|

Forecast

Period

|

2026-2030

|

|

Market

Size (2024)

|

USD

472.75 Million

|

|

CAGR

(2025-2030)

|

8.04%

|

|

Fastest

Growing Segment

|

Cardiology

|

|

Largest

Market

|

West

India

|

|

Market

Size (2030)

|

USD

744.73 Million

|

Market Overview

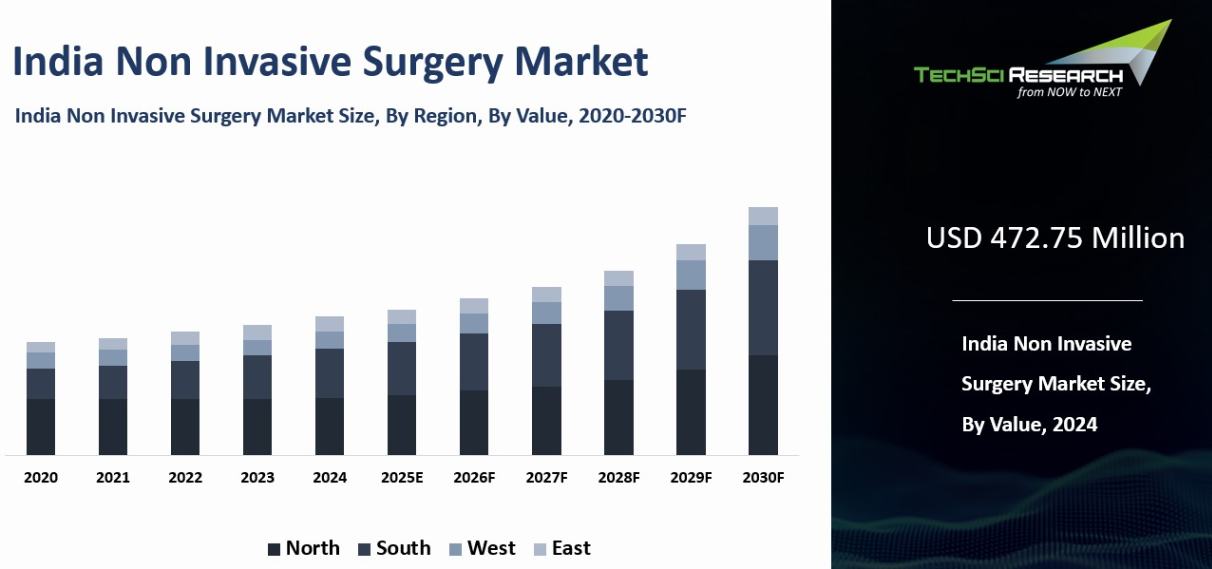

India Non-Invasive Surgery Market was valued at USD 472.75 Million in 2024 and is expected to reach USD 744.73 Million by 2030 with a CAGR of 8.04% during the forecast period.

Non-invasive

surgery, also known as non-surgical or minimally invasive procedures, refers to

a range of medical interventions that do not necessitate any incisions or

tissue removal. These cutting-edge surgeries rely on advanced technological

devices and techniques to achieve remarkable results. For example, lasers,

ultrasound, and MRI are utilized in radiation therapy for cancer treatment,

while endoscopes enable the thorough examination of internal organs.

One of the key advantages of

non-invasive surgeries is their ability to minimize patient discomfort and

pain. Unlike traditional surgical methods, they leave behind minimal scarring,

allowing individuals to recover more swiftly and resume their daily activities

sooner. The risk of infection associated with these procedures is

significantly lower. With their numerous benefits, non-invasive surgeries have

revolutionized the medical field and continue to provide patients with safer

and more effective treatment options.

Download Free Sample Report

Key Market Drivers

Rising

Prevalence of Chronic Disorders

The growing burden of chronic disorders in India is accelerating the demand for non-invasive surgery. Cardiovascular diseases account for 26.6% of total deaths and 13.6% of total disability-adjusted life years (DALYs) in India as of 2017. Diabetes prevalence is projected to reach 8,585.45 cases per 100,000 population by 2031, while obesity affects 40.3% of adults according to the Niyantrita Madhumeha Bharata 2017 survey of 100,531 adults.

An aging population further compounds this issue. The India Human Development Survey-II indicates that 63% of adults aged 65 and above are overweight or obese, and one-third experience hypertension. These conditions increase the need for procedures that minimize physical strain. Non-invasive surgeries offer shorter recovery times, lower infection risks, and reduced pain, making them an attractive alternative to traditional open surgery. Evidence from rural hospitals using gas-less laparoscopic surgery (GILLS) shows strong results, with median surgical volumes rising from 108.7 to 374.29 annually between February 2022 and February 2024—a 245% increase.

Technological progress has enhanced precision and reduced recovery times. In December 2024, Pune’s Noble Hospital launched SSI Mantra, India’s first CDSCO-certified robotic telesurgery system. Medtronic announced in May 2024 that its Engineering and Innovation Centre in Hyderabad will become its largest global R&D hub by 2025, employing 1,500 engineers and investing USD 350 million in non-invasive medical technologies, including pacemakers, heart valves, and laparoscopic systems.

Economic changes are also driving growth. Recent tax reforms exempt individuals earning up to Rs 12 lakh (Rs 12.75 lakh for salaried individuals), boosting disposable income for healthcare spending. The Ayushman Bharat–Pradhan Mantri Jan Arogya Yojana (AB-PMJAY) now extends coverage to individuals aged 70 and above, benefiting about 6 crore senior citizens from 4.5 crore families. The Jan Aushadhi and AMRIT schemes have improved affordability and access to cardiovascular and orthopedic treatments, motivating patients to choose high-quality, less invasive procedures.

Hospitals nationwide are expanding their capacity for minimally invasive procedures. Facilities using GILLS training programs recorded a 270% increase in immediate population surgical coverage and a 662% rise in extended target populations between 2022 and 2024, with a strong correlation (r = 0.88). The TARGET program, launched in 2019 at Kolkata Medical College, has trained surgeons from northeastern states in laparoscopic and gas-less techniques, helping resource-limited hospitals adopt cost-effective methods.

Government initiatives, particularly under PMJAY, are facilitating this shift, though surgical rates remain modest at 166 surgeries per 100,000 eligible beneficiaries. The combination of technological innovation, rising income, and a health-conscious population is driving a major transition toward non-invasive surgical care in India..

Growing

Geriatric Population

The growing demand for non-invasive surgery in India is closely linked to the expanding geriatric population. According to the Longitudinal Ageing Study of India (LASI) 2021, older adults account for 12% of the population, projected to reach 319 million by 2050 with an annual growth rate of about 3%. The Technical Group on Population Projections 2020 report estimates that India’s elderly population will reach 230 million by 2036, representing 15% of the total, with states such as Kerala expected to have 23% elderly by that year. The elderly population is growing faster than any other age group, with a decadal growth rate of 41%.

With advancing age, chronic illnesses become more common, increasing the need for medical interventions. Invasive surgeries pose higher risks for older patients due to longer recovery times and complications, while non-invasive procedures such as laparoscopic surgeries reduce these risks. They offer faster recovery, less pain, and shorter hospital stays, making them suitable for older adults. The LASI 2021 also highlights that nearly one-third of India’s elderly population suffers from hypertension, reflecting a significant chronic disease burden that can benefit from less invasive treatment approaches.

India’s expanding healthcare infrastructure and technological progress have made advanced diagnostic and surgical procedures more accessible. The launch of India’s first indigenously developed 1.5 Tesla MRI scanner in July 2023 under the National Biopharma Mission reduced dependence on imports and expanded access to precision imaging. The Competition Commission of India’s 2024 report noted that India has about 4,800 MRI machines three times fewer than CT scanners though demand is expected to double by 2030. The Delhi government’s plan to install MRI and CT machines across 36 public hospitals by January 2026 represents a major capacity expansion.

The government and medical institutions have strengthened training in non-invasive surgery. The National Board of Examinations offers a 2-year Fellowship in Minimal Access Surgery, while AIIMS runs a 3-year MCh in Minimally Invasive Surgery. These programs support the growing need for skilled surgeons in laparoscopic and robotic techniques.

Cost-effectiveness is another driver. In 2025, laparoscopic appendectomy procedures in India cost around Rs 25,000, with complex surgeries reaching Rs 75,000 far below the USD 5,000–10,000 charged in the United States. Recovery is faster, with patients discharged within 1–2 days and healing within 1–3 weeks. Non-invasive surgeries also reduce pressure on India’s limited hospital capacity currently 0.79 beds per 1,000 population versus the National Health Policy target of 2 beds per 1,000. With a shortfall of 2.4 million beds, quicker recovery procedures improve hospital efficiency.

Affordable, minimally invasive surgical options, supported by government programs such as the Pradhan Mantri Jan Arogya Yojana (PMJAY), are expanding access to quality healthcare for lower-income groups, making non-invasive surgery a key component of India’s evolving healthcare landscape.

Increasing

Outpatient Surgeries

The surge in outpatient surgeries in

India is significantly stimulating the demand for non-invasive procedures. This

upswing is attributed to the growing awareness among patients about the

advantages of non-invasive surgeries, such as minimal scarring, reduced pain,

lower risk of infection, shorter hospital stays, and quicker recovery times. In

addition, the incorporation of state-of-the-art technologies, such as robotic

surgery and laser procedures, is adding further impetus to this trend.

These

cutting-edge techniques enable precision and control, enhancing surgical

outcomes and patient satisfaction. As healthcare providers strive

to optimize resources and meet the increasing demand for efficient and

cost-effective solutions, outpatient surgeries present an appealing option.

With their efficiency, shorter hospital stays, and reduced healthcare costs,

outpatient surgeries alleviate the burden on hospitals and contribute to a more

streamlined healthcare system.

The advent of telemedicine is

propelling the viability of outpatient surgeries even amidst rural and remote

demographics, breaking down geographical barriers. Patients in remote areas now

have access to specialized medical care without the need for long and costly

travel. This advancement in healthcare delivery is revolutionizing the

landscape of healthcare in India and improving the overall accessibility and

quality of care.

Consequently, the increasing inclination towards outpatient

surgeries is fuelling the shift from traditional surgical methods to

non-invasive alternatives, reshaping the healthcare landscape in India. As patients

continue to seek safer and more efficient treatment options, the demand for

non-invasive procedures will continue to grow, driving innovation and

advancements in the field of healthcare.

Key Market Challenges

Lack

of Skilled Professionals

In India, the demand for non-invasive

surgery is experiencing a remarkable decrease, primarily attributable to a

critical lack of skilled professionals. Non-invasive procedures require a high

level of precision and expertise, underlining the need for well-trained medical

professionals. The deficit in the number of proficient practitioners has

consequently resulted in a declining consumer confidence. Potential patients

frequently express concerns about the quality of care and the risk involved in

non-invasive procedures if performed by less experienced surgeons.

This factor

is significantly impacting the preference of patients, tilting the scale

towards traditional surgical methods that are perceived to be safer due to the

larger pool of experienced surgeons. The Indian healthcare system, despite its

inherent potential for growth and innovation, struggles with this skill

shortage, hampering the adoption of non-invasive surgical techniques. Thus, the

lack of trained professionals in this field imposes a significant hurdle to the

demand for non-invasive surgery in India.

Stringent

Regulatory Framework

The demand for non-invasive surgery is

currently experiencing a downward trend, largely due to an increasingly

stringent regulatory framework. These regulations, aimed at ensuring patient

safety and high-quality medical practices, place substantial demands on medical

institutions and practitioners. They require advanced equipment, rigorous

training, and meticulous record-keeping, all of which significantly increase

operational costs. As a result, many healthcare providers are hesitant to offer

non-invasive surgical options, pushing potential patients towards traditional

surgical methods.

The complex approval processes and frequent

inspections create further barriers to entry and sustainability for hospitals

and clinics. This regulatory strictness, while important for maintaining high

standards of healthcare, inadvertently discourages the adoption and

availability of non-invasive surgery in Indian healthcare institutions, thereby

decreasing its demand among patients. Consequently, it is imperative to strike

a balance between regulatory rigour and the promotion of advanced, less

invasive surgical procedures. This might include the provision of incentives,

such as subsidies for equipment purchase, or tailored training programs to help

practitioners meet these high standards, thereby stimulating the demand for

non-invasive surgery.

Key Market Trends

Increasing

R&D Investment

India's healthcare sector is poised for

significant growth, and the demand for non-invasive surgeries is set to rise.

The key driver of this surge is the significant increase in Research &

Development (R&D) investment. When R&D investment increases, it

accelerates innovation in medical technology, resulting in the development of

advanced non-invasive surgical procedures.

For instance, in May 2024, Medtronic, a US-based medical device leader, announced that its rapidly expanding Engineering and Innovation Centre (MEIC) in Hyderabad will become its largest global R&D hub by 2025, employing approximately 1,500 engineers with a total investment of USD 350 million. The company is also exploring the establishment of a manufacturing unit for products such as pacemakers, heart valves, surgical laparoscopic systems, and orthopedic implants, aligning with the shift towards minimally invasive surgery.

Discussions are in the early stages with the state government regarding the potential setup of this unit at the Sultanpur medical device park. These methods are typically less

risky, less painful, and less time-consuming than traditional surgery. As a

result, they are likely to gain preference among potential patients.

The Indian population is growing and aging, which will naturally

lead to a higher demand for medical procedures, including non-invasive

surgeries. Increased R&D can help to meet this demand by improving the effectiveness

and efficiency of these procedures. The increased investment will

also help in training medical professionals, which is crucial in a country

where there is a shortage of well-trained doctors and nurses. Therefore, higher

R&D investment will not only enhance the quality of non-invasive surgical

procedures but also improve their accessibility, thus driving up demand in the

Indian healthcare market.

Technological

Advancement in Minimally Invasive Surgery Devices

Technological advancements in minimally

invasive surgery devices signify a transformative shift in India's healthcare

industry. These cutting-edge technologies have made surgeries safer, quicker,

and less painful, increasing their demand. The most significant benefit of

minimally invasive procedures lies in their reduced post-operative

complications and quicker healing time. This helps increase patient comfort and

reduces hospitalization duration, making it a preferred choice for numerous

patients and medical professionals alike.

India's rapidly growing

middle class and aging population are contributing to a higher incidence of

chronic diseases, escalating the need for non-invasive surgeries. The Indian

Government's initiatives, such as the Pradhan Mantri Jan Arogya Yojana (PMJAY),

have increased access to healthcare, with minimally invasive procedures now

being within the financial reach of a larger population segment. Hospitals are

investing in high-end minimally invasive devices to cater to this upsurge in

demand. Considering these factors, it is evident that the technological

advancements in minimally invasive surgery devices will lead to an increasing

demand for non-invasive surgeries in India.

Segmental Insights

Application Insights

Based on application,

cardiology emerged as the fastest growing segment in the India Non-Invasive Surgery Market during the forecast period. This

can be attributed to several factors. There is an alarming increase in

the prevalence of cardiovascular diseases in India, which has created a

pressing need for advanced cardiac treatments. The rise in the

aging population has contributed to the growing demand for non-invasive cardiac

procedures. The advancements in medical technology have also played a crucial

role in expanding the scope of non-invasive surgical options available in

cardiology.

The growing awareness among individuals about the

benefits of early diagnosis and treatment of cardiac conditions has fueled the

demand for non-invasive surgery in this field. As a result, cardiology stands

at the forefront of the India Non-Invasive Surgery Market, offering innovative

and effective solutions for patients in need.

Download

Free Sample Report

Regional Insights

Based on Region, West India emerged as the dominant region in the Indian market for non-invasive surgery in 2024. This can be attributed to the presence

of major cities like Mumbai and Pune, which are renowned healthcare hubs

housing a multitude of top-tier hospitals and clinics. These healthcare

facilities have not only embraced cutting-edge surgical techniques but have

also shown a remarkable inclination towards non-invasive procedures.

In addition to the advanced medical practices,

these hospitals and clinics in Maharashtra have established robust

collaborations with research institutions and pharmaceutical companies. This

collaborative approach fosters continuous innovation and the development of

novel non-invasive surgical solutions. The availability of state-of-the-art

infrastructure, including advanced imaging technologies and minimally invasive

surgical tools, further enhances the region's capabilities in delivering highly

effective non-invasive treatments to patients.

Recent Development

- In February 2025, AIIMS Delhi and the Vattikuti Foundation announced a collaboration to introduce MR-guided High-Intensity Focused Ultrasound (MRgFUS) treatments using an Insightec system donated with five years of service support, enabling incisionless therapy options for conditions such as essential tremor, Parkinson’s disease, and other neurological disorders.

- In February 2025, AIIMS Delhi officials confirmed that MR-guided HIFU services would become operational within approximately six months at subsidized costs, significantly broadening access to non-invasive neurosurgical treatments in India.

- In March 2025, Insightec and the Vattikuti Foundation formalized a partnership with AIIMS Delhi to expand focused ultrasound access and advance clinical research in India, reinforcing a collaborative model for innovation-driven care.

- In March 2025, the Focused Ultrasound Foundation launched its India Program to accelerate the adoption of focused ultrasound therapies for indications including essential tremor, Parkinson’s disease, and neuropathic pain, supporting treatment expansion across multiple clinical sites nationwide.

- In January 2025, national media coverage highlighted the growing adoption of the CyberKnife S7 system as a breakthrough in the treatment of moving tumors, citing early deployments such as Valentis’ first installation in India and high-volume programs at Ruby Hall Clinic, Pune, and Apollo Hospital, Bengaluru.

- In February 2025, U.S. specialists from the University of North Carolina (UNC) participated in an educational symposium on MR-guided focused ultrasound held in New Delhi, emphasizing the importance of clinical training, technology transfer, and international collaboration in supporting India’s MRgFUS adoption.

- In 2025, the Insightec–Vattikuti–AIIMS access partnership combined a system donation, multi-year service support, and integrated clinical research objectives, representing a comprehensive effort to expand the availability of focused ultrasound therapies in India.

- In

October 2024, Krishna Institute of Medical Sciences (KIMS) Hospitals signed a

Memorandum of Understanding (MoU) with Intuitive, a global leader in minimally

invasive care and pioneer of robotic-assisted surgery (RAS). The Robotic

Surgery Centre of Excellence will be established at KIMS-PES Hospital in

Bengaluru and will provide training for robotic surgeries across all

specialties at KIMS branches nationwide. This collaboration aims to launch 25

robotic surgery programs featuring da Vinci robotic-assisted systems in

Maharashtra, Karnataka, Andhra Pradesh, and Telangana, expanding access to

advanced minimally invasive surgical care in tier 2 and tier 3 cities. The da

Vinci systems will be deployed in key locations, including Nagpur, Nashik, and

Thane (Maharashtra); Bengaluru (Karnataka); Secunderabad, Begumpet, Kondapur,

and Gachibowli (Telangana); as well as Visakhapatnam, Srikakulam, Rajahmundry,

Ongole, Kurnool, Nellore, and Anantapur (Andhra Pradesh), and Kannur (Kerala).

Key Market Players

- India Medtronic Private

Ltd

- Abbott

India Ltd.

- Intuitive

Surgical India Pvt. Ltd.

- B Braun

Medical (India) Pvt. Ltd.

- Boston

Scientific India Pvt. Ltd.

- Conmed

Linvatec India Pvt. Ltd.

- Siemens

Healthineers India

- Olympus

Medical Systems India Pvt. Ltd.

- Wipro

Ge Healthcare Pvt Ltd.

- Stryker

India Pvt. Ltd.

|

By

Type

|

By

End User

|

By

Application

|

By Region

|

- Radiosurgery

- Lithotripsy

- Defibrillation

- Brachytherapy

- Non-Invasive

Ventilation

- Oxygen Therapy

- Others

|

- Hospitals &

Clinics

- Ambulatory

Surgical Centers

- Specialty Clinics

- Others

|

- Oncology

- Cardiology

- Renal Disorders

- Gynecology

- Urology

- Dermatology

- Neurology

- ENT

- Others

|

- West India

- North India

- South India

- East India

|

Report Scope:

In this report, the India Non Invasive Surgery

Market has been segmented into the following categories, in addition to the

industry trends which have also been detailed below:

- India Non Invasive Surgery

Market, By

Type:

o Radiosurgery

o Lithotripsy

o Defibrillation

o Brachytherapy

o Non-Invasive Ventilation

o Oxygen Therapy

o Others

- India Non Invasive Surgery

Market, By

Application:

o Oncology

o Cardiology

o Renal Disorders

o Gynecology

o Urology

o Dermatology

o Neurology

o ENT

o Others

- India Non Invasive Surgery

Market, By

End User:

o Hospitals & Clinics

o Ambulatory Surgical Centers

o Specialty Clinics

o Others

- India Non Invasive Surgery

Market, By

Region:

o North

o South

o West

o East

Competitive Landscape

Company Profiles: Detailed analysis of the major companies

present in the India Non Invasive Surgery Market.

Available Customizations:

India Non Invasive Surgery Market report with

the given market data, TechSci Research offers customizations according to a

company's specific needs. The following customization options are available for

the report:

Company Information

- Detailed analysis and

profiling of additional market players (up to five).

India Non Invasive Surgery Market is an upcoming

report to be released soon. If you wish an early delivery of this report or

want to confirm the date of release, please contact us at [email protected]