|

Forecast Period

|

2026-2030

|

|

Market Size (2024)

|

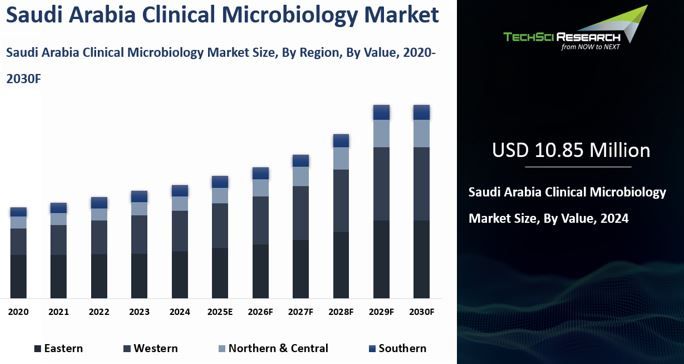

USD 10.85 Million

|

|

CAGR (2025-2030)

|

3.38%

|

|

Fastest Growing Segment

|

Laboratory Instruments

|

|

Largest Market

|

Northern & Central

|

|

Market Size (2030)

|

USD 13.09 Million

|

Market Overview

Saudi

Arabia Clinical Microbiology Market was valued at USD 10.85 Million in 2024 and

is expected to reach USD 13.09 Million by 2030 with a CAGR of 3.38% during the

forecast period.

The clinical microbiology market in Saudi Arabia is witnessing

steady growth, driven by the increasing demand for accurate and timely

diagnostic services in healthcare. As the country continues to enhance its

healthcare infrastructure, the role of clinical microbiology in diagnosing,

treating, and preventing infectious diseases has become more crucial. This

market covers a wide range of applications, including pathogen identification,

antimicrobial susceptibility testing, and the detection of hospital-acquired

infections, all of which are vital to improving patient outcomes and ensuring

public health.

The

growing prevalence of infectious diseases, such as respiratory infections,

gastrointestinal diseases, and bloodstream infections, is a key factor driving

the demand for advanced clinical microbiology services. As a result, healthcare

providers are investing in state-of-the-art diagnostic tools, such as molecular

diagnostics, polymerase chain reaction (PCR) testing, and next-generation

sequencing (NGS), to improve the speed and accuracy of microbial detection.

These technologies are playing an essential role in reducing diagnostic delays,

enabling quicker treatments, and curbing the spread of infectious diseases.

However,

challenges such as the high cost of advanced diagnostic technologies and a

shortage of skilled microbiologists may hinder market expansion. Addressing

these challenges will be essential for ensuring that the latest innovations in

clinical microbiology can be widely adopted across the healthcare sector.

Download Free Sample Report

Key Market Drivers

Growth in Healthcare Industry

The

expansion of hospitals, clinics, and diagnostic centers across Saudi Arabia has

led to a higher demand for clinical microbiology services, particularly in

diagnosing infectious diseases. As of 2020, there are a total of 504

hospitals. Of these, 287 are managed by the Ministry of Health, 50 are operated

by other governmental entities, and the remaining 167 are privately run. As

healthcare providers focus on delivering timely and accurate diagnostics, the

need for advanced microbiological testing tools has grown. Clinical

microbiology plays a crucial role in identifying pathogens, monitoring disease

outbreaks, and guiding effective treatment plans, which is essential as the

healthcare system scales up to meet the needs of a growing population.

The

rapid development of healthcare facilities in Saudi Arabia has highlighted the

importance of preventing healthcare-associated infections (HAIs), which are a

major concern for hospitals worldwide. As part of Vision 2030, the Saudi

Arabian Government is set to invest over USD 65 billion to enhance the

country’s healthcare infrastructure, restructure and privatize health services

and insurance, establish 21 health clusters nationwide, and expand e-health

services. Additionally, the initiative aims to boost private sector involvement

from 40 percent to 65 percent by 2030, with plans to privatize 290 hospitals

and 2,300 primary health centers. This creates substantial commercial

opportunities for U.S. companies in Saudi Arabia’s evolving healthcare market. Clinical

microbiology is critical for detecting and controlling the spread of these

infections by providing healthcare providers with reliable data on pathogens,

antimicrobial resistance patterns, and contamination sources. The increasing

focus on infection control and patient safety in hospitals and healthcare

facilities has driven the demand for more sophisticated clinical microbiology

services.

Surge in Technological Advancements

The

surge in technological advancements is a key driver propelling the growth of

the clinical microbiology market in Saudi Arabia. As the healthcare sector

increasingly adopts cutting-edge diagnostic technologies, the demand for

advanced microbiological testing methods has risen significantly. These

advancements not only improve the accuracy and speed of diagnosis but also

enhance the capacity to detect a wider range of pathogens, making them

essential for effective disease management and infection control.

One

of the major areas where technological progress is transforming clinical

microbiology is the integration of automated systems and artificial

intelligence (AI). In collaboration with KAIMRC scientists, physicians from

the Ministry of National Guard Health Affairs (MNGHA), and Recursive, chest

X-ray imaging data will be leveraged to improve early screening and detection

of TB. This partnership reflects Recursive's dedication to driving a

sustainable future by utilizing advanced AI technology for healthcare

innovation. Automation in microbial testing allows laboratories to process

high volumes of samples efficiently, reducing human error and significantly

speeding up the time to diagnosis. AI-driven platforms further optimize this

process by analyzing complex data sets, identifying microbial patterns, and

offering predictive insights into infection trends. These technologies are

particularly valuable in Saudi Arabia's growing healthcare infrastructure,

where rapid and accurate diagnosis is crucial for patient outcomes, especially

in the management of healthcare-associated infections (HAIs) and emerging

diseases.

Key Market Challenges

High Cost of Equipment and

Technology

The

high cost of equipment and technology represents a significant challenge to the

growth of the clinical microbiology market in Saudi Arabia. Advanced diagnostic

tools, such as polymerase chain reaction (PCR) machines, next-generation

sequencing (NGS) platforms, and automated microbial identification systems, are

essential for ensuring precision and efficiency in detecting infectious

diseases. However, the acquisition, installation, and maintenance of this

state-of-the-art technology come with substantial financial burdens,

particularly for smaller healthcare facilities and laboratories.

For

many institutions, the high upfront costs associated with purchasing advanced

microbiology equipment create barriers to adoption. Smaller clinics and

regional hospitals may struggle to allocate the necessary capital for such

investments, resulting in a reliance on outdated, manual methods that are less

accurate and efficient. This disparity in technological access can lead to

slower diagnostic processes, delayed treatment decisions, and suboptimal

patient outcomes, particularly in the fight against fast-spreading infections.

Key Market Trends

Increasing Adoption of

Point-of-Care Testing (POCT)

The primary advantage of POCT in clinical microbiology is the ability to deliver timely diagnostic results at the point of care, enabling healthcare providers to diagnose infections quickly and initiate appropriate treatments without delay. Emerging trends in point-of-care testing (POCT) include advancements in less invasive methods, the rise of miniaturized technologies developed at research hubs like King Abdullah University of Science and Technology (KAUST), and the increasing use of telemedicine for remote monitoring, all aligned with Saudi Vision 2030's goals for digital transformation. At the core of POCT is the biosensor, which enables accurate diagnostics and facilitates real-time health monitoring.

This is particularly important in cases where rapid intervention is critical, such as sepsis, respiratory infections, and healthcare-associated infections (HAIs). The increasing emphasis on improving patient outcomes has contributed to the rising adoption of POCT in Saudi Arabia's over 2,000 hospitals and numerous clinics and emergency care settings.

The adoption of POCT is also driving the decentralization of diagnostic services in Saudi Arabia. Traditionally, microbiological tests were performed in central laboratories, leading to delays. With POCT, testing can be performed directly at the patient’s bedside or in outpatient settings, minimizing the need for sample transportation and reducing waiting times. This shift toward decentralized testing is improving the accessibility of microbiological diagnostics, particularly in remote or underserved areas, supporting the country’s efforts under the Health Sector Transformation Program to enhance healthcare equity and reach a broader population.

Segmental Insights

Product Insights

Based

on Product, Laboratory Instruments have emerged as the fastest growing segment

in the Saudi Arabia Clinical Microbiology Market in 2024. One of the primary

reasons for this surge is the adoption of automated laboratory instruments.

These systems streamline the workflow in microbiology labs by automating key

processes such as sample preparation, microbial culturing, and identification.

The integration of automation reduces human error, enhances efficiency, and

significantly shortens the time needed for diagnostic results, making it

indispensable for hospitals and clinical laboratories in Saudi Arabia. As

healthcare facilities focus on improving turnaround times and diagnostic

accuracy, the demand for automated laboratory instruments has grown

exponentially.

Disease Insights

Based

on Disease, Respiratory Diseases have emerged as the fastest-growing segment in

the Saudi Arabia Clinical Microbiology Market during the forecast period. One

of the primary drivers is the increasing prevalence of respiratory infections,

such as tuberculosis, influenza, and, more recently, COVID-19, which has

heightened the demand for advanced microbial diagnostics. The rise in

respiratory conditions linked to environmental factors, such as high levels of

air pollution and dust in the region, has also contributed to the growing need

for respiratory disease diagnostics.

Download Free Sample Report

Regional Insights

Based on region, Northern and Central Saudi Arabia have emerged as the dominating regions in the Saudi Arabia Clinical Microbiology Market in 2024. These regions are home to a large number of advanced hospitals, healthcare centers, and research institutions, particularly in cities like Riyadh, which serves as the capital and a healthcare hub with over 40 hospitals. The concentration of these facilities, including major centers like King Faisal Specialist Hospital & Research Centre, drives demand for clinical microbiology services, including pathogen detection, infection control, and disease diagnostics, making Northern and Central Saudi Arabia the leading regions in the market.

Recent Development

- August 2025: MS Pharma launched a new biologics manufacturing plant in Saudi Arabia following a $50 million investment. Designed to meet U.S. FDA and European standards, the facility will focus on producing monoclonal antibodies and complex peptides. It also houses the region’s first in-house bioanalytical testing laboratories, expected to significantly accelerate the approval process for essential medicines.

- May 2025: ImmunityBio signed a Memorandum of Understanding (MoU) with Saudi Arabia’s Ministry of Investment (MISA), King Faisal Specialist Hospital & Research Centre (KFSH&RC), and King Abdullah International Medical Research Center (KAIMRC). This collaboration aims to launch the FDA-approved Cancer BioShield platform, localize advanced immunotherapy technologies, and establish a regional center of excellence.

- February 2025: Saudi German Health (SGH), a leading healthcare provider in the region, signed an MoU with BD (Becton, Dickinson and Company), a global leader in advanced healthcare solutions. The agreement focuses on introducing rapid and precise microbiology diagnostic technologies across SGH facilities. This partnership aims to address current microbiology challenges by offering fast, accurate diagnostic solutions that enhance patient outcomes and set new benchmarks for healthcare efficiency across the region.

- January 2024: The MIT Jameel Clinic entered a partnership with King Faisal Specialist Hospital and Research Centre (KFSH&RC) in Saudi Arabia to advance AI-driven clinical research. The collaboration integrates the clinic’s breast and lung cancer prediction technologies, Mirai and Sybil, into local research initiatives, enhancing patient care and improving clinical outcomes. This expansion underscores Saudi Arabia’s ongoing commitment to healthcare innovation, supported by strategic investments in infrastructure, education, training, and policy frameworks that position the country as a regional leader in medical advancements.

- August 2024: The Ministry of Health announced a major initiative to modernize the healthcare system through digital transformation and innovation. The newly launched “Regulatory Healthcare Sandbox” program aims to foster the development and adoption of cutting-edge healthcare solutions. Aligned with the objectives of the Virtual Health Hospital (Seha), this initiative highlights the government’s strong commitment to advancing the nation’s healthcare capabilities through technology.

- March 2024: Esco Lifesciences partnered with Al Fahim Healthcare Solutions during Medlab 2024, held at the Dubai World Trade Centre. The event facilitated productive meetings with Esco Lifesciences’ global distributors from Saudi Arabia, Jordan, Qatar, Oman, Pakistan, and India, emphasizing the company’s growing regional presence. Discussions paved the way for collaborations in pharmaceutical manufacturing, public health, government hospitals, and international research universities—reinforcing Esco Lifesciences’ role in driving healthcare innovation across the Middle East and beyond.

Key Market Players

- Becton,

Dickinson and Company

- Bruker

Arabia Limited

- Hologic,

Inc.

- Bio-Rad

Laboratories, Inc.

- Danaher

Corporation

|

By Product

|

By Disease

|

By Region

|

- Laboratory Instruments

- Automated Culture System

- Reagents

|

- Respiratory Diseases

- Bloodstream Infections

- Gastrointestinal Diseases

- Sexually Transmitted Diseases

- Urinary Tract Infections

- Periodontal Diseases

- Others

|

- Eastern

- Western

- Northern & Central

- Southern

|

Report Scope

In this report, the Saudi Arabia Clinical

Microbiology Market has been segmented into the following categories, in

addition to the industry trends which have also been detailed below:

- Saudi Arabia Clinical Microbiology Market, By Product:

o Laboratory Instruments

o Automated Culture System

o Reagents

- Saudi Arabia Clinical Microbiology Market, By Disease:

o Respiratory Diseases

o Bloodstream Infections

o Gastrointestinal Diseases

o Sexually Transmitted Diseases

o Urinary Tract Infections

o Periodontal Diseases

o Others

- Saudi Arabia Clinical Microbiology Market, By Region:

o Eastern

o Western

o Northern & Central

o Southern

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Saudi

Arabia Clinical Microbiology Market.

Available Customizations:

Saudi Arabia Clinical Microbiology Market report

with the given market data, Tech Sci Research offers customizations according

to a company's specific needs. The following customization options are

available for the report:

Company Information

- Detailed analysis and profiling of additional

market players (up to five).

Saudi Arabia Clinical

Microbiology Market is an upcoming report to be released soon. If you wish an

early delivery of this report or want to confirm the date of release, please

contact us at [email protected]