|

Forecast Period

|

2026-2030

|

|

Market Size (2024)

|

USD 137.41 Million

|

|

Market Size (2030)

|

USD 263.50 Million

|

|

CAGR (2025-2030)

|

11.54%

|

|

Fastest Growing Segment

|

Reusable

|

|

Largest Market

|

North India

|

Market Overview

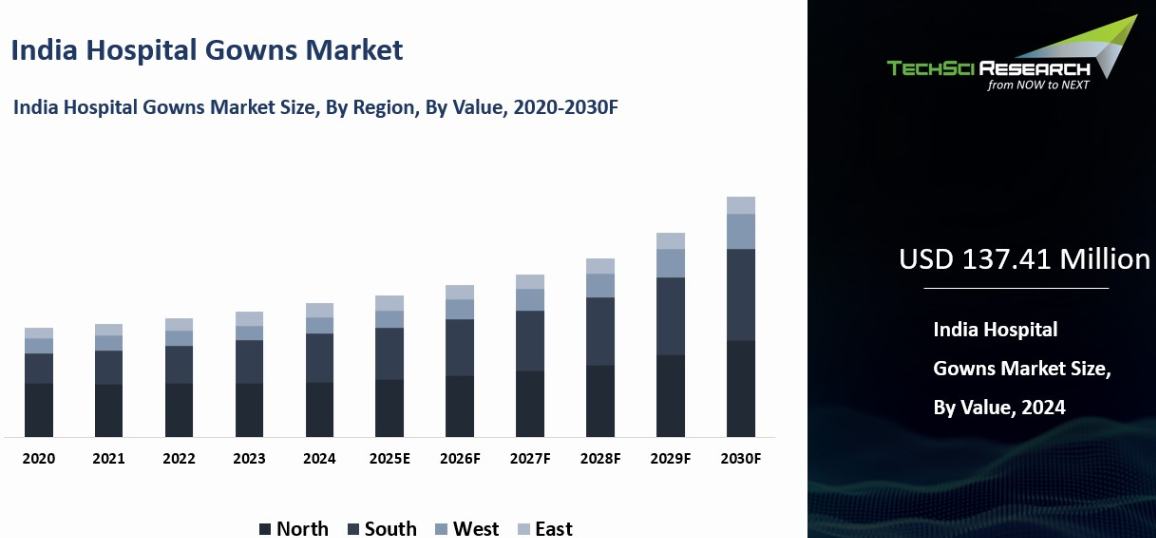

India Hospital Gown Market was valued at USD 137.41 Million and is anticipated to reach USD 263.50 Million by 2030, with a CAGR of 11.54% during 2025-2030.

Hospital gowns, also known as patient gowns, are a specific type

of attire worn by individuals during their stay in a hospital or medical

facility. These gowns are purposefully designed to provide easy access and

convenience for medical examinations or procedures, ensuring that healthcare

professionals can administer the necessary care efficiently. Crafted with

meticulous attention to detail, hospital gowns are typically made from

lightweight fabric that is gentle on the skin, promoting utmost comfort for

patients. The loose-fitting nature of these gowns allows for ease of movement

while maintaining the patient's dignity.

The use of hospital gowns goes beyond comfort and convenience. They play a

crucial role in upholding strict hygiene standards within the healthcare

setting. By acting as a barrier between the patient's body and the surrounding

environment, these gowns contribute to the prevention of potential infections, safeguarding

the well-being of both patients and healthcare providers. In essence, the

significance of hospital gowns extends beyond their functional purpose. They

serve as a symbol of care, ensuring a safer and more secure healthcare

experience for everyone involved.

Download Free Sample Report

Key Market Drivers

Growing Number of Surgeries

The demand for hospital gowns in India has grown sharply due to the rising number of surgical procedures nationwide. In 2019, India recorded 1,385.28 surgeries per 100,000 people, reflecting an unmet need of 49 million surgeries compared to the Lancet Commission benchmark of 5,000. Surgical rates increased by 9.24% annually, led by minor procedures at 4.16%, signaling higher medical intervention levels driven by better healthcare access and awareness. Government initiatives like NMAP (2017–2022) and NPCDCS have expanded healthcare coverage, with non-communicable diseases now causing 61.8% of deaths, up from 37.9% in 1990.

With ongoing infrastructure expansion, demand for high-quality hospital gowns has intensified. Delhi alone has invested ₹860 crore to add 1,300 hospital beds. Rising surgical volumes emphasize the need for sterile environments, promoting disposable gowns over reusable ones. Under the Medical Device Rules 2017, sterile surgical gowns are Class B, and non-sterile ones are Class A devices regulated by CDSCO. Disposable gowns are preferred for their single-use safety, superior protection, and alignment with NCDC’s infection prevention guidelines.

Advances in gown design have improved fluid resistance, breathability, and comfort. Products must comply with ISO 13485 and AAMI PB70 standards. Manufacturers increasingly use ARAS SMS fabric for better barrier performance. Growing NCD prevalence and medical tourism—foreign arrivals for treatment reached about 650,000 in 2024—continue to fuel demand.

The Union Budget 2025–26 earmarked nearly ₹1 lakh crore for healthcare, including over 200 cancer centers and expanded critical care under PM-Ayushman Bharat. India’s hospital bed density of 1.3 per 1,000 people remains far below WHO’s 3-bed standard, indicating strong growth prospects. For manufacturers, this creates opportunities to deliver cost-effective, high-performance gowns supporting India’s move toward advanced, infection-controlled healthcare systems..

Increasing Prevalence of

Chronic Diseases

In India, the rising prevalence of chronic diseases such as heart disease, diabetes, and cancer has resulted in a substantial increase in the demand for hospital gowns, with ICMR estimating 101 million people living with diabetes (ICMR-INDIAB, 2023), WHO attributing about 2.8 million deaths annually to cardiovascular diseases in the country (WHO Global Health Estimates), and the National Cancer Registry Programme projecting 1.57 million new cancer cases in 2025 (ICMR–NCRP). These conditions often require prolonged hospital stays and ongoing medical care, leading to an increased need for comfortable, accessible, and hygienic gowns that can accommodate diverse patient needs; hospital gowns are designed both for patient comfort and to minimize infection transmission, an emphasis reinforced by the National Guidelines for Infection Prevention and Control in Healthcare Facilities (MoHFW, 2020; updated 2023) and the Bureau of Indian Standards specification for surgical gowns, drapes, and clean air suits, IS 17334:2020 (BIS).

The ongoing COVID-19 pandemic further exacerbated demand, with the Ministry of Textiles documenting a rapid domestic scale-up to roughly 450,000 PPE coveralls per day by mid-2020, creating manufacturing capacity and supply-chain linkages that also support medical gown availability (Ministry of Textiles); this surge coincided with COVID-related hospitalizations and pressure on health systems, heightening the need for disposable and high-quality gowns that ensure patient and healthcare worker protection. Demand is further compounded by India’s aging population 138 million people aged 60 years and above in 2021, projected to reach 194 million by 2031 who are more susceptible to chronic conditions and require more frequent hospital visits and extended stays (MoSPI, Elderly in India 2021; National Commission on Population projections).

In parallel, India’s rapidly expanding healthcare sector bolstered by Ayushman Bharat with over 150,000 Health and Wellness Centres operational, more than 30 crore Ayushman cards issued, upwards of 26,000 hospitals empanelled, and over 5 crore authorized admissions since launch continues to enlarge the treated patient base and the consumption of essential hospital products such as gowns (National Health Authority/NHM dashboards and annual reports). The surge in chronic diseases, combined with stricter infection control standards and a growing emphasis on patient-centered care, underscores the essential role of durable, comfortable, and protective hospital gowns in India’s healthcare ecosystem; manufacturers have opportunities to innovate in barrier performance, fit, and donning/doffing usability while aligning with BIS and MoHFW specifications, ensuring reliable domestic supply chains and cost-effective production to meet sustained demand from tertiary hospitals, day-care centers, and expanding public schemes.

Growing Geriatric Population

India’s aging population is creating strong demand for hospital gowns, a key element of patient care. As the elderly share of the population grows, hospitalizations are becoming longer because of age-related conditions, leading to higher consumption of gowns designed for comfort and protection. This trend is pushing manufacturers to adopt advanced fabric technologies that improve breathability, antibacterial properties, and stretchability while maintaining infection control.

Awareness of patient dignity and hygiene is shaping gown preferences. Hospitals are increasingly opting for disposable or easily washable gowns that balance practicality with privacy. Private healthcare providers, focused on patient experience, are investing in high-quality gowns that enhance comfort and reassurance during treatment. This approach reflects a broader shift toward patient-centric care, where satisfaction is linked to every detail, including apparel.

Medical tourism is further expanding the market. India, while home to the world’s largest youth population, is witnessing rapid aging. The elderly population, currently at 153 million, is expected to reach 347 million by 2050. This demographic shift, along with the influx of foreign patients seeking advanced medical treatment, is increasing the need for premium gowns across hospitals, rehabilitation centers, and home care facilities. In 2024, India received nearly 650,000 medical tourists, highlighting the growing importance of global healthcare standards in patient amenities.

As healthcare infrastructure expands, hospital gowns are becoming more than a necessity they represent a critical part of patient safety and experience. Manufacturers are focusing on durability, comfort, and protective features to meet evolving expectations. Supported by demographic changes, better healthcare access, and rising medical tourism, the demand for hospital gowns in India will continue to climb, driving innovation and setting higher standards for patient care.

Increasing Incidence of

Accidents

India’s growing population and high accident rates are sharply increasing the demand for hospital gowns. Official data reported 461,312 road accidents in 2022, while the country’s population reached 1.43 billion in April 2023. The surge in road injuries has placed significant pressure on healthcare facilities, with national surveys identifying injuries as a major cause of inpatient hospitalization. Work-related accidents in mining, construction, and manufacturing further add to patient inflow, creating sustained demand for gowns used by both patients and healthcare personnel. Data from the Directorate General Factory Advice Service and Labour Institutes confirm persistent industrial injuries and fatalities contributing to hospital admissions.

Infrastructure gaps, including poor emergency response and traffic congestion, prolong patient transfers, increasing gown use during extended hospital stays. The pandemic further emphasized the role of personal protective equipment, establishing hospital gowns as essential for infection control under national health protocols. Managing both accident-related trauma and public health threats has pushed healthcare providers to expand gown inventories to meet safety standards.

This growing need offers manufacturers an opportunity to scale up production and reinforce supply chains, as seen in the rapid expansion of PPE output to several lakh units per day during recent health emergencies. Hospitals now require gowns that meet Indian Standards for surgical apparel and national infection prevention guidelines. Manufacturers are focusing on design improvements, producing gowns with better comfort, durability, and barrier protection based on evolving clinical evidence.

Disposable gowns with enhanced protective performance are becoming the norm in high-risk care settings, supported by national infection prevention and control guidance. With over 168,000 deaths and 443,000 injuries from road accidents in 2022 alone, the burden on India’s healthcare system remains heavy. Expanding medical textile production and adhering to strict quality standards are essential to ensuring a reliable supply of hospital gowns and maintaining infection control in a system facing rising patient volumes.

Key Market Challenges

Infections Due to The Usage of

Reusable Gowns and Drapes Due to The Outbreaks

The

recent outbreaks have led to an unexpected predicament in India's healthcare

sector, particularly concerning the use of hospital gowns. Hospitals have

witnessed a significant decline in demand for these essential items due to a

surge in infections attributed to reusable gowns and drapes. These reusable

items, which were originally intended to serve as a reliable barrier against

potential contaminants, have unfortunately become unwitting vehicles for

disease transmission. The root of the problem lies in the frequent and improper

handling, cleaning, and disinfection processes associated with these reusable

items. Despite efforts to maintain hygiene and sanitation protocols, the very

nature of their reusability inadvertently creates an environment that fosters

the thriving of infectious agents. This has understandably caused healthcare

professionals and patients alike to grow increasingly cautious and wary of

using such items, leading to a significant decrease in their demand.

The

issue of infection due to the usage of reusable gowns and drapes underscores a

pressing need to rethink and reform existing hygiene and sanitation protocols

in Indian hospitals. It calls for a comprehensive reassessment of the

materials, manufacturing processes, and disposal methods associated with these

items. The overall situation undeniably poses a major challenge to the medical

textile industry in India, which must now pivot towards the development and

production of safer, more reliable alternatives to traditional hospital gowns.

Taking

into consideration the urgency and importance of this matter, collaborative

efforts between healthcare professionals, researchers, and industry experts are

crucial. By addressing the shortcomings of current practices and exploring

innovative solutions, we can ensure the safety and well-being of both

healthcare workers and patients. It is through such endeavors that we can

effectively mitigate the risks associated with reusable gowns and drapes and

pave the way for a more secure and resilient healthcare system in India.

Existing Product Recalls

Recent

product recalls of hospital gowns in India have significantly impacted the

demand for these essential healthcare items. Several manufacturers, including

some well-known brands, have had to recall their products due to quality

concerns, leading to a crisis of confidence among consumers and healthcare

providers alike. The recalls were initiated due to various reasons, ranging

from inadequate sterilization practices to faulty design and the use of subpar

materials, all of which pose potential risks to patient safety.

This

situation has not only stirred apprehension among hospitals and healthcare

providers but has also created a ripple effect throughout the industry. The

decrease in demand for hospital gowns has forced hospitals to rethink their

procurement strategies, potentially deferring or even cancelling orders. The

recalls have also raised awareness among consumers about the quality of

healthcare products, making them more cautious and skeptical about their choices.

With

the heightened scrutiny and skepticism surrounding hospital gown products,

manufacturers now face the challenge of regaining consumer trust and restoring

demand. This requires significant investments in quality control and assurance

to ensure that future products meet the highest standards of safety and

reliability. It is crucial for manufacturers to address the concerns raised by

the recalls, not only to regain consumer confidence but also to rebuild the

reputation of the industry as a whole. In a market like India, where price

sensitivity is high and healthcare affordability is a major concern, the impact

of these recalls can be long-lasting. It is imperative for manufacturers to

take proactive measures to restore trust and confidence among consumers and

healthcare providers. By prioritizing quality control and investing in robust

assurance processes, manufacturers can work towards rebuilding the demand for

hospital gowns and ensuring the safety and well-being of patients.

Key Market Trends

Increase In Number of Hospital

Admissions

As

India continues to grapple with a surge in hospital admissions caused by

ongoing health crises and an ever-growing population, the demand for hospital

gowns has seen an exponential rise. These gowns, which play a vital role in

maintaining hygiene and preventing cross-contamination in healthcare settings,

are now more essential than ever before. Medical facilities across the nation

are witnessing an unprecedented demand for these garments, necessitating an

increase in their production and procurement.

The

surge in hospital admissions has not only led to an increased need for fresh

and clean gowns but has also resulted in a diversification of the types of

gowns required. The introduction of more specialized medical services and

facilities has expanded the range of gowns needed, encompassing everything from

patient gowns to surgical gowns. This expansion in the variety of gowns further

amplifies the demand for these essential garments.

Public health awareness campaigns have emphasized the criticality of

maintaining hygiene in healthcare settings. As a result, there are now

stringent regulations in place regarding the usage of gowns, which has further

fueled the surge in demand. The burgeoning private healthcare sector in India

has also contributed to this growth. These facilities, striving to provide

high-quality care, understand the significance of hospital gowns as a symbol of

cleanliness and professionalism, thereby driving up the need for them. The

escalating number of hospital admissions in India is a key driving force behind

the increasing demand for hospital gowns. This trend is expected to continue as

the country navigates through ongoing health crises and focuses on delivering

top-notch healthcare services to its growing population.

Rising Popularity of Medical

Consumables

The

burgeoning popularity of medical consumables in India is closely linked to the

escalating demand for hospital gowns, a trend fueled by several factors. As the

healthcare system grapples with the contagion, the surge in patient intake has

simultaneously increased the need for hospital gowns. Hospitals and medical

facilities across the country are witnessing a significant influx of patients,

necessitating a steady supply of gowns to meet the growing demand. The Indian population's growing awareness and emphasis on hygiene and infection

control have further amplified this demand. With the increased focus on

personal hygiene and preventive healthcare practices, individuals are seeking

quality hospital gowns that provide optimal protection and comfort.

The rise of medical tourism in the country is another key driver of the demand

for hospital gowns. As India becomes a preferred destination for patients

worldwide, the need for high-quality medical consumables, including hospital

gowns, is inevitable. International patients, who come to India for affordable

and advanced medical treatments, expect top-notch facilities and equipment,

including reliable and hygienic hospital gowns.

Government initiatives to bolster healthcare infrastructure across urban and

rural settings have contributed to an uptick in demand for hospital gowns. As

part of efforts to enhance the healthcare system, the government has been

investing in the development and expansion of healthcare facilities, including

hospitals and clinics. This expansion and upgradation of healthcare

infrastructure have increased the overall patient capacity, leading to a higher

requirement of hospital gowns.

These developments have made the procurement of

hospital gowns - recognized as a staple in patient care and infection control -

an essential aspect in the burgeoning landscape of medical consumables in

India. The demand for hospital gowns continues to rise, as they play a crucial

role in ensuring the safety and well-being of both patients and healthcare

providers, contributing to the overall improvement of healthcare standards in

the country.

Segmental Insights

Type

Insights

Based on the type, it is projected that

the Surgical gowns type will continue to maintain its dominance in the India

Hospital Gowns Market. This sustained dominance can be attributed to the high

usage rate of surgical gowns, which is driven by the ever-increasing number of

surgeries performed in healthcare facilities across the country. The

growing awareness about infection control measures among both healthcare

professionals and patients has also played a significant role in consolidating

the position of surgical gowns in the market. As the healthcare industry

recognizes the importance of reliable and effective protective garments, the

demand for surgical gowns continues to rise, further solidifying their

dominance in the India Hospital Gowns Market.

With their unparalleled ability to offer

superior protection and comfort, surgical gowns have become an integral part of

healthcare settings, ensuring the safety of both patients and medical staff.

The use of high-quality materials and advanced manufacturing techniques in the

production of surgical gowns has contributed to their durability and

effectiveness. The ongoing advancements in surgical gown designs,

such as ergonomic features and enhanced breathability, have further enhanced

their appeal among healthcare professionals. These innovations address the

needs for flexibility and mobility during surgical procedures, ultimately

improving the overall experience for both the medical staff and patients.

As

the Indian healthcare industry continues to evolve and advance, the relevance

and significance of surgical gowns are expected to persist, maintaining their

stronghold in the India Hospital Gowns Market. The continuous research and

development efforts in the field of medical textiles and infection control will

further drive the growth and innovation in surgical gown technology, ensuring

their continued dominance in the market.

Product

Type Insights

Based on product type, In India, the

hospital gown market is characterized by a pronounced preference for reusable

gowns. This trend is driven by a multitude of factors that have shaped the

industry landscape. Firstly, the cost-effectiveness of reusable gowns makes

them an attractive option for many hospitals. By being able to clean and reuse

these gowns multiple times, hospitals can significantly reduce their expenses

compared to constantly repurchasing disposable gowns. This not only helps in

optimizing their budget but also ensures a sustainable supply of gowns.

The growing emphasis on sustainability within the healthcare

sector has played a significant role in the popularity of reusable gowns. With

increasing awareness about environmental concerns, hospitals are actively

seeking ways to reduce waste generation. By opting for reusable gowns, they not

only minimize the amount of waste produced but also contribute to a greener and

more eco-friendly healthcare system. This aligns with the global shift towards

more sustainable practices in healthcare.

In

addition to cost-effectiveness, sustainability, and durability, another factor

that contributes to the dominance of reusable gowns in the Indian market is

their versatility. These gowns can be easily customized and tailored to meet

the specific needs of different medical procedures and patient requirements.

The availability of a wide range of sizes, styles, and fabrics further enhances

their appeal and practicality. Overall, the combination of cost-effectiveness,

sustainability, durability, and versatility has solidified the position of

reusable gowns in the Indian market. The preference for these gowns not only

reflects the pragmatic approach of hospitals but also aligns with the global

shift towards more sustainable practices in healthcare. With ongoing

advancements in fabric technology and design, the future of reusable gowns

looks promising, promising even greater benefits for healthcare providers,

patients, and the environment.

Download Free Sample Report

Regional Insights

The North region of India, particularly the

states such as Delhi, Punjab, and Haryana, is currently dominating the hospital

gowns market. This dominance can be attributed to several factors. The

presence of a large number of hospitals and healthcare facilities in these

areas ensures a steady demand for hospital gowns. The high population

density in these states further contributes to the demand for healthcare

services and related products. The North region of India boasts a

robust infrastructure for the manufacturing and distribution of hospital gowns.

The availability of skilled labor and advanced production facilities allows for

efficient and cost-effective production, meeting the growing demand in the

market. The region's strategic location and well-connected

transportation networks facilitate the smooth movement of hospital gowns to

different parts of the country. The North region of India has

witnessed a surge in medical tourism, with an increasing number of foreign

patients seeking healthcare services in the region. This trend has further

propelled the demand for hospital gowns, as the region strives to maintain

international standards in healthcare facilities and services.

The North region

of India has also witnessed significant government initiatives and policies

aimed at promoting the healthcare sector. The implementation of various schemes

and programs, along with investments in healthcare infrastructure, has created

a conducive environment for the growth of the hospital gowns market. As a

result of these combined factors, the North region of India has emerged as a

key player in the hospital gowns market, showcasing its potential for sustained

growth and expansion in the healthcare industry. The region's dominance in the

market is expected to continue, driven by the increasing demand for quality

healthcare products and services.

Recent Developments

- In August 2024, AIIMS New Delhi floated GeM tenders for surgical and medical gowns, including a bid for 90,000 surgical gowns and a separate procurement of disposable sterile gowns for attendants, signaling strong institutional demand.

- In August 2024, AIIMS issued a multi-center GeM bid for “O.T. Gown” procurement across its main campus and associated centers (NCI Jhajjar, CRHSP Ballabgarh, NDDTC Ghaziabad), highlighting efforts toward standardized gown sourcing across facilities.

- In October 2024, HLL Lifecare Limited announced FY2024–25 e-tendering activities supporting healthcare sourcing programs that typically include surgical consumables and protective apparel for partner institutions.

- In November 2024, Sree Chitra Tirunal Institute for Medical Sciences and Technology (SCTIMST), Thiruvananthapuram, issued a GeM tender for surgical gowns and drapes specifying IS 17334 Level 1 sterile single-use gowns with defined dimensions and closures, demonstrating early institutional compliance with IS 17334 levels.

- In February 2025, the Bureau of Indian Standards (BIS) published IS 17334:2025 “Textiles — Medical/Surgical Gowns and Medical/Surgical Drapes — Specification,” replacing the 2019 version and introducing updated performance levels and test methods for India’s gown market.

- In July 2025, BIS released detailed implementation guidance for IS 17334:2025, renaming protection levels (Level 0→1, 1→2, 2→3, 3→4), adding explicit blood and viral penetration test procedures, and clarifying lint and microbial cleanliness requirements.

- In September 2025, a GeM bid document for “Level 4 Barrier Standard Surgical Gown” reflected the adoption of IS 17334:2025’s revised level schema in institutional tenders, indicating integration of the new standard into procurement frameworks.

Key Market Players

- Medline Industries India Private Limited

- 3M

India Limited

- Atlas

Infiniti

- Bellcross

Industries Private Limited

- Sara

Healthcare Private Limited

- GPC

Medical Limited

- Apothecaries

Sundries Manufacturing Co.

- Deluxe

Scientific Surgico Private Limited

|

By

Type

|

By

Product Type

|

By

Risk Type

|

By

Distribution Channel

|

By

End User

|

By

Region

|

- Surgical

- Non-Surgical

- Patient

|

|

|

- Direct

Sales

- Retail

Pharmacies

- Online

|

- Hospitals

& Clinics

- Ambulatory

Care Centers

- Others

|

|

Report Scope:

In this report, the

India Hospital Gowns Market has

been segmented into the following categories, in addition to the industry

trends which have also been detailed below:

- India Hospital Gowns Market, By Type:

o

Surgical

o

Non-Surgical

o

Patient

- India Hospital Gowns Market, By Product

Type:

o

Reusable

o

Disposable

- India Hospital Gowns Market, By Risk

Type:

o

Minimal

o

Low

o

Moderate

o

High

- India Hospital Gowns Market, By Distribution

Channel:

o

Direct Sales

o

Retail Pharmacies

o

Online

- India Hospital Gowns Market, By End

User:

o

Hospitals & Clinics

o

Ambulatory Care Centres

o

Others

- India Hospital Gowns Market, By Region:

o

North

o

South

o

West

o

East

Competitive Landscape

Company

Profiles: Detailed

analysis of the major companies present in the India Hospital Gowns Market.

Available Customizations:

India

Hospital Gowns Market report with

the given market data, TechSci Research offers customizations according to a

company's specific needs. The following customization options are available for

the report:

Company Information

- Detailed analysis and profiling of

additional market players (up to five).

India Hospital Gowns Market is an upcoming report to be released

soon. If you wish an early delivery of this report or want to confirm the date

of release, please contact us at [email protected]