|

Forecast

Period

|

2026-2030

|

|

Market

Size (2024)

|

USD

4.68 Billion

|

|

Market

Size (2030)

|

USD

7.49 Billion

|

|

CAGR

(2025-2030)

|

8.11%

|

|

Fastest

Growing Segment

|

Plastics

& Polymers

|

|

Largest

Market

|

West

India

|

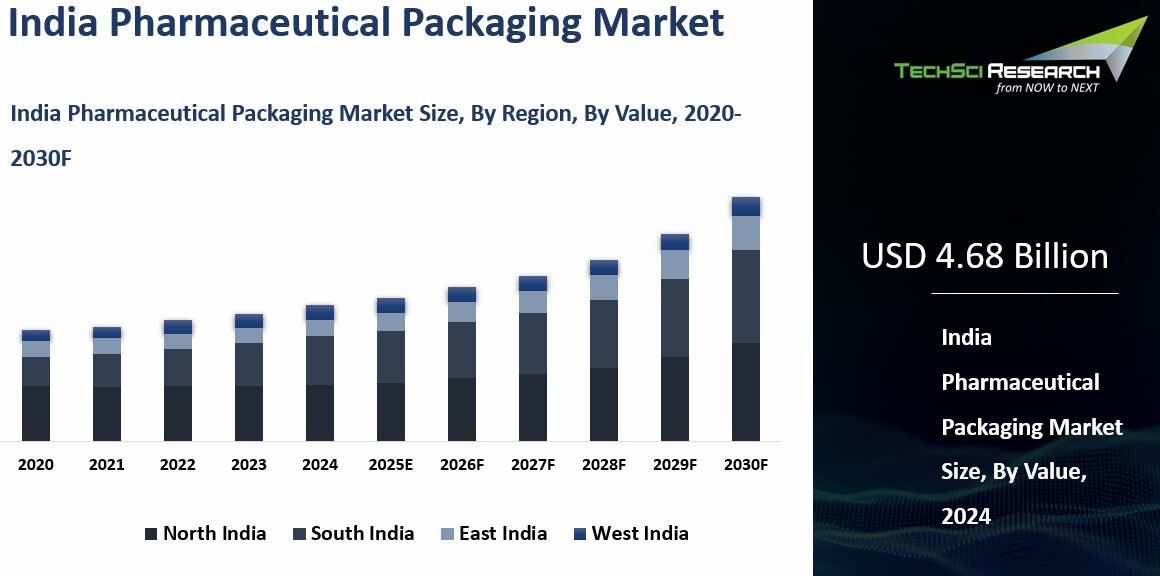

Market Overview

The India Pharmaceutical Packaging Market was valued at USD 4.68 billion in 2024 and is expected to reach USD 7.49 billion by 2030, growing with a CAGR of 8.81% in the forecast period.

The pharmaceutical packaging market in India has grown significantly in recent years and is forecast to continue its upward

trajectory. The expansion of the healthcare sector in India, coupled with an

increasing number of pharmaceutical manufacturing units and higher healthcare

spending, serves as a key catalyst for this market’s growth. The market is set

for continued expansion, fueled by ongoing developments within the

pharmaceutical industry, advancements in packaging technologies, and rising

demand for healthcare products.

Companies

in this sector are increasingly focusing on innovation, sustainability, and

adhering to rigorous regulatory standards to leverage emerging opportunities.

These factors are shaping a competitive environment where companies are

investing in cutting-edge solutions to enhance safety, product integrity, and

supply chain efficiency. The Indian pharmaceutical packaging market is

positioned for robust growth, presenting significant opportunities for both

established market leaders and new entrants seeking to capitalize on the

evolving landscape of the pharmaceutical industry.

Download Free Sample Report

Key Market Drivers

Expansion of the

Pharmaceutical Industry

The pharmaceutical industry's expansion is a primary driver of India's pharmaceutical packaging market growth. India ranks among the world's largest pharmaceutical producers, holding a 13% share of the global market and leading as the foremost vaccine manufacturer and generic drug exporter by volume. India dominates the global generic medication supply, accounting for 20% of worldwide volume and meeting approximately 60% of global vaccine demand.

The country's pharmaceutical exports demonstrate robust performance, reaching USD 27.82 billion in FY24 (April-March) and USD 14.42 billion in the first half of FY25 (April-September). The domestic pharmaceutical sector's growth, fueled by both local consumption and export demand, escalates the volume of products requiring packaging. The production of diverse medications including generic drugs, biologics, and over-the-counter products necessitates varied, high-quality packaging solutions tailored to different drug formulations.

India's expanding pharmaceutical exports require packaging that meets international standards and regulatory frameworks such as FDA and EMA guidelines. Advanced packaging must ensure product safety during long-distance shipping while maintaining temperature control, preventing contamination, and incorporating tamper-evident and child-resistant features. Growing demand for biologics and biosimilars drives innovation in packaging materials and technologies. These complex products require enhanced protection against moisture, light, and temperature fluctuations, stimulating the market to develop cutting-edge protective packaging formats.

Heightened scrutiny from regulatory bodies demands packaging that incorporates serialization, tamper-evident features, and child-resistant mechanisms. The rising threat of counterfeit drugs has accelerated adoption of anti-counterfeiting technologies including holograms, QR codes, and tamper-evident solutions, ensuring product security and consumer safety across domestic and international markets. The surge in both over-the-counter and prescription drug consumption, driven by an expanding middle class and greater healthcare access, further underscores the need for efficient, scalable packaging solutions that ensure product safety, durability, and convenience.

Technological Advancements in

Packaging Materials

Technological advancements in packaging materials are a key driver of growth in the Indian pharmaceutical packaging market, as expanding drug output and tighter quality expectations are increasing demand for sophisticated, cost-effective, and sustainable packaging that protects product integrity while improving traceability and compliance. Advanced materials with superior protective properties are being adopted for sensitive products such as vaccines, biologics, and injectables, using high-barrier films, multi-layer structures, and advanced glass and polymer formats to reduce moisture, oxygen, and light exposure and improve stability through distribution and storage.

Smart packaging and coding technologies are also moving from optional to compliance-driven, as CDSCO has clarified that manufacturers of the top 300 drug brands listed in Schedule H2 must print or affix a bar code or QR code carrying key product and batch particulars, with this requirement effective from 1 August 2023, directly pushing wider use of QR codes and track-and-trace compatible packaging design. Sustainability-led material innovation is accelerating in parallel due to India’s regulatory push on plastic waste management, with the Government of India noting that the Plastic Waste Management (Amendment) Rules, 2022 notified Guidelines on Extended Producer Responsibility for plastic packaging on 16 February 2022, which stipulate mandatory targets on EPR, recycling of plastic packaging waste, reuse of rigid plastic packaging, and use of recycled plastic content, thereby encouraging pharma pack conversion toward recyclable structures, lower-weight formats, and recycled-content compliant materials where feasible.

Safety feature enhancements through technological advancement have also expanded uptake of tamper-evident and child-resistant packaging formats, while manufacturing process improvements such as automated packaging lines, digital printing, and precision moulding reduce human error, improve line speeds, and minimise material waste, supporting consistent, regulation-aligned packaging at scale.

Rising Healthcare Expenditure

Rising healthcare expenditure in India is a significant driver for pharmaceutical packaging demand because expanding public financing and higher service utilisation translate into higher medicine throughput and stricter expectations on product safety, integrity, and compliance. For instance, the Ministry of Health and Family Welfare’s National Health Accounts estimates show Government Health Expenditure as a share of GDP increased from 1.13 in 2014 to 15 to 1.84 in 2021 to 22, while its share in General Government Expenditure rose from 3.94 to 6.12 over the same period, reflecting sustained public investment that expands treatment access and pharmaceutical consumption across public and private channels.

This higher utilisation is also visible in large government health coverage programs, where Ayushman Bharat PM JAY reported more than 34.7 crore Ayushman cards created and 7.37 crore hospital admissions authorised as of 30 June 2024, increasing demand for packaged medicines, sterile injectables, and hospital-use consumables across diverse formats such as bottles, blisters, ampoules, and prefilled delivery systems. As access widens into semi-urban and rural areas and chronic disease management expands, packaging manufacturers face higher volume pull as well as tighter requirements around affordability, anti-counterfeiting, tamper evidence, and patient-friendly formats, while growth in biologics, vaccines, and other sensitive therapies raises demand for high-barrier and cold-chain compatible packaging solutions that protect stability and enable safe administration.

Key Market Challenges

Stringent Regulatory

Compliance and Standards

The Indian pharmaceutical packaging market, a critical component of the nation's $50 billion pharmaceutical sector, is heavily influenced by a complex web of regulatory requirements from both domestic and international bodies. Compliance with standards set by the Central Drugs Standard Control Organization (CDSCO) in India, the U.S. Food and Drug Administration (FDA), and the European Medicines Agency (EMA) is essential for manufacturers to ensure product safety, quality, and integrity. However, the evolving nature of these regulations and the need to adhere to multiple standards for both local and export markets create significant challenges for packaging manufacturers.

Pharmaceutical packaging must comply with various regulations related to labeling, anti-counterfeiting, tamper-evident features, and child-resistant packaging. Furthermore, the introduction of new regulations, such as those requiring the serialization of pharmaceutical products, adds to the complexity. India's track and trace system, for instance, mandates that products be barcoded (typically with 2D barcodes), serialized, aggregated, and reported to the government's DAVA portal. This serialization is required on all three levels of packaging primary, secondary, and tertiary. As of January 1, 2023, all active pharmaceutical ingredients (APIs) manufactured in or imported into India must feature QR codes on their packaging.

Adapting to these frequent regulatory changes can be costly and time-consuming, especially for small and medium-sized enterprises (SMEs). Of India's roughly 10,500 pharmaceutical manufacturing units, about 8,500 are SMEs. A significant portion of these smaller companies face hurdles with the high cost of compliance, the complexity of evolving rules, and limited resources for comprehensive quality assurance. Currently, only 2,000 of the 8,500 SMEs hold WHO Good Manufacturing Practice (GMP) certification. Recognizing these difficulties, the Indian government has extended the deadline for SMEs to comply with the revised Schedule M of the Drugs and Cosmetic Act to the end of 2025. The constant need for updates and adherence to global standards requires heavy investment in research, development, and technology upgrades to remain compliant.

High Raw Material Costs and

Supply Chain Challenges

The

rising cost of raw materials used in pharmaceutical packaging, such as

plastics, glass, and specialized films, is a significant challenge faced by

packaging manufacturers in India. The prices of raw materials are influenced by

global supply chain disruptions, fluctuations in petroleum prices, and a

reliance on imports for certain specialized packaging materials. These cost

pressures are often passed down the supply chain, increasing the overall cost

of packaging and making it harder for manufacturers to offer affordable

solutions, especially in a price-sensitive market like India.

In

addition to raw material costs, supply chain inefficiencies further exacerbate

the situation. The lack of robust infrastructure in some regions, coupled with

logistical challenges, can lead to delays in sourcing materials, production,

and distribution. For pharmaceutical packaging companies, these inefficiencies

can result in prolonged lead times, unpredictable supply costs, and inventory

management challenges. This creates market instability, making it harder

for manufacturers to plan, manage costs, and scale operations in line with

growing demand.

Key Market Trends

Increased Adoption of Smart

and Connected Packaging

One of the most significant trends driving the future growth of the pharmaceutical packaging market in India is the adoption of smart and connected packaging solutions. With the growing focus on enhancing drug safety, patient adherence, and supply chain transparency, pharmaceutical companies are increasingly integrating digital technologies into their packaging designs. Smart packaging incorporates technologies such as Radio Frequency Identification (RFID), Near-Field Communication (NFC), and QR codes, enabling it to track and communicate data in real time.

Smart packaging plays a crucial role in ensuring product traceability, combating counterfeiting, and enhancing overall supply chain efficiency. This is particularly critical in India, where an estimated 12% to 25% of all supplied pharmaceuticals are believed to be fake. Globally, the World Health Organization (WHO) reports that 50% of medicines sold online are counterfeit. To address this, India mandated in August 2023 that its top 300 pharmaceutical brands must include QR codes on their packaging for authentication.

However, this system has faced challenges, as counterfeiters have replicated the static QR codes, undermining its integrity. This has pushed the industry to explore more secure technologies, such as NFC, which enables secure data transfer with a simple smartphone tap and is harder to copy than a static barcode. These technologies help pharmaceutical companies meet regulatory requirements for serialization, such as the Drug Supply Chain Security Act (DSCSA) in the U.S. and similar mandates in Europe.

Additionally, smart packaging can enhance patient engagement by providing information about medication usage, dosage reminders, and authentication details directly to a patient's smartphone. Some smart packages even include features that let patients start a virtual consultation by scanning a code.

Sustainability and

Eco-friendly Packaging Innovations

Sustainability

is increasingly becoming a core focus in the pharmaceutical packaging market,

driven by both regulatory pressure and growing consumer demand for

environmentally responsible solutions. The need for sustainable packaging has

intensified as governments and organizations worldwide emphasize reducing the

environmental impact of plastic waste and promoting circular economy practices.

In India, the growing awareness of environmental issues and the need to comply

with emerging environmental regulations are prompting pharmaceutical companies

to explore alternative, eco-friendly packaging materials.

Innovation

in packaging materials, such as biodegradable plastics, recycled PET (rPET),

and plant-based materials, is gaining momentum. These materials are not only

more environmentally friendly but also address the growing demand for packaging that can be easily recycled or disposed of sustainably.

Furthermore, sustainable packaging solutions can enhance pharmaceutical companies' reputations by aligning their practices with broader environmental goals, which is especially important in the global market, where eco-conscious consumers increasingly make purchasing decisions based on sustainability.

In India, where waste management infrastructure is still developing, the

emphasis on sustainable packaging is driving investments in advanced recycling systems and fostering partnerships between packaging

manufacturers and waste management companies. As sustainability becomes an

essential criterion for packaging design, the Indian pharmaceutical packaging

market is set to see a substantial shift toward eco-friendly materials and

processes in the coming years.

Segmental Insights

Material Insights

Based

on the category of Material, the Plastics & polymers segment emerged as the

dominant in the India pharmaceutical packaging market in 2024. The Plastics

& Polymers segment dominates the Indian pharmaceutical packaging market due

to their versatility, cost-effectiveness, and ability to meet the unique

demands of the pharmaceutical industry. Plastics and polymers, including

materials such as polyethylene, polypropylene, polyethylene terephthalate

(PET), polyvinyl chloride (PVC), and others, are the most used materials for

packaging pharmaceutical products.

This dominance is driven by several key

factors that align with both the operational needs of pharmaceutical

manufacturers and consumer preferences. The major factors driving the dominance of plastics and

polymers in pharmaceutical packaging are their cost-effectiveness. Compared to

alternative materials such as glass or metal, plastics are generally less

expensive to produce, transport, and store. They are lightweight, reducing both

raw material costs and logistical expenses. In a price-sensitive market like

India, where affordability is a key concern, the cost advantages of plastic

packaging make it the material of choice for both local and international

pharmaceutical companies.

Plastics

and polymers are highly scalable in production, allowing packaging

manufacturers to meet the large and growing demand for pharmaceutical products.

With the rapid expansion of the pharmaceutical industry in India, the ability

to produce plastic packaging at scale is a significant advantage, enabling

manufacturers to meet increasing demand without compromising production efficiency. Plastics and polymers offer unmatched versatility when

it comes to customizing packaging solutions. These materials can be easily

molded into a variety of shapes and sizes, making them suitable for packaging a

wide range of pharmaceutical products, from tablets and capsules to liquids,

creams, and injectables. Plastics can be used to create bottles, blister packs,

jars, pouches, tubes, and ampoules, each with specific functions depending on the type of pharmaceutical product being packaged. These factors are

expected to drive the growth of this segment.

Download Free Sample Report

Regional Insights

West

India emerged as the dominant in the India pharmaceutical packaging market in

2024, holding the largest market share in terms of value. West India,

comprising key states such as Maharashtra, Gujarat, and Rajasthan, holds the

largest share of the Indian pharmaceutical packaging market. This region is

home to a robust pharmaceutical manufacturing infrastructure, which is a major

driver for the demand for packaging materials.

Maharashtra,

particularly Mumbai, is the center of the pharmaceutical industry in India,

housing numerous pharmaceutical companies and multinational corporations.

Gujarat, with its established industrial base and strategic location, is

another key pharmaceutical manufacturing hub. These states are not only major

producers of generic drugs but also serve international markets, driving demand for advanced packaging solutions. West India plays a crucial role in the

export of pharmaceutical products.

The region’s well-developed infrastructure,

including ports such as Jawaharlal Nehru Port (JNPT) and Mumbai Port,

facilitates the global export of pharmaceuticals, which requires compliance

with international packaging standards. This drives the demand for high-quality

packaging solutions like tamper-evident and child-resistant features, as well

as compliance with serialization requirements. West India is home to several

leading packaging companies that specialize in providing innovative packaging

solutions to the pharmaceutical industry. The region benefits from significant

investments in research and development (R&D), with companies focusing on

introducing new materials, smart packaging technologies, and sustainable

solutions. The concentration of these packaging manufacturers helps fuel the

growth of the pharmaceutical packaging market in West India.

Recent Developments

- In February 2026, ACG Packaging Materials said its Shirwal facility was inducted into the World Economic Forum’s Global Lighthouse Network and reported measurable operating improvements there (including 40% reduction in lead times and 71% reduction in defects).

- In January 2026, ACG Packaging Materials launched SuperPod, a cold-form blister packaging technology it said can shrink blister cavities (up to 39% in some cases) while maintaining barrier performance and machine runnability, with a debut planned at Pharmapack 2026.

- In September 2025, industry events such as the PPL Awards highlighted excellence and innovation in pharmaceutical packaging, celebrating companies that have made significant advancements in areas such as patient-centric design and anti-counterfeiting measures.

- In July 2025, the Indian government introduced new labelling regulations to enhance patient safety. These rules mandate clearer instructions, improved tamper-evident features, and better drug identification, pushing companies to innovate their packaging designs.

- In January 2025, PAG acquired a majority stake in Pravesha Industries, a pharmaceutical packaging company. The Asia-focused private equity firm PAG confirmed the acquisition, although financial details were not disclosed. A source familiar with the transaction revealed that the deal valued Pravesha Industries at USD 200 million.

- In November 2024, DuPont announced the launch of Tyvek with Renewable Attribution (RA), an extension of its current Tyvek healthcare packaging portfolio. This new offering significantly reduces the carbon footprint,

supporting the shift towards more sustainable healthcare packaging solutions.

- In

October 2024, UPM Biochemicals, Selenis, and Bormioli Pharma teamed up to

produce the world’s first pharmaceutical bottles made from partially wood-based

PET. This innovative packaging solution sets a new benchmark for sustainability

in the pharmaceutical sector. Given the high regulatory and performance

standards for pharmaceutical packaging, which often restrict the use of new or

recycled materials, the bottle utilizes standard PET made with UPM’s

groundbreaking wood-based BioMEG, UPM BioPura, marking a significant

advancement in the sustainable transformation of pharmaceutical packaging.

- In October 2024, Uhlmann India officially inaugurated its new office and showcased its advancements in blister packaging solutions. The event, held on October 16th at Chakan MIDC Phase II in Pune, Maharashtra, brought together industry leaders, partners, and customers to highlight Uhlmann India’s progress in blister packaging technology and its efforts toward localization, marking a significant milestone in the company’s expansion in India.

Key Market Players

- Amcor

Flexibles India Pvt. Ltd.

- Becton

Dickinson India Private Limited

- Aptar

Pharma India Pvt. Ltd

- Gerresheimer

AG

- SCHOTT

Poonawalla

- West

Pharmaceutical Services, Inc

- SGD

Pharma India Private Limited

|

By

Material

|

By

End User

|

By

Region

|

- Plastics

& Polymers

- Paper

& Paperboard

- Glass

- Aluminium

Foil

- Others

|

- Pharmaceutical

& Biotechnology companies

- Contract

Manufacturers

- Others

|

- North

India

- South

India

- East

India

- West

India

|

Report Scope:

In this report, the India Pharmaceutical Packaging

Market has been segmented into the following categories, in addition to the

industry trends which have also been detailed below:

- India Pharmaceutical Packaging Market, By Material:

o Plastics & Polymers

o Paper & Paperboard

o Glass

o Aluminium Foil

o Others

- India Pharmaceutical Packaging Market, By End User:

o Pharmaceutical & Biotechnology companies

o Contract Manufacturers

o Others

- India Pharmaceutical Packaging Market, By

Region:

o North India

o South India

o West India

o East India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Pharmaceutical

Packaging Market.

Available Customizations:

India Pharmaceutical

Packaging market report with the given market data, Tech Sci Research

offers customizations according to a company's specific needs. The following

customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional

market players (up to five).

India Pharmaceutical Packaging Market is an

upcoming report to be released soon. If you wish an early delivery of this

report or want to confirm the date of release, please contact us at [email protected]