|

Forecast Period

|

2026-2030

|

|

Market Size (2024)

|

USD

79.09 Million

|

|

CAGR (2025-2030)

|

10.37%

|

|

Fastest Growing Segment

|

Small

Molecule

|

|

Largest Market

|

South India

|

|

Market Size (2030)

|

USD 143.28 Million

|

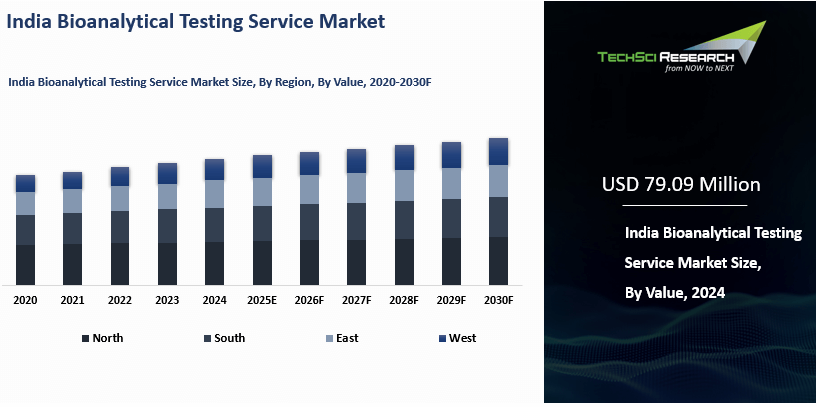

Market Overview

India Bioanalytical Testing Service

Market was valued at USD 79.09 Million in 2024 and is expected to reach USD 143.28

Million by 2030 with a CAGR of 10.37% during the forecast period.

The India

Bioanalytical Testing Service market is experiencing robust growth, primarily

driven by the increasing demand from the pharmaceutical and biotechnology

sectors. The rising need for drug efficacy, safety, and regulatory compliance

has led to a surge in bioanalytical testing services. Outsourcing of these

services to India, driven by cost-effectiveness and a skilled talent pool, has

further fueled market expansion. The growing number of clinical trials and

stringent regulatory requirements by bodies like the CDSCO and WHO have also

contributed to the rising demand for bioanalytical testing. Additionally,

advancements in technologies such as mass spectrometry and chromatography have

enhanced testing capabilities, attracting more companies to utilize these

services.

However, the market faces challenges such as the

complexity of testing for biologics, which requires specialized equipment and

expertise. The lengthy regulatory approval processes and high costs associated

with setting up advanced testing laboratories can also be hurdles. Furthermore,

there is an increasing need for skilled professionals to meet the growing

demand, which may create talent shortages in the future. Despite these

challenges, the India Bioanalytical Testing Service market is poised for continued

growth, with the Southern region emerging as the dominant player, benefiting

from the concentration of pharmaceutical and biotech firms, strong government

support, and an established infrastructure.

Download Free Sample Report

Key Market Drivers

Rising

Demand for Pharmaceutical and Biotech Research

The rising demand for pharmaceutical and biotech research in India is fueled by multiple factors that align with global healthcare trends. India is a significant player in the clinical trials landscape, conducting about 8% of global clinical trials as of 2022. This is supported by the country's large and diverse patient pool of over 1.4 billion people, which provides valuable demographic data for clinical research. India's cost advantages, with trials being significantly cheaper than in Western nations, and a skilled, English-speaking medical workforce further enhance its appeal as a hub for all phases of clinical trials.

India’s pharmaceutical sector plays a crucial role in the global supply chain. The country is the largest provider of generic medicines globally, accounting for a 20% share of the global supply by volume. It supplies approximately 60% of the world's vaccine demand and fulfills 65-70% of the World Health Organization's vaccine requirements. In the fiscal year 2024, India's pharmaceutical exports reached $27.8 billion. Consequently, both domestic and international pharmaceutical companies are increasing their R&D spending in India, which necessitates advanced bioanalytical testing services to ensure the safety and efficacy of new drugs.

The Indian government actively supports this growth through various initiatives.

- The Production Linked Incentive (PLI) schemes for pharmaceuticals, bulk drugs, and medical devices have a total financial outlay of over ₹25,000 crore (approximately $3 billion USD). As of late 2024 and early 2025, these schemes had already attracted investments significantly higher than the initially committed amounts

- The scheme aims to attract a total R&D investment of approximately ₹11,000 crore, not ₹17,000 crore. This investment will be used to support around 300 projects involving new medicines, complex generics, biosimilars, and novel medical devices. Some sources incorrectly stated the higher figure, likely conflating targets or referring to outdated information.

- The Biotechnology Industry Research Assistance Council (BIRAC) provides funding through programs like the Biotechnology Ignition Grant (BIG), which offers up to ₹50 lakhs (around $60,000) to support early-stage research projects with commercial potential.

India's growing role in biotechnology innovation is also evident from its significant contributions to vaccine development. The country has the highest number of US FDA-compliant pharmaceutical plants outside of the United States. It is a leading producer of affordable vaccines for diseases such as measles, DPT (Diphtheria, Tetanus, and Pertussis), and polio. For instance, India accounts for nearly 90% of the global demand for the measles vaccine. During the COVID-19 pandemic, India supplied 242 million low-cost, high-quality vaccine doses to 101 countries. This focus on biotechnology, along with advancements in genomics and personalized medicine, is increasing the demand for bioanalytical testing services as companies require these services to meet stringent regulatory standards.

Surge in Technological

Advancements

The increase in clinical trials in India

has been a significant driver of the rising demand for pharmaceutical and

biotech research, along with bioanalytical testing services. India has emerged

as a preferred destination for clinical trials due to its large, diverse

population, cost-effectiveness, and efficient regulatory processes. As of

recent reports, India conducts over 1,000 clinical trials annually, with a

substantial proportion—approximately 60-70%—being sponsored by international

pharmaceutical companies. This makes India one of the leading locations

globally for clinical trial activities.

The country’s vast patient pool, which

exceeds 1.4 billion people, is a major attraction for pharmaceutical companies.

India's population includes a broad spectrum of genetic backgrounds, providing

valuable insights into the effectiveness and safety of new drugs across diverse

demographic groups. This is particularly beneficial for trials related to

chronic conditions such as diabetes, hypertension, cancer, and cardiovascular

diseases, which are prevalent in India. For example, global pharmaceutical companies

like Novartis and Pfizer have conducted clinical trials in India for drugs

targeting diabetes and oncology, benefiting from the country’s large patient

base and cost advantages.

India’s clinical trials also offer

significant cost savings compared to developed nations. The cost of

conducting clinical trials in India is often 40-60% lower than in countries

like the United States or Europe. This includes reduced costs for patient

recruitment, data collection, and clinical monitoring. A study by the Clinical

Trials Registry of India revealed that clinical trial costs in India are

approximately one-fourth of those in the U.S., making it an attractive option

for global drug developers.

India’s regulatory framework, overseen

by the Central Drugs Standard Control Organization (CDSCO), has evolved in

recent years to support the growing clinical trials market. The government has

introduced reforms to expedite the approval process for new trials and has

worked to align regulatory practices with global standards such as Good

Clinical Practice (GCP). These regulatory advancements have contributed to an

increase in the number of multinational companies conducting clinical trials in

India.

For instance, the COVID-19 pandemic saw

significant clinical trials in India, with companies like Bharat Biotech and

Serum Institute of India conducting large-scale trials for vaccines such as

Covaxin and Covishield. These trials not only helped in addressing the global

pandemic but also highlighted India’s critical role in the global clinical

trials landscape.

Key Market Challenges

Lack

of Skilled Workforce

One of the significant challenges facing the

bioanalytical testing services market in India is the shortage of a highly

skilled workforce. As the demand for bioanalytical testing services grows with

the expanding pharmaceutical and biotechnology sectors, there is a clear gap in

the availability of professionals who possess specialized skills in advanced

testing techniques and technologies. This lack of skilled labor directly

impacts the quality, efficiency, and scalability of testing services,

especially in a market that is rapidly evolving and requires adherence to

stringent global standards.

India's bioanalytical testing sector relies heavily on

professionals skilled in complex areas such as pharmacokinetics (PK),

bioavailability, and bioequivalence, among others. However, many testing

facilities in India struggle to attract and retain talent capable of performing

high-level analyses using state-of-the-art technologies like mass spectrometry,

liquid chromatography, and other cutting-edge instrumentation. While the Indian

pharmaceutical and clinical research industries have a large talent pool, the

highly specialized skills required in bioanalytical testing are often limited,

as bioanalytical testing is a niche area that requires specific academic and

practical training.

According to a report by NASSCOM, the Indian

pharmaceutical industry is expected to employ over 4.5 million people by 2025, but a

significant portion of these professionals will need further specialization in

bioanalytical testing to meet the increasing demands of drug development and

clinical trials. The gap in highly skilled talent is further compounded by the

rapid pace of technological advancements in the field, requiring professionals

to continuously upgrade their skills.

A survey by BioPharma Asia reported that over 60% of

bioanalytical service providers in India faced challenges in hiring

professionals with the necessary skills and experience in bioanalytical

testing, with 47% of respondents citing difficulty in finding qualified experts

in advanced testing techniques like HPLC and mass spectrometry. This shortage

of skilled professionals not only slows down the growth of the bioanalytical

services market but also increases labor costs as companies compete for the

limited talent pool available.

Key Market Trends

Growth

in the Contract Research Organization (CRO) Market in India

The Contract Research Organization (CRO) market in India is experiencing significant expansion, positioning the nation as a premier hub for pharmaceutical and biotech research. This growth is fueled by a compelling combination of cost-effective R&D services, a vast and diverse patient population, and a highly skilled scientific workforce. As global demand for efficient drug development escalates, India's CROs are increasingly sought after for outsourcing critical research services, from discovery to post-market surveillance. This trend solidifies India's strategic importance in the global pharmaceutical value chain and its role in accelerating medical innovation.

A key driver of this growth is the increasing trend of global pharmaceutical firms outsourcing their clinical trial services to India. The country's robust regulatory framework, which aligns with international Good Clinical Practice (GCP) standards, provides assurance of data quality and compliance. Furthermore, supportive government initiatives and streamlined approval processes have simplified the initiation and execution of clinical trials. This favorable environment reduces timelines and costs, making India a highly attractive destination for multinational companies looking to accelerate their drug development pipelines and gain a competitive advantage.

Indian CROs are rapidly integrating technological advancements to enhance service delivery and trial outcomes. The adoption of artificial intelligence (AI), machine learning, and advanced data analytics is revolutionizing clinical trial management. These digital tools streamline patient recruitment, enable real-time data monitoring, and improve the accuracy of clinical data analysis. By leveraging technology, Indian CROs offer more efficient, precise, and high-quality services in data management and clinical monitoring, boosting their competitive edge in the global market and ensuring superior trial performance for their clients.

The market is also benefiting from India's expanding capabilities in conducting complex, multi-phase clinical trials, including Phase I-IV studies. This expertise is particularly prominent in high-demand therapeutic areas like oncology, diabetes, and vaccines. Concurrently, the rising global demand for biosimilars and biologics has created new opportunities for specialized CRO services. Indian organizations are adept at navigating the specific regulatory pathways and testing requirements for these complex molecules, offering end-to-end support from development to post-market surveillance, further fueling market expansion..

Segmental Insights

Molecule

Insights

Based on Molecule, Small Molecule have

emerged as the fastest growing segment in the India Bioanalytical Testing

Service Market in 2024. Small molecules, which are typically

low-molecular-weight compounds, are central to the development of a wide range

of pharmaceutical products, particularly generic drugs, and are widely used in

the treatment of chronic diseases such as cancer, cardiovascular conditions,

and diabetes. The increasing prevalence of these diseases in India, coupled

with rising healthcare access, has driven the demand for small molecule-based

therapies. Additionally, small molecules are essential in the development of

cost-effective drugs, which is crucial for India, where there is a large market

for affordable pharmaceutical solutions.

The expansion of the Indian pharmaceutical sector,

particularly in the generic drug manufacturing industry, has also contributed

to the rise in small molecule testing services. India is one of the largest

suppliers of generic medicines globally, and the bioanalytical testing required

to ensure the efficacy and safety of these molecules is increasingly outsourced

to bioanalytical testing labs. Furthermore,

advancements in drug formulation technologies, along with the growing adoption

of biologics and biosimilars, have further highlighted the need for efficient

small molecule testing. The large number of clinical trials and regulatory

requirements to validate the quality of these molecules also plays a critical

role in the demand for bioanalytical testing services tailored to small

molecule drugs.

Test Insights

Based on Test, Pharmacokinetics (PK) have

emerged as the fastest growing segment in the India Bioanalytical Testing

Service Market during the forecast period. PK testing plays a crucial role in

evaluating the absorption, distribution, metabolism, and excretion (ADME) of a

drug, helping to understand its behavior within the body. As the demand for

both new drug development and generic drug approval continues to rise, PK

testing has become essential for ensuring the safety, efficacy, and proper

dosage of pharmaceutical products.

With an increase in clinical trials, particularly for

small molecules and biologics, PK testing is a vital step in the drug

development process to optimize drug formulations and ensure therapeutic

effectiveness. Regulatory authorities like the USFDA and CDSCO (Central Drugs

Standard Control Organization) require detailed PK studies to support drug

approvals, further driving the need for bioanalytical testing services in

India.

.png)

Download Free Sample Report

Regional Insights

Based on Region, South India have

emerged as the dominating region in the India Bioanalytical Testing Service

Market in 2024. South India has emerged as the dominating region in the India

Bioanalytical Testing Service Market in 2024 due to several key factors. The

region is home to a well-established and rapidly growing pharmaceutical and

biotechnology industry, which significantly contributes to the demand for

bioanalytical testing services. Cities like Hyderabad, Bangalore, and Chennai

have become major hubs for pharmaceutical research and development, with a high

concentration of contract research organizations (CROs), clinical research

institutions, and bioanalytical laboratories.

Hyderabad, often referred to as "India’s

Pharmaceutical Capital," houses a number of global pharmaceutical

companies, contract manufacturers, and biotech firms, further driving the need

for bioanalytical testing services. South India also benefits from a robust

infrastructure and favorable government policies aimed at fostering growth in

the life sciences sector, including initiatives like the establishment of

biotechnology parks and tax incentives for R&D activities. Additionally,

the region has a well-developed pool of skilled professionals in pharmaceutical

sciences and clinical research, making it an attractive destination for

bioanalytical testing service providers.

Recent Development

- In September 2024, the

Indian Council of Medical Research (ICMR) signed Memorandum of Agreements

(MoAs) with multiple industry and academic partners to advance first-in-human

Phase 1 clinical trials for four promising molecules. These collaborations

include the development of a small molecule targeting multiple myeloma in

partnership with Aurigene Oncology Limited, a Zika virus vaccine with Indian

Immunologicals Limited, a seasonal influenza vaccine with Mynvax Private

Limited, and the exploration of CAR-T cell therapy for chronic lymphocytic

leukemia with ImmunoACT. This initiative is designed to position India as a

leader in clinical development by improving its capacity for early-phase

clinical trials and fostering indigenous pharmaceutical innovations.

- In April 2024, India's biopharmaceutical

company Biocon embarked on developing its own version of Novo Nordisk's

weight-loss medication, Wegovy. The company aimed to introduce a

semaglutide-based product to tap into the burgeoning obesity treatment market,

projected to reach at least $100 billion by 2030.

- In February 2024, India achieved a

significant milestone by conducting its first human clinical trial of gene

therapy for haemophilia A at Christian Medical College (CMC) Vellore. This

pioneering study was supported by the Department of Biotechnology, the Centre

for Stem Cell Research (a unit of InStem Bengaluru), and Emory University, USA.

The innovative approach involved using a lentiviral vector to express a Factor

VIII (FVIII) transgene in the patient's own haematopoietic stem cells, enabling

the production of FVIII from specific differentiated blood cells.

- In October 2023, Roche Pharma India

launched its Clinical Trial Excellence project to enhance the capabilities of

public health institutions in conducting clinical trials and drug research. The

initiative aims to transform government hospitals into Centres of Excellence for

Clinical Research, elevating their position in the value chain. The Kalyan

Singh Super Specialty Cancer Institute (KSSSCI) in Lucknow, Uttar Pradesh,

became the first partner in this project. KSSSCI is a 750-bed state-of-the-art

cancer center involved in cancer research and education.

Key Market Players

- Syneos

Health Pvt Ltd

- Intertek

Group PLC

- SGS

SA

- IQVIA

Inc

- Icon

PLC

- Labcorp

Holdings Inc

- Charles

River Laboratories India Pvt. Ltd.

|

By Molecule

|

By Test

|

By Workflow

|

By Application

|

By End Use

|

By Region

|

- Small Molecule

- Large Molecule

- Others

|

- ADME

- PK

- PD

- Bioavailability, Bioequivalence

- Others

|

- Sample Preparation

- Sample Analysis

- Others

|

- Oncology

- Neurology

- Infectious Diseases

- Gastroenterology

- Cardiology

- Other

|

- Pharma & BioPharma Companies

- CDMO

- CRO

|

- East India

- West India

- North India

- South India

|

Report Scope

In this report, the India Bioanalytical Testing

Service Market has been segmented into the following categories, in addition to

the industry trends which have also been detailed below:

- India Bioanalytical Testing

Service Market, By

Molecule:

o Small Molecule

o Large Molecule

o Others

- India Bioanalytical Testing

Service Market, By

Test:

o ADME

o PK

o PD

o Bioavailability

o Bioequivalence

o Others

- India Bioanalytical Testing

Service Market, By

Workflow:

o Sample Preparation

o Sample Analysis

o Others

- India Bioanalytical Testing

Service Market, By

Application:

o Oncology

o Neurology

o Infectious Diseases

o Gastroenterology

o Cardiology

o Other

- India Bioanalytical Testing

Service Market, By

End Use:

o Pharma & BioPharma Companies

o CDMO

o CRO

- India Bioanalytical Testing

Service Market, By Region:

o East India

o West India

o North India

o South India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies

present in the India Bioanalytical Testing Service Market.

Available Customizations:

India Bioanalytical Testing Service Market report

with the given market data, TechSci Research offers customizations according

to a company's specific needs. The following customization options are

available for the report:

Company Information

- Detailed analysis and

profiling of additional market players (up to five).

India Bioanalytical Testing Service Market is an

upcoming report to be released soon. If you wish an early delivery of this

report or want to confirm the date of release, please contact us at [email protected]