Forecast Period | 2025-2029 |

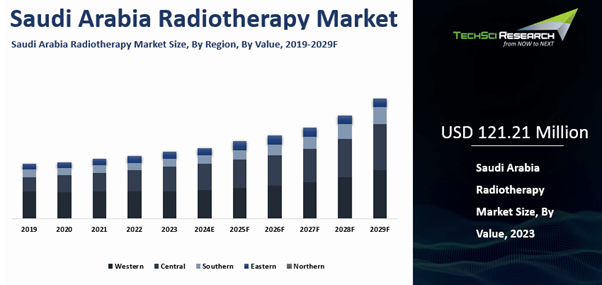

Market Size (2023) | USD 121.21 Million |

Market Size (2029) | USD 180.94 Million |

CAGR (2024-2029) | 7.09% |

Fastest Growing Segment | External Beam Radiation Therapy |

Largest Market | Central Region |

Market Overview

The Saudi Arabia Radiotherapy Market was valued at USD 121.21 million in 2023 and is expected to reach USD 180.94 million by 2029 with a CAGR of 7.09% during the forecast period.

Several key factors primarily drive the Saudi Arabia radiotherapy market. An

increasing incidence of cancer cases across the country has spurred demand for

advanced treatment options like radiotherapy. Government initiatives and

investments in healthcare infrastructure have bolstered the accessibility and

affordability of radiotherapy services, thereby expanding market reach.

Rising

awareness among both healthcare providers and patients about the benefits of

radiotherapy in cancer treatment has contributed to its growing adoption. Technological advancements in radiotherapy equipment

and techniques have enhanced treatment efficacy and patient outcomes, further

propelling market growth. These factors combined underscore a robust expansion

trajectory for the Saudi Arabia radiotherapy market, with a continued focus on

improving cancer care and patient outcomes nationwide.

Download Free Sample Report

Key Market Drivers

Increasing Cancer Incidence

Saudi Arabia has observed a notable increase in the prevalence of cancer in recent years, prompting a heightened demand for advanced treatment modalities such as radiotherapy. This upward trend can be attributed to several interrelated factors, including shifting lifestyles, dietary changes, and an aging population demographic.

According to a 2022 fact sheet from the Global Cancer Observatory, Saudi Arabia has an age-standardized incidence rate (ASIR) for all types of cancer of 89.7 per 100,000 individuals, while the age-standardized mortality rate (ASMR) is 46.2 per 100,000 individuals. Among Gulf countries, Saudi Arabia recorded high incidence and mortality rates for certain cancers. For example, breast cancer is the most common malignancy among Saudi women, representing over 30% of all female cancer cases, while colorectal cancer is the second most common cancer in men.

Advancements in diagnostic technologies and healthcare infrastructure across the kingdom have enhanced early detection rates, thereby uncovering more cases of cancer that require treatment. The Saudi Cancer Registry now provides accurate statistics on incidence and mortality, enabling better planning. These combined factors underscore the urgent need for effective cancer therapies like radiotherapy to manage and treat the growing burden of cancer in Saudi Arabia, which is projected to double in the next two decades. As the healthcare system continues to evolve, radiotherapy remains pivotal in providing effective and targeted treatment options for cancer patients across the country.

Government Healthcare Initiatives

The Saudi government has embarked on substantial investments in healthcare infrastructure, particularly in expanding and upgrading radiotherapy facilities, aimed at enhancing accessibility and affordability of healthcare services across the kingdom. These investments are part of broader initiatives under Vision 2030, the country's ambitious strategic framework for economic diversification, which includes plans to invest over $65 billion in the healthcare sector. Vision 2030 places a strong emphasis on transforming healthcare to meet international standards and address the growing needs of Saudi citizens.

By prioritizing improvements in healthcare infrastructure, including the establishment of state-of-the-art radiotherapy centers, the government aims to ensure that advanced medical treatments are readily available to all segments of the population. The Health Sector Transformation Program is a key part of this strategy, with goals to increase private sector participation, add thousands of hospital beds, and launch integrated health clusters to serve millions of people.

This strategic approach not only supports the health and well-being of Saudi residents but also stimulates market growth in the healthcare sector by fostering innovation and attracting private investments. As a result, the healthcare landscape in Saudi Arabia is poised to witness significant advancements, with radiotherapy playing a crucial role in improving patient outcomes and addressing healthcare challenges in the years to come.

Growing Awareness and Education

In Saudi Arabia, there has been a notable increase in awareness efforts among healthcare providers and patients about the advantages of radiotherapy. This heightened awareness is largely driven by ongoing education campaigns and the dissemination of knowledge through medical conferences and seminars. The Ministry of Health and regional bodies, such as the Eastern Health Cluster, run initiatives, including the "National Campaign for Breast Cancer Awareness" and the "Your Ribbon is Pink" campaign, to promote early detection and treatment options. Healthcare providers are increasingly recognizing radiotherapy's role in improving patient outcomes through targeted, precise treatment delivery, enabled by advanced techniques such as IMRT and IGRT, which are available in the Kingdom.

Medical conferences and symposiums serve as platforms for exchanging insights and sharing best practices. Numerous international conferences on radiology, oncology, and radiation therapy are held annually in cities like Riyadh, Jeddah, and Dammam, facilitating informed decision-making among healthcare professionals. Simultaneously, patient-focused educational efforts, such as providing evidence-based Arabic resources for cancer patients, are underway to increase acceptance and adoption of this treatment modality.

While some studies have indicated a need for greater radiation safety awareness among non-radiology staff, a study in Tabuk found that 76% had low levels of awareness. The ongoing training and educational campaigns aim to address this gap. As awareness continues to grow and healthcare professionals gain more expertise in radiotherapy techniques, the utilization of radiotherapy is expected to expand further in Saudi Arabia.

Technological Advancements

Advances in radiotherapy equipment and techniques, notably intensity-modulated radiation therapy (IMRT) and image-guided radiation therapy (IGRT), have revolutionized cancer treatment by significantly enhancing treatment precision and patient outcomes. IMRT delivers highly focused radiation beams that conform closely to the tumor's shape, minimizing exposure to surrounding healthy tissues. This precision not only improves efficacy but also reduces the risk of side effects.

In December 2023, Almana Group of Hospitals, a prominent healthcare provider in the Eastern Province, announced the successful treatment of its first patient utilizing Surface Guided Radiation Therapy (SGRT). This advancement enhances safety and precision, offering benefits like tattooless therapy and protecting the heart during left breast radiation by using the Deep Inspiration Breath Hold (DIBH) technique, where the system's sub-millimeter accuracy automatically shuts off the beam if it detects patient motion.

Similarly, IGRT utilizes advanced imaging techniques such as CT scans, MRI, or PET scans to precisely locate and target tumors in real-time during treatment sessions. This real-time imaging capability enables radiation oncologists to make immediate adjustments to the treatment plan based on any changes in the tumor position, further optimizing treatment accuracy and effectiveness.

These technological innovations have attracted substantial investments in healthcare infrastructure in Saudi Arabia, as providers seek to integrate state-of-the-art radiotherapy technologies into their facilities. The availability of advanced equipment and techniques not only attracts patients seeking superior cancer care but also positions Saudi Arabia as an emerging hub for medical tourism, with centers like the planned Proton Beam Therapy Centre in Riyadh being designed to serve both Saudi and international patients. These advancements drive market expansion by fostering collaborations with international manufacturers and stimulating innovation in radiotherapy capabilities.

Key Market Challenges

Shortage of Skilled Personnel

In Saudi Arabia, the shortage of qualified

radiation oncologists, medical physicists, and radiotherapy technologists poses

a significant challenge to the effective delivery of radiotherapy treatments.

This scarcity is exacerbated by the increasing incidence of cancer cases across

the kingdom, which demands a corresponding expansion in specialized healthcare

personnel. Radiation oncologists play a crucial role in devising and overseeing

radiotherapy treatment plans tailored to individual patient needs, ensuring

optimal therapeutic outcomes while minimizing side effects.

Medical physicists are essential for maintaining

and calibrating radiotherapy equipment, ensuring its accuracy and safety in

delivering radiation doses to target tumors. Their expertise is vital to quality assurance processes, ensuring treatment precision and efficacy. Radiotherapy

technologists operate the equipment and provide direct patient care during

treatment sessions, requiring specialized training to ensure proper positioning

and monitoring of patients throughout the treatment process. The shortage of

these skilled professionals limits healthcare facilities in Saudi Arabia's capacity to effectively meet the growing demand for radiotherapy services.

Patients may face longer wait times for treatment, reduced access to

specialized care in remote areas, and challenges in receiving timely

interventions critical to cancer management. The recruitment and retention of

qualified personnel are essential for sustaining high-quality cancer care

standards and fostering innovation in radiotherapy techniques and technologies.

Cost and Affordability

Radiotherapy, particularly advanced techniques such

as Intensity-Modulated Radiation Therapy (IMRT) and Image-Guided Radiation

Therapy (IGRT), represents a significant financial burden for patients in Saudi

Arabia. The high costs associated with these treatments stem from the

sophisticated equipment required, specialized training for healthcare

professionals, and ongoing maintenance of technology-intensive facilities.

Government initiatives in Saudi Arabia aim to

improve the affordability of radiotherapy through healthcare reforms and infrastructure investments. Despite these efforts, out-of-pocket

expenses remain a substantial concern for many patients, particularly those

without comprehensive health insurance coverage. The variability in insurance

policies and coverage levels further complicates access to radiotherapy, often

leaving patients to navigate complex financial decisions during a time of

medical crisis. The financial challenges associated with radiotherapy can

impact treatment decisions and patient outcomes. Some individuals may delay or

forego recommended treatments due to cost concerns, potentially compromising

their health and prognosis. The financial strain on patients and their families

can lead to additional stress and hardship, affecting overall quality of life

during cancer treatment and recovery.

Key Market Trends

Collaboration with International Partners

Partnerships with international healthcare providers and collaborations in research and training have become pivotal in advancing radiotherapy capabilities and treatment standards in Saudi Arabia. These strategic alliances facilitate the transfer of expertise, knowledge, and cutting-edge technologies from global leaders in oncology and radiotherapy to local healthcare institutions. By partnering with renowned international hospitals and technology firms like Varian and Elekta, Saudi Arabia gains access to state-of-the-art radiotherapy equipment, software solutions, and treatment protocols. This exchange of know-how enables healthcare providers in Saudi Arabia to offer advanced treatment options, enhancing the quality of cancer care. For example, Johns Hopkins Aramco Healthcare (JHAH) has launched over 50 knowledge-sharing programs in specialties including oncology.

Collaborations in research and training foster the development of local talent and expertise in radiotherapy. Joint research initiatives enable Saudi researchers and clinicians to contribute to global oncology advancements, while training programs offer opportunities for continuous professional development. The Saudi Commission for Health Specialties (SCFHS) established a five-year radiation oncology residency program in 2019, adapted from North American curricula, to meet the rising demand for competent specialists. Furthermore, institutions like Alfaisal University offer advanced degrees such as a Master of Science in Radiation Medicine, and the King Faisal Specialist Hospital has had an accredited pediatric oncology fellowship program since 2010. These educational exchanges ensure that healthcare professionals in Saudi Arabia remain abreast of the latest advancements in radiotherapy techniques, thereby improving treatment outcomes and patient care.

Medical Tourism

Saudi Arabia has emerged as a prominent destination

for medical tourism, including the provision of advanced radiotherapy services,

which has significantly contributed to the growth of its healthcare sector. The

kingdom's reputation for high-quality medical care, coupled with its strategic

geographic location, attracts patients from neighboring countries and beyond

who seek specialized treatments not readily available in their own regions. One

of the key attractions for medical tourists seeking radiotherapy in Saudi

Arabia is the availability of cutting-edge technology and world-class

facilities. Saudi hospitals and clinics equipped with state-of-the-art

radiotherapy equipment, such as linear accelerators for IMRT and IGRT, offer patients

access to advanced treatment modalities that may be limited or unavailable in

their home countries. This technological advantage ensures that patients

receive optimal care and outcomes, thereby enhancing the appeal of Saudi Arabia

as a medical tourism destination.

The kingdom's commitment to healthcare excellence,

supported by initiatives like Vision 2030, has further bolstered its reputation

in the global medical tourism market. Vision 2030 aims to transform Saudi

Arabia into a leading healthcare hub in the Middle East by enhancing healthcare

infrastructure, improving service quality, and fostering innovation in

healthcare delivery. These efforts not only attract patients seeking

specialized medical treatments but also stimulate market demand for radiotherapy

services, driving growth and investment in the sector.

Segmental Insights

Type Insights

Based on the Type, External

Beam Radiation Therapy (EBRT) is currently dominating as the primary treatment

modality. EBRT involves delivering high-energy radiation beams externally to

target cancerous tumors while minimizing exposure to surrounding healthy

tissues. This non-invasive approach is widely utilized across various types of

cancers, including prostate, breast, lung, and head and neck cancers, among

others.

The dominance of EBRT in

Saudi Arabia can be attributed to several factors. EBRT is versatile and

effective, offering precise targeting of tumors with minimal side effects,

which is crucial for enhancing patient outcomes and quality of life. The

technology used in EBRT, such as linear accelerators capable of delivering

advanced techniques like IMRT (Intensity-Modulated Radiation Therapy) and IGRT

(Image-Guided Radiation Therapy), has been progressively integrated into

healthcare facilities across the kingdom.

These advancements enable oncologists

to customize treatment plans based on individual patient characteristics,

optimizing therapeutic efficacy while reducing radiation exposure to healthy

tissues. The preference for EBRT in Saudi Arabia reflects global trends in

cancer treatment, where external beam techniques have become standard practice

due to their proven efficacy and established clinical outcomes. The

availability of skilled radiation oncologists, medical physicists, and

technologists trained in EBRT further supports its widespread adoption and

utilization in the kingdom's healthcare system.

Application Insights

Based on the Application, breast

cancer stands out as one of the most prevalent and treated types of cancer,

thus dominating the landscape of radiotherapy treatments. Breast cancer is a

significant health concern globally and in Saudi Arabia, affecting a

considerable number of women each year. The increasing incidence of breast

cancer in the kingdom has led to a corresponding rise in the demand for

effective treatment options, including radiotherapy.

Radiotherapy plays a

crucial role in the management of breast cancer at various stages of the

disease. It is commonly used post-surgery (adjuvant therapy) to eradicate any

remaining cancer cells and reduce the risk of recurrence. Radiotherapy may be

employed before surgery (neoadjuvant therapy) to shrink tumors and make

surgical removal more effective. In cases where the cancer has metastasized to

other parts of the body, radiotherapy can help alleviate symptoms and improve

quality of life. The dominance of breast cancer in the Saudi Arabia

radiotherapy market can be attributed to several factors. The proactive

approach of the Saudi healthcare system in promoting breast cancer awareness

and screening programs has led to earlier detection and diagnosis. This early

detection often results in more effective treatment outcomes, with radiotherapy

playing a pivotal role in the multidisciplinary management of the disease.

Download Free Sample Report

Regional Insights

Among Saudi Arabia's regions, the Central Region dominates the Saudi Arabia radiotherapy market. The Central

Region, which includes the capital city Riyadh, represents the hub of

healthcare infrastructure and services in the kingdom. This region houses

several prominent hospitals, specialized cancer centers, and healthcare

facilities equipped with state-of-the-art radiotherapy technologies and

treatment capabilities. Riyadh, as the capital and largest city in Saudi

Arabia, serves as a focal point for advanced medical treatments, including

radiotherapy, attracting patients from across the country seeking specialized

care. The concentration of healthcare resources in the Central Region, coupled

with its accessibility and connectivity through major transportation networks,

further enhances its prominence in the radiotherapy market.

Several factors support the dominance of the Central Region in the Saudi Arabia radiotherapy market. The region benefits

from significant investments in healthcare infrastructure and technology under

initiatives such as Vision 2030. These investments aim to enhance healthcare

services, expand treatment capacities, and improve the overall quality of care

available to patients requiring radiotherapy for various types of cancers. The

presence of leading medical institutions and academic centers in Riyadh and the

Central Region facilitates collaboration among healthcare professionals,

researchers, and industry stakeholders. This collaborative environment fosters

innovation in radiotherapy techniques, clinical trials, and patient care

practices, positioning the Central Region at the forefront of oncology

advancements in the kingdom.

Recent Developments

- In October 2025, Johns Hopkins Aramco Healthcare (JHAH) announced the opening of its Oncology Center of Excellence in Riyadh. The center specializes in treating the most prevalent cancers in the region, including breast, colorectal, and prostate cancers, and will provide comprehensive, patient-centric care.

- In May 2025, ImmunityBio signed a Memorandum of Understanding (MoU) with Saudi Arabia's Ministry of Investment (MISA), KFSH&RC, and the King Abdullah International Medical Research Center (KAIMRC). This collaboration aims to launch the FDA-approved "Cancer BioShield" immunotherapy platform in the Middle East, a significant advancement in cancer treatment that integrates cell therapy and radiotherapy.

- In July 2025, CEL-SCI Corporation announced a partnership agreement with a leading Saudi pharmaceutical company for the commercialization of Multikine, an investigational immunotherapy for head and neck cancer. This collaboration is expected to bring a novel treatment option to patients in the Kingdom.

- In October 2024, KFSH&RC further solidified its position as a leader in cancer treatment by pioneering the use of advanced therapies like CAR-T cell therapy and CRISPR gene editing. These breakthrough treatments are delivering exceptional outcomes and revolutionizing cancer care in the region.

- In December 2024, the King Faisal Specialist Hospital & Research Centre (KFSH&RC) announced that it is leading innovation in cancer radiopharmaceuticals by locally producing essential radionuclides, such as iodine-123 and gallium-67. This move reduces reliance on imports and strengthens the domestic supply chain for critical diagnostic and therapeutic materials.

- In May 2024, RaySearch Laboratories and C-RAD signed a collaboration agreement to develop innovative solutions for radiotherapy. This partnership aims to enhance the precision and effectiveness of radiation treatments through integrated technology.

- In April 2024, Varian, a Siemens Healthineers company, partnered with BaraSeen Medical Company to install the first Halcyon™ system in Saudi Arabia. This advanced radiation therapy system, housed at the new Batik-X radiation therapy center in Riyadh, is designed to expand access to high-quality, sustainable cancer treatment in the Kingdom.

Key Market Players

- Gulf Medical Co. Ltd.

- Siemens Industrial LLC

- Almana Group of Hospitals

- Varian Medical Systems Arabia Commercial Limited

|

By Type

|

By Application

|

By End User

|

By Region

|

- External Beam Radiation Therapy

- Internal Radiation Therapy

- Systemic Radiation Therapy

|

- Skin & Lip Cancer

- Breast Cancer

- Prostate Cancer

- Cervical Cancer

- Lung Cancer

- Others

|

- Hospitals

- Research Institutes

- Ambulatory & Radiotherapy Centers

|

- Western Region

- Central Region

- Southern Region

- Eastern Region

- Northern Region

|

Report Scope:

In this report, the Saudi Arabia Radiotherapy

Market has been segmented into the following categories, in addition to the

industry trends which have also been detailed below:

- Saudi Arabia Radiotherapy

Market, By

Type:

o External Beam Radiation Therapy

o Internal Radiation Therapy

o Systemic Radiation Therapy

- Saudi Arabia Radiotherapy

Market, By

Application:

o Skin & Lip Cancer

o Breast Cancer

o Prostate Cancer

o Cervical Cancer

o Lung Cancer

o Others

- Saudi Arabia Radiotherapy

Market, By

End User:

o Hospitals

o Research Institutes

o Ambulatory & Radiotherapy Centers

- Saudi Arabia Radiotherapy Market,

By Region:

o Western Region

o Central Region

o Southern Region

o Eastern Region

o Northern Region

Competitive Landscape

Company Profiles: Detailed analysis of the major companies

present in the Saudi Arabia Radiotherapy Market.

Available Customizations:

Saudi Arabia Radiotherapy Market report with

the given market data, Tech Sci Research offers customizations according to a

company's specific needs. The following customization options are available for

the report:

Company Information

- Detailed analysis and

profiling of additional market players (up to five).

Saudi Arabia Radiotherapy Market is an upcoming

report to be released soon. If you wish an early delivery of this report or

want to confirm the date of release, please contact us at [email protected]