|

Forecast Period

|

2027-2031

|

|

Market Size (2025)

|

USD 1.18 Billion

|

|

CAGR (2026-2031)

|

6.17%

|

|

Fastest Growing Segment

|

Retrofitting

|

|

Largest Market

|

South

|

|

Market Size (2031)

|

USD 1.69 Billion

|

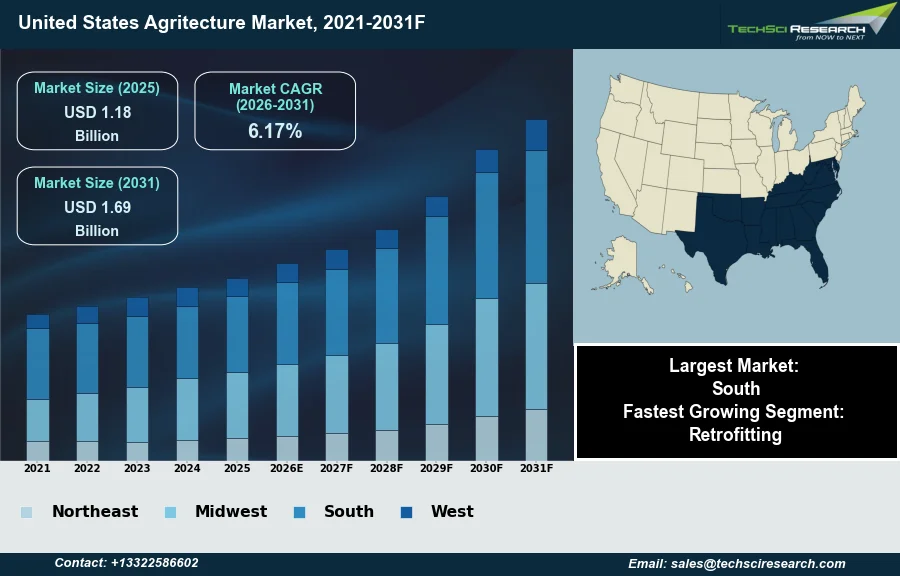

Market Overview

The United States Agritecture Market is anticipated to grow from USD 1.18 Billion in 2025 to USD 1.69 Billion by 2031 at a 6.17% CAGR. The United States Agritecture market encompasses the strategic integration of agricultural production into the built environment, utilizing methods such as vertical farming, rooftop greenhouses, and controlled environment agriculture (CEA) to optimize urban food systems. This sector is primarily driven by increasing urbanization, the imperative for national food security, and a rising consumer demand for locally sourced produce that mitigates supply chain vulnerabilities. According to the Resource Innovation Institute, in 2024, an analysis of industry data revealed that vegetable and herb production in greenhouses experienced a 74% increase in wholesale farmgate value over the preceding five-year period, underscoring the significant economic momentum within this sector.

A significant challenge impeding broader market expansion is the substantial initial capital expenditure required for infrastructure and the ongoing high operational costs associated with energy consumption. These financial barriers often delay profitability for new entrants and necessitate precise resource management to ensure long-term economic viability effectively.

Key Market Drivers

Growing investment in vertical farming and hydroponic ventures is a primary catalyst for the United States Agritecture market, providing capital to scale operations to commercial viability. Investors are funding operators that demonstrate efficient unit economics through controlled environments. This liquidity allows companies to expand their architectural footprint near urban centers, shortening supply chains. According to Contain Inc., January 2025, in the 'Indoor Ag Outlook: Funding Trends and 2025 Projections' report, total investment in the indoor agriculture sector reached $847 million in 2024, reflecting a shift towards established businesses. Furthermore, the market's maturity is evident in the valuations of key players; according to The Motley Fool, January 2026, Village Farms International held a market capitalization of $421.6 million, underscoring the economic value attributed to scalable greenhouse operations.

Supportive government policies and grants for urban agriculture initiatives are equally critical in driving market adoption by lowering the barrier to entry associated with infrastructure costs. Federal programs are incentivizing the integration of agricultural systems into the built environment to enhance food security and sustainable land use. These financial mechanisms target projects that improve food access while fostering innovation. According to the U.S. Department of Agriculture, January 2025, in the 'USDA Announces Grants and Technical Assistance Funding for Urban Agriculture' press release, the agency is providing a total of $14.4 million in grants to support urban agriculture projects. Such funding empowers municipalities to incorporate productive green infrastructure into city planning.

Download Free Sample Report

Key Market Challenges

The United States Agritecture market faces a critical obstacle in the form of substantial initial capital requirements and the prohibitive ongoing operational costs linked to energy consumption. Establishing indoor farming facilities demands significant investment in advanced HVAC, lighting, and automation technologies, creating a high barrier to entry that deters investors and strains the liquidity of early-stage companies. This intense financial pressure often delays the timeline for profitability, forcing operators to prioritize survival over expansion. Consequently, the sector struggles to transition from a venture-backed niche into a mainstream agricultural alternative, as the cost of production remains disproportionately high compared to conventional farming methods.

This reliance on energy-intensive systems renders the market highly susceptible to utility price fluctuations, directly affecting economic stability. According to the Resource Innovation Institute, in 2025, energy expenses for vertical farming operations accounted for approximately 45 percent of total operational costs. This elevated overhead compels producers to pass costs onto consumers, resulting in premium pricing that restricts the customer base to affluent demographics. By limiting the market’s ability to compete on price with traditional agriculture, these financial and operational burdens significantly hamper the broader adoption and growth of the agritecture sector.

Key Market Trends

The Integration of AI-Driven Environmental Control Systems is emerging as a decisive trend, enabling operators to optimize microclimates with unprecedented precision to enhance crop yields and unit economics. Advanced algorithms now manage critical variables such as humidity, lighting, and temperature in real-time, significantly mitigating the energy inefficiencies that previously hampered profitability. This technological maturation is evident in the financial performance of leading hybrid operators. According to the Tri-Cities Area Journal of Business, April 2025, in the 'Local Bounti reports a booming 2024' article, Local Bounti Corporation reported a 38% increase in sales, a growth trajectory directly attributed to the improved output and efficiency of its proprietary, AI-enhanced Stack & Flow Technology.

Simultaneously, the Adoption of Robotic Harvesting and Seeding Automation is reshaping the operational landscape by drastically reducing labor dependency and production costs. As scaling demands increase, producers are prioritizing fully automated facilities that ensure "hands-free" cultivation from seeding to packaging, thereby improving food safety and operational consistency. This shift towards capital-intensive, high-tech infrastructure is fueling substantial new projects across the region. According to TN.gov, June 2025, in the 'Little Leaf Farms to Expand, Selects Manchester for First Tennessee Location' press release, Little Leaf Farms committed to a $75 million investment to establish a new, state-of-the-art automated greenhouse facility, underscoring the market's aggressive pivot towards mechanized production models.

Segmental Insights

Market analysis indicates that Retrofitting is the fastest-growing segment in the United States Agritecture Market. This trajectory is fueled by the financial viability of converting underutilized urban properties, such as vacant warehouses and industrial facilities, into controlled growing environments, which is significantly more cost-effective than new construction. This method allows for the swift integration of agriculture into dense metropolitan areas, directly addressing local food security needs. Support from the United States Department of Agriculture, specifically the Office of Urban Agriculture and Innovative Production, further accelerates this sector by providing funding initiatives that encourage the adaptive reuse of existing buildings for sustainable food production.

Regional Insights

The South US holds the leading position in the United States Agritecture market, driven by favorable climatic conditions that optimize energy efficiency for controlled environment agriculture. High solar gain in the region significantly lowers operational costs for greenhouse structures compared to northern areas, making year-round production more expanding. Furthermore, rapid population growth across the Sun Belt has necessitated the integration of vertical farming systems into urban planning to ensure local food security. Supportive frameworks from the United States Department of Agriculture regarding urban food production further solidify the region's dominance.

Recent Developments

-

In June 2025, Water Garden Farms, Siemens, and CEAd formed a strategic alliance to drive innovation within the United States Agritecture Market through the integration of artificial intelligence and automation. This collaboration focused on developing a highly automated technology platform for a planned 500,000-square-foot indoor farming facility in West Virginia. The partnership aimed to leverage data analytics and precision agriculture tools to optimize environmental controls, reduce energy consumption, and increase crop consistency. By combining expertise in digital infrastructure and facility design, the companies sought to establish a new standard for operational efficiency and sustainability in large-scale controlled environment agriculture projects across the country.

-

In September 2024, Plenty Unlimited Inc. achieved a breakthrough in the United States Agritecture Market by commencing operations at the world’s first commercial-scale indoor vertical strawberry farm in Richmond, Virginia. This advanced facility was engineered to produce millions of pounds of strawberries annually, utilizing vertical growing towers to maximize yield in a fraction of the space required by conventional farming. Through a strategic partnership with Driscoll’s, the company aimed to supply fresh, high-quality berries to retailers in the Northeast year-round, overcoming seasonal limitations. This product launch signified a major technological advancement, proving that vertical farming could successfully scale beyond leafy greens to include complex flowering crops.

-

In June 2024, Soli Organic Inc. advanced its capabilities in the United States Agritecture Market with the opening of a new high-tech, soil-based vertical farm in San Antonio, Texas. The 140,000-square-foot facility was designed to cultivate organic herbs and leafy greens using a proprietary growing system that integrates the benefits of soil with controlled indoor environments. This launch allowed the company to significantly boost its production capacity and distribution reach throughout the Southwest and Midwest regions. By leveraging automation and precision fertigation, the facility aimed to achieve higher yields while using substantially less water and land than traditional farming, demonstrating the commercial viability of soil-based indoor agriculture.

-

In January 2024, Gotham Greens expanded its footprint in the United States Agritecture Market by opening a significant new hydroponic greenhouse facility in Seagoville, Texas. This 210,000-square-foot operation, located near Dallas, was established to supply a range of pesticide-free leafy greens and salad kits to major retailers across the region, including Whole Foods Market and Kroger. The launch represented a strategic move to localize production in the Southwest, thereby reducing food transportation miles and ensuring a consistent supply of fresh produce regardless of weather conditions. This development highlighted the company's commitment to scaling sustainable, controlled environment agriculture to meet growing consumer demand in major American metropolitan areas.

Key Market Players

- AeroFarms

- BrightFarms

- Plenty Unlimited

- Freight Farms

- Gotham Greens

- Spread Co.

- Bowery Farming

- Green Sense Farms

- Lufa Farms USA

- Vertical Harvest

|

By Integration

|

By Structure

|

By Application

|

By Region

|

|

|

- Retrofitting

- Extension

- New Building

|

|

- Northeast

- Midwest

- South

- West

|

Report Scope:

In this report, the United States Agritecture Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

-

United States Agritecture Market, By Integration:

-

United States Agritecture Market, By Structure:

-

Retrofitting

-

Extension

-

New Building

-

United States Agritecture Market, By Application:

-

United States Agritecture Market, By Region:

-

Northeast

-

Midwest

-

South

-

West

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the United States Agritecture Market.

Available Customizations:

United States Agritecture Market report with the given market data, TechSci Research offers customizations according to a company's specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five).

United States Agritecture Market is an upcoming report to be released soon. If you wish an early delivery of this report or want to confirm the date of release, please contact us at [email protected]