|

Forecast

Period

|

2026-2030

|

|

Market

Size (2024)

|

USD

6.74 Million

|

|

Market

Size (2030)

|

USD

8.56 Million

|

|

CAGR

(2025-2030)

|

4.02%

|

|

Fastest

Growing Segment

|

Hospitals

|

|

Largest

Market

|

Dubai

|

Market Overview

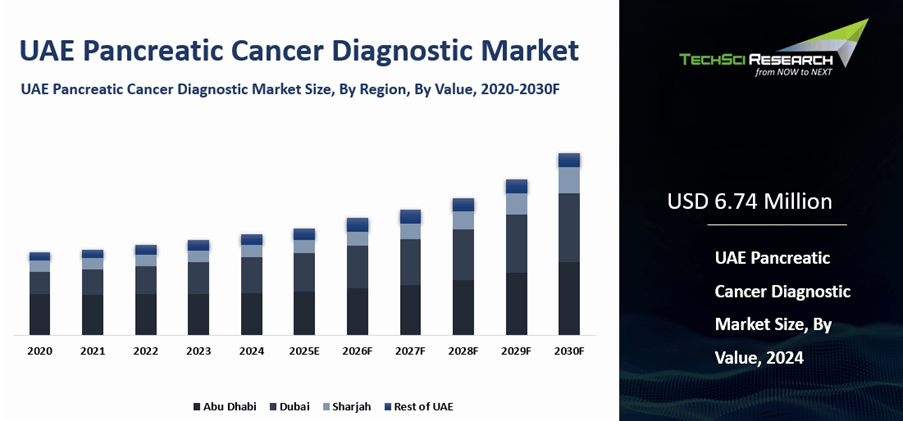

UAE Pancreatic Cancer Diagnostic Market was valued at USD

6.74 Million in 2024 and is expected to reach USD 8.56 Million with a CAGR of 4.02%

through 2030. The UAE Pancreatic Cancer Diagnostic Market is being driven by

several key factors, including rising awareness about the disease, advancements

in diagnostic technologies, and increasing healthcare investments. Pancreatic

cancer, being one of the most aggressive and hard-to-diagnose cancers, is often

diagnosed at advanced stages, which makes early detection critical. As a

result, there is a growing demand for advanced diagnostic solutions that can

detect the disease at earlier stages, where treatment outcomes are more

favorable.

Technological advancements in imaging techniques,

such as enhanced CT scans, MRIs, and the integration of artificial intelligence

in medical imaging, are significantly improving the accuracy and speed of

pancreatic cancer detection. AI-driven diagnostic tools, particularly those

using machine learning algorithms to analyze medical images, are becoming a

vital part of the diagnostic process in the UAE. These tools are helping

healthcare providers to identify tumors and abnormalities more effectively,

even in the early stages.

Download Free Sample Report

Key Market Drivers

Technological Advancements in Diagnostic Tools

The UAE pancreatic cancer diagnostic market is

significantly driven by advancements in diagnostic technologies. Pancreatic

cancer is known for its aggressive nature and difficulty in detection, often

diagnosed at later stages when treatment options are limited. As a result,

there is an increasing demand for cutting-edge diagnostic solutions to identify

the disease at earlier stages, improving treatment outcomes. The market has

seen a rise in the adoption of advanced imaging technologies such as high-resolution

CT scans, MRIs, and endoscopic ultrasound, which are crucial for detecting

tumors and abnormalities in the pancreas. The integration of artificial

intelligence (AI) and machine learning algorithms into diagnostic tools has

taken this a step further.

AI applications are helping radiologists analyze

imaging data with greater speed and accuracy, identifying potential signs of

pancreatic cancer that human eyes might have overlooked. As these

technologies continue to evolve, they are expected to play a central role in

enhancing early detection rates and improving survival outcomes for patients in

the UAE. In July 2021, the Emirati Genome Program was introduced as a

government initiative with the goal of sequencing the genetic data of the UAE

population. The program aims to enhance personalized and preventive healthcare

by analyzing genetic information. The initiative has received a largely

positive response from the Emirati community, with many expressing enthusiasm

about the potential benefits of the program and the associated biobank for

advancing biomedical research.

Government Initiatives and Healthcare Investment

Government initiatives and increasing healthcare

investments are vital drivers of the UAE pancreatic cancer diagnostic market.

The UAE government has placed a significant focus on transforming its

healthcare infrastructure, emphasizing the adoption of state-of-the-art

technologies in medical diagnosis and treatment. The UAE's National Health

Strategy aims to elevate the country’s position as a global leader in

healthcare, encouraging the implementation of advanced diagnostic technologies

for cancer care. Along with these strategic plans, there has been a surge in

funding for research into more accurate diagnostic tools for pancreatic cancer,

which has resulted in innovative solutions being introduced to the market. In

May 2021, Burjeel Medical City launched the first specialized clinic for

precision oncology, which leverages cutting-edge tools in precision medicine to

offer personalized treatment plans for patients.

Healthcare investments are increasing across the

UAE, with both private and public hospitals adopting the latest technologies to

offer better diagnostic services to their patients. For instance, hospitals in

cities like Dubai and Abu Dhabi are already integrating AI-powered diagnostic

platforms and modern imaging techniques into their pancreatic cancer detection

protocols. With the government’s emphasis on healthcare excellence, there is

ample support for the continued growth of the diagnostic market in the UAE.

Increasing Awareness and Early Detection Focus

Raising awareness about pancreatic cancer and the

importance of early detection is becoming a prominent driver in the UAE’s

diagnostic market. Pancreatic cancer is often diagnosed at advanced stages, and

many patients experience delayed treatment due to a lack of awareness regarding

the disease's symptoms and risk factors. As a result, health authorities,

nonprofit organizations, and medical associations in the UAE are ramping up

efforts to educate the public about the signs of pancreatic cancer and the significance

of early detection. Initiatives such as awareness campaigns, health seminars,

and screenings are encouraging individuals to undergo regular check-ups and

take proactive measures to detect cancer at its nascent stages. Healthcare

providers in the region are now more actively involved in advocating for early

screening, particularly among individuals with a family history of cancer or

other risk factors. This heightened awareness has led to a greater demand for

diagnostic services, resulting in a growing market for pancreatic cancer

diagnostics, as people seek out more accessible and efficient methods for early

detection.

Rising Incidence of Pancreatic Cancer in the UAE

The increasing incidence of pancreatic cancer in

the UAE is a significant factor contributing to the growth of the diagnostic

market. As the country experiences shifts in lifestyle and diet, the prevalence of chronic conditions such as diabetes, obesity, and smoking, known risk factors for pancreatic cancer, is also rising. These factors, combined with an

aging population, have resulted in a higher number of cancer cases, including

pancreatic cancer. The UAE’s population has seen a growing awareness of cancer

risk, prompting healthcare providers to implement more advanced diagnostic

measures to detect cancers such as pancreatic cancer at earlier stages. In

2021, the UAE-National Cancer Registry (UAE-NCR) recorded 110 cases of

pancreatic cancer out of a total of 5,612 cancer diagnoses, representing 1.96%

of all malignant cases for that year. Non-UAE citizens accounted for a higher

proportion of pancreatic cancer cases, with 79 cases (71.8%), while UAE

citizens made up a smaller portion, with 31 cases (28.1%). Among the cases,

males were more frequently affected, representing 69 cases (62.7%), while

females accounted for 41 cases (37.2%).

The data on pancreatic cancer

occurrences in the UAE over the past decade from published UAE-NCR reports. The

government's focus on cancer surveillance and early detection has led to better

tracking and reporting of cancer statistics, which has raised awareness among

medical professionals and the public about the increasing number of cases. As a

result, there is growing demand for innovative diagnostic tools capable of

accurately detecting pancreatic cancer at an early stage, fueling the market’s

growth in the region.

Key Market Challenges

High Cost of Advanced Diagnostic Technologies

One of the significant challenges faced by the UAE

pancreatic cancer diagnostic market is the high cost of advanced diagnostic

technologies. Diagnostic tools such as high-resolution imaging systems,

endoscopic ultrasounds, and genetic testing equipment are critical in the early

detection of pancreatic cancer. However, the cost of these technologies can be

prohibitive, especially for healthcare providers that are not backed by

extensive financial resources. For instance, advanced imaging systems like MRIs

and CT scans require significant investment in both equipment and maintenance.

This can lead to limited access to these diagnostic tools, particularly for

patients from lower-income backgrounds or those residing in areas with less

access to cutting-edge healthcare facilities. While the government has made

strides in improving the healthcare infrastructure, the financial barrier for

patients and healthcare institutions can still hinder the widespread adoption

of these diagnostic technologies. The ongoing need for skilled professionals,

such as radiologists and technicians, to operate these advanced devices further

increases the cost, contributing to higher overall diagnostic expenses in the

market. As a result, despite the availability of innovative diagnostic solutions,

the high costs can act as a deterrent to their broader utilization, especially

in early-stage cancer detection, where affordability remains a concern.

Late Diagnosis Due to Symptom Overlap with Other

Diseases

Pancreatic cancer is often diagnosed at advanced

stages, primarily due to the late onset of symptoms and the overlap with other

common diseases. Symptoms such as abdominal pain, weight loss, jaundice, and

digestive problems are often misattributed to less severe conditions like

irritable bowel syndrome, ulcers, or even other gastrointestinal disorders.

This delay in diagnosis can lead to reduced effectiveness of treatments, as

pancreatic cancer is most treatable when detected early. Even with the advancement

in diagnostic technologies, there is a constant challenge in raising awareness

about the specific early symptoms of pancreatic cancer, especially since these

symptoms are not unique to the disease.

Many patients may not seek medical

attention until the cancer has already reached an advanced stage, further

complicating the chances of early detection. This results in a diagnostic

challenge, where healthcare providers face difficulties distinguishing pancreatic

cancer from other common conditions, thereby leading to delayed diagnoses and

treatment. Consequently, the market for pancreatic cancer diagnostics is

challenged by this issue, as even with state-of-the-art technologies, accurate

diagnosis often depends on the ability to recognize the disease early enough to

implement life-saving treatments.

Key Market Trends

Collaborations with Global Research Institutions

The UAE’s pancreatic cancer diagnostic market is

further driven by collaborations with leading global research institutions and

healthcare companies. These partnerships enable local healthcare providers to

gain access to the latest technologies and research findings, enhancing the

country’s diagnostic capabilities. For example, several hospitals in the UAE

have entered into collaborations with prominent cancer research centers

worldwide to introduce state-of-the-art diagnostic tools. These collaborations

help facilitate the exchange of knowledge, technologies, and best practices,

improving the accuracy and reliability of pancreatic cancer diagnostics in the

region.

In April 2024, Meitra Care Network (MCN) announced its

partnership with Canadian Specialist Hospital (CSH) in Dubai to establish a

collaborative Centre of Excellence, dedicated to providing heart and vascular

care services to patients. The two organizations are in advanced discussions to

sign a Memorandum of Understanding (MoU) for a comprehensive range of services.

In the initial phase, the center will focus on advanced interventional

cardiology procedures and will feature an electrophysiology department. A full-time

Meitra team will also be stationed at CSH as part of the agreement. The second

phase will expand the center to include a complete cardiac sciences department

offering a wide range of heart-related surgical procedures. Centers of

Excellence in Orthopedics and Robotic Surgery, as well as Advanced

Neurosciences and Spine, will be introduced during this phase.

Partnerships with biotech companies and AI-driven

startups are contributing to the development of innovative diagnostic solutions

such as AI-based imaging software, genetic testing, and liquid biopsy

techniques, which can detect early signs of pancreatic cancer with a

non-invasive approach. Such global collaborations are enabling the UAE to

remain at the forefront of technological innovation in cancer diagnostics, thus

driving growth in the pancreatic cancer diagnostic market.

Improved Healthcare Infrastructure and Facilities

In 2023, the UAE’s ongoing investment in healthcare infrastructure continued to strengthen the pancreatic cancer diagnostic market, with Dubai reporting 119 diagnostic centers and 53 hospitals. Over the years, the country has upgraded its medical facilities to ensure providers are equipped with advanced diagnostic tools and technologies. Cleveland Clinic Abu Dhabi, for example, operates a 394-bed hospital with the Fatima bint Mubarak Cancer Center offering 32 exam rooms and 24 infusion rooms.

The center has conducted over 14,000 imaging studies since 2023 and collaborates with G42 on AI-enabled oncology solutions, highlighting the country’s growing emphasis on early cancer detection through advanced imaging and artificial intelligence. State-of-the-art hospitals such as Cleveland Clinic Abu Dhabi, Mediclinic, and other leading facilities in Dubai and Abu Dhabi are expanding access to sophisticated diagnostic services that were previously limited. Since 2023, Cleveland Clinic Abu Dhabi alone has recorded more than 55,000 oncology clinic visits, 22,000 chemotherapy infusions, and 14,000 radiation treatments.

The establishment of specialized cancer treatment centers focused on early diagnosis and management of diseases such as pancreatic cancer is further supporting the country’s healthcare goals. According to the UAE National Cancer Registry, 110 pancreatic cancer cases were reported in 2021. The expanding network of diagnostic centers and specialized outpatient clinics, 2,315 and 119, respectively, in Dubai in 2023, continues to improve screening accessibility and meet the growing demand for high-quality cancer diagnostics across the nation.

Segmental Insights

End Use Insights

Based on the End Use, hospitals

are the dominant force. Hospitals play a critical role in the diagnostic

process for pancreatic cancer due to their ability to provide comprehensive

care and access to advanced medical technologies. They are equipped with the

necessary infrastructure, skilled healthcare professionals, and diagnostic

tools required for the accurate detection and diagnosis of pancreatic cancer,

making them the primary setting for diagnosis. Hospitals in the UAE, especially

those in major cities such as Dubai and Abu Dhabi, are leveraging

state-of-the-art technologies, including CT scans, MRI imaging, and endoscopic

ultrasounds, to diagnose pancreatic cancer at early stages, significantly improving

treatment outcomes.

The key reason hospitals

dominate the market is their central role in patient care. Hospitals are

generally equipped with multidisciplinary teams of specialists, including

oncologists, radiologists, gastroenterologists, and pathologists, who work

collaboratively to diagnose and treat pancreatic cancer. This multidisciplinary

approach ensures that all aspects of the disease are addressed, from imaging

and biopsy to genetic testing and surgical planning. These hospitals also

provide access to more comprehensive treatments like chemotherapy, radiation

therapy, and potential surgical interventions, all of which are crucial for

managing pancreatic cancer effectively. Hospitals are generally the first point

of contact for patients who experience symptoms that could indicate pancreatic

cancer.

Download Free Sample Report

Regional Insights

Dubai stands as the dominant force in the UAE

pancreatic cancer diagnostic market. The city is not only the commercial and

financial hub of the UAE but also a major center for healthcare, offering a

wide range of advanced medical services. Dubai's dominance in this market is

attributed to its world-class healthcare infrastructure, state-of-the-art

diagnostic technologies, and a high concentration of specialized medical

professionals. The region’s strong emphasis on healthcare innovation and

research further boosts its position as a leader in pancreatic cancer

diagnostics.

Dubai’s hospitals and healthcare facilities are

equipped with the latest diagnostic tools, such as advanced imaging

technologies, genetic testing, and biopsy techniques, all essential for the

early detection of pancreatic cancer. These technologies, including MRI scans,

CT scans, and endoscopic ultrasounds, allow for precise and early-stage

detection, which is crucial for improving survival rates in pancreatic cancer

patients. Dubai also boasts several renowned hospitals and cancer centers that

have multidisciplinary teams, consisting of oncologists, radiologists, and

gastroenterologists, who collaborate to deliver comprehensive care to patients.

This integrated care approach ensures that patients receive timely and accurate

diagnoses, followed by effective treatment plans tailored to their specific

needs. Dubai is a significant player in the medical tourism industry,

attracting patients from across the Middle East, Africa, and South Asia. This

influx of international patients looking for high-quality medical services,

including pancreatic cancer diagnosis, further strengthens Dubai’s position in

the market. Many of these international patients seek advanced diagnostic

services, which local hospitals in Dubai can provide, benefiting from the

latest research and medical technologies available globally.

Recent Developments

- In June 2025, M42, AstraZeneca, and SOPHiA GENETICS launched a UAE liquid biopsy initiative validated at Cleveland Clinic Abu Dhabi, with a phased clinical rollout beginning in late Q2 2025. The program targets multiple cancers, including pancreatic, and enables non-invasive molecular profiling to support earlier detection and personalized therapy selection.

- In June 2025, the Abu Dhabi Department of Health issued new screening guidance for high-risk individuals, including CDKN2A carriers. The recommendations advise initiating pancreatic screening at age 40, or 10 years earlier than the youngest affected family member, establishing localized practice parameters for early cancer detection.

- In February 2025, Emirates Health Services presented several national innovation projects at Arab Health 2025, featuring AI-enabled platforms and integrated care pathways designed to enhance early disease detection. These data-driven systems improve triage and referral efficiency, indirectly strengthening cancer diagnostic workflows across the UAE healthcare ecosystem.

- In July 2024, Burjeel

Holdings, a healthcare services provider, has unveiled the opening of a new

cancer care institute in Abu Dhabi. The Burjeel Cancer Institute (BCI) is

housed in a four-story tower and offers private chemotherapy suites,

specialized clinics, a dedicated breast cancer unit, and various

patient-focused amenities. In addition to these facilities, the institute

provides treatments such as targeted therapy and precision medicine, while also

integrating services for chemotherapy, immunotherapy, surgical oncology, stereotactic

radiosurgery (SRS), and stereotactic body radiotherapy (SBRT).

- In October 2024, Pfizer is

offering new hope to patients with Metastatic Castration-Resistant Prostate

Cancer (mCRPC) in the UAE by introducing its first and only approved oral

treatment. This treatment combines Talazoparib and Enzalutamide, designed to

enhance outcomes for patients whose cancer continues to progress despite

previous therapies. This combination therapy marks a significant advancement in

the available treatment options for mCRPC patients. The launch follows its

successful introduction in the United States, where it was acknowledged for its

effectiveness in clinical trials. This development aims to improve patient

outcomes in a challenging and complex area of oncology.

Key Market Players

- Thermo Fisher Scientific Middle East

- Bristol Myers Squibb, Middle East & Africa FZ-LLC

- Illumina Dubai Middle East FZE

- Roche Diagnostics Middle East FZCO

- Gulf Bio Analytical LLC

- Abbott Laboratories S.A.

- Hitachi Ltd.

- Gulf International Cancer Center

- Pfizer Gulf FZ LLC

- AstraGene LLC

|

By End Use

|

By Region

|

- Hospitals

- Outpatient

Facilities

- Home Care

- Research

& Manufacturing

|

- Abu Dhabi

- Dubai

- Sharjah

- Rest of UAE

|

Report Scope:

In this report, the UAE Pancreatic Cancer

Diagnostic Market has been segmented into the following categories, in addition

to the industry trends which have also been detailed below:

- UAE Pancreatic Cancer Diagnostic Market, By End Use:

o Hospitals

o Outpatient Facilities

o Home Care

o Research & Manufacturing

- UAE Pancreatic Cancer Diagnostic Market, By

Region:

o Abu Dhabi

o Dubai

o Sharjah

o Rest of UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the UAE Pancreatic

Cancer Diagnostic Market.

Available Customizations:

UAE Pancreatic Cancer Diagnostic Market report

with the given market data, TechSci Research offers customizations according to

a company's specific needs. The following customization options are available

for the report:

Company Information

- Detailed analysis and profiling of additional

market players (up to five).

UAE Pancreatic Cancer Diagnostic Market is an

upcoming report to be released soon. If you wish an early delivery of this

report or want to confirm the date of release, please contact us at [email protected]