|

Forecast

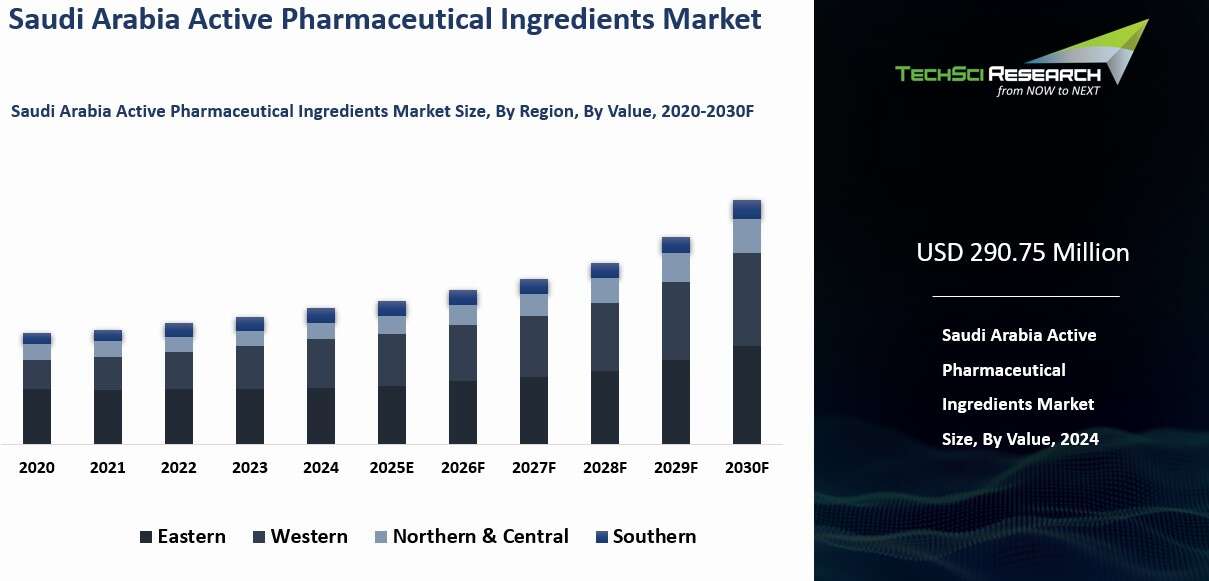

Period

|

2026-2030

|

|

Market

Size (2024)

|

USD

290.75 Million

|

|

Market

Size (2030)

|

USD

417.62 Million

|

|

CAGR

(2025-2030)

|

6.18%

|

|

Fastest

Growing Segment

|

Synthetic

|

|

Largest

Market

|

Northern

and Central

|

Market Overview

Saudi

Arabia Active Pharmaceutical Ingredients Market was valued at USD 290.75 Million in 2024 and is expected to reach USD 417.62 Million by 2030 with a CAGR of 9.56% during the forecast period.

The Active Pharmaceutical Ingredients

(API) market in Saudi Arabia is a critical segment of the country’s

pharmaceutical industry, which is experiencing notable expansion. This growth

is fueled by rising healthcare needs, substantial government investment, and a

shift toward enhancing local manufacturing capabilities. As one of the largest

pharmaceutical markets in the Middle East, Saudi Arabia is integral to the

regional API supply chain, both as a consumer and a producer.

The

demand for APIs is driven by the increasing prevalence of chronic diseases such

as diabetes, cardiovascular conditions, and cancer, which necessitate both

essential and specialized pharmaceutical products. Additionally, the growing

adoption of generic drugs is stimulating API production, as generics typically

rely on more cost-effective active ingredients compared to branded drugs.

This

trend is further supported by government policies that encourage the use of

generics to reduce healthcare costs and improve access to medications. The

regulatory landscape, overseen by the Saudi Food and Drug Authority (SFDA),

ensures that all APIs meet international standards of quality, safety, and

efficacy. The SFDA’s rigorous regulations foster a controlled and high-quality

manufacturing environment, which is essential for long-term market stability

and growth.

The

Saudi API market is poised for continued expansion. Local production capacity

is set to increase, driven by government initiatives aimed at reducing reliance

on imports and promoting domestic manufacturing. This will be complemented by

growing demand for high-quality generic APIs and further investment in the

sector. As Saudi Arabia aligns its pharmaceutical sector with Vision 2030, the

market is expected to become an even more prominent player within the MENA

region, creating new avenues for innovation, investment, and market leadership

in API production.

Download Free Sample Report

Key Market Drivers

Rising Healthcare Demand and

Disease Prevalence

Rising healthcare demand and increasing disease prevalence are driving the growth of the Active Pharmaceutical Ingredients (API) market in Saudi Arabia. Population growth, longer life expectancy, and changing demographics are expanding the need for pharmaceuticals, with total API consumption estimated to grow from 2.91 million Kgs in 2021 to 3.97 million Kgs by 2026. This is particularly true for chronic conditions such as diabetes, which costs the Kingdom SAR 17 billion annually, hypertension, cardiovascular diseases, and obesity. Older populations experience a higher incidence of these conditions, which creates a consistent demand for APIs in treatments like insulin, antihypertensives, and medications for cardiovascular health.

Saudi Arabia represents 60% of healthcare expenditure in the Gulf Cooperation Council (GCC), with the government allocating $50.4 billion to healthcare and social development in 2023. Healthcare is a strategic priority, with initiatives like mandatory local-content quotas for Ministry of Health tenders, which cover about 60% of national drug purchases, stimulating API demand. A plan for universal insurance by 2026 and a target to raise domestic pharmaceutical production to 40% ensure a steady need for pharmaceutical products to address both chronic and acute conditions.

Specialized treatments are becoming increasingly important, particularly in oncology and immunology. Cancer cases are projected to rise from 27,885 in 2020 to 60,429 by 2040, driving demand for targeted therapies and biologics. The shift toward personalized medicine and complex treatment regimens is supported by government-backed biologics clusters being developed in King Abdullah Economic City (KAEC) and Jeddah, which require high-quality APIs for advanced therapies like monoclonal antibodies.

The government’s public health initiatives also play a role in increasing API demand. Programs aimed at preventing lifestyle diseases such as diabetes and hypertension, combined with nationwide screening and early detection efforts, encourage more patients to seek timely pharmaceutical care. Vision 2030 and the National Transformation Program further strengthen healthcare accessibility, with localization incentives like cash grants and 30-year tax relief driving growth in local pharmaceutical production.

Global health trends influence Saudi Arabia as well. Rising rates of metabolic diseases, cancer, and other non-communicable diseases increase demand for modern treatments. The Kingdom’s position as a regional healthcare leader attracts international pharmaceutical companies, with over 350 multinationals having secured regional headquarters licenses by March 2024, introducing advanced medications and therapies that rely heavily on APIs. This trend, exemplified by insulin production tie-ups with companies like Novo Nordisk and Sanofi, boosts the market for both essential and specialized ingredients.

Overall, the combination of rising chronic and specialized disease prevalence, government investment in healthcare infrastructure, preventive health initiatives, increasing adoption of personalized medicine, and international pharmaceutical participation is creating sustained growth in Saudi Arabia’s API market, ensuring a robust pipeline of demand for both domestic and imported APIs.

Government Initiatives and

Policy Support

Government initiatives and policy support are key drivers of Saudi Arabia’s Active Pharmaceutical Ingredients (API) market. Vision 2030 emphasizes healthcare workforce development and the growth of the pharmaceutical sector, aiming to recruit 175,000 healthcare professionals by 2030, including 69,000 doctors, 64,000 nurses, and 42,000 allied health workers. These measures address the rising healthcare demand, reduce reliance on imports, and support the development of a competitive local pharmaceutical industry.

Vision 2030 encourages local production of pharmaceuticals, including APIs, to build a self-sufficient supply chain, create jobs, and foster industrial innovation. The National Transformation Program (NTP) complements this by improving healthcare access, expanding drug production capacity, and enhancing treatment quality. These initiatives stimulate both domestic and foreign investment in API manufacturing, boosting production capabilities and technological advancement.

The Saudi Food and Drug Authority (SFDA) ensures all APIs meet international quality and safety standards. Regulatory reforms have streamlined approval processes, reduced bureaucratic hurdles, and accelerated time-to-market for new products. This clarity attracts international pharmaceutical companies to invest in the Kingdom.

Financial incentives further support the sector, including tax exemptions, reduced customs duties on raw materials, and grants for research and development. Public-private partnerships promote innovation and the production of high-quality, cost-effective APIs for domestic and regional markets.

Localization strategies target domestic API manufacturing, reducing historical dependence on imports from countries like India and China. Incentives encourage building new facilities, upgrading existing plants, and adopting advanced technologies to enhance efficiency. Expanding the local API base ensures a stable and cost-effective supply of pharmaceuticals while strengthening Saudi Arabia’s position in the regional healthcare market..

Shift Toward Generic Medicines

The shift toward generic medicines is a major driver of Saudi Arabia’s Active Pharmaceutical Ingredients (API) market. Growing demand for cost-effective drugs is reshaping the pharmaceutical landscape, creating a need for high-quality APIs that form the backbone of generics. Government policies, cost-saving measures, and evolving healthcare preferences are fueling this transition. Generic medicines provide affordable treatment options for chronic conditions such as diabetes, hypertension, and cardiovascular diseases, helping both public and private healthcare providers manage rising costs. For manufacturers, generics offer a lower-cost alternative to developing new branded drugs, directly increasing the demand for APIs.

The Saudi government strongly supports generic adoption as part of healthcare reforms. Policies and financial incentives, including subsidies, tax breaks, and regulatory streamlining by the SFDA, encourage local production of generic APIs. Regulatory clarity and expedited approval processes allow generics to enter the market quickly, building confidence among consumers and healthcare providers. Currently, generics account for less than 20 percent of the pharmaceutical market, but rising healthcare costs and a shift toward a market-driven system are expected to expand their share in both public and private sectors.

Chronic diseases and an aging population further drive demand for generics. Lifelong treatments for conditions like diabetes and cancer make affordable options essential, boosting the need for APIs. Global trends also influence Saudi Arabia, as developed markets increasingly prioritize generics for cost containment. Regional demand across the MENA region strengthens this trend, positioning Saudi Arabia to meet both domestic and export needs.

Local API production aligns with this shift, reducing dependence on imports, stabilizing supply, and enabling export opportunities. Government incentives, infrastructure support, and research grants encourage domestic manufacturing, enhancing competitiveness and ensuring a steady supply of APIs for generics. As the adoption of generics grows, the demand for APIs continues to rise, making Saudi Arabia’s pharmaceutical sector more self-reliant and regionally influential.

Key Market Challenges

Dependence on Imported Raw

Materials and Technology

One

of the most significant challenges facing the Saudi Arabian API market is the

heavy reliance on imported raw materials and technology. While the Kingdom has

made strides in promoting local pharmaceutical manufacturing, a large portion

of the active ingredients used in the production of both branded and generic

medicines is still imported from countries like India, China, and Europe. This

dependency on foreign suppliers creates vulnerabilities in the supply chain,

including fluctuations in raw material prices, geopolitical risks, and issues

related to international trade.

The

production of APIs often requires advanced technology, specialized equipment,

and expertise in manufacturing processes. While Saudi Arabia has made progress

in developing its local production capabilities, there remains a gap in terms

of cutting-edge technology and know-how. As a result, local manufacturers face

challenges in scaling up production to meet the growing demand for APIs,

particularly for complex and biologic ingredients. The lack of sufficient

domestic production capacity and reliance on foreign suppliers can lead to

disruptions in supply, increased costs, and difficulty in meeting market

demands in a timely manner.

To

address this challenge, Saudi Arabia has been focusing on fostering local

production through public-private partnerships and attracting foreign

investment to build state-of-the-art manufacturing facilities. However, the

transition to self-sufficiency in API production will take time, and until that

happens, the market will remain vulnerable to external disruptions and price

volatility.

Regulatory and Compliance

Challenges

The

Saudi Arabian pharmaceutical industry, including the API market, is subject to

stringent regulatory frameworks governed by the Saudi Food and Drug Authority

(SFDA). While these regulations are designed to ensure safety, efficacy, and

quality, they can also pose significant challenges to API manufacturers. The

regulatory requirements for API production are complex and often involve

lengthy approval processes, particularly for new products or for generics that

are being introduced to the market.

The

process of obtaining approvals for both the importation of APIs and the

registration of locally manufactured APIs can be time-consuming and expensive,

which discourages some manufacturers from entering the market or expanding

their operations. In addition, the SFDA imposes strict quality control

standards that require significant investments in technology, facilities, and

testing processes to ensure compliance. Smaller local manufacturers, in

particular, may struggle to meet these high standards, limiting their ability

to compete effectively with international players.

Another

issue is the harmonization of Saudi regulations with international standards.

While Saudi Arabia is increasingly aligning its pharmaceutical regulations with

global best practices, differences between local and international regulatory

requirements can lead to delays and additional costs for API producers,

especially those who wish to export their products. Regulatory complexity,

coupled with a lack of clear guidance in some areas, continues to be a

significant barrier to the growth of the Saudi API market.

Key Market Trends

Increased Focus on

Biotechnology and Biopharmaceuticals

One

of the most prominent trends influencing the future of the Saudi Arabian API

market is the growing emphasis on biotechnology and biopharmaceuticals. With

advancements in biologics and biosimilars, the pharmaceutical industry is

experiencing a shift from traditional small-molecule drugs to more complex

biologic treatments. These biologic drugs, which include monoclonal antibodies,

recombinant proteins, and gene therapies, rely on specialized APIs that require

advanced manufacturing processes and cutting-edge technology.

As

Saudi Arabia moves towards improving its healthcare system and expanding access

to modern treatments, the demand for biologic drugs is anticipated to rise.

This trend is already visible in the increasing focus on cancer therapies,

autoimmune disease treatments, and personalized medicine, all of which heavily

rely on biologic APIs. The Saudi government’s efforts to boost local

pharmaceutical manufacturing, combined with its push to foster biotechnology

and innovation, will create a favorable environment for the growth of

biopharmaceutical API production in the Kingdom. The establishment of local

manufacturing facilities for biologics and biosimilars will allow Saudi Arabia

to reduce reliance on international suppliers and capture a larger share of the

MENA region’s rapidly expanding market for biologics. This trend will likely

drive both domestic production and exports, positioning Saudi Arabia as a key

player in the biopharmaceutical space.

Adoption of Advanced

Manufacturing Technologies (Industry 4.0)

The

integration of advanced manufacturing technologies, often referred to as

Industry 4.0, is another trend expected to drive the future growth of the Saudi

API market. Industry 4.0 encompasses the use of automation, artificial

intelligence (AI), machine learning, the Internet of Things (IoT), and big data

analytics to optimize manufacturing processes, enhance quality control, and

reduce operational costs.

As

API manufacturers in Saudi Arabia look to improve efficiency, reduce production

costs, and increase the scale of their operations, the adoption of these

advanced technologies will be crucial. Automation and AI can help streamline

the production of APIs, while IoT-enabled systems can provide real-time

monitoring and predictive maintenance, minimizing downtime and increasing

productivity. Big data analytics can further enhance decision-making by

providing insights into production efficiency, supply chain management, and

customer demand. These technologies also enable manufacturers to improve the

quality and consistency of their APIs, ensuring compliance with global

standards. With the regulatory landscape in Saudi Arabia becoming increasingly

aligned with international guidelines, the implementation of Industry 4.0

technologies will be essential for maintaining competitiveness in both domestic

and international markets.

Moreover,

Industry 4.0 technologies enable the production of more complex APIs, such as

those required for biologics and high-potency drugs, further enhancing the

Kingdom’s ability to meet growing demand for advanced pharmaceutical products.

Segmental Insights

Type of Synthesis Insights

The synthetic segment dominated the Saudi Arabia Active Pharmaceutical Ingredients (API) market in 2024, primarily due to cost-effectiveness and scalability. Synthetic APIs require less time and raw material investment compared to biotechnological or natural extraction methods, enabling large-scale production of essential medicines. In a market with rising chronic diseases and growing demand for affordable medications, synthetic APIs help reduce costs, especially for generics. Their ability to scale production ensures a steady supply of key ingredients, supporting local manufacturing and reducing import dependence.

Synthetic APIs are used across therapeutic areas, including cardiovascular, anti-infective, oncology, and central nervous system disorders. They are essential for producing widely used medicines such as statins, antihypertensives, and insulin. Typically small molecules, they can be formulated into oral tablets, injectables, and other dosage forms, making them accessible and effective. Their broad applicability and critical role in both branded and generic drugs make synthetic APIs a cornerstone of the Saudi pharmaceutical market. The combination of affordability, versatility, and production efficiency continues to drive growth in this segment..

Type Insights

The Innovative API segment in Saudi Arabia is expected to grow rapidly, driven by rising demand for specialized, targeted, and personalized treatments. Chronic and complex diseases such as cancer, diabetes, autoimmune disorders, and cardiovascular conditions require novel therapies. Innovative APIs, particularly for biologic drugs like monoclonal antibodies, recombinant proteins, and gene therapies, enable precise and effective treatment options. Saudi Arabia’s expanding oncology and immunology markets rely heavily on these APIs, and local production helps provide advanced treatments while addressing complex healthcare needs. Growing patient awareness and demand for specialized therapies further boost the segment’s prominence.

Government support under Vision 2030 is a key driver. Policies encourage domestic production of innovative APIs through tax exemptions, R&D subsidies, and funding for advanced manufacturing facilities. Investments in healthcare infrastructure, biotechnology, and pharmaceutical manufacturing aim to reduce reliance on imported medicines. Collaborations between private companies and research institutions foster expertise in cutting-edge drug production. This strategic focus on self-sufficiency is expected to consolidate the market, allowing larger players to capture significant share and strengthen Saudi Arabia’s position in the global innovative API sector.

Download Free Sample Report

Regional Insights

In 2024, the Northern and Central regions dominated Saudi Arabia’s Active Pharmaceutical Ingredients (API) market by value. Riyadh, the capital of the Central region, serves as the political and economic hub of the Kingdom. Its central location and developed infrastructure make it ideal for pharmaceutical manufacturing, research, and distribution. Riyadh hosts numerous pharmaceutical companies, research centers, and government institutions, and functions as a logistics hub for efficient API distribution nationwide.

The Northern region, including cities like Al-Jouf and Hail, benefits from proximity to strategic borders and trade routes, facilitating exports to the Middle East and North Africa. Both regions feature advanced industrial infrastructure, including state-of-the-art manufacturing facilities for generic and innovative APIs. Industrial parks in Riyadh provide incentives such as tax breaks, skilled labor access, and financial support, attracting domestic and international pharmaceutical firms. This combination of infrastructure, strategic location, and policy support strengthens the Northern and Central regions as key contributors to Saudi Arabia’s API production and supply chain.

Recent Developments

- In First Quarter 2025, the Saudi General Authority for Competition reported a 16% year-on-year increase in M&A filings, with 80% of transactions involving foreign entities. The manufacturing sector led this activity, signalling a dynamic environment for strategic consolidation and foreign investment in industries like API manufacturing.

- In January 2025, in a significant development aimed at enhancing cancer treatment in the Middle East, BOSTON ONCOLOGY ARABIA and SPIMACO have formalised a Memorandum of Understanding (MoU) to establish local production of advanced oral oncology therapies within the Kingdom.

- In

December 2024, Bio-Thera Solutions Inc., a commercial-stage biopharmaceutical

company focused on developing innovative therapies and biosimilars, has

announced a strategic partnership with Tabuk Pharmaceutical Manufacturing

Company, a wholly-owned subsidiary of Astra Industrial Group and a leading

pharmaceutical company in the MENA region. Under the agreement, Tabuk will hold

exclusive rights to manufacture, distribute, and market BAT2206, Bio-Thera’s

ustekinumab biosimilar, in Saudi Arabia.

- In October 2024, Eisai Saudi Arabia officially commenced business activities, launching sales and marketing for two of its key products: Methycobal (mecobalamin), used for peripheral neuropathies, and Fycompa (perampanel), an anti-epileptic drug. This marked a significant step in bringing new neurological and CNS (Central Nervous System) treatments to the Saudi market.

Key Market Players

- Pfizer

Scientific Technical Limited Company

- Aurobindo

Pharma Limited

- Novartis

AG

- BASF

Saudi Arabia Co. Ltd.

- Viatris

Inc

- Novo

Nordisk Saudi Arabia

|

By

Type of Synthesis

|

By

Type of Manufacturer

|

By

Type

|

By

Application

|

By

Type of Drugs

|

By

Region

|

- Synthetic

- Biotech

- Monoclonal

Antibodies

- Recombinant

Proteins

- Vaccines

- Hormones

- Cytokines

- Therapeutic

Enzymes

- Blood

Factors

|

- Captive

APIs

- Merchant

APIs

- Biotech

Merchant APIs

- Synthetic

Merchant APIs

|

- Generic

APIs

- Innovative

APIs

|

- Cardiovascular

Diseases

- Oncology

- CNS

and Neurology

- Orthopedic

- Endocrinology

- Pulmonology

- Gastroenterology

- Nephrology

- Ophthalmology

- Others

|

|

- Eastern

- Western

- Northern

& Central

- Southern

|

Report Scope:

In this report, the Saudi Arabia Active

Pharmaceutical Ingredients Market has been segmented into the following

categories, in addition to the industry trends which have also been detailed

below:

- Saudi Arabia Active Pharmaceutical Ingredients

Market, By Type of Synthesis:

o Synthetic

o Biotech

o Monoclonal Antibodies

o Recombinant Proteins

o Vaccines

o Hormones

o Cytokines

o Therapeutic Enzymes

o Blood Factors

- Saudi Arabia Active Pharmaceutical Ingredients

Market, By Type of Manufacture:

o Captive APIs

o Merchant APIs

o Biotech Merchant APIs

o Synthetic Merchant APIs

- Saudi Arabia Active Pharmaceutical Ingredients

Market, By Type:

o Generic APIs

o Innovative APIs

- Saudi Arabia Active Pharmaceutical Ingredients

Market, By Application:

o Cardiovascular Diseases

o Oncology

o CNS and Neurology

o Orthopedic

o Endocrinology

o Pulmonology

o Gastroenterology

o Nephrology

o Ophthalmology

o Others

- Saudi Arabia Active Pharmaceutical Ingredients

Market, By Type of Drugs:

o Prescription

o OTC

- Saudi Arabia Active Pharmaceutical Ingredients

Market, By Region:

o Eastern

o Western

o Northern & Central

o Southern

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Saudi

Arabia Active Pharmaceutical Ingredients Market.

Available Customizations:

Saudi Arabia

Active Pharmaceutical Ingredients market report with the given market

data, TechSci Research offers customizations according to a company's specific

needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional

market players (up to five).

Saudi Arabia Active Pharmaceutical Ingredients

Market is an upcoming report to be released soon. If you wish an early delivery

of this report or want to confirm the date of release, please contact us at [email protected]