|

Forecast

Period

|

2026-2030

|

|

Market

Size (2024)

|

USD

845.91 Million

|

|

Market

Size (2030)

|

USD

1366.46 Million

|

|

CAGR

(2025-2030)

|

8.28%

|

|

Fastest

Growing Segment

|

Ultrasound

System

|

|

Largest

Market

|

West

India

|

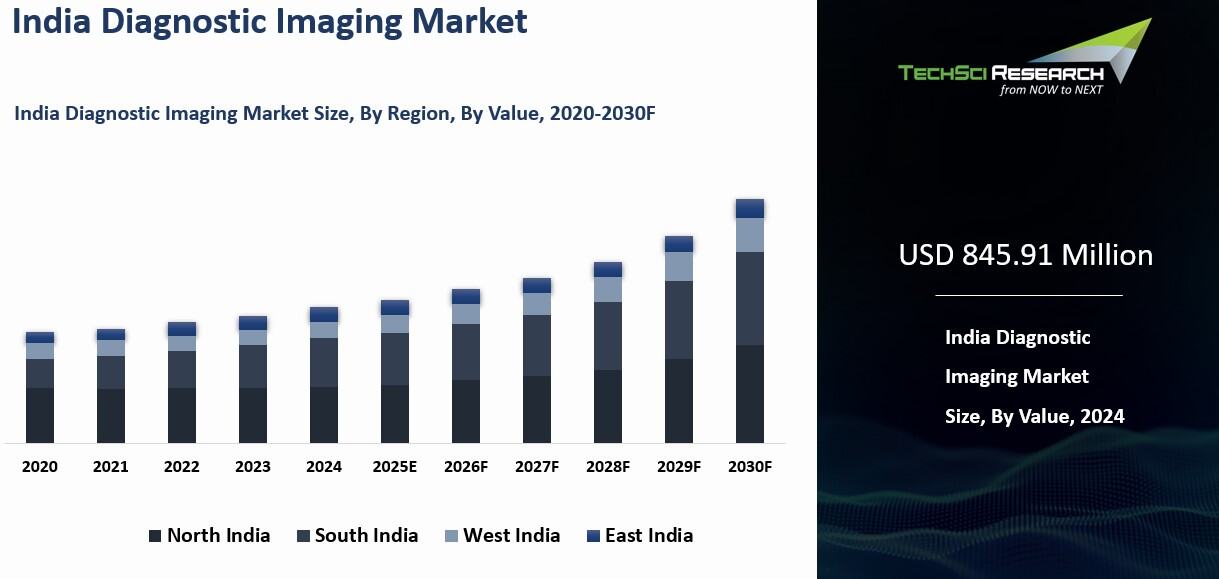

Market Overview

India

Diagnostic Imaging Market was valued at USD 845.91 Million in 2024 and is expected to reach USD 1366.46 Million by 2030 with a CAGR of 8.28% during the forecast period.

Diagnostic imaging is a field that encompasses a wide range of

non-invasive techniques used to identify and monitor diseases or injuries.

These methods involve the generation of detailed images that represent specific

parts of the body, allowing healthcare professionals to gain valuable insights

into a patient's condition. Some of the commonly used technologies in

diagnostic imaging include X-ray radiography, which uses electromagnetic

radiation to capture images of bones and tissues. Magnetic resonance imaging

(MRI) utilizes powerful magnets and radio waves to produce highly detailed

images of internal structures.

Computed tomography (CT) combines X-rays with

computer technology to create cross-sectional images of the body. Ultrasound

uses high-frequency sound waves to generate real-time images of organs and

tissues. Additionally, nuclear medicine techniques like positron emission

tomography (PET) enable physicians to visualize metabolic processes within the

body for diagnosis and treatment planning. By utilizing these advanced imaging

techniques, healthcare professionals can accurately diagnose medical conditions

and develop personalized treatment plans, ultimately improving patient outcomes

and quality of care.

Download Free Sample Report

Key Market Drivers

Rise

in the Prevalence of Chronic Diseases and Increased Adoption of Advanced Technologies in Medical Imaging

The

surge in chronic diseases within India is amplifying the need for high-quality

diagnostic imaging services. Recent findings from the Longitudinal Ageing Survey in India (LASI) reveal that 21% of the elderly population in India is affected by at least one chronic condition. Notably, the prevalence is higher in urban areas, where 29% of seniors experience chronic health issues, compared to 17% in rural areas. This data underscores the growing health challenges faced by India's aging population, particularly in urban centers, highlighting the need for targeted healthcare interventions and solutions for the elderly demographic. As the prevalence of conditions such as cancer,

diabetes, heart disease, and respiratory disorders continues to rise, early and

accurate diagnosis becomes a critical factor in effective patient management.

Diagnostic imaging, encompassing modalities like CT scans, MRIs, PET scans, and

ultrasound, is a cornerstone in identifying these conditions early on and

planning precise treatment pathways.

Hypertension and diabetes are the leading chronic conditions among India's elderly, collectively accounting for approximately 68% of all chronic diseases within this demographic. Cardiovascular diseases impact 37% of individuals aged 75 and above, highlighting a significant health concern in the aging population. Additionally, bone and joint diseases, along with chronic lung diseases, emerge as other prominent health challenges, further exacerbating the healthcare burden on the elderly. These statistics underline the critical need for specialized healthcare solutions to address the multifaceted health needs of older adults in India. This increased demand for diagnostic

imaging is further fueled by India's growing population, changing lifestyle

patterns, and heightened awareness about regular health check-ups. Moreover,

the advancements in medical technology and imaging techniques have

revolutionized the field of diagnostics, enabling healthcare professionals to

obtain detailed and comprehensive insights into the patient's condition. From

high-resolution images that help detect minute abnormalities to functional

imaging that assesses organ functionality, diagnostic imaging has become an

indispensable tool in the diagnostic process.

However,

to meet this surge in demand and ensure accessibility to all sections of

society, it's imperative for the Indian healthcare sector to tackle challenges

of equitable distribution, affordability, and infrastructure development for

these advanced diagnostic tools. This includes expanding the reach of

diagnostic centers to remote areas, implementing cost-effective solutions, and

fostering collaborations between public and private healthcare providers. By

focusing on these areas and harnessing the power of diagnostic imaging, India

can effectively manage the increasing burden of chronic diseases. Through early

and accurate diagnosis, healthcare professionals can initiate timely

interventions, develop personalized treatment plans, and improve patient

outcomes. With the continuous advancements in diagnostic imaging technology and

a collaborative approach, India can pave the way for a healthier future for its

population.

Increased

Adoption of Advanced Technologies in Medical Imaging

India's

healthcare sector is experiencing a remarkable surge in the demand for

diagnostic imaging, fueled by the widespread adoption of cutting-edge

technologies in medical imaging. The advent of digital radiography, 3D

ultrasonography, and multi-slice CT scanning has revolutionized the landscape

of advanced imaging technologies in the country.

By

leveraging these state-of-the-art technologies, healthcare professionals are

able to provide faster and more accurate diagnoses, ultimately leading to

improved patient outcomes. The high-resolution images produced by these

advanced imaging modalities enable early detection and treatment of diseases,

facilitating timely intervention and potentially saving lives. Furthermore,

these advancements have paved the way for minimally invasive procedures,

resulting in reduced recovery times and enhanced patient comfort.

This

upward trajectory in the utilization of advanced diagnostic imaging

technologies is further propelled by the government's commitment to modernizing

healthcare infrastructure and increasing investments in the sector. Industry

reports predict a significant growth in the diagnostic imaging market in India

in the coming years, driven by the increasing prevalence of chronic diseases

and the expanding aging population. As a result, the demand for advanced

diagnostic imaging will continue to rise, fostering notable growth and

development in this sector.

Growing

Geriatric Population

The elderly population in India, defined as individuals aged 60 and above, is projected to reach 158.7 million by 2025, representing 11.1% of the total population. This significant demographic shift presents a critical healthcare challenge, particularly regarding the rising prevalence of chronic diseases among the elderly. As highlighted in the India Ageing Report 2023, conditions such as hypertension, diabetes, cardiovascular diseases, and chronic lung diseases are becoming increasingly prevalent within this age group, emphasizing the urgent need for specialized healthcare solutions to manage the growing health demands of the aging population.

This demographic shift, coupled with an alarming rise in chronic diseases, has

resulted in an unprecedented demand for diagnostic imaging services. Advanced

imaging techniques not only provide detailed insights into various diseases but

also enable early detection and effective treatment, which is of utmost

importance for the elderly population who are more susceptible to health

complications. Moreover, the prevalence of non-communicable diseases (NCDs)

such as cardiovascular diseases, cancers, chronic respiratory diseases, and

diabetes has witnessed a surge among the elderly. These conditions necessitate

frequent monitoring and testing, further contributing to the escalating demand

for diagnostic imaging services.

The LASI study reveals that approximately 23% of India’s elderly population experiences multi-morbidities, with women disproportionately affected compared to men. The prevalence of multi-morbidity increases with age, rising from 10% in the 45-49 age group to 26% among individuals aged 70-74. Alarmingly, even among the younger elderly population (ages 60-64), 28% are affected by chronic hypertension. This trend highlights the growing healthcare burden and the need for targeted interventions to address the complex health needs of an aging population.

The

growth of the Indian healthcare sector, driven by government initiatives aimed

at improving healthcare accessibility and advancements in medical technology,

has played a significant role in this trend. With the increasing availability

of sophisticated diagnostic imaging technologies in both urban and rural areas,

elderly patients now have improved access to these essential services, which in

turn, further raises the demand. The combination of a growing geriatric

population and the surge in chronic diseases has substantially increased the

demand for diagnostic imaging in India. Healthcare providers must be prepared

to meet this escalating demand to ensure optimal patient care and effective

disease management. By embracing these advancements in diagnostic imaging,

healthcare professionals can deliver the highest standard of care to the

elderly population and address the evolving healthcare needs of the nation.

Rising

Demand for The Early Detection of Diseases

The

burgeoning demand for early detection of diseases in India is leading to a

significant surge in the need for diagnostic imaging services. As the

prevalence of lifestyle diseases and chronic conditions continues to rise, the

importance of early diagnosis cannot be overstated. Diagnostic imaging,

encompassing advanced technologies such as Magnetic Resonance Imaging (MRI),

Computed Tomography (CT) scans, and ultrasound, plays a crucial role in this

paradigm shift towards proactive health management. Indigenous diagnostic tools for the early detection of critical diseases such as Alzheimer’s, cancer, and gastrointestinal disorders were launched on Tuesday as part of the 'Make in India' initiative. The Drugs Controller General of India (DCGI) has granted approval for the use of these in-vitro biomarkers, which will be produced in Kochi, Kerala. This development marks a significant step towards enhancing India’s capabilities in the healthcare sector by promoting locally manufactured diagnostic solutions for critical health conditions.

These

sophisticated tools empower physicians to pinpoint abnormalities and potential

medical issues in their nascent stages, thereby enhancing the chances of

successful treatment and recovery. With their high-resolution imaging

capabilities, MRI scans provide detailed information about the body's internal

structures, enabling accurate diagnosis and guiding treatment plans. CT scans,

on the other hand, offer cross-sectional images of the body, assisting in the

identification of conditions such as tumors, infections, or fractures.

Ultrasound, a non-invasive and radiation-free imaging technique, is widely used

for examining organs, soft tissues, and blood vessels, making it invaluable in

prenatal care and assessing a wide range of medical conditions.

Moreover, the

growing health awareness among India's populace, coupled with the increasing

accessibility of advanced medical facilities, further fuels the demand for

diagnostic imaging services. The Indian government's proactive push for

improved healthcare infrastructure also acts as a catalyst in driving this

sector's growth. Investing in state-of-the-art imaging technologies and

expanding the reach of diagnostic centers to remote areas can significantly

bridge the healthcare gap and improve patient outcomes across the country.

Consequently,

the diagnostic imaging sector in India is witnessing robust expansion and is

poised to become a significant player in the country's healthcare industry. The

rising demand for diagnostic imaging services underscores the urgency for increased

investment in this sector. It also highlights the need to prioritize quality,

affordability, and accessibility in diagnostic imaging services to cater to

India's diverse demographic. By ensuring these factors, the healthcare industry

can effectively address the evolving healthcare needs of the Indian population,

resulting in better preventive care, early disease detection, and improved

treatment outcomes.

Key Market

Challenges

High

Cost of Diagnostic Imaging Procedures and Equipment

The

high cost of diagnostic imaging procedures and equipment is significantly

affecting the overall demand for these critical services. Diagnostic imaging,

encompassing essential techniques such as MRI, CT scan, and X-ray, plays a

crucial role in ensuring accurate diagnosis and effective treatment. However,

the exorbitant costs associated with these advanced technologies pose a

significant barrier, limiting access for the average Indian.

Moreover,

the financial burden extends to the establishment of diagnostic imaging centers

equipped with state-of-the-art equipment. The substantial investment required

in setting up these facilities leads to increased pricing for procedures,

further exacerbating the affordability challenge. Consequently, numerous

patients are compelled to defer or completely forgo necessary diagnostic

procedures, resulting in a restricted demand.

Furthermore,

the disparity in the distribution of these facilities, primarily concentrated

in urban areas, exacerbates the accessibility and demand gap in rural regions.

As a consequence, individuals residing in remote areas face additional hurdles

in obtaining vital diagnostic services, further widening the healthcare divide.

Recognizing the urgency of addressing this issue, the Indian government has

initiated efforts to alleviate the situation through public-private

partnerships, subsidies, and initiatives like the Ayushman Bharat Yojana.

However, it is evident that there remains a long road ahead in making

diagnostic imaging more affordable and accessible to all segments of society,

thereby increasing the overall demand and improving healthcare outcomes.

Side

Effects of Diagnostic Imaging Procedures

Diagnostic

imaging procedures, such as computed tomography (CT) scans and X-rays, have

become increasingly valuable in modern healthcare. They play a crucial role in

diagnosing and monitoring various medical conditions, allowing healthcare

professionals to make informed decisions about patient care. However, in India,

the demand for these procedures is currently experiencing a downturn due to

concerns about the potential side effects associated with radiation exposure.

Radiation

exposure from CT scans and X-rays can have varying side effects, ranging from

minor issues like temporary skin reddening to more significant risks like

radiation-induced cancer. These risks, although relatively low, have raised

concerns among patients and healthcare providers alike. Additionally, the

invasive nature of certain imaging procedures can cause anxiety and stress for

patients, further contributing to the hesitancy in seeking such diagnostic

tests. Another factor that contributes to the decreased demand for diagnostic

imaging procedures in India is the high cost involved. These imaging tests are

often not covered by health insurance, making them inaccessible for many

individuals. The financial burden associated with these procedures acts as a

significant barrier, deterring patients from undergoing such tests unless

absolutely necessary.

The

cumulative effect of these factors has led to a decreased demand for diagnostic

imaging procedures in India. Patients and healthcare providers are actively

seeking safer, less invasive, and cost-effective alternatives to address their

diagnostic needs. This shift in demand highlights the importance of exploring

and adopting innovative technologies and practices that can provide accurate

diagnoses while minimizing potential risks and costs.

Key Market Trends

Growing

Expenditure in The Healthcare Sector

India's

healthcare sector is currently experiencing a remarkable upswing in

expenditure, driven by a multitude of factors. The escalating healthcare needs

of the population, coupled with increased public awareness and government initiatives

to improve healthcare infrastructure, have contributed to this surge. Within

this context, the demand for diagnostic imaging services has witnessed a

significant boost.

Diagnostic

imaging plays a crucial role in patient care as it offers a non-invasive

approach to identify and monitor diseases. By providing physicians with the

ability to make accurate diagnoses, it ultimately enhances treatment outcomes.

Furthermore, the rising prevalence of chronic diseases, the aging population,

and the growing importance of early diagnosis have all contributed to the

increasing demand for diagnostic imaging in India.

Notably,

advancements in technology and the introduction of sophisticated imaging

equipment have made these services more accessible and accurate. As a result,

there has been a substantial adoption of diagnostic imaging services across the

country. Given this landscape, the growing expenditure in the healthcare sector

plays a pivotal role in further augmenting the demand for diagnostic imaging in

India, thereby paving the way for improved healthcare outcomes for its

population.

Increasing

Adoption of Latest Technologies in Diagnostic Imaging Equipment

India's

healthcare sector has been experiencing a substantial surge in the demand for

diagnostic imaging services. This surge can be primarily attributed to the

widespread adoption of cutting-edge technologies in diagnostic imaging

equipment. The integration of advanced technologies such as 3D/4D ultrasound,

High-definition MRI, and PET-CT scans has truly revolutionized the landscape of

diagnostic imaging in India. These state-of-the-art technologies have proven to

be instrumental in delivering highly accurate and detailed images that greatly

facilitate precise diagnoses. One of the key advantages of these advanced

imaging technologies is their ability to enable non-invasive procedures,

thereby minimizing patient discomfort and risk. This has been a significant

breakthrough in the field of diagnostic imaging, allowing patients to undergo

thorough examinations without the need for invasive procedures. The escalating

urbanization and the rapid growth of the middle-class population in India have

resulted in an increased emphasis on health awareness. Consequently, there has

been a surge in the demand for accurate and early diagnosis. Moreover, the

rising prevalence of chronic diseases necessitates regular monitoring and

detailed diagnosis, which is effectively catered to by modern diagnostic

imaging equipment.

In

addition to the rising demand from patients, the government's focus on

improving healthcare infrastructure and accessibility has further fueled the

growth of the diagnostic imaging sector in India. The proliferation of private

diagnostic centers across the country has also played a significant role in enhancing

accessibility to these advanced imaging services.

The

incorporation of the latest technologies in diagnostic imaging equipment has

emerged as a crucial component in meeting the ever-growing imaging requirements

of India's expansive healthcare sector. The utilization of these advanced

imaging technologies not only ensures accurate and early diagnoses but also

contributes to the overall improvement of patient care and outcomes.

Segmental Insights

Type Insights

Based on the

type, in 2024, The ultrasound systems segment has emerged as the largest market share holder within the medical imaging industry, a position driven by the growing adoption of ultrasound equipment in the healthcare sector. The segment’s dominance can be attributed to the affordability, advanced features, and user-friendly nature of ultrasound technology. Its ability to deliver instant and precise results, coupled with safety advantages such as radiation-free imaging and non-invasive procedures, has made ultrasound one of the most widely utilized diagnostic tools in India. These factors have firmly established ultrasound as a leading segment in the medical imaging market.

Application Insights

Based on the

application, the oncology segment dominated the global diagnostic imaging

market in 2024, in terms of revenue, and is projected to sustain its dominance

during the forecast period. This can be attributed to the increased prevalence

of cancer among the population, particularly with lung cancer being the most

prominent type and accounting for the highest number of cancer deaths in India.

Remarkably, according to the International Agency for Research on Cancer,

breast cancer has now surpassed lung cancer as the most diagnosed type of

cancer. As a result, the demand for oncology diagnostic imaging has experienced

a significant surge, contributing to the growth of this segment.

Download Free Sample Report

Regional Insights

The

western region of India, particularly Maharashtra, is widely recognized as the

frontrunner in the India Diagnostic Imaging Market. This region's remarkable

growth potential is driven by its advanced healthcare infrastructure, comprising

state-of-the-art hospitals and cutting-edge medical facilities that are at the

forefront of technological innovation. These top-tier facilities are equipped

with the latest and most advanced diagnostic imaging equipment, enabling

healthcare professionals to provide accurate and efficient diagnoses with

utmost precision. Moreover, the population in Maharashtra exhibits a

commendable level of awareness and appreciation for medical technology, leading

to a significant surge in the demand for diagnostic imaging services. This

increased demand is effectively met by key market players who have

strategically established a strong presence in the region. These leading

manufacturers and providers offer a diverse range of diagnostic imaging

solutions, catering to the specific needs and requirements of the healthcare

industry in Maharashtra.

With

its solid foundation and unwavering commitment to advancements, the western

region of India, particularly Maharashtra, is positioned to dominate the India Diagnostic

Imaging Market for the foreseeable future. Maharashtra's prominence in the

industry is further solidified by its continuous drive for innovation and

excellence, ensuring that it remains at the forefront of the market. This

remarkable growth trajectory not only reinforces Maharashtra's prominence but

also serves as a catalyst for further expansion and advancement in the

healthcare industry.

Recent Developments

- In January 2025, Siemens Healthineers showcased its latest imaging portfolio at AOCR 2025 in Chennai. The company unveiled the helium-free 1.5T Magnetom Flow MRI with DryCool technology, the Dual Source CT Somatom Pro.Pulse, the locally manufactured Multix Impact E digital X-ray system, and AI-powered Acuson ultrasound solutions.

- In January 2025, Philips introduced its AI-enabled CT 5300 at AOCR 2025 in India. The system is designed to support diagnostic imaging, interventional procedures, and screening applications, improving clinical workflow and image precision.

- In February 2025, Philips and Medtronic announced a clinician upskilling partnership in India. The program aims to train more than 300 healthcare professionals on advanced structural heart imaging workflows using echocardiography and MRI through hands-on sessions.

- In April 2025, Philips launched the AI-enabled Elevate Platform upgrade for its EPIQ Elite ultrasound imaging system at UltraFest 2025 in India. The update enhances diagnostic accuracy and workflow efficiency in ultrasound imaging.

- In June 2025, Siemens Healthineers promoted its SPECT/CT modernization initiative and launched the Symbia Pro.specta through a virtual event hosted on its India digital platforms.

- In April 2025, Fujifilm India introduced a mobile diagnostic unit in Mandi, Himachal Pradesh, equipped with the FDR Xair portable X-ray and DRI-CHEM NX600 analyzer. This initiative expands access to teleradiology and diagnostic imaging in remote regions.

- In October 2025, Sir H. N. Reliance Foundation Hospital in Mumbai commissioned a photon-counting CT scanner, marking the first such installation in South Asia and advancing ultra-high-resolution CT imaging capabilities in India.

- In November 2024, Levitating with Digitisation: The Growth of India’s Diagnostic Imaging Sector Medical imaging systems are an essential diagnostic tool for radiologists, and with the rise of digitisation, these systems have undergone significant evolution, becoming more patient-centric. Technological advancements and innovations have been pivotal in driving the growth of India’s diagnostic imaging industry, enhancing both the accuracy and efficiency of diagnostic processes.

- In July 2024, Philips, a global leader in health technology, has announced its strategic partnership with Star Imaging, Pune, to launch India’s first-ever MRI Training School. This pioneering initiative will offer world-class training on MRI technologies across 17 sub-specialties, setting a new benchmark for professional development in the field of medical imaging. The collaboration aims to enhance the skill set of healthcare professionals in India, equipping them with cutting-edge expertise in MRI technology.

- In June 2024, Fujifilm India’s Healthcare Division, in partnership with NM Medical Mumbai, has officially launched its inaugural Fujifilm Skill Lab, designed to offer advanced training in Full-Field Digital Mammography (FFDM) technologies for radiologists and radiographers. The launch session saw the participation of eight candidates, including four radiologists and four radiographers, marking a significant step towards enhancing expertise in cutting-edge mammography technologies. This initiative underscores Fujifilm India’s commitment to advancing the skills of healthcare professionals and improving diagnostic capabilities in the field of medical imaging.

- In February 2024, FUJIFILM India, a leader in healthcare imaging solutions, is showcasing its innovative imaging product portfolio at the 76th National Conference of the Indian Radiological and Imaging Association (IRIA). The conference, held from January 25–28, 2024, in Vijayawada, Andhra Pradesh, is organized by IRIA, the country’s largest association focused on advancing the study and practice of radiology and imaging. FUJIFILM’s participation underscores its commitment to advancing medical imaging technologies and contributing to the growth of the radiology sector in India.

Key Market Players

- Wipro GE Healthcare Private Limited

- Siemens Healthineers India

- Allengers Medical Systems Limited

- Erbis Engineering Co Limited

- Samsung India Electronics (SIEL)

- Philips India Limited

- Olympus Medical Systems India Private

Limited

- Fujifilm India Private Limited

- Carestream Health India Private Limited

- Shimadzu Medicals (India) Private

Limited

|

By Type

|

By Mobility

|

By Source

|

By Application

|

By Component

|

By End User

|

By Region

|

|

- X-Ray Imaging Solutions

- Ultrasound Systems

- MRI Systems

- CT Scanner

- Nuclear Imaging Solutions

- Mammography

- Others

|

|

|

- Cardiology

- Oncology

- Neurology

- Orthopedics

- Gastroenterology

- Gynecology

- Others

|

|

- Hospitals & Clinics

- Diagnostic Centers

- Ambulatory Care Centers

- Others

|

- North India

- South India

- West India

- East India

|

|

|

|

|

|

|

|

|

Report

Scope:

In

this report, the India Diagnostic Imaging Market has been segmented into the following

categories, in addition to the industry trends which have also been detailed

below:

- India Diagnostic Imaging Market, By Type:

o

X-Ray Imaging Solutions

o

Ultrasound Systems

o

MRI Systems

o

CT Scanner

o

Nuclear Imaging Solutions

o

Mammography

o

Others

- India Diagnostic Imaging Market, By Mobility:

o

Portable

o

Standalone

- India Diagnostic Imaging Market, By Source:

o

Domestic

o

Import

- India Diagnostic Imaging Market, By Application:

o

Cardiology

o

Oncology

o

Neurology

o

Orthopedics

o

Gastroenterology

o

Gynecology

o

Others

- India Diagnostic Imaging Market, By Component:

o

OEM

o

Refurbished

- India Diagnostic Imaging Market, By End User:

o

Hospitals & Clinics

o

Diagnostic Centers

o

Ambulatory Care Centers

o

Others

- India Diagnostic Imaging Market, By Region:

o

North India

o

South India

o

West India

o

East India

Competitive

Landscape

Company

Profiles: Detailed

analysis of the major companies present in the India Diagnostic Imaging Market.

Available

Customizations:

India

Diagnostic Imaging Market report with the given market data, TechSci

Research offers customizations according to a company's specific needs. The

following customization options are available for the report:

Company

Information

- Detailed analysis and profiling of

additional market players (up to five).

India Diagnostic

Imaging Market is an upcoming report to be released soon. If you wish an early

delivery of this report or want to confirm the date of release, please contact

us at [email protected]