|

Forecast

Period

|

2026-2030

|

|

Market

Size (2024)

|

USD

4.03 Billion

|

|

Market

Size (2030)

|

USD

6.22 Billion

|

|

CAGR

(2025-2030)

|

7.45%

|

|

Fastest

Growing Segment

|

Vitamins

|

|

Largest

Market

|

North

India

|

Market Overview

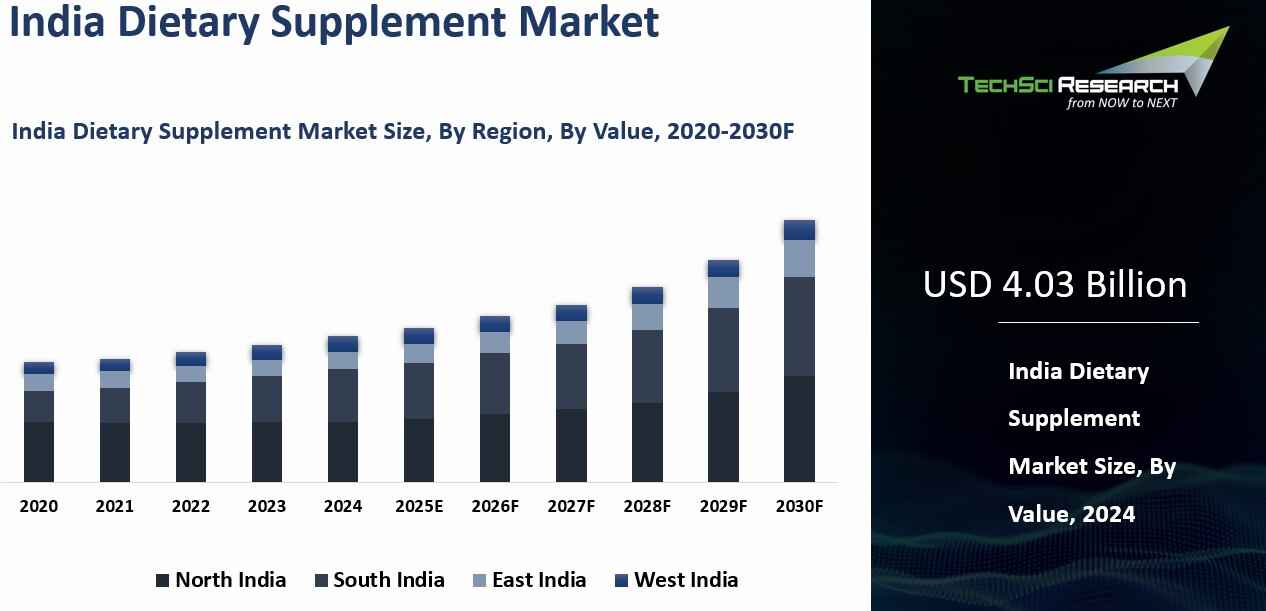

India

Dietary Supplement Market was valued at USD 4.03 Billion in 2024 and is anticipated to reach USD 6.22 Billion by 2030, with a CAGR of 7.45% during 2025-2030. The Indian dietary supplement market has witnessed robust growth

in recent years, fueled by shifts in consumer lifestyles, heightened health

awareness, and an increasing preference for preventive healthcare. This market

is expected to maintain its growth trajectory, driven by advancements in

product formulations, the rapid expansion of e-commerce channels, and a growing

emphasis on health maintenance.

Companies

that successfully leverage digital marketing strategies, prioritize product

quality, and remain responsive to evolving consumer preferences are

well-positioned to excel in this competitive landscape. The Indian dietary

supplement market offers significant opportunities for both established brands

and new entrants, provided they effectively navigate existing challenges and

align their product offerings with consumer demands and regulatory

requirements.

Download Free Sample Report

Key Market Drivers

Rising Health Consciousness

As health awareness rises, Indian consumers are increasingly adopting a proactive approach to well-being, emphasizing prevention over treatment. According to some reports, 94% of Indians express concern about their family’s health compared to 82% globally, and 52% intend to sustain mental well-being habits post-COVID, well above the global average of 39%. These figures highlight a lasting commitment to proactive health management in India’s post-pandemic landscape.

Following COVID-19, individuals have become more conscious of immunity and fitness, viewing dietary supplements as essential for prevention. Products like vitamin C, zinc, and herbal formulations are witnessing growing popularity. The digital era, with India having over 850 million internet users, has amplified this trendsocial media, blogs, and influencers actively shape public awareness about nutrition and supplements, motivating consumers to bridge dietary gaps and enhance health outcomes.

India’s fitness culture, with over 20,000 gyms and wellness programs, further fuels supplement use. Gyms and wellness programs emphasize nutrition, recommending supplements to boost performance and recovery, particularly among younger demographics. Awareness of widespread deficiencies, with studies showing over 75% of Indians lack vitamin D3 and an estimated 73% are protein-deficient, drives targeted supplement consumption. With busy urban lifestyles and nuclear families, many individuals rely on supplements for convenience and nutritional balance.

A shift toward holistic health philosophies also supports this growth. Consumers increasingly seek supplements that promote not just physical health but also mental clarity and stress relief, reflecting a broader understanding of well-being. India’s Ayurvedic heritage reinforces the popularity of herbal and plant-based products perceived as natural and safe alternatives to synthetic options.

As companies respond with organic, vegan, and clean-label offerings supported by transparent sourcing, consumer trust continues to deepen. Overall, India’s rising health consciousness, driven by proactive health attitudes, digital awareness, fitness culture, and holistic wellness, positions the dietary supplement market for robust expansion and innovation.

Increasing Incidence of

Lifestyle Diseases

India is witnessing a sharp rise in non-communicable diseases (NCDs) such as diabetes, which now affects over 100 million people, hypertension, cardiovascular ailments, and obesity. In India, NCDs account for 5.87 million deaths annually, nearly 60% of total mortality, underscoring the urgent need for preventive healthcare and lifestyle interventions.

As awareness grows about the link between poor nutrition and chronic illnesses, consumers are turning to preventive solutions like dietary supplements. Products such as omega-3 fatty acids, fiber supplements, and multivitamins are increasingly viewed as essential for managing heart health and metabolism. Urban lifestyles and processed diets have created nutritional gaps, driving demand for targeted supplements, for instance, phytosterols for cholesterol management and magnesium for hypertension.

Following the COVID-19 pandemic, the prevalence of lifestyle diseases has further heightened consumer education on nutrition, with healthcare professionals and wellness influencers now advocating supplementation as part of disease prevention and daily routines. In response, supplement manufacturers are developing specialized formulations addressing weight control, heart health, and blood sugar regulation. The aging population, more prone to chronic conditions, also fuels demand for age-specific supplements supporting joint, cognitive, and cardiovascular health. Meanwhile, the rise of fitness culture has boosted the use of protein powders and recovery supplements.

Government initiatives like the Poshan Abhiyaan (National Nutrition Mission), promoting nutrition and preventive health, further support this growth. As awareness deepens, the convergence of health education, demographic shifts, and wellness trends positions dietary supplements as key tools in combating lifestyle diseases and expanding India’s preventive healthcare market.

Growing E-commerce Penetration

E-commerce platforms have revolutionized access to dietary supplements in India, offering unmatched convenience and variety. With an internet user base surpassing 850 million, the country has one of the world’s largest e-commerce markets. Investments from global players like Amazon and Walmart, along with government initiatives such as Digital India, which aims to provide high-speed internet to all 250,000 gram panchayats (village councils), continue to fuel this digital expansion.

Online shopping eliminates geographical barriers, allowing both rural and urban consumers to access supplements previously unavailable in local stores. The ability to compare brands, read reviews, and explore niche products empowers consumers to make informed choices, boosting experimentation and overall market demand.

E-commerce platforms use data analytics to deliver personalized recommendations, improving engagement and conversion rates. For instance, fitness enthusiasts may receive tailored suggestions for protein or pre-workout supplements. Such personalization builds loyalty and drives repeat purchases. Reviews and ratings further reinforce trust, providing social proof that enhances confidence in product efficacy and safety.

Subscription models and loyalty programs have become increasingly popular, ensuring consistent product supply and savings for consumers while generating steady revenue for brands. At the same time, social media and influencer marketing amplify product visibility health influencers on platforms with a collective user base of over 500 million frequently promote supplements, directing audiences to e-commerce channels and fostering brand credibility.

The COVID-19 pandemic accelerated the shift to online shopping as consumers prioritized safety and convenience. Even post-pandemic, the preference for e-commerce persists, supported by heightened health awareness. Strategic collaborations between supplement brands and e-commerce platforms, such as exclusive bundles and online-only offerings, have further expanded reach and sales potential.

Overall, the growing penetration of e-commerce in India has become a powerful catalyst for the dietary supplement market. Enhanced accessibility, targeted marketing, consumer trust, and integrated digital strategies are collectively driving market expansion and shaping the future of supplement retail in India..

Key Market Challenges

Regulatory Hurdles and

Compliance Issues

The

dietary supplement market in India faces significant regulatory challenges,

primarily due to the fragmented regulatory framework governing food and health

products. The Food Safety and Standards Authority of India (FSSAI) has

established guidelines for dietary supplements; however, the lack of

comprehensive and uniform regulations can create confusion among manufacturers

and consumers alike.

The

terms “dietary supplements,” “functional foods,” and “nutraceuticals” are often

used interchangeably, leading to ambiguity in classification and regulation.

This lack of clarity can deter potential entrants from investing in the market, as compliance requirements remain uncertain. Obtaining regulatory

approval for new products can be time-consuming and costly. Manufacturers may

face delays in product launches, impacting their competitiveness and market

share. Companies must navigate complex documentation and testing requirements, which

can slow down innovation and product development.

Inconsistencies

in regulatory enforcement can lead to substandard or unsafe products on the market. Consumers may become skeptical of dietary supplements

if they perceive a lack of regulatory oversight, which can hinder overall

market growth. Building consumer trust is critical for sustaining demand, and

any incidents of non-compliance can adversely affect the entire industry.

Market Fragmentation and

Competition

The

Indian dietary supplement market is highly fragmented, with numerous players

ranging from established brands to local manufacturers and unregulated sellers.

This fragmentation poses several challenges:

The

presence of numerous competitors often leads to aggressive price competition.

Smaller brands and unregulated sellers may offer lower-priced products, making

it difficult for established companies to maintain market share without

compromising on quality or profitability. This price war can lead to reduced

margins and hinder investments in research, development, and marketing. In a

crowded marketplace, it can be challenging for brands to differentiate

themselves. Many dietary supplements offer similar health benefits, making it

difficult for consumers to discern quality and efficacy. As a result, consumers

may gravitate towards familiar or lower-cost options rather than exploring

premium or innovative products. This challenge limits the potential for growth

in the premium segment of the market.

While

e-commerce is on the rise, many consumers still prefer purchasing dietary

supplements through traditional retail channels. The fragmentation of

distribution networks complicates brands' ability to reach their target

consumers effectively. Smaller companies may lack the resources to establish

strong distribution partnerships, restricting their market presence and growth

potential.

Key Market Trends

Personalization and Customized

Nutrition

As Indian consumers become more health-conscious and better informed, demand is rising for personalized dietary supplements that align with individual health needs, lifestyles, and food preferences. This shift is especially visible in urban India, where consumers are increasingly proactive about preventive health and are willing to experiment with targeted products rather than generic multivitamins. People are looking for solutions that match specific goals such as weight management, immunity, skin and hair health, energy and sleep support, sports performance, and stress management.

Technology is enabling this personalization trend to scale. Supplement brands in India are increasingly using digital onboarding journeys—such as online questionnaires, app-based assessments, and subscription models to recommend custom routines based on age, activity level, diet type (including vegetarian preferences), and self-reported symptoms. Some platforms also integrate deeper data sources, including at-home lab reports, wearable-linked activity metrics, and, in select cases, genetic testing, to refine recommendations and improve product–consumer fit over time. As artificial intelligence and data analytics become more embedded in consumer health platforms, personalization is becoming a practical go-to-market strategy rather than a premium niche.

At the same time, Indian consumers are showing stronger interest in holistic health approaches, where nutrition is linked with gut health, hormonal balance, cognitive function, and emotional well-being. Personalized supplementation supports this mindset by offering more targeted combinations and dosages that address specific concerns and reduce the trial-and-error typical of one-size-fits-all products. It also encourages more active self-management of health, especially among consumers managing modern lifestyle pressures, inconsistent routines, or diet-related gaps.

Growth of Plant-Based and

Natural Supplements

The

increasing preference for plant-based and natural dietary supplements is a

notable trend that aligns with broader consumer movements towards

sustainability and health. Today's consumers are more discerning about

ingredient sourcing and product formulations. They are increasingly inclined to

choose dietary supplements free of artificial additives,

preservatives, and genetically modified organisms (GMOs). Brands that emphasize

transparency and sustainability in their sourcing practices are likely to gain

a competitive advantage.

India's

rich Ayurvedic heritage is experiencing a resurgence, with

consumers turning to traditional herbal formulations as safe and effective

alternatives to synthetic supplements. Products that harness the benefits of

indigenous plants and herbs resonate well with consumers seeking natural

wellness solutions. The growing acceptance of these products in mainstream

health and wellness discourse is indicative of a significant market

opportunity. Research highlighting the health benefits of plant-based

ingredients is further driving this trend. Consumers are increasingly drawn to

supplements containing natural antioxidants, anti-inflammatory compounds, and

adaptogens, as they seek to improve overall health and well-being. This trend

is particularly appealing to younger demographics who prioritize health and

wellness in their purchasing decisions.

Segmental Insights

Product Type Insights

Based

on the category of Product, the Vitamins segment emerged as the dominant in the

market for Dietary Supplement in 2024. The vitamins segment also plays a

significant role in the Indian dietary supplement market. Increased awareness

of the importance of vitamins for overall health and well-being has led to

robust demand for vitamin supplements. This category is particularly popular

among consumers looking to enhance their immunity, energy levels, and overall

vitality.

The

focus on health and wellness, particularly following the COVID-19 pandemic, has

prompted consumers to prioritize their nutritional intake. Vitamins such as

Vitamin C, Vitamin D, and various B vitamins have gained prominence, with

consumers actively seeking products that enhance immune function and support

metabolic health. The vitamins segment encompasses a wide array of products,

including single vitamins, multivitamins, and vitamin-infused foods and

beverages. This diversity allows consumers to select products that align with

their specific health goals, contributing to the sustained growth of this

segment.

Form Insights

The

tablets segment is projected to grow rapidly during the forecast

period. Tablets hold a significant share of the dietary supplement market in

India, primarily due to their convenience, stability, and cost-effectiveness.

They are widely used for multivitamins, mineral supplements, and combination

products, making them a popular choice among consumers seeking an

easy-to-consume option.

Many

consumers are accustomed to taking tablets for medication and dietary

supplementation. This familiarity translates into higher acceptance rates,

especially among older demographics who may prefer traditional formats over

newer alternatives. Tablets also allow for precise dosing, a crucial

factor for consumers managing specific health conditions. The tablet segment

offers a diverse range of products, including chewable, effervescent, and

enteric-coated tablets. This versatility appeals to various consumer

preferences, from those who prefer a straightforward swallowing experience to

those seeking flavor or enhanced absorption. The ability to cater to specific

dietary needs further solidifies tablets' dominance in the market.

These factors collectively contribute to the growth of this segment.

Download Free Sample Report

Regional Insights

North India emerged as the dominant region in the dietary supplement market in 2024, holding the largest share by value. Urban centers such as Delhi, Chandigarh, and Jaipur have seen rising health awareness, driven by the growing prevalence of lifestyle diseases and a stronger focus on preventive healthcare. This has boosted demand for immunity, wellness, and performance-enhancing supplements.

Rapid urbanization and rising disposable incomes have further supported market growth, as busy urban consumers increasingly seek convenient nutritional solutions. Demand is especially strong for vitamins, minerals, protein supplements, and herbal products.

The region’s diverse dietary habits and growing fitness culture, particularly among younger consumers, have increased consumption of protein powders, weight management products, and health drinks. Additionally, North India’s strong cultural affinity for Ayurveda and herbal remedies continues to drive demand for plant-based and traditional supplement formulations, reinforcing its market leadership.

Recent Developments

- In Jan 2026, Kapiva launched a ₹50 crore fund to support Ayurveda R&D, relevant to building next-gen evidence-backed supplement formats in modern Ayurveda.

- In Dec 2025, Marico was reported to be in talks to acquire plant-based protein supplements brand Cosmix (reported deal value ~₹300 crore) to strengthen its nutrition/protein portfolio.

- In Dec 2025, Earthful raised ₹26 crore in a Pre-Series A round led by Fireside Ventures and V3 Ventures, aimed at accelerating product innovation and omnichannel expansion.

- June 2025: Dabur India officially entered the nutraceutical sector with the launch of "Siens," a new, digital-first wellness brand. The product line focuses on beauty, gut health, and daily wellness, offering supplements in modern formats like gummies, softgels, and tablets, including marine collagen and pre- & probiotics.

- March 2025: GNC India launched "GNC Pro Performance 100% Whey + Nitro Surge." This product is marketed as India's first whey protein with a cardio-protective formulation, containing clinically proven ingredients to support vasodilation and sustained blood circulation during intense physical activity.

- March 2025: Amway India announced that it is actively exploring an entry into the Ayurveda segment. The company plans to launch new products integrating traditional Indian herbs under its successful Nutrilite brand within the next two to three years, building on its existing Nutrilite Traditional Herb Range.

Key Market Players

- Amway

India Enterprises Pvt. Ltd.

- Herbalife

International of America, Inc

- DABUR

INDIA LIMITED

- Abbott

India Limited

- The

Kraft Heinz Company

- Himalaya

Wellness Company

- Sun

Pharmaceutical Industries Ltd.

- GSK

plc

- Danone

India

- Patanjali

Ayurved Limited

|

By

Product Type

|

By

Form

|

By

Distribution Channel

|

By

Application

|

By

End User

|

By

Region

|

- Vitamin

- Combination

Dietary Supplements

- Protein

- Herbal

Supplements

- Fish

Oil & Omega Fatty Acid

- Others

|

- Capsules

- Tablets

- Powder

- Soft

Gels

- Liquid

|

- Pharmacies

and Drug Stores

- Online

- Supermarkets

and Hypermarkets

- Others

|

- Immunity

- General

Health

- Energy

& Weight Management

- Bone

& Joint Health

- Others

|

- Adults

- Geriatric

- Pregnant

Females

- Children

- Infants

|

- North

India

- South

India

- West

India

- East

India

|

Report Scope:

In this report, the India Dietary Supplement Market

has been segmented into the following categories, in addition to the industry

trends which have also been detailed below:

- India Dietary Supplement Market, By Product Type:

o Vitamin

o Combination Dietary Supplements

o Protein

o Herbal Supplements

o Fish Oil & Omega Fatty Acid

o Others

- India Dietary Supplement Market, By Form:

o Capsules

o Tablets

o Powder

o Soft Gels

o Liquid

- India Dietary Supplement Market, By Distribution Channel:

o Pharmacies and Drug Stores

o Online

o Supermarkets and Hypermarkets

o Others

- India Dietary Supplement Market, By Application:

o Immunity

o General Health

o Energy & Weight Management

o Bone & Joint Health

o Others

- India Dietary Supplement Market, By End User:

o Adults

o Geriatric

o Pregnant Females

o Children

o Infants

- India Dietary Supplement Market, By Region:

o North India

o South India

o West India

o East India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India

Dietary Supplement Market.

Available Customizations:

India

Dietary Supplement market report with the given market data, TechSci

Research offers customizations according to a company's specific needs. The

following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional

market players (up to five).

India Dietary Supplement Market is an upcoming

report to be released soon. If you wish an early delivery of this report or

want to confirm the date of release, please contact us at [email protected]