|

Forecast

Period

|

2026-2030

|

|

Market

Size (2024)

|

USD

724.03 Million

|

|

Market

Size (2030)

|

USD

920.94 Million

|

|

CAGR

(2025-2030)

|

4.05%

|

|

Fastest

Growing Segment

|

Reagent

|

|

Largest

Market

|

Northern

& Central

|

Market Overview

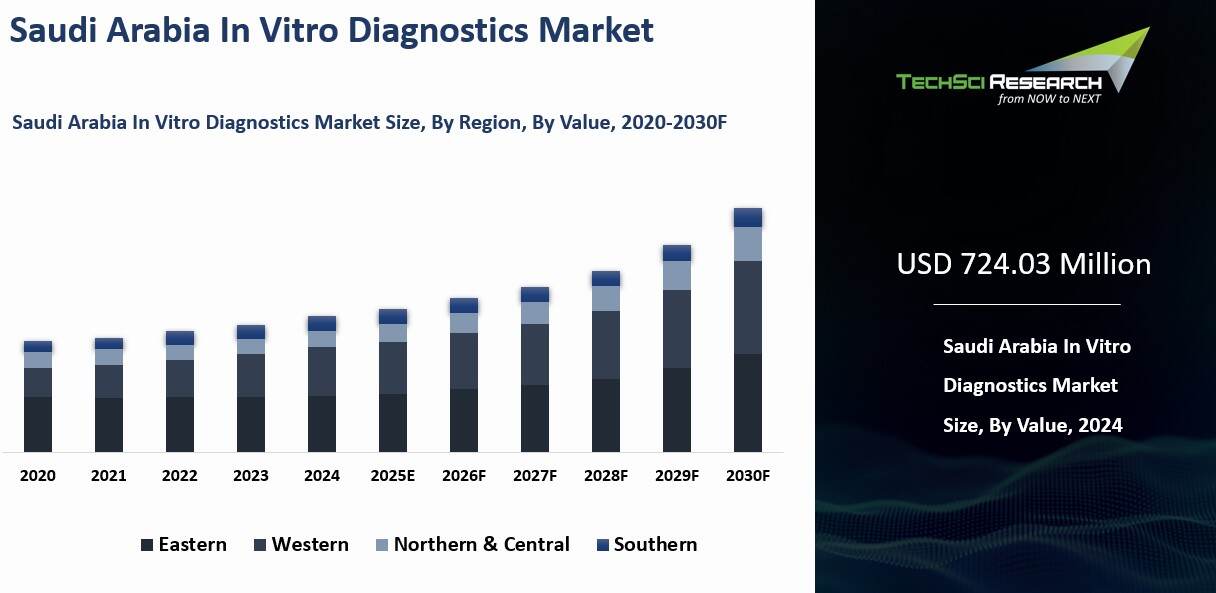

Saudi

Arabia In Vitro Diagnostics Market was valued at USD 724.03 Million in 2024 and

is expected to reach USD 920.94 Million by 2030 with a CAGR of 4.05%.

In Vitro Diagnostics (IVD) refers to medical tests performed on biological samples such as blood, urine, tissue, or other bodily fluids outside the body in a controlled laboratory setting. The term “in vitro,” meaning “in glass,” reflects tests conducted using lab instruments like test tubes or Petri dishes. IVD tests provide essential insights into a patient’s health by detecting diseases, infections, and other medical conditions. They play a critical role in diagnosis, disease monitoring, and early screening across various healthcare settings, including hospitals, clinics, laboratories, and point-of-care (POC) environments.

IVD encompasses multiple diagnostic categories, including clinical chemistry, hematology, microbiology, immunology, pathology, and genetics, each using specific sample types such as blood, saliva, or cerebrospinal fluid, depending on the diagnostic purpose.

In Saudi Arabia, an aging population and increasing awareness of preventive healthcare are driving the demand for diagnostic testing, especially in geriatric care. Technological innovations such as molecular diagnostics and rapid POC testing are enhancing accuracy, efficiency, and accessibility. The COVID-19 pandemic accelerated the adoption of telehealth and digital health platforms, creating new opportunities for remote testing and monitoring. Furthermore, Saudi Arabia’s rising healthcare expenditure and infrastructure investments are fostering a supportive environment for IVD market expansion and innovation.

Download Free Sample Report

Key Market Drivers

Rising Burden of Chronic and

Infectious Diseases

The rising prevalence of chronic and infectious diseases in Saudi Arabia is a major driver of the In Vitro Diagnostics (IVD) market. Chronic diseases such as diabetes, hypertension, and obesity pose significant public health challenges. Recent data show diabetes affects 14.8% of men and 11.7% of women, while hypertension impacts 17.7% of men and 12.5% of women. With over 18% of adults living with diabetes, Saudi Arabia ranks among the highest globally.

The growing burden of cardiovascular conditions linked to obesity and sedentary lifestyles has increased the need for regular diagnostic monitoring through lipid profiles, cardiac biomarkers, and enzyme assays. Similarly, rising cancer incidence, 96.5 cases per 100,000 people in 2020, has spurred demand for molecular diagnostics, tumor markers, and genetic testing. Nearly two-thirds of all cancer cases in GCC countries occur in Saudi Arabia, emphasizing the importance of early detection and continuous testing. These conditions have significantly increased the consumption of IVD reagents, kits, and analyzers in hospitals and private labs.

The emergence of infectious diseases such as COVID-19, MERS-CoV, and influenza has further reinforced the importance of rapid and accurate diagnostics. Saudi Arabia saw COVID-19 cases surge from one to over 100,000 within months, with a 71.4% recovery rate reported by the NIH. This highlighted the essential role of RT-PCR and antigen testing in disease management. Post-pandemic, the focus has shifted toward preparedness, driving sustained demand for infectious disease testing, including multiplex panels and point-of-care devices.

The rising disease burden is also fostering a stronger culture of preventive healthcare. Early detection is increasingly viewed as critical for lowering long-term costs and improving outcomes. Employers, insurers, and healthcare providers are promoting regular screenings and health check-ups, fueling demand for biochemical, immunoassay, and hematology-based IVD tests, particularly in primary and outpatient care settings.

Aging Population and

Population Growth

Saudi Arabia’s demographic landscape is rapidly transforming, marked by steady population growth and a rising share of elderly citizens, factors that significantly shape healthcare demand and fuel the In Vitro Diagnostics (IVD) market. Driven by natural birth rates and urbanization, the country’s total population continues to expand, while the proportion aged 60 and above rose from 5.59% to 6.9% between 2020 and 2022. This growing elderly demographic is increasing demand for age-specific healthcare and chronic disease management, underscoring the need for advanced IVD solutions.

Government and global health data indicate that the elderly population in Saudi Arabia is expected to double in the coming decades, carrying major implications for diagnostics. This shift has a dual impact: it increases overall testing volume across all age groups and heightens demand for complex, continuous diagnostics targeting chronic and age-related conditions. As aging accelerates, the healthcare system is emphasizing preventive care and early detection through annual check-ups, cancer screenings, and risk-factor monitoring in older adults. These initiatives are sustaining growth in IVD services such as hematology, immunoassays, and clinical chemistry testing.

The expanding and aging population is also pressuring healthcare infrastructure, prompting hospital and diagnostic lab expansions, investment in high-throughput and automated IVD systems, and decentralization through point-of-care testing. These developments are enhancing diagnostic accessibility while creating new revenue opportunities for both local and international IVD manufacturers and solution providers, reinforcing Saudi Arabia’s position as a key emerging diagnostics market in the region.

Key Market Challenges

Regulatory Complexity and

Lengthy Approval Processes

Despite

recent efforts to streamline medical device regulations, navigating the

regulatory landscape in Saudi Arabia remains a key challenge for IVD

manufacturers and distributors. The Saudi Food and Drug Authority (SFDA)

requires strict compliance with documentation, testing, and certification

protocols before granting market access. Delays in approval timelines and

frequent regulatory updates can hinder the speed-to-market for new diagnostic

technologies. International companies often face additional hurdles related to

product localization, language requirements, and coordination with local

partners for distribution and licensing. This regulatory burden can discourage

innovation, delay the introduction of advanced testing methods, and increase

operational costs, particularly for small to mid-sized players seeking market

entry.

Limited Local Manufacturing

and Overdependence on Imports

Saudi

Arabia relies heavily on imported IVD products, equipment, and testing kits,

primarily sourced from North America, Europe, and East Asia. This

overdependence on foreign suppliers makes the market vulnerable to global

supply chain disruptions, currency fluctuations, and extended lead times factors

that became especially evident during the COVID-19 pandemic. The absence of a

robust local manufacturing base restricts the country's ability to respond

swiftly to domestic diagnostic needs and increases healthcare costs. Moreover,

local players often lack the R&D capabilities, technical expertise, and

infrastructure required to develop and scale up innovative IVD solutions. This

dependency limits Saudi Arabia’s self-sufficiency and hinders the long-term

growth of a resilient, sustainable diagnostic ecosystem.

Key Market Trends

Expansion of AI and Big Data

in Healthcare

Artificial Intelligence (AI) and Big Data analytics are becoming fundamental to Saudi Arabia’s eHealth ecosystem, driven by Vision 2030 and the National Strategy for Data and AI (NSDAI), which includes investments of over $20 billion. These technologies are reshaping diagnostics, predictive healthcare, and operational efficiency, enabling providers to deliver more accurate, timely, and cost-effective medical services.

AI-driven solutions are increasingly being integrated into radiology, pathology, and disease detection. Machine learning algorithms are being applied in radiology for computerized medical imaging analysis, which can achieve diagnostic performance equal to or superior to highly qualified radiologists. Big Data analytics enables risk assessment models that help predict patient admission rates and manage chronic conditions like diabetes and cardiovascular disease, which are highly prevalent in the Kingdom. By analyzing patient data, including genetic information, AI can recommend personalized treatment plans, with some AI-powered systems having demonstrated the ability to reduce hospital readmissions by over 14% in other countries.

AI is streamlining hospital management by automating appointment scheduling, patient triage, and administrative workflows. Some automation tools have been shown to reduce patient no-shows by 20–30%. Chatbots and AI-driven customer service platforms are also being deployed to handle patient inquiries, improving engagement while reducing operational costs.

AI and Big Data will drive the next wave of healthcare efficiency, helping Saudi Arabia’s hospitals and clinics handle growing patient volumes while ensuring faster, data-driven decision-making. The adoption of AI-powered tools, supported by initiatives like the Seha Virtual Hospital and a national goal to train 20,000 AI experts, will accelerate as providers seek to reduce diagnostic errors, enhance treatment outcomes, and lower healthcare costs.

Growth of Digital Therapeutics

and Remote Patient Monitoring

The

rise of digital therapeutics (DTx) and remote patient monitoring (RPM) is

transforming Vietnam’s approach to chronic disease management and

post-treatment care. These solutions provide continuous, tech-enabled medical

supervision, reducing reliance on hospitals and improving long-term patient

outcomes.

Digital

therapeutics are software-driven treatments designed to supplement or replace

traditional medication. In Vietnam, mobile-based DTx solutions are being

developed for diabetes management, mental health support, and rehabilitation

programs. These tools provide behavioral coaching, medication adherence

reminders, and real-time health tracking to empower patients in self-managing

their conditions. Smartwatches, biosensors, and IoT-enabled medical devices are

gaining traction, enabling continuous monitoring of vital signs, including heart

rate, blood pressure, glucose levels, and oxygen saturation. This is

particularly beneficial for elderly patients, post-surgery recovery, and

high-risk populations who require ongoing medical supervision. Digital

therapeutics platforms now offer physical therapy, cognitive rehabilitation,

and post-stroke recovery programs through AI-driven virtual assistants and

interactive exercises. These innovations reduce the need for frequent hospital

visits, making healthcare more convenient and accessible.

The

shift toward preventive and long-term digital health solutions will reduce the

burden on Vietnam’s hospitals while improving patient engagement. As the prevalence of chronic diseases rises, integrating DTx and RPM into standard care models will be essential to improving treatment adherence and

overall population health.

Segmental Insights

Product Insights

Based

on the category of Product, Reagent segment emerges as the fastest growing segment

in the Saudi Arabia IVD Market and is predicted to continue expanding over the

coming years. Reagents are fundamental components of diagnostic tests. They

consist of various substances, such as chemicals, antibodies, or enzymes, that

interact with patient samples to produce a measurable signal. Nearly all IVD

tests, from blood tests to molecular diagnostics, rely on reagents for accurate

and specific results. Many routine diagnostic tests, such as blood chemistry,

haematology, and immunoassays, depend on reagents. These tests are commonly

performed in healthcare settings to assess a patient's overall health and to

diagnose various medical conditions.

Reagents are crucial for testing

infectious diseases, including viral and bacterial infections. The demand for

such tests, especially considering the COVID-19 pandemic, has significantly

increased the prominence of the Reagent segment. Reagents are integral to the

management of chronic diseases such as diabetes, cardiovascular conditions, and

autoimmune disorders. Continuous monitoring of these conditions requires

regular testing, which drives the demand for reagents. Reagents are used in

point-of-care testing, which has gained importance due to its rapid results and

convenience. These tests can be performed in various healthcare settings, including

clinics and physicians offices. These factors are expected to drive the growth

of this segment.

Application Insights

Based on Application, the Cardiology segment dominated the Saudi Arabia In Vitro Diagnostics Market and is expected to continue expanding over the coming years. Cardiovascular diseases,

including heart disease and hypertension, are major health concerns in Saudi

Arabia. These conditions are leading causes of morbidity and mortality in the

country. The high prevalence of cardiovascular diseases necessitates a

significant number of diagnostic tests for risk assessment, diagnosis, and

ongoing monitoring. An aging population is more susceptible to cardiovascular

diseases. Saudi Arabia, like many other countries, has been experiencing

demographic changes with a growing elderly population.

This demographic shift

has driven increased demand for cardiovascular diagnostic tests.

Unhealthy lifestyle factors, such as sedentary behavior, poor diet, and

smoking, have been on the rise in Saudi Arabia. These factors are known

contributors to heart diseases, making it essential to diagnose and manage

cardiovascular conditions. There has been an increased awareness of the

importance of cardiovascular health and the benefits of early detection and

management of heart-related conditions.

This has led more individuals to seek diagnostic tests, especially for risk assessment and preventive

measures. The Saudi government has launched various healthcare initiatives to tackle non-communicable diseases, including cardiovascular diseases.

These initiatives often involve screening programs and diagnostic campaigns,

further boosting the demand for cardiovascular IVD tests.

Download Free Sample Report

Regional Insights

The

Northern & Central region emerged as the largest market in the Saudi Arabia

In Vitro Diagnostics Market in 2024.

These regions are home to some of the most densely populated cities in Saudi

Arabia, including Riyadh, the capital city, in the Central region.

Higher population density typically correlates with a greater demand for

healthcare services, including diagnostic testing. Northern and Central regions

have a concentration of major healthcare facilities, including hospitals,

clinics, and diagnostic centers. These healthcare institutions are more likely

to offer a wide range of diagnostic tests and services, contributing to a

larger share of the IVD market. Urban areas in these regions tend to have

better healthcare infrastructure and access to medical services.

As

urbanization continues to increase, the demand for diagnostic tests grows,

driven by lifestyle-related diseases and access to better healthcare

facilities. The Northern and Central regions are economically vibrant, with higher standards of living and greater economic activity. This can result in

increased healthcare spending and greater access to a broader range of

medical services, including IVD tests. These regions are more likely to host

educational institutions and research centers that advance medical knowledge and innovation. This environment can lead to the adoption of

the latest diagnostic technologies and practices.

Recent Developments

- In October 2025, the Global Health Exhibition 2025, held in Riyadh, served as a major platform for international manufacturers to showcase cutting-edge IVD technologies. The event highlighted the significant international interest in Saudi Arabia's modernizing health sector and provided a venue for new collaborations and product introductions.

- In April 2025, in a major domestic acquisition, Elm Company, a key player in Saudi Arabia's digital solutions sector, acquired Thiqah Business Service for $907 million. While not exclusively an IVD deal, this strategic move is part of Elm's broader expansion into sectors that include healthcare technology, which is expected to impact the digital integration of IVD services.

- In July 2025, the Saudi Food and Drug Authority (SFDA) proposed a new technical regulation for medical devices, including IVD products. This move is part of a broader effort to harmonize regional standards and ensure the quality and safety of medical devices entering the market.

- In June 2025, leading global IVD companies, including Abbott, Roche, and Siemens Healthineers, continued to expand their operations in the Kingdom. These expansions involved introducing new diagnostic technologies and strengthening partnerships with local healthcare providers to improve access to advanced testing.

- In September 2024, the King Faisal Specialist Hospital & Research Centre (KFSH&RC) announced significant advancements in its cancer radiopharmaceutical program. This initiative heavily integrates advanced IVD technologies to support personalized therapy and improve patient outcomes, showcasing the growing link between diagnostics and treatment.

Key

Market Players

- Altona Diagnostics GmbH

- Beckman Coulter, Inc.

- Siemens Healthineers AG

- OncoDNA SA

- Vela Diagnostics (Nile

Science Corporation)

- Abbott Laboratories, Inc.

- Becton, Dickinson, and

Company

- F. Hoffmann-La Roche AG

- Thermo Fischer Scientific,

Inc.

- Sysmex Corporation

|

By

Product

|

By

Technology

|

By

Application

|

By

End User

|

By

Region

|

- Instruments

- Reagent

- Software

& Services

|

- Immunoassay

- Hematology

- Clinical

Chemistry

- Molecular

Diagnostic

- Microbiology

- Others

|

- Infectious

Diseases

- Diabetes

- Oncology

- Cardiology

- Nephrology

- Others

|

- Hospitals

& Clinics

- Diagnostic

Centers & Laboratories

- Others

|

- Eastern

- Western

- Northern

& Central

- Southern

|

Report Scope:

In this report, the Saudi Arabia In Vitro

Diagnostics Market has been segmented into the following categories, in

addition to the industry trends which have also been detailed below:

- Saudi Arabia In Vitro Diagnostics Market, By Product:

o Instruments

o Reagent

o Software & Services

- Saudi Arabia In Vitro Diagnostics Market, By Technology:

o Immunoassay

o Hematology

o Clinical Chemistry

o Molecular Diagnostic

o Microbiology

o Others

- Saudi Arabia In Vitro Diagnostics

Market, By

Application:

o Infectious Diseases

o Diabetes

o Oncology

o Cardiology

o Nephrology

o Others

- Saudi Arabia In Vitro

Diagnostics Market, By End-User:

o Hospitals & Clinics

o Diagnostic Centers & Laboratories

o Others

- Saudi Arabia In Vitro Diagnostics Market, By region:

o Eastern

o

Western

o

Northern

& Central

o

Southern

Competitive Landscape

Company Profiles: Detailed analysis of the major companies presents in the Saudi

Arabia In Vitro Diagnostics Market.

Available Customizations:

Saudi Arabia In Vitro Diagnostics Market report with the given market data,

TechSci Research offers customizations according to a company's specific

needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional

market players (up to five).

Saudi Arabia In Vitro Diagnostics Market is an upcoming report to be released

soon. If you wish an early delivery of this report or want to confirm the date

of release, please contact us at [email protected]