|

Forecast

Period

|

2026-2030

|

|

Market

Size (2024)

|

USD

403.16 Million

|

|

Market

Size (2030)

|

USD

504.00 Million

|

|

CAGR

(2025-2030)

|

3.75%

|

|

Fastest

Growing Segment

|

X-Ray Imaging Solutions

|

|

Largest

Market

|

Northern

& Central

|

Market Overview

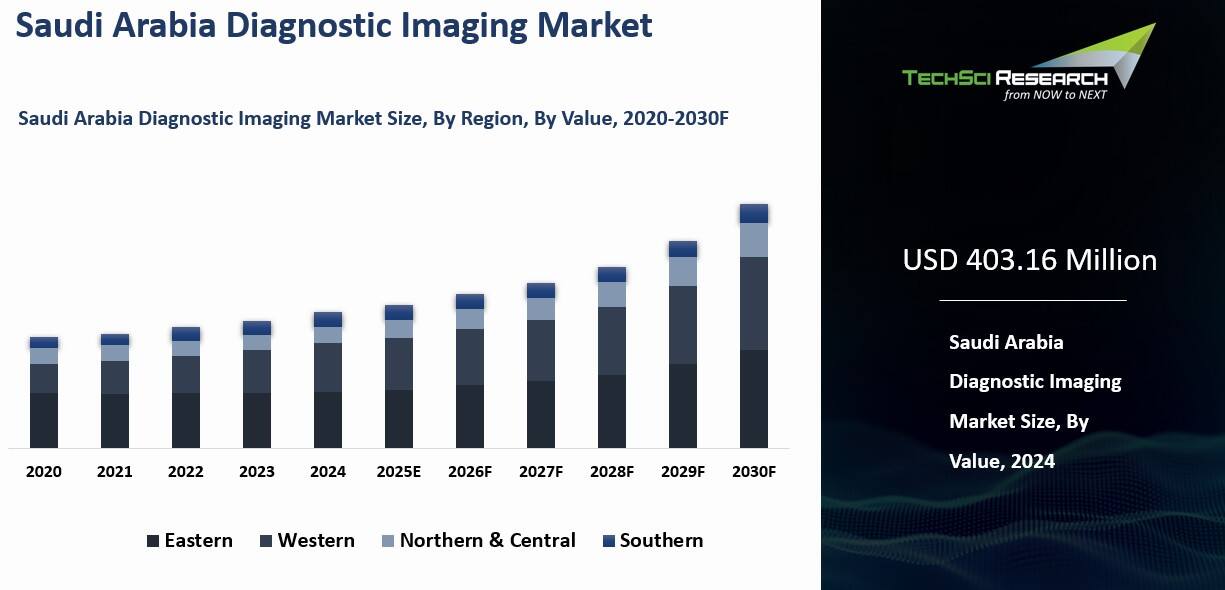

Saudi Arabia Diagnostic Imaging Market was valued at USD 403.16 Million in 2024 and is expected to reach USD 504.00 Million by 2030 with a CAGR of 3.75%.

Diagnostic imaging involves non-invasive techniques that create visual representations of the body’s interior to diagnose, monitor, and treat medical conditions. These images reveal critical information about organs, tissues, and systems, supporting accurate diagnosis and treatment planning. As a cornerstone of modern medicine, diagnostic imaging is essential across specialties helping identify diseases, assess their stage and progression, guide surgical or minimally invasive procedures, and monitor treatment outcomes.

In Saudi Arabia, rising medical tourism especially for complex procedures has driven demand for advanced imaging services. Continuous innovations in MRI, CT, PET-CT, and ultrasound have enhanced diagnostic precision, shortened scan times, and broadened clinical applications. The country’s aging population, prone to chronic diseases, further boosts imaging needs. Additionally, growing awareness about early diagnosis and screening, along with increased investments by private healthcare providers in state-of-the-art equipment, continues to strengthen the diagnostic imaging landscape.

Download Free Sample Report

Key Market Drivers

Rising Prevalence of Chronic Diseases

The rising prevalence of chronic and non-communicable diseases (NCDs) in Saudi Arabia is a key driver of the diagnostic imaging market. The population faces high exposure to NCD risk factors such as obesity, tobacco use, sedentary habits, and poor diets. According to the World Bank, between 54.1% and 70.2% of women and 57.5% and 68.3% of men in the Kingdom are overweight, figures that highlight the urgent need for early diagnosis and preventive healthcare. Conditions such as diabetes, cardiovascular diseases, cancer, and respiratory disorders are increasing rapidly, fueling the demand for advanced imaging technologies. Chronic illnesses often require early detection, regular monitoring, and imaging-based follow-ups. Techniques like CT, MRI, ultrasound, and nuclear imaging are vital for diagnosing cardiovascular issues, assessing cancer progression, and evaluating organ function in diabetic patients creating a sustained demand for diagnostic imaging services.

Saudi Arabia’s evolving demographics, marked by a young yet gradually aging population, along with unhealthy lifestyle patterns high processed food intake, low physical activity, and rising tobacco use are intensifying the chronic disease burden. In 2019, 2.4% of adults used smokeless tobacco, while overall smoking prevalence rose by nearly eight percentage points from 2000 to 2019, reaching 14.36%. Alarmingly, 9.4% of adolescents aged 13-15 were tobacco users by 2022. These factors have contributed to some of the world’s highest diabetes and obesity rates, reinforcing the need for imaging in both diagnosis and long-term management.

To meet rising clinical demands, hospitals and diagnostic centers are investing in advanced imaging systems to improve diagnostic accuracy, reduce waiting times, and handle growing patient volumes especially in rapidly modernizing urban areas. As chronic diseases demand multidisciplinary management, diagnostic imaging now plays a central role in clinical decision-making, guiding interventions, monitoring treatment response, and detecting complications..

Increasing

Aging Population

The demographic shift toward an aging population in Saudi Arabia is emerging as a major driver of growth in the diagnostic imaging market. Over the next decade, the proportion of individuals aged 40 and above, including those over 50 and 60, is set to rise significantly. While the youth population continues to power economic productivity in the near term, the growing elderly segment is reshaping healthcare demand. Aging is closely associated with a higher risk of chronic and degenerative diseases, increasing the need for advanced diagnostic imaging.

According to the Saudi Health Interview Survey (SHIS), which covered over 10,000 adults aged 15 and older, the prevalence of hypertension and diabetes among those aged 65 and above stood at 65% and 50%, respectively. Older adults face a greater risk of osteoporosis, arthritis, cardiovascular diseases, cancer, neurodegenerative disorders such as Alzheimer’s and Parkinson’s, and vision impairments, all of which require precise and timely imaging for diagnosis, monitoring, and treatment planning. Modalities like MRI, CT, DEXA, and ultrasound are widely used in geriatric care, driving up imaging volumes in hospitals and diagnostic centers.

Elderly patients also undergo more frequent imaging due to chronic disease management, post-surgical care, and preventive screening. This repeated utilization sustains long-term growth in imaging demand. In line with Vision 2030, Saudi Arabia is expanding healthcare infrastructure to cater to senior citizens through specialized geriatric units, home healthcare programs, and mobile imaging services. These initiatives improve accessibility while boosting demand for both fixed and portable imaging equipment.

Furthermore, growing awareness of preventive healthcare and early disease detection among the elderly has led to nationwide screening programs targeting common age-related diseases such as breast and prostate cancer, cardiovascular conditions, and bone density loss. These efforts are significantly increasing the volume of diagnostic imaging procedures across the Kingdom.

Key Market Challenges

Workforce

Shortages

Saudi Arabia has

experienced significant population growth, and the demand for healthcare

services, including diagnostic imaging, has risen accordingly. This increased

demand places strain on the healthcare workforce. There may be a shortage of

skilled radiologists, radiologic technologists, medical physicists, and other

professionals who play critical roles in diagnostic imaging. This shortage can

affect the efficiency and quality of diagnostic services. Healthcare providers

in Saudi Arabia often compete for a limited pool of qualified healthcare

professionals.

Many countries worldwide face a similar issue, and the

competition for talent can lead to staffing challenges. Building a skilled

workforce in diagnostic imaging requires time and investment in education and

training programs. The development of a robust educational infrastructure for

radiology and imaging professionals is a key aspect of addressing workforce

shortages. Retaining skilled healthcare professionals can be a challenge. Some

professionals may seek opportunities in other countries with more competitive

salaries or better working conditions, leading to turnover and retention

problems. Workforce shortages may vary by region, with some areas facing more

significant shortages than others, especially in remote and underserved areas.

Cost

Pressures

The overall cost of

healthcare services, including diagnostic imaging, has been increasing due to

factors such as technological advancements, inflation, and the rising cost of

medical equipment and supplies. As the population of Saudi Arabia expands,

there is a growing demand for healthcare services, which, in turn, increases

the overall cost of providing these services, including diagnostic imaging. While

technological advancements have improved diagnostic accuracy and patient care,

they often come with a high price tag. The cost of acquiring, maintaining, and

upgrading advanced imaging equipment can strain healthcare budgets.

The

reimbursement rates from government healthcare programs and insurance providers

may not always keep pace with the rising costs of diagnostic imaging services.

This can lead to financial challenges for healthcare providers. Cost

disparities between the private and public healthcare sectors can create

challenges. Private healthcare providers may be better equipped to invest in

advanced technology, while public facilities may face budget constraints.

Key Market Trends

Environmental

Sustainability

The Saudi government has shown a commitment to sustainability and environmental conservation through initiatives aligned with Vision 2030, and healthcare organizations in the country are aligning their practices with these national goals.

Healthcare facilities are investing in energy-efficient diagnostic imaging equipment to reduce energy consumption and lower operational costs. Studies in Saudi radiology departments show that energy efficiency measures have resulted in energy consumption reductions of 17-35%. These imaging departments can consume 20-50% more energy per square meter than general hospital areas.

Healthcare providers are adopting strategies to reduce radiation doses in diagnostic imaging while maintaining image quality. Techniques such as automatic current modulation and iterative reconstruction technologies are used to lower radiation exposure, which is particularly beneficial for vulnerable patients such as children. This not only improves patient safety but also aligns with environmental sustainability goals by minimizing radiation exposure.

Facilities are increasingly adopting practices for the proper disposal and recycling of diagnostic imaging equipment, which reduces electronic waste and contributes to environmental conservation. Saudi healthcare facilities generate about 180,000 tons of medical waste each year. A study of Saudi radiology departments found that targeted waste management strategies reduced hazardous waste by 23-41%.

The shift from film-based imaging to digital imaging, particularly through the implementation of Picture Archiving and Communication Systems (PACS), reduces the need for chemicals and materials used in film processing. This transition has led to an 82-97% reduction in chemical waste and a 94% decrease in physical storage needs.

Electronic medical records and paperless reporting systems are reducing the use of paper and promoting eco-friendly practices in healthcare settings. More than 80% of hospitals in Saudi Arabia have adopted electronic health records. The Ministry of National Guard Health Affairs (MNGHA), for instance, has been working to become completely paperless. A shift to paperless data has the potential to generate savings between SAR 1.9 billion and SAR 2.7 billion.

Healthcare facilities are being designed with sustainability in mind, including energy-efficient architecture and construction materials that have a reduced environmental impact. With an anticipated need for an additional 20,000 hospital beds, there is a significant opportunity to develop a more sustainable healthcare infrastructure.

Segmental Insights

Type Insights

Based on the category of type, X-Ray Imaging Solutions segment emerged as the fastest growing segment in the Saudi Arabia Diagnostic Imaging Market. X-ray

imaging is a versatile and widely used diagnostic modality for various medical

conditions. It is not limited to a specific medical specialty and can be used for

a broad range of applications, including orthopedics, cardiology, pulmonology,

and general radiology. X-ray machines are relatively more affordable and

accessible compared to some other advanced imaging modalities like MRI or CT

scans.

This accessibility makes X-ray imaging a popular choice for many

healthcare facilities, including hospitals, clinics, and diagnostic centers. X-ray

imaging provides quick results, making it suitable for emergency cases and

routine diagnostics. Patients and healthcare providers often favor X-rays for

their speed and efficiency. X-ray imaging is frequently used for routine

screenings, such as chest X-rays for pulmonary conditions and mammography for

breast cancer screening. These routine screenings contribute to a high volume

of X-ray procedures. X-rays are commonly used in orthopedics for diagnosing

bone fractures, joint dislocations, and other musculoskeletal issues. Since

orthopedic conditions are prevalent, X-ray imaging plays a vital role in this

medical specialty.

Application Insights

Based in the category of application, Oncology segment dominated the Saudi Arabia Diagnostic Imaging Market and is predicted to continue expanding over the coming years. A

significant increase in cancer cases in Saudi Arabia may have led to a higher

demand for oncology-related diagnostic imaging services. This could be

attributed to various factors, including lifestyle changes, increased life

expectancy, and improved cancer detection methods. Saudi Arabia has been

investing in advanced cancer care and treatment, with an emphasis on early

detection and personalized treatment plans.

This could have led to a growing

need for advanced diagnostic imaging modalities to support cancer diagnosis and

staging. The country may have established specialized oncology centers that

focus on providing comprehensive cancer care. These centers would require a

substantial share of diagnostic imaging services for cancer patients. Investments

in cancer research and innovation may have driven the demand for cutting-edge

diagnostic imaging technology in the field of oncology.

This could include the

use of advanced imaging techniques like positron emission tomography (PET)

scans for cancer diagnosis and treatment planning. Saudi Arabia has been

attracting patients from neighbouring countries for specialized medical care,

including cancer treatment. The availability of advanced oncology diagnostic

imaging services is a factor in this attraction.

End-User Insights

Based on category of end-user, Diagnostic Centers segment segment dominates the Saudi Arabia Diagnostic Imaging Market and is predicted

to continue expanding over the coming years. Diagnostic

centers are often dedicated to providing a wide range of diagnostic imaging

services, such as X-rays, CT scans, MRI scans, ultrasound, and more.

Their

specialization in diagnostic services makes them a go-to choose for patients

and referring physicians looking for accurate and comprehensive imaging. Diagnostic

centers typically invest in state-of-the-art diagnostic imaging equipment. This

includes high-quality MRI machines, CT scanners, digital radiography systems,

and advanced ultrasound equipment. The availability of advanced technology

often leads to more accurate diagnoses, attracting both patients and healthcare

providers.

Diagnostic centers are usually strategically located in urban and

accessible areas, making it convenient for patients to schedule appointments

and access services. This convenience factor is especially crucial for patients

seeking routine check-ups or non-emergency imaging. Diagnostic centers often

offer quicker appointment scheduling and faster turnaround times for reporting

results. This is appealing to patients and healthcare professionals who need

prompt diagnoses to initiate treatment plans. Many diagnostic centers offer

extended working hours and even weekend appointments, accommodating the diverse

schedules of patients. This flexibility enhances accessibility for a broader

patient population.

Download Free Sample Report

Regional Insights

Based on region, Northern

& Central region emerged as the largest market in the Saudi Arabia Diagnostic Imaging Market in

2024. The Northern and Central regions of Saudi Arabia, which

include major cities like Riyadh (in the Central region) and Jeddah (in the Western

part of the Central region), have higher population densities compared to other

regions. This concentration of population naturally results in a higher demand

for healthcare services, including diagnostic imaging. These regions are

typically more economically developed and have well-established healthcare

infrastructure.

This includes modern hospitals, clinics, and diagnostic imaging

centers equipped with advanced technology. The presence of a robust healthcare

ecosystem attracts patients and supports the growth of diagnostic imaging

services. Saudi Arabia attracts medical tourists from neighboring countries in

the Middle East and North Africa. Many of these medical tourists prefer to seek

healthcare services in the more developed Northern and Central regions,

contributing to the high demand for diagnostic imaging. The Northern and

Central regions are more likely to host specialized medical facilities and

research centers. These institutions often require advanced diagnostic imaging

services for their research and patient care, further driving the market.

Recent Developments

- In October 2025, Siemens Healthineers showcased its comprehensive portfolio of diagnostic imaging, cancer care, and value-added services at the Global Health Exhibition 2025, reaffirming its commitment to advancing healthcare technology in Saudi Arabia.

- In March 2025, Lunit, a leading provider of AI-powered cancer solutions, expanded its collaboration with Dr. Sulaiman Al Habib Medical Group (HMG). Under this second contract, Lunit’s AI chest X-ray solution Lunit INSIGHT CXR will analyze approximately one million images over three years to improve diagnostic accuracy.

- In February 2025, At the European Congress of Radiology (ECR) 2025, DeepHealth unveiled a new suite of AI-powered radiology informatics and cancer screening solutions. These innovations are designed to streamline clinical workflows and enhance early cancer detection.

- In February 2024, Riverain Technologies expanded its global presence by launching its FDA-cleared ClearRead technology in Saudi Arabia. The AI-powered software is designed to assist radiologists in detecting diseases at an early stage through chest X-ray images, enhancing diagnostic confidence and accuracy.

- In November 2024, Recursive Inc. and the King Abdullah International Medical Research Center (KAIMRC) signed a Memorandum of Understanding (MoU) to develop an AI-based early screening system for tuberculosis, leveraging artificial intelligence to improve public health outcomes.

- In December 2024, PaxeraHealth and Saudi German Health (SGH) extended their partnership to introduce an AI-powered Teleradiology Project, aimed at strengthening remote diagnostic services across SGH facilities.

Key Market Players

- GE Healthcare

- Siemens Ltd. Saudi Arabia

- Philips Healthcare Saudi Arabia Ltd

- Hitachi Medical Systems Saudi Arabia

- Shimadzu Middle East & Africa FZE

- Fujifilm-Middle East

- Medtronic Saudi Arabia Co

- Johnson & Johnson Medical Saudi Arabia Limited

- Abbott Saudi Arabia Trading LLC

- Becton, Dickinson, and Company Saudi Arabia

|

By

Type

|

By

Mobility

|

By

Source

|

By

Application

|

By

End User

|

By

Region

|

- X-Ray

Imaging Solutions

- Ultrasound

Systems

- MRI

Systems

- CT

Scanners

- Nuclear

Imaging Solutions

- Mammography

- Others

|

|

|

- Cardiology

- Oncology

- Neurology

- Orthopaedics

- Gastroenterology

- Gynaecology

- Others

|

- Hospitals

& Clinics

- Diagnostic

Centers

- Ambulatory

Care Centers

- Others

|

- Eastern

- Western

- Northern

& Central

- Southern

|

Report Scope:

In this report, the Saudi Arabia Diagnostic Imaging

Market has been segmented into the following categories, in addition to the

industry trends which have also been detailed below:

- Saudi Arabia Diagnostic Imaging Market, By Type:

o X-Ray Imaging Solutions

o Ultrasound Systems

o MRI Systems

o CT Scanners

o Nuclear Imaging Solutions

o Mammography

o Others

- Saudi Arabia Diagnostic Imaging Market, By Mobility:

o Portable

o Standalone

- Saudi Arabia Diagnostic Imaging Market, By Source:

o Domestic

o Import

- Saudi Arabia Diagnostic Imaging Market, By Application:

o Cardiology

o Oncology

o Neurology

o Orthopaedics

o Gastroenterology

o Gynaecology

o Others

- Saudi Arabia Diagnostic Imaging Market, By End-User:

o Hospitals & Clinics

o Diagnostic Centers

o Ambulatory Care Centers

o Others

- Saudi Arabia Diagnostic Imaging Market, By

Region:

o Eastern

o Western

o Northern & Central

o Southern

Competitive

Landscape

Company

Profiles: Detailed analysis of the major companies presents

in the Saudi Arabia Diagnostic Imaging Market.

Available

Customizations:

Saudi Arabia Diagnostic

Imaging Market report with the given market data, TechSci Research offers customizations according to a company's specific needs. The

following customization options are available for the report:

Company

Information

- Detailed

analysis and profiling of additional market players (up to five).

Saudi Arabia

Diagnostic Imaging Market is an upcoming report to be released

soon. If you wish an early delivery of this report or want to confirm the date

of release, please contact us at[email protected]