Forecast Period | 2026-2030 |

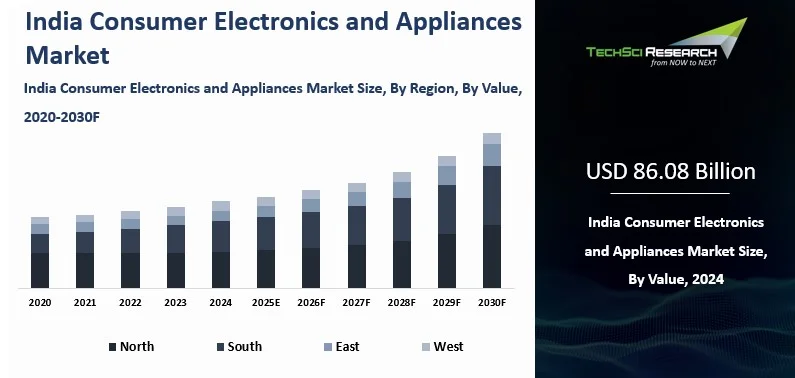

Market Size (2024) | USD 86.08 Billion |

CAGR (2025-2030) | 12.83% |

Fastest Growing Segment | Online |

Largest Market | North |

Market Size (2030) | USD 177.05 Billion |

Market Overview

India Consumer Electronics and

Appliances Market was valued at USD 86.08 billion in 2024 and is anticipated to

grow with a CAGR of 12.83% through 2030. The consumer electronics and

appliances market in India is a dynamic and rapidly evolving sector

characterized by significant growth driven by several key factors. With a

population exceeding 1.3 billion people and a growing middle class, India

represents a vast market for consumer electronics and home appliances. Factors

such as increasing disposable incomes, urbanization, and the availability of

easy financing options have fueled the demand for a wide range of products

including smartphones, televisions, refrigerators, washing machines, air

conditioners, and kitchen appliances.

The market is highly competitive with

both domestic and international players vying for market share. Domestic brands

like Samsung, LG, Voltas, Godrej, and Whirlpool compete alongside global giants

such as Sony, Panasonic, Haier, and Xiaomi. This competition fosters innovation

and drives technological advancements tailored to local preferences and

affordability.

Digitalization has played a crucial role

in shaping consumer behavior, with e-commerce platforms offering convenience

and competitive pricing, contributing significantly to the market's growth.

Additionally, government initiatives such as Make in India and Digital India

have further bolstered manufacturing capabilities and digital infrastructure,

supporting the industry's expansion.

Key Market Drivers

Urbanization

and Changing Lifestyles

The rapid pace of urbanization in India has

transformed lifestyles and consumption patterns. Urban areas not only have higher

population densities but also offer better infrastructure and access to modern

retail outlets. This urban demographic tends to adopt new technologies and

products more readily, fueling demand for smartphones, smart TVs, air

conditioners, and other electronic gadgets. Moreover, urban consumers often

prioritize convenience and are more likely to invest in appliances that save

time and energy.

Technological

Advancements and Product Innovation

Technological innovation plays a crucial role in

shaping the consumer electronics and appliances market in India. Advancements

such as IoT (Internet of Things), AI (Artificial Intelligence), and smart

connectivity have led to the emergence of smart homes and connected devices.

Products like smart TVs with streaming capabilities, energy-efficient

appliances, and smartphones with advanced features are increasingly sought

after by tech-savvy consumers. Manufacturers continuously innovate to cater to

these evolving consumer preferences, enhancing product features, durability,

and user experience.

Digital

Transformation and E-Commerce Growth

The proliferation of digital platforms and e-commerce

has revolutionized the retail landscape in India. Online shopping offers

consumers convenience, competitive pricing, and access to a wide range of

products from both domestic and international brands. E-commerce platforms have

become crucial channels for consumer electronics and appliances, enabling

manufacturers to reach a broader audience across geographies. This digital

transformation has not only expanded market reach but also facilitated consumer

education, product comparison, and reviews, influencing purchase decisions

significantly.

Demographic

Trends and Consumer Preferences

Demographic factors such as a youthful population and

increasing urbanization significantly shaped consumer preferences and

purchasing behaviors in the electronics and appliances market. Younger

demographics showed a strong inclination towards digital gadgets and

technologically advanced products that resonate with their modern lifestyles

and aspirations. Regional disparities were notable, with urban consumers

favoring premium brands, while rural and smaller town consumers prioritized

affordability and product durability.

During festive seasons, electronic items emerged as

the top choice for consumers, according to a 2023 study. Over 70% of consumers

strategically awaited festive sales to purchase electronics, with 76%

specifically targeting smartphones. Additionally, three out of four consumers

prefer online festive shopping events to buy large appliances like

refrigerators, washing machines, geysers, and air conditioners. These findings

underscore the significant influence of festive sales events on consumer

purchasing behavior in the electronics and appliances sector, highlighting

opportunities for retailers and manufacturers to capitalize on seasonal demand

spikes through targeted marketing and promotional strategies.

Download Free Sample Report

Key Market Challenges

Price

Sensitivity and Affordability

Price sensitivity remains a significant

challenge in the Indian market, where a large segment of consumers is highly

price-conscious. Despite rising disposable incomes, many consumers prioritize

affordability when purchasing electronics and appliances. This trend is

particularly prevalent in semi-urban and rural areas where purchasing power may

be lower compared to urban centers. As a result, manufacturers must balance

offering innovative, feature-rich products with maintaining competitive pricing

to cater to diverse consumer segments.

Additionally, fluctuating exchange rates

and raw material costs can impact pricing strategies, posing further challenges

for manufacturers and retailers in managing profit margins while remaining

competitive in a price-sensitive market.

Intense

Competition and Market Saturation

The consumer electronics and appliances

market in India is highly competitive, characterized by both domestic and

international players vying for market share. Established brands like Samsung,

LG, and Sony compete alongside emerging players and new entrants offering

innovative products at competitive prices. This intense competition drives

constant innovation and improvement in product offerings, benefiting consumers

with a wider range of choices.

However, market saturation in certain

product categories, such as smartphones and televisions, poses challenges for

manufacturers seeking differentiation and sustainable growth. Brands must

continually innovate and invest in research and development to introduce

compelling features and technologies that resonate with evolving consumer

preferences.

Complex

Regulatory Environment

Navigating the regulatory landscape in

India can be complex and challenging for consumer electronics and appliances

manufacturers. Regulatory requirements related to product certification, safety

standards, environmental sustainability, and import/export policies vary and

can impact product pricing, distribution, and market entry strategies.

For instance, compliance with Bureau of

Indian Standards (BIS) certification for electronic products is mandatory,

ensuring adherence to safety and quality standards. Manufacturers must also

comply with e-waste management regulations, which require responsible disposal

and recycling of electronic waste, adding operational costs and logistical

complexities.

Furthermore, changes in tax policies and

tariffs, such as those related to GST (Goods and Services Tax) and customs

duties on imported components, can affect production costs and pricing

strategies. Adapting to regulatory changes while maintaining operational

efficiency and compliance poses ongoing challenges for industry stakeholders.

Consumer

Education and After-Sales Service

Educating consumers about product

features, benefits, and technological advancements remains a critical challenge

in the Indian market. Many consumers, particularly in semi-urban and rural

areas, may have limited awareness of the latest technologies or may prioritize

basic functionality and durability over advanced features. Effective marketing

and consumer education initiatives are essential for manufacturers to

communicate the value proposition of their products and drive adoption.

Moreover, ensuring robust after-sales

service and support is crucial for building consumer trust and loyalty. Timely

maintenance, repairs, and availability of genuine spare parts contribute to

customer satisfaction and brand reputation. Establishing and maintaining a

comprehensive service network across diverse geographical regions presents

logistical and operational challenges, particularly in remote areas where

infrastructure may be less developed.

Key Market Trends

Rise

of Smart and Connected Devices

One of the most significant trends in

the Indian consumer electronics market is the growing popularity of smart and

connected devices. These include smart TVs, home automation systems, connected

kitchen appliances, and wearable devices. The proliferation of high-speed

internet connectivity and the increasing adoption of smartphones have fueled

the demand for devices that offer IoT (Internet of Things) capabilities.

Consumers are increasingly seeking products that can be controlled remotely via

smartphones or voice assistants, enhancing convenience and efficiency in daily

tasks.

Smart TVs, in particular, have witnessed

rapid adoption, driven by the availability of streaming services and affordable

internet plans. Manufacturers are integrating advanced features such as voice

control, AI-powered recommendations, and seamless connectivity with other smart

devices to cater to tech-savvy consumers.

Shift

Towards Energy Efficiency and Sustainability

There is a growing awareness and

emphasis on energy efficiency and sustainability in the consumer electronics

and appliances sector. With rising concerns about environmental impact and

energy consumption, consumers are prioritizing products that are energy-efficient

and eco-friendly. Energy-efficient appliances such as refrigerators, air

conditioners, and washing machines are gaining popularity due to their lower

operating costs and reduced carbon footprint.

Manufacturers are responding to this

trend by incorporating technologies such as inverter compressors, LED lighting,

and energy-efficient motors in their products. Additionally, there is an

increasing focus on designing products that are recyclable and use

environmentally friendly materials, aligning with global sustainability goals

and regulatory requirements.

Demand

for Premium and Innovative Products

There is a growing demand for premium and innovative

products in the Indian consumer electronics market, driven by rising disposable

incomes and aspirational lifestyles. Consumers are willing to invest in

technologically advanced products that offer superior performance, design

aesthetics, and enhanced user experience. Premium categories such as

high-definition TVs, gaming consoles, flagship smartphones, and luxury kitchen

appliances are witnessing strong demand among affluent consumers.

Manufacturers are capitalizing on this trend by

launching flagship models with cutting-edge features, superior build quality,

and innovative designs. Product differentiation through advanced technologies

such as OLED displays, 5G connectivity, AI-powered cameras, and immersive audio

systems helps brands appeal to discerning consumers seeking the latest

innovations.

Adoption

of AI and Machine Learning

Artificial Intelligence (AI) and Machine

Learning (ML) are transforming the consumer electronics and appliances market

by enabling smarter, more intuitive products. AI-powered technologies enhance

device functionality, automate routine tasks, and personalize user experiences

based on behavioral patterns and preferences. Voice assistants such as Amazon

Alexa and Google Assistant are increasingly integrated into smart home devices,

allowing users to control appliances, access information, and manage tasks through

voice commands.

AI and ML algorithms are also enhancing

product capabilities in areas such as image and voice recognition, predictive

maintenance, energy optimization, and adaptive learning. These technologies

enable devices to learn and adapt to user habits, improving efficiency,

convenience, and user satisfaction. As AI continues to evolve, its application

in consumer electronics is expected to drive innovation and redefine the future

of smart living.

Segmental Insights

Type Insights

Personal care devices have emerged as

the fastest-growing segment in the Indian consumer electronics and appliances

market, driven by increasing awareness of personal grooming and wellness among

consumers. This segment includes products such as electric shavers, hair

dryers, hair straighteners, electric toothbrushes, and facial cleansing

devices. The rising disposable incomes, changing lifestyles, and growing

emphasis on personal appearance and hygiene are key factors fueling the demand

for these products.

Technological advancements have played a

significant role in enhancing the functionality and effectiveness of personal

care devices. Innovations such as adjustable settings, ergonomic designs, and

advanced materials improve user experience and attract tech-savvy consumers.

Moreover, the influence of social media, celebrity endorsements, and beauty

influencers has heightened consumer awareness and aspiration for grooming

products.

E-commerce platforms have been

instrumental in driving the growth of personal care devices by offering a wide

range of products, competitive pricing, and convenient shopping experiences.

Manufacturers are expanding their product portfolios and marketing efforts to

cater to diverse consumer preferences and capitalize on this expanding market

segment. As consumer demand for convenience, efficiency, and personal wellness

continues to rise, the personal care devices segment is poised for sustained

growth in the Indian market.

Sales

Channel Insights

The online segment is

experiencing rapid growth in the India consumer electronics and appliances

market, driven by increasing internet penetration, smartphone usage, and

digital literacy across urban and rural areas. E-commerce platforms have become

popular channels for purchasing electronics due to their convenience,

competitive pricing, and wide product selection. Consumers can easily compare

products, read reviews, and make informed decisions online, which has

accelerated the shift towards digital retail.

The COVID-19 pandemic

further accelerated this trend as lockdowns and social distancing measures

prompted consumers to rely more on online shopping for safety and convenience.

Major e-commerce players have capitalized on this opportunity by expanding their

product offerings, improving logistics networks, and enhancing customer service

to meet growing demand.

Manufacturers and

retailers are adapting to this shift by investing in digital marketing

strategies, optimizing online platforms for user experience, and implementing

robust supply chain solutions to ensure timely delivery. As consumer confidence

in online transactions continues to grow, the online segment is expected to

remain a key growth driver in the Indian consumer electronics and appliances

market, shaping the future of retail in the digital age.

Download Free Sample Report

Regional Insights

The northern region of India stands out

as a dominant force in the consumer electronics and appliances market,

characterized by its large population base, rapid urbanization, and strong

economic growth. Major cities like Delhi, NCR (National Capital Region),

Chandigarh, and Jaipur are key contributors to the region's market dominance,

supported by a high concentration of affluent households and a burgeoning middle

class.

The northern region's significant

economic activities and infrastructure development have created a conducive

environment for the growth of consumer electronics and appliances. Urban

consumers in these areas display a strong preference for premium and technologically

advanced products, including smartphones, high-definition televisions, air

conditioners, and home appliances that offer convenience and efficiency.

The region benefits from

well-established retail networks and distribution channels, facilitating easy

access to a wide range of products from both domestic and international brands.

Brick-and-mortar stores, shopping malls, and electronics markets continue to

play a crucial role in catering to consumer preferences and driving sales.

Recent Developments

- In March 2024, Samsung, India's leading

consumer electronics brand, launched a new series of AI Ecobubble™ fully

automatic front load washing machines. This innovative range, the first in the

11 kg segment, introduces advanced functionalities including AI Wash, Q-Drive™

technology, and Auto Dispense. These features enhance washing efficiency and

user convenience by leveraging artificial intelligence for optimized washing

cycles, faster performance with Q-Drive™, and automated detergent dispensing.

- In May 2024, LG introduced a new lineup

of AI-powered smart TVs in India, featuring cutting-edge technologies such as

real-time upscaling. The launch includes 55 new models, ranging from 43 inches

to 97 inches in size. These models encompass LG OLED evo AI and LG QNED AI TVs,

designed to deliver enhanced viewing experiences through advanced artificial

intelligence capabilities.

Key Market Players

- Samsung Electronics Co., Ltd.

- Xiaomi Technology India Private Limited

- LG Electronics India Private Limited

- Whirlpool of India Limited

- Panasonic Life Solutions India Private

Limited

- Sony India Private Limited

- Crompton Greaves Consumer Electricals

Ltd

- Godrej & Boyce Manufacturing Company

Limited

- Bajaj Electricals Limited

- IFB Industries Limited

|

By Type

|

By Application

|

By Sales Channel

|

By Region

|

- Audio & Visual Electronics

- Home Appliances

- Kitchen Appliances

- Personal Care Devices

|

|

- Multi-Branded Stores

- Hypermarket/ Supermarket

- Online

- Others

|

|

Report Scope:

In this report, the India Consumer Electronics and

Appliances Market has been segmented into the following categories, in addition

to the industry trends which have also been detailed below:

- India Consumer Electronics

and Appliances Market, By Type:

o Audio & Visual Electronics

o Home Appliances

o Kitchen Appliances

o Personal Care Devices

- India Consumer Electronics

and Appliances Market, By Application:

o Residential

o Commercial

- India Consumer Electronics

and Appliances Market, By Sales Channel:

o Multi-Branded Stores

o Hypermarket/ Supermarket

o Online

o Others

- India Consumer Electronics

and Appliances Market, By Region:

o North

o South

o East

o West

Competitive Landscape

Company Profiles: Detailed analysis of the major companies presents

in the India Consumer Electronics and Appliances Market.

Available Customizations:

India Consumer Electronics and Appliances Market report

with the given market data, TechSci Research offers customizations according

to a company's specific needs. The following customization options are

available for the report:

Company Information

- Detailed analysis and

profiling of additional market players (up to five).

India Consumer

Electronics and Appliances Market is an upcoming report to be released soon. If

you wish an early delivery of this report or want to confirm the date of

release, please contact us at [email protected]