|

Forecast

Period

|

2026-2030

|

|

Market

Size (2024)

|

USD

254.35 Million

|

|

Market

Size (2030)

|

USD

597.31 Million

|

|

CAGR

(2025-2030)

|

15.25%

|

|

Fastest

Growing Segment

|

Dental

Implants

|

|

Largest

Market

|

Dubai

|

Market Overview

UAE

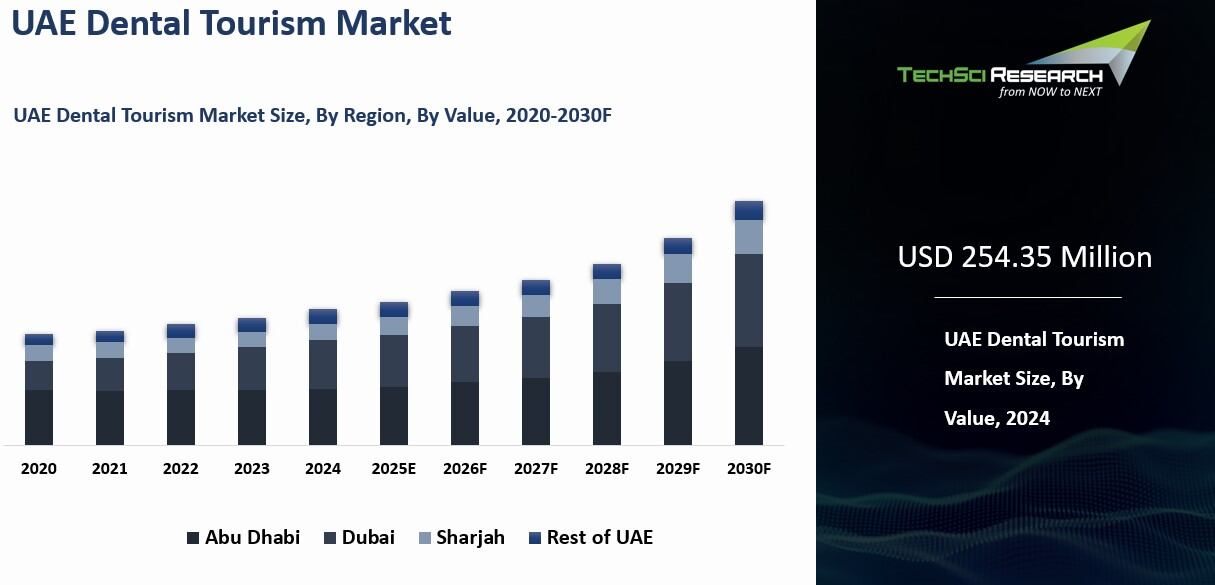

Dental Tourism Market was valued at USD 254.35 Million in 2024 and is expected to reach USD 597.31 Million by 2030 with a CAGR of 15.25% during the forecast period.

The UAE dental tourism market has been significantly impacted by

innovation in dental products. The main focus in dentistry during the past ten

years has been on dental innovations that combine engineering, art, science,

and technology to promote oral health. Dental care and patient experiences have

been transformed by the technical advancement known as computer-aided

design/computer-aided milling (CAD/CAM). This factor is fueling the demand for dental tourism in the UAE.

Multiple

factors are expected to continue driving the dental tourism market in the UAE

in the forecast years. International patients looking for reliable and

cost-effective treatments will continue to be drawn to the nation due to its

developing image as a centre for high-quality dental care. The UAE's appeal as

a destination for dental tourism is aided by its advanced healthcare

infrastructure, innovative dental facilities, and skilled dental professionals.

Additionally, the growth of internet platforms that link patients with dental

clinics and medical tourism facilitators will make the procedure even simpler

for people seeking dental treatments in the UAE.

Additionally, the UAE's strategic

location, easy access to transportation, and measures to simplify the visa

process will increase its accessibility for international patients,

particularly those from neighboring countries. The UAE will see more dental

tourism as a result of the country's focus on promoting wellness travel and the

availability of full dental packages which combine medical care with

recreational activities. The

COVID-19 pandemic has had a substantial influence on the UAE's dental tourism

market. Travel restrictions, lockdown procedures, and concerns about the state

of the world's health have led to a fall in both international travel and

dental tourism.

Due to security concerns and uncertainties surrounding the

pandemic, many patients have been hesitant to travel abroad for dental care.

Additionally, the expense and logistical difficulties for patients have

increased due to the strict health and safety rules that have been implemented

in dental clinics, including enhanced sterilization standards and PPE

requirements. However, it is expected that the dental tourism market in the UAE

would gradually recover as long as worldwide immunization efforts continue and

travel restrictions loosen, driven by pent-up demand for dental procedures and

the nation's reputation for providing high-quality healthcare services.

Download Free Sample Report

Key Market Drivers

Rise in Government Initiatives

The UAE government has been central to the growth of dental tourism through strong policies, infrastructure investment, and partnerships that elevate healthcare quality. As per MoHAP’s 2019 Annual Health Statistic Book, 1,089,054 people visited dental clinics in Dubai, including 580,466 females, 508,588 males, and 387,703 Emiratis, reflecting the growing appeal of dental care in the country.

Programs such as the Dubai Health Experience (DXH) and the Abu Dhabi Medical Tourism Program integrate dental services into comprehensive tourism strategies offering visa support, accommodation, and transport, alongside digital platforms that connect patients with accredited clinics. Partnerships with airlines and hotels further enhance patient convenience.

Regulatory bodies such as the DHA, DOH, and MOHAP enforce strict licensing, JCI accreditation, and regular audits to ensure safety and transparency in pricing, strengthening patient trust. The UAE Centennial Plan 2071 outlines a vision for global leadership through innovation and healthcare excellence, including investments in AI-driven diagnostics, 3D-printed implants, and robotic-assisted surgeries. Establishing multi-specialty dental centers, collaborating with international institutions, and integrating telehealth for virtual consultations and post-treatment care have improved service quality and accessibility for global patients.

To ease travel, specialized medical visas with extended validity, simplified application processes, and partnerships with Emirates and Etihad offering discounted travel packages make the UAE more accessible for dental tourists. Government-led campaigns promote UAE dental care through participation in global expos, collaborations with foreign healthcare bodies, and multilingual digital marketing aimed at Europe, Asia, and the Middle East.

Public-private partnerships strengthen this growth through world-class dental centers, research collaborations, and incentives such as tax benefits and grants for private providers. These combined initiatives ensure the UAE remains a trusted and advanced destination for high-quality dental tourism worldwide.

Growing Demand for Cosmetic

and Aesthetic Dentistry

The UAE has emerged as a global hub for cosmetic and aesthetic dentistry, attracting affluent clients, influencers, professionals, and medical tourists seeking premium smile enhancements. Growing global attention to aesthetics, driven by social media and higher disposable income, has accelerated this expansion. Studies show Snapchat (45.8%) and Instagram (44.5%) dominate esthetic dentistry content, with sociodemographic factors influencing engagement. Demand for veneers, whitening, and Hollywood smiles has surged, led by celebrities and influencers. Clinics now feature celebrity endorsements, digital smile design tools that preview post-treatment outcomes, and customized, high-quality aesthetic solutions meeting international standards.

Technological innovation underpins the sector’s appeal. AI-driven smile analysis, 3D digital design, and CAD/CAM systems enable personalized plans and same-day crowns or veneers. Laser whitening delivers faster results with less sensitivity, while 3D printing speeds up custom implant production. These tools ensure precise, natural-looking outcomes within shorter treatment windows, attracting global patients to the UAE.

Dental care in the UAE reflects luxury healthcare standards. Clinics offer five-star hospitality, VIP suites, multilingual concierge services, and wellness packages combining dental and cosmetic treatments. Privacy-focused care appeals to high-profile clients, creating an exclusive treatment experience.

Despite its premium quality, UAE cosmetic dentistry remains more cost-effective than in the US, UK, or Europe. Competitive pricing for veneers, implants, and orthodontics, tax-free healthcare, and all-inclusive packages covering accommodation and transport enhance affordability. Patients benefit from immediate appointments, same-day procedures, and efficient recovery plans, allowing faster turnaround with minimal downtime.

This combination of luxury, technology, affordability, and speed has positioned the UAE as a preferred global destination for advanced cosmetic dental care and aesthetic transformations.

Highly Qualified Dental

Professionals

The presence of highly qualified dental professionals is a key factor driving the growth of UAE dental tourism. As international patients seek safe, precise, and world-class treatment, the UAE has positioned itself as a center for advanced dental expertise. The country attracts leading specialists, enforces strict professional standards, and invests in ongoing skill development, building a trusted ecosystem defined by quality and innovation.

Many dentists in the UAE are educated and trained at top global institutions in the US, UK, Germany, and Canada. They hold certifications from recognized bodies such as the American Dental Association (ADA), British Dental Association (BDA), and European Federation of Periodontology (EFP). Their exposure to global practices and multidisciplinary expertise in implantology, orthodontics, prosthodontics, and aesthetic dentistry strengthens the UAE’s reputation as a reliable destination for specialized dental care.

Dentists must meet rigorous qualification and experience requirements. Board certification, periodic re-evaluation, and clinical audits ensure adherence to international healthcare standards. Ethical protocols and patient safety frameworks reinforce confidence in treatment quality. These measures guarantee consistent outcomes and enhance trust among medical tourists seeking dependable dental services.

The UAE’s pool of specialists enables advanced and complex procedures, including oral and maxillofacial surgery, precision root canal treatments, orthodontics with Invisalign, and high-end aesthetic dentistry. Access to such expertise attracts patients from varied regions who require advanced or customized treatments.

UAE dental professionals emphasize patient-centered care through personalized treatment plans supported by AI-driven digital smile design. Comprehensive consultations, multilingual communication, and customized solutions cater to the functional and aesthetic needs of each patient.

This professional expertise is supported by cutting-edge technology such as AI-based diagnostics, CAD/CAM for same-day restorations, 3D printing for implants and prosthetics, and laser dentistry for minimally invasive care. By combining global talent with advanced tools, the UAE delivers superior, safe, and efficient dental outcomes that strengthen its position as a leading destination for international dental tourism.

Key Market Challenges

High Treatment Costs Compared

to Emerging Competitors

Although

the UAE offers world-class dental care, its pricing remains relatively high

compared to emerging dental tourism hubs like Turkey, Thailand, India, and

Eastern European countries. These nations provide equally advanced treatments

at significantly lower costs, making them strong competitors in the global

dental tourism market.

Dental

clinics in Dubai and Abu Dhabi operate in high-cost urban centers, leading to

increased overhead expenses such as rent, utilities, and staffing. The Dubai

Health Authority (DHA) and Department of Health - Abu Dhabi (DOH) impose strict

regulatory requirements, leading to higher compliance costs for clinics. The

UAE attracts internationally trained dentists, many from the US, UK, and

Europe, who command higher salaries, increasing treatment costs. The UAE relies

on imported dental technology, prosthetics, and consumables, making procedures

costlier compared to countries with local manufacturing capabilities.

Visa and Medical Travel

Restrictions for Certain Nationalities

Despite

its strong infrastructure and global connectivity, the UAE’s visa policies and

medical travel restrictions create barriers for certain dental tourists. While

the government has eased travel requirements for many countries, some

nationalities still face entry challenges, limiting market growth potential.

Unlike

Turkey and Thailand, where dental tourists can easily obtain visas on arrival,

the UAE still requires pre-approval for many countries, adding bureaucratic

delays. Patients traveling for extensive dental treatments may need a medical

visa, which involves additional paperwork and processing time. Nationals from

certain countries (e.g., parts of Africa, South Asia, and former CIS countries)

may face restrictions in obtaining visas for dental treatments in the UAE.

Key Market Trends

Rise of Luxury Dental Tourism

& Concierge Healthcare Services

A growing number of affluent international patients are choosing the UAE for luxury dental tourism, where premium dental treatments are paired with high-end hospitality, wellness, and concierge services. Dubai welcomed 691,478 international medical tourists in 2023, with international patient spending reaching AED 992 million in 2022. The UAE, particularly Dubai and Abu Dhabi, is leveraging this trend by offering a seamless mix of world-class dental care and luxury travel, supported by 168 five-star hotels and over 52,000 five-star rooms designed to accommodate recovery stays and VIP experiences.

Exclusive VIP treatment packages include private dental suites, personalized care plans, chauffeur services, dedicated medical coordinators, and post-treatment recovery in luxury resorts. Dubai’s healthcare infrastructure, comprising 4,609 licensed facilities, 52 hospitals, and 82 dental clinics, anchors this ecosystem, along with the emirate’s first specialized dental hospital offering seven distinct specialties. Patients can integrate dental procedures with spa retreats, aesthetic services, and wellness tourism, benefitting from Dubai’s extensive luxury hotel inventory and curated recovery programs.

The UAE caters to discreet, high-profile clientele such as high-net-worth individuals, celebrities, and business executives. Dentistry ranks among Dubai’s leading medical tourism specialties, with new clinic licenses continuing to expand premium capacity. The country’s position as a global luxury travel hub naturally supports high-end dental tourism, offering concierge-led stays within its deep five-star hospitality network.

High-income patients from Europe, the US, and GCC countries prefer the UAE’s combination of advanced care and premium experiences, with consistent year-over-year growth in international medical tourist arrivals. Unlike price-driven markets such as Turkey or Thailand, the UAE distinguishes itself through luxury-focused clinics and ultra-premium recovery options. As demand for exclusive, patient-centered dental tourism rises, dental providers in the UAE are set to expand VIP offerings, concierge healthcare, and integrated luxury travel experiences, supported by ongoing investment and an increasing number of licensed health facilities..

Digital Dentistry &

AI-Powered Dental Tourism Experience

The

UAE is witnessing rapid adoption of digital dentistry, where cutting-edge

technology is transforming patient diagnosis, treatment planning, and

procedural efficiency. The integration of AI-driven dental solutions and

virtual consultations is redefining how international patients access and

experience dental treatments before arriving in the country. The 11th International Conference on Innovations in Digital Dentistry & Implants is a premier virtual dental event, offering participants exceptional networking and professional development opportunities. In addition to engaging discussions and insights from industry leaders, attendees can enjoy a diverse range of world-class entertainment beyond the conference experience.

Use

of AI-driven diagnostics, 3D imaging, and digital smile design (DSD) to plan

treatments remotely. Virtual Consultations & Pre-Treatment Engagement, Patients

can consult UAE dentists via telemedicine platforms before traveling. Digital

previews of procedures allow patients to see expected results beforehand. Same-Day

& Minimally Invasive Procedures

Advanced

CAD/CAM technology enables same-day crowns, veneers, and dental implants,

reducing patient stay duration. Blockchain for Secure Patient Data &

Medical Records, Seamless access to dental history, allowing continuity of care

across borders. Digital innovations reduce treatment uncertainty, making UAE

clinics more attractive to international patients. Faster, less invasive

procedures mean patients can complete treatments without long stays. AI and 3D

technology create highly accurate, personalized results, enhancing patient

satisfaction. With continuous investment in AI-powered diagnostics and digital

treatment solutions, the UAE will establish itself as a global leader in

high-tech dental tourism, attracting patients who prioritize precision,

efficiency, and cutting-edge technology.

Segmental Insights

Service Insights

Based on the category of service, the Dental Implant segment was the fastest-growing segment in the UAE Dental Tourism market in 2024. Dental implants have emerged as the dominant service within the UAE dental tourism industry, significantly driving revenue and attracting a growing number of international patients seeking high-quality, long-lasting tooth replacement solutions. The UAE has established itself as a global hub for advanced implant dentistry, offering cutting-edge technology and highly skilled specialists, which boosts its appeal to dental tourists.

Dental implants are increasingly preferred over traditional solutions like bridges and dentures due to their superior durability, aesthetics, and functionality. Unlike dentures and bridges, which require frequent replacements, dental implants can last 15-25 years or even a lifetime, making them a more cost-effective and healthier long-term option. Additionally, high-quality zirconia and titanium implants closely mimic the appearance of natural teeth, offering superior aesthetics. Implants also prevent bone loss and help maintain facial integrity, adding to their appeal. These factors are fueling the rapid growth of the dental implant segment in the UAE’s dental tourism market..

Download Free Sample Report

Regional Insights

Dubai

emerged as the dominant region in the UAE Dental Tourism Market in 2024,

holding the largest market share in terms of value. Dubai boasts

state-of-the-art dental facilities equipped with cutting-edge technology and

staffed by highly skilled professionals, many of whom are internationally

trained. In 2023, Dubai attracted over 691,000 international health tourists, generating more than AED 1.03 billion in healthcare-related spending. This marks an increase from 2022, when the city welcomed 674,000 health tourists, contributing AED 992 million in expenditure. Additionally, Dubai’s indirect revenues from health tourism reached an impressive AED 2.3 billion in 2023, significantly contributing to the city’s GDP and driving growth across key economic sectors.

As

a global tourism hotspot, Dubai attracts millions of visitors annually. Many

tourists combine leisure travel with dental procedures, taking advantage of

competitive pricing and high-quality care. The UAE's streamlined medical visa

process facilitates easy access for international patients, particularly from

Europe, Asia, and Africa. Dubai's proactive marketing of its healthcare

services, including dental tourism, has positioned it as a preferred

destination for medical travelers.

Recent Developments

- In February 2025, AEEDC Dubai 2025 concluded with business deals exceeding AED 20 billion. The event welcomed more than 85,000 participants from 177 countries and featured 5,328 brands, reinforcing Dubai’s status as a global center for dental innovation and a leading destination for dental tourists through distributor agreements and product launches.

- In February 2025, AEEDC Dubai 2025 concluded with landmark deals exceeding AED 20 billion and the launch of new dental products and technologies, reinforcing Dubai’s status as a global center for dental care and medical tourism.

- In February, UAE national news emphasized AEEDC’s 29th edition achievements, featuring strategic agreements that strengthen innovation pipelines and foster international collaborations, supporting the continued growth of inbound dental tourism in the region.

- In December 2024, Dubai Health’s Dental Hospital Pediatric Dentistry Clinic became the first healthcare facility in the emirate to achieve Certified Autism Center designation from the IBCCES. This milestone supports Dubai’s Certified Autism Destination initiative and enhances access to specialized pediatric dental care for international families seeking treatment.

- In December 2024, AEEDC’s 2025 press communications emphasized record dealmaking expectations and highlighted Dubai’s growing appeal as a destination that blends tourism with advanced dentistry. These developments align with Dubai Healthcare City’s broader plans to expand international patient services and strengthen the emirate’s medical tourism ecosystem.

- In December 2024, Dubai Healthcare City (DHCC) released its annual highlight report outlining plans to collaborate with new developments to extend hospital outreach through community clinics, improving patient access and streamlining care pathways for international visitors seeking dental and related services in DHCC.

Key Market Players

- Micris

Dental Clinics

- American Hospital

- Dr. Michael’s Dental Clinics

- Zulekha Hospital

- Canadian Specialist Hospital

- NMC Specialty Hospital

|

By

Service

|

By

Providers

|

By

Region

|

- Dental

Implants

- Orthodontics

- Dental

Cosmetics

- Others

|

- Hospitals

- Dental

Clinics

- Others

|

- Abu

Dhabi

- Dubai

- Sharjah

- Rest

of UAE

|

Report Scope:

In this report, the UAE Dental Tourism Market has

been segmented into the following categories, in addition to the industry

trends which have also been detailed below:

- UAE Dental Tourism Market, By Service:

o Dental Implants

o Orthodontics

o Dental Cosmetics

o Others

- UAE Dental Tourism Market, By Providers:

o Hospitals

o Dental Clinics

o Others

- UAE Dental Tourism Market, By Region:

o Abu Dhabi

o Dubai

o Sharjah

o Rest of UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the UAE Dental

Tourism Market.

Available Customizations:

UAE Dental

Tourism market report with the given market data, TechSci Research

offers customizations according to a company's specific needs. The following

customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional

market players (up to five).

UAE Dental Tourism Market is an upcoming

report to be released soon. If you wish an early delivery of this report or

want to confirm the date of release, please contact us at [email protected]