|

Forecast

Period

|

2026-2030

|

|

Market

Size (2024)

|

USD

13.60 Billion

|

|

Market

Size (2030)

|

USD

21.99 Billion

|

|

CAGR

(2025-2030)

|

8.30%

|

|

Fastest

Growing Segment

|

In-house

Manufacturing

|

|

Largest

Market

|

North

India

|

Market Overview

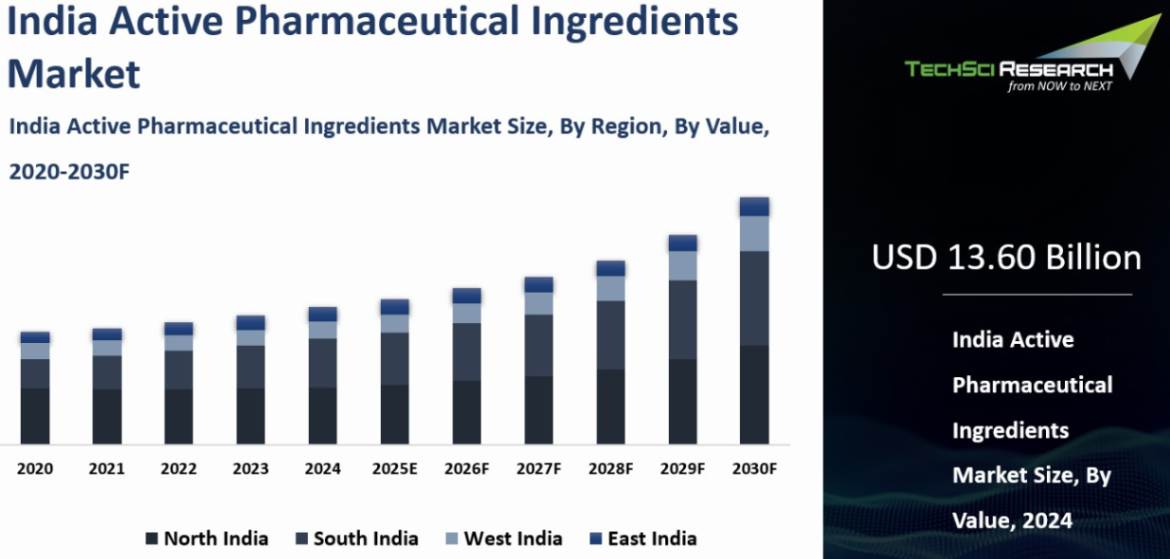

India Active Pharmaceutical Ingredients Market was valued at USD 13.60 Billion in 2024 and is anticipated to reach USD 21.99 Billion by 2030, with a CAGR of 8.30% through 2030.

Active Pharmaceutical Ingredients (APIs) are the bioactive components in drugs that produce therapeutic effects. They include small molecules, peptides, proteins, and nucleic acids, depending on the drug’s mechanism of action. APIs are formulated into dosage forms like tablets, capsules, or injections for safe administration.

India ranks third globally in API production by volume and 14th by value, holding an 8 percent global share. The country produces over 500 APIs and accounts for 57 percent of the WHO’s prequalified list.

Strong R&D investment by Indian pharmaceutical firms supports innovation and market expansion. Rising demand for both generic and specialty drugs has pushed the government to promote local API manufacturing. In 2020, the government approved INR 6,940 crore under the Production-Linked Incentive (PLI) scheme to strengthen domestic output of Key Starting Materials, Drug Intermediates, and APIs. Production of 35 APIs, covering about 67 percent of the nation’s import-dependent materials, has already begun.

Custom synthesis and contract manufacturing services further enhance the sector by enabling tailored API development and collaboration with global clients. The growing integration of Indian manufacturers into international supply chains continues to expand exports and drive the growth of the India Active Pharmaceutical Ingredients Market.

Download Free Sample Report

Key Market Drivers

Rise in the Domestic Pharmaceutical Market

India’s large population has extensive healthcare needs, from treating diseases to managing chronic conditions. The widespread use of affordable generic medicines is a key feature of the country’s healthcare system, and their production relies heavily on active pharmaceutical ingredients (APIs), which drives API market demand.

According to the International Diabetes Federation, around 74 million Indians were living with diabetes in 2021, projected to reach nearly 93 million by 2030. This growing number of chronic patients raises the need for safe and effective medicines, increasing API consumption. Recent data from the Longitudinal Ageing Survey in India (LASI) indicates that 21% of the elderly population has at least one chronic condition, with hypertension and diabetes being the most prevalent.

Rising incomes and expanding healthcare spending further support this trend. Government programs such as the National Health Mission improve healthcare access and strengthen the pharmaceutical market. Chronic illnesses like diabetes, cardiovascular diseases, and respiratory disorders continue to increase, sustaining API demand. Non-communicable diseases (NCDs) now account for the majority of deaths in India; in 2023, ischemic heart disease was the leading cause of death, with a mortality rate of 127.82 per lakh.

India’s expanding middle class, with higher health awareness and expectations for quality care, contributes to growing pharmaceutical consumption. Broader health insurance coverage has made medical treatment more affordable, while improved distribution networks ensure medicines reach all regions efficiently.

Together, these factors reinforce the strong growth of the India Active Pharmaceutical Ingredients Market, supported by population health needs, chronic disease prevalence, government support, and an accessible healthcare system.

Increasing Demand of Custom Synthesis and Contract

Manufacturing

Custom synthesis and contract manufacturing services allow pharmaceutical companies to obtain APIs tailored to their specific formulations and development needs. This customization supports innovation and efficient production of proprietary drugs. Partnering with specialized service providers offers cost efficiency, with Indian API production being 30–40% cheaper than in Western markets.

Outsourcing API manufacturing helps pharmaceutical companies shorten development timelines and focus on research and commercialization. It also minimizes risks associated with supply chain disruptions, a key consideration for global firms diversifying away from single-source dependencies. Reputed contract manufacturers in India maintain high-quality and compliance standards, with the country accounting for 57% of all WHO-prequalified APIs.

These providers offer flexible production capabilities, enabling companies to scale manufacturing as needed. Indian manufacturers produce over 500 different APIs and are recognized for their ability to handle both traditional and complex chemical syntheses. Their ability to transfer technology smoothly from lab-scale to commercial production ensures consistency and continuity.

Many API manufacturers with custom synthesis capabilities serve international clients, providing global reach and safeguarding intellectual property. They also collaborate on R&D initiatives across therapeutic segments, such as oncology and cardiovascular diseases, fostering innovation and new drug development.

The combination of technical expertise, regulatory reliability, scalability, and global collaboration continues to strengthen demand for custom synthesis and contract manufacturing services, supporting the growth of the India Active Pharmaceutical Ingredients Market.

Key Market Challenges

Quality Control and Assurance

Meeting the stringent quality standards and

regulatory requirements of various international markets, such as the US FDA

and the European Medicines Agency (EMA), is a continuous challenge. API

manufacturers in India must invest in robust quality control and assurance

processes to gain and maintain regulatory approvals.

Maintaining consistent

quality across different batches of APIs is a challenge. Variability in API quality can lead to manufacturing issues and affect the safety and

efficacy of the final drug product. The quality of raw materials, including

starting materials and intermediates, is crucial for API production. Ensuring

the quality and traceability of these materials can be challenging, especially

when sourced from diverse suppliers.

Ensuring compliance with Good

Manufacturing Practices (GMP) standards is essential for API manufacturers. It

requires a significant investment in infrastructure, equipment, training, and

quality management systems. Recruiting and retaining skilled professionals with

expertise in analytical chemistry, quality control, and quality assurance is a

challenge. Highly qualified personnel are needed to implement quality control

processes effectively.

Market Access Barriers

Meeting the stringent regulatory standards of

various international markets, such as the US FDA and the European Medicines

Agency (EMA), can be a significant barrier. API manufacturers must ensure that

their facilities and processes adhere to these standards to gain market access.

Maintaining consistent quality and adherence to Good Manufacturing Practices

(GMP) is essential for market access. Variability in API quality can lead to

rejection by regulatory authorities and customers.

The protection of intellectual

property rights can be a barrier when exporting APIs to certain markets. API

manufacturers must navigate complex patent landscapes and intellectual property

regulations to gain market access. Accurate and comprehensive documentation is

crucial for regulatory approvals and market access. Ensuring that all required

documents are in order can be a challenge. API manufacturers often face intense

price competition in global markets.

Ensuring cost competitiveness while

maintaining quality can be a barrier. Trade barriers, such as tariffs and

non-tariff barriers, can affect the export of APIs to specific countries.

Negotiating these barriers can be a challenge. Complying with customs and

import regulations in target markets can be complex and time-consuming, leading

to delays and potential barriers.

Key Market Trends

Environmental Sustainability

Increasingly stringent environmental regulations require pharmaceutical manufacturers, including API producers, to adopt more sustainable and environmentally friendly production processes. Compliance with these regulations is essential for market access and reputation. The adoption of green chemistry principles is gaining traction.

Green chemistry focuses on minimizing the environmental impact of chemical processes, reducing waste, and conserving resources. API manufacturers are seeking ways to optimize resource use, with many plants in Gujarat and Telangana now equipped with zero-liquid discharge and water recycling plants. Minimizing waste generation is also a priority; high-temperature incineration (1200°C) is a preferred alternative for waste disposal to avoid environmental pollution. Some API manufacturers, including Dr. Reddy's Laboratories and Ipca Laboratories, are transitioning to the use of renewable energy sources, with one company reporting a 30% reduction in energy consumption through the adoption of solar panels and other high-efficiency systems.

The pharmaceutical industry is showing an interest in sourcing raw materials and starting materials from suppliers who follow sustainable practices. Efforts to reduce the carbon footprint of API manufacturing are becoming more common, with initiatives to measure and reduce greenhouse gas emissions, as the supply chain accounts for a significant portion of the sector's total emissions. The concept of a circular economy, where resources and materials are recycled and reused, is being applied in the pharmaceutical industry, including the recycling of solvents and the reuse of waste products.

Growing Research and Development

Pharmaceutical research and development (R&D) primarily aim to discover and develop new drugs, driving demand for specific APIs sourced or synthesized for these drugs, with Indian manufacturers producing over 500 different types of APIs. R&D focuses on innovating drug formulations and delivery systems, often necessitating novel APIs. Ongoing efforts in R&D aim to enhance the efficacy, safety, and patient experience of existing drugs, potentially leading to modified APIs or new production processes. The trend toward personalized medicine further increases API demand, as treatments are tailored to individuals' genetic profiles, a field that is growing in India despite a still-developing regulatory framework.

The growth of biopharmaceuticals, including biologics and biosimilars, relies on R&D to develop corresponding APIs like monoclonal antibodies and recombinant proteins, with Indian firms like Biocon Biologics and Dr. Reddy's building global biosimilar portfolios. Advanced therapies such as gene and cell therapies also require specialized APIs, contributing to API demand. Clinical trials, crucial for drug development, drive API demand for trial supply and subsequent production; India has become a favored destination for these trials, with over 94,000 registered since 2000, and requires specific regulatory permissions like Form CT-16 for the import of APIs for this purpose.

Early-stage R&D involves identifying potential drug targets and compounds, laying the groundwork for API development. Pharmaceutical companies expanding into new therapeutic areas often need to source or develop APIs for drugs in these markets. R&D activities are pivotal for meeting regulatory standards and obtaining approvals, with government initiatives like the Production Linked Incentive (PLI) Scheme supporting the domestic production of 54 critical APIs, 38 of which were already developed in-house by mid-2023.

Companies may invest in R&D for generic drug development post-patent expiry, leading to generic API production, a significant area for India as it is the world's largest supplier of generic medicines by volume. Quality-driven R&D efforts ensure API safety, efficacy, and adherence to standards, fueling demand for high-quality ingredients from India, which contributes a majority of the APIs on the WHO's prequalified list. To stay competitive, companies invest in R&D to differentiate their products, driving the development of unique APIs, with some firms like Piramal offering a portfolio of over 50 ready-to-offer APIs. This trend is poised to accelerate demand in the India Active Pharmaceutical Ingredients Market.

Segmental Insights

Method of Synthesis

Insights

In 2024, the Synthetic segment held the largest share of the India Active Pharmaceutical Ingredients Market and is expected to continue expanding over the coming years. Synthetic APIs are highly

versatile and can be used in a wide range of pharmaceutical products, including

both generic and innovative drugs. Their broad applicability makes them a

popular choice for pharmaceutical manufacturers.

Synthetic APIs are often more

cost-effective to produce compared to their natural or biologically derived

counterparts. This cost advantage is particularly appealing to pharmaceutical

companies, as it helps reduce overall production expenses. Synthetic APIs can

be manufactured with a high degree of consistency and quality control, ensuring

that each batch meets strict regulatory and quality standards.

This is crucial

for drug safety and efficacy. Many Indian pharmaceutical companies specializing

in synthetic APIs have invested in maintaining rigorous quality standards and

obtaining approvals from stringent regulatory authorities, such as the US Food and

Drug Administration (FDA) and the European Medicines Agency (EMA). Synthetic

APIs can be tailored to meet specific requirements, allowing pharmaceutical

manufacturers to create proprietary formulations and optimize drug performance.

Synthetic APIs are often associated with a reliable and consistent supply,

reducing the risk of shortages or disruptions in the pharmaceutical supply

chain.

Source Insights

In 2024, the largest share of the India Active Pharmaceutical Ingredients Market was held by the Contract Manufacturing Organizations (CMO) segment and is predicted to continue expanding over the coming years. The global pharmaceutical industry has

witnessed a growing trend of outsourcing various aspects of drug development

and manufacturing to CMOs.

This trend extends to the production of APIs, with

many pharmaceutical companies preferring to focus on research, marketing, and

sales, while outsourcing API manufacturing. CMOs often offer cost-effective

solutions for API manufacturing. They have specialized facilities, expertise,

and efficient processes that can lead to cost savings for pharmaceutical

companies. India is known for its cost-effective pharmaceutical manufacturing.

Reputed Indian CMOs have invested in meeting stringent regulatory standards,

such as those set by the US Food and Drug Administration (FDA) and the European

Medicines Agency (EMA). This compliance is critical for API manufacturing,

especially for companies seeking to export to global markets. CMOs in India

often have significant production capacities and can efficiently scale up or

down based on the needs of their clients.

This flexibility is appealing to

pharmaceutical companies looking for reliable API suppliers. Many Indian CMOs

have a skilled and experienced workforce with expertise in various chemical and

pharmaceutical processes. This expertise is crucial for the development and

production of APIs. CMOs offer customized solutions that allow pharmaceutical

companies to tailor their API production to specific requirements. This

flexibility can be especially important for companies developing novel drugs or

unique formulations.

Download Free Sample Report

Regional Insights

The North India region dominated the India Active

Pharmaceutical Ingredients Market in 2024. North India, particularly the states of Himachal Pradesh and Punjab,

has a long history of pharmaceutical manufacturing. Many well-established

pharmaceutical companies, including some of the country's largest, are based in

this region. North India offers a conducive business environment with access to

skilled labor, infrastructure, and connectivity. It has well-developed

industrial clusters that support pharmaceutical manufacturing.

The proximity of

North India to the national capital, New Delhi, is advantageous for regulatory

and administrative purposes. It facilitates interactions with government bodies

and regulatory agencies. North India is home to several prominent educational

and research institutions specializing in pharmaceutical sciences. These institutions

provide a pool of trained talent and contribute to research and development in

the pharmaceutical sector. The state governments in North India have often been

proactive in promoting pharmaceutical manufacturing through incentives,

subsidies, and the establishment of pharmaceutical parks and special economic

zones.

Recent Developments

- In February 2024, in line with the government's Production Linked Incentive (PLI) scheme and other supportive policies, multiple Indian pharmaceutical firms announced significant expansions of their Active Pharmaceutical Ingredient (API) manufacturing capacities. These initiatives are designed to boost domestic production and reduce the country's reliance on imported raw materials.

- During the 2024-25 financial year, the Indian Department of Pharmaceuticals approved 13 Foreign Direct Investment (FDI) proposals for brownfield Active Pharmaceutical Ingredient (API) and pharmaceutical projects, amounting to rupee 7,246.40 crore. These approvals are intended to further stimulate growth and modernization in the sector.

- In September 2024, Wanbury announced its new Active Pharmaceutical Ingredient (API) product portfolio for the 2024–2025 fiscal year. The expansion includes products in high-demand therapeutic areas like anti-diabetics (Metformin), anti-depressants (Sertraline), and analgesics (Tramadol). The company also stated its plan to file for regulatory approvals, including the United States Drug Master File (USDMF) and the Certificate of Suitability (CEP) for these new and existing products.

- In July 2024, Mankind Pharma announced its acquisition of Bharat Serums and Vaccines (BSV) from Advent International for an enterprise value of approximately rupee 13,630 crore. Following regulatory approvals, the acquisition was completed in October 2024 for a purchase consideration of rupee 13,768 crore. This deal significantly enhances Mankind's capabilities in biosimilars, women's health, and specialized pharmaceutical products, leveraging BSV's strong R&D platforms.

- In a significant industry consolidation, Suven Pharmaceuticals and Cohance Lifesciences announced a merger in February 2024. The strategic move, which became effective on May 1, 2025, was aimed at combining their respective strengths in the Contract Development and Manufacturing Organization (CDMO) and API sectors to create a more robust, integrated entity. The merged company now operates under the name Cohance Lifesciences Limited.

Key

Market Players

- Teva Pharmaceutical Industries Ltd.

- Pfizer Inc.

- Dr. Reddy's Laboratories

Ltd.

- Sun Pharmaceutical

Industries Limited

- Cipla Limited

- Lupin Limited

- Aurobindo Pharma Limited

- Aarti Drugs Ltd.

- IOL Chemicals and

Pharmaceuticals Limited

- GSK plc

|

By

Method of Synthesis

|

By

Source

|

By

Therapeutics Application

|

By

Drug Type

|

By

Region

|

|

|

- Contact

Manufacturing Organizations

- In-house

Manufacturing

|

- Cardiovascular

Diseases

- Anti-diabetic

Drugs

- Oncology

Drugs

- Neurological

Disorders

- Musculoskeletal

Disorders

- Others

|

|

- North

India

- South

India

- West

India

- East

India

|

Report Scope:

In this report, the India Active Pharmaceutical

Ingredients Market has been segmented into the following categories, in

addition to the industry trends which have also been detailed below:

- India Active Pharmaceutical Ingredients

Market, By

Method of Synthesis:

o Synthetic

o Biological

- India Active Pharmaceutical Ingredients

Market, By

Source:

o Contact Manufacturing Organizations

o In-house Manufacturing

- India Active Pharmaceutical Ingredients

Market, By

Therapeutic Application:

o Cardiovascular Diseases

o Anti-diabetic Drugs

o Oncology Drugs

o Neurological Disorders

o Musculoskeletal Disorders

o Others

- India Active Pharmaceutical Ingredients

Market, By Drug Type:

o Generics

o Innovator

- India Active Pharmaceutical Ingredients Market, By

region:

o North India

o

South

India

o

East

India

o

West

India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies presents in the India Active Pharmaceutical Ingredients Market.

Available Customizations:

India Active Pharmaceutical Ingredients

Market report with the given market data, TechSci Research offers

customizations according to a company's specific needs. The following

customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional

market players (up to five).

India Active Pharmaceutical Ingredients Market is

an upcoming report to be released soon. If you wish an early delivery of this

report or want to confirm the date of release, please contact us at [email protected]