac events, and metabolic disorders can significantly improve patient outcomes. The growing adoption of POCT devices and reagents for such critical applications is a major driver of market growth.

Advances in POCT technology, including the development of miniaturized and multifunctional devices, are expanding the range of tests that can be performed at the point of care. Innovations such as microfluidics, biosensors, and smartphone-based diagnostics are making POCT more accurate, affordable, and user-friendly. These advancements are expected to increase the adoption of POCT and drive the demand for related IVD reagents.

Segmental Insights

Test Type Insights

Based on the category of Test Type, the Clinical Chemistry segment emerged as the dominant in the market for India In-vitro diagnostic Reagents in 2024. Clinical chemistry tests cover a vast array of health conditions, including metabolic disorders, kidney and liver functions, lipid profiles, electrolytes, and glucose levels. The wide scope of these tests ensures their routine use in medical diagnostics, making clinical chemistry an essential part of healthcare. These tests are fundamental to routine health check-ups and preventive healthcare measures. Regular monitoring of biochemical markers helps in the early detection and management of chronic diseases such as diabetes, cardiovascular diseases, and kidney disorders. The high frequency of these routine tests significantly boosts the demand for clinical chemistry reagents.

India has a high prevalence of chronic diseases like diabetes and cardiovascular conditions, which require continuous monitoring through clinical chemistry tests. For instance, blood glucose tests and lipid profiles are crucial for managing diabetes and heart disease, respectively. The increasing number of patients with these conditions drives the substantial demand for relevant IVD reagents. Chronic kidney disease (CKD) and liver disorders are also prevalent in India, necessitating regular biochemical testing to monitor disease progression and treatment efficacy. Tests such as serum creatinine, blood urea nitrogen (BUN), and liver function panels are routinely used, further strengthening the dominance of the clinical chemistry segment.

Product Insights

The Reagents segment is projected to experience rapid growth during the forecast period. Reagents are fundamental to the diagnostic process as they react with biological samples to produce measurable results. Whether it's blood, urine, or tissue samples, reagents are indispensable for detecting, quantifying, and monitoring various biomarkers and analytes.

Reagents are used across multiple diagnostic disciplines, including clinical chemistry, hematology, immunology, microbiology, and molecular diagnostics. This wide application range ensures a consistent demand for reagents, reinforcing their dominance in the market. The rising prevalence of chronic diseases such as diabetes, cardiovascular diseases, and cancer in India necessitates regular diagnostic testing. Tests for glucose levels, lipid profiles, and tumor markers, all of which rely heavily on reagents, are routinely performed to manage these conditions. The burden of infectious diseases like tuberculosis, malaria, and more recently, COVID-19, has driven the demand for diagnostic tests. Reagents for PCR tests, ELISA assays, and rapid antigen tests are critical in diagnosing and managing these diseases, further boosting the reagent segment.

Advances in biotechnology and analytical chemistry have led to the development of highly sensitive and specific reagents. Innovations such as monoclonal antibodies, recombinant proteins, and synthetic peptides enhance the accuracy and reliability of diagnostic tests, increasing their adoption. Modern diagnostic laboratories are increasingly adopting automated and high-throughput systems, which require a steady supply of high-quality reagents. Automation improves efficiency and reduces human error, driving the demand for reagents compatible with these advanced systems. These factors collectively contribute to the growth of this segment.

Download Free Sample Report

Regional Insights

North India emerged as the dominant in the India In-vitro Diagnostics Reagents market in 2024, holding the largest market share in terms of value. North India is home to several major metropolitan cities such as Delhi, Noida, Gurgaon, Chandigarh, and Jaipur. These cities serve as healthcare hubs with a high concentration of hospitals, diagnostic laboratories, and healthcare centers. The presence of these facilities increases the demand for IVD reagents to support a wide range of diagnostic tests.

The region boasts renowned specialty hospitals and medical centers that attract patients from across the country and neighboring regions. These facilities require a constant supply of high-quality IVD reagents for routine diagnostic tests as well as specialized assays in areas like oncology, cardiology, and nephrology. North India has a dense population, including urban centers with a significant demand for healthcare services. The densely populated states of Uttar Pradesh, Punjab, Haryana, and Delhi-NCR collectively contribute to a substantial volume of diagnostic tests, thereby driving the demand for IVD reagents. The region has witnessed significant investments in healthcare infrastructure, including the establishment of new hospitals, clinics, and diagnostic centers. This development has expanded access to healthcare services and increased the utilization of diagnostic tests, supporting the growth of the IVD reagents market.

Recent Developments

- In September 2023, Siemens Healthcare Private Limited announced an expansion of its manufacturing operations in India. The company's focus will be on the medical devices sector, which encompasses various sub-categories including electronic equipment, implants, consumables and disposables, surgical instruments, and in-vitro diagnostic reagents.

Key Market Players

- Abbott Laboratories Inc.

- Becton, Dickinson and Company

- F. Hoffmann-La Roche Ltd

- Transasia Bio-Medicals Ltd

- Thermo Fisher Scientific Inc.

By Test Type | By Product | By Usability | By Application | By End User | By Region |

- Clinical Chemistry

- Molecular Diagnostics

- Hematology

- Immuno Diagnostics

- Test Types

| | | - Infectious Disease

- Diabetes

- Cancer/Oncology

- Cardiology

- Autoimmune Disease

- Nephrology

- Other

| - Diagnostic Laboratories

- Hospitals and Clinics

- Other

| - North India

- South India

- East India

- West India

|

Report Scope:

In this report, the India In-vitro Diagnostic Reagents Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

- India In-vitro Diagnostic Reagents Market, By Test Type:

o Clinical Chemistry

o Molecular Diagnostics

o Hematology

o Immuno Diagnostics

o Test Types

- India In-vitro Diagnostic Reagents Market, By Product:

o Instrument

o Reagent

o Other

- India In-vitro Diagnostic Reagents Market, By Usability:

o Disposable

o Reusable

- India In-vitro Diagnostic Reagents Market, By Application:

o Infectious Disease

o Diabetes

o Cancer/Oncology

o Cardiology

o Autoimmune Disease

o Nephrology

o Other

- India In-vitro Diagnostic Reagents Market, By End User:

o Diagnostic Laboratories

o Hospitals and Clinics

o Other

- India In-vitro Diagnostic Reagents Market, By Region:

o North India

o South India

o West India

o East India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India In-vitro Diagnostic Reagents Market.

Available Customizations:

India In-vitro Diagnostic Reagents market report with the given market data, Tech Sci Research offers customizations according to a company's specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five).

India In-vitro Diagnostic Reagents Market is an upcoming report to be released soon. If you wish an early delivery of this report or want to confirm the date of release, please contact us at [email protected]