|

Forecast

Period

|

2025-2029

|

|

Market

Size (2023)

|

USD

146.25 Million

|

|

Market

Size (2029)

|

USD

197.35 Million

|

|

CAGR

(2024-2029)

|

5.08%

|

|

Fastest

Growing Segment

|

Monoclonal

Antibody

|

|

Largest

Market

|

Southern

Vietnam

|

Market Overview

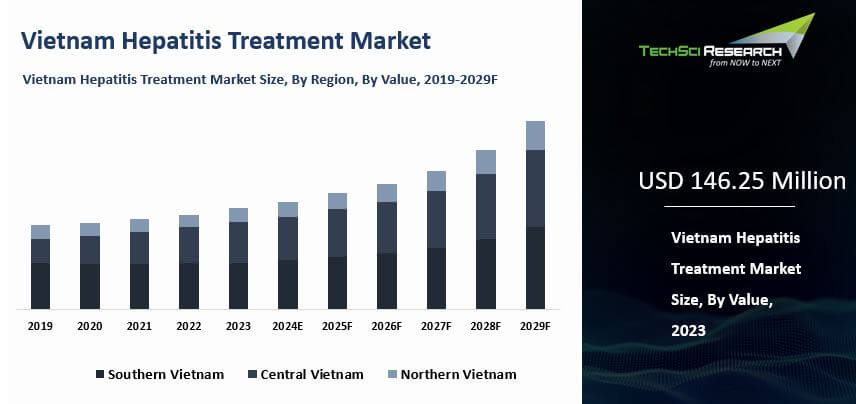

The Vietnam Hepatitis Treatment Market was valued at USD 146.25 million in 2023 and is expected to reach USD 197.35 million by 2029, with a CAGR of 5.08% over the forecast period.

The growth of the Vietnam Hepatitis Treatment Market can be attributed to the increasing demand for functional medications. These medications offer several benefits, including a holistic approach to treatment, individualized treatment plans, reduced reliance on traditional medications, and improved quality of life for patients. Additionally, rising demand for antiviral medications as part of daily health routines is further driving market growth.

Also, demand for additives in antiviral medications is rising, alongside the growing popularity of functional medications and liver-protective drugs such as ursodeoxycholic acid (UDCA), silymarin, glycyrrhizin, and vitamin E. These drugs are increasingly used in the treatment of chronic hepatitis, given the significant impact of the virus on liver health.

The prevalence of hepatitis B in Vietnam, with approximately one in eleven Vietnamese affected, underscores the urgent need for effective treatment and awareness initiatives within the business landscape. Many individuals with hepatitis B are unaware of their condition, highlighting the importance of early detection and treatment. Left untreated, hepatitis B can lead to severe liver damage and increase the risk of liver cancer in a significant proportion of affected individuals. Addressing these challenges presents opportunities for market growth and the development of innovative solutions in the Vietnam Hepatitis Treatment Market during the forecast period.

Download Free Sample Report

Key Market Drivers

Increasing Prevalence of Hepatitis Drives the

Market Growth

Vietnam's high incidence of hepatitis, particularly hepatitis B and hepatitis C, presents a significant market opportunity for hepatitis treatment and related healthcare services. According to the World Health Organization (WHO), an estimated 2.5 million individuals in Vietnam live with chronic hepatitis B, while 500,000 people live with chronic hepatitis C.

The substantial patient population drives demand for hepatitis treatment, leading to an increased need for healthcare services, medications, and other treatment options in the Vietnam Hepatitis Treatment Market. Vietnam is notably prevalent for hepatitis B virus (HBV) and hepatitis C virus (HCV) diseases, with high infection rates among the population.

As the prevalence of hepatitis rises, there is a growing demand for diagnostic testing to identify infected individuals. Diagnostic services such as blood tests, serological assays, and molecular diagnostic techniques are increasingly utilized for accurate diagnosis. This trend drives demand for diagnostic equipment and testing kits, fostering growth in the Vietnam Hepatitis Treatment Market.

The increasing prevalence of hepatitis necessitates proper treatment for affected individuals. Hepatitis treatment comprises antiviral medications, liver-protective drugs, and other supportive therapies. As prevalence continues to rise, more individuals require these treatments, increasing demand for medications and related healthcare services across the business landscape.

Increasing Awareness About Hepatitis Drives the

Market Growth

Increasing awareness plays an important role in driving the growth of the Vietnam Hepatitis Treatment Market. Increased awareness about hepatitis

encourages individuals to seek testing and diagnosis at an earlier stage. Early

detection allows for timely intervention and treatment initiation, leading to

better health outcomes. As awareness grows, more individuals are likely to get

tested for hepatitis, which drives the demand for diagnostic services and

contributes to the treatment market.

Increased awareness of the accessibility and effectiveness of hepatitis treatment options helps people seek appropriate medical care. As people become more aware of the benefits of treatment, they are more likely to actively use it, leading to increased demand for medications, therapies, and healthcare services related to hepatitis treatment and driving growth in the Vietnam Hepatitis Treatment Market. In 2019, 9.4 million individuals were treated for chronic HCV

infection, a more than nine-fold increase from 2015.

Drugs are available to

treat hepatitis B that prevent liver damage and slow the progression of the

disease. Awareness campaigns organized by government bodies, non-governmental

organizations, and healthcare institutions help distribute knowledge about

hepatitis prevention, testing, and treatment. These campaigns often focus on

raising awareness about the risks of hepatitis, modes of transmission, and

available treatment options. By increasing public knowledge, these campaigns

drive the demand for Vietnam Hepatitis Treatment Market.

Improved Healthcare Infrastructure Drives the

Market Growth

Improved healthcare infrastructure plays an important role in driving the growth of the Vietnam Hepatitis Treatment Market. As healthcare infrastructure expands, Vietnam is targeting 35 hospital beds per 10,000 people by 2030, up from 33 beds in 2025. These facilities offer greater reach and convenience for people seeking hepatitis treatment.

Vietnam's health status has improved significantly, with overall basic health indicators bettering other developing countries in the region with similar or higher per capita incomes. With more healthcare facilities available, particularly in the private sector which is encouraged by government policy, the demand for hepatitis treatment services is likely to grow. Improved healthcare infrastructure often includes access to advanced diagnostic technologies and equipment. This enables accurate and effective diagnosis of hepatitis cases, leading to earlier detection and timely treatment, thereby improving the overall quality of care and driving demand.

Improved healthcare infrastructure also implies the development of a trained healthcare workforce. This includes trained doctors, nurses, technicians, and other medical professionals specializing in the diagnosis and treatment of hepatitis. To address shortages, especially in rural areas, the government aims to have 19 doctors and 33 nurses per 10,000 people by 2030. A well-trained healthcare workforce ensures effective management of hepatitis cases, leading to increased demand for treatment services and promoting growth in Vietnam's Hepatitis Treatment Market.

Increasing Medical Tourism Drives the Market Growth

Medical tourism significantly contributes to the growth of the Vietnam Hepatitis Treatment Market. Vietnam has emerged as a sought-after destination for medical tourists seeking hepatitis treatment, primarily due to its provision of high-quality healthcare services. In 2025, the country is projected to welcome 18 million international visitors, many seeking health checkups and treatments. In dentistry alone, clinics in Ho Chi Minh City generate nearly $150 million each year.

Vietnam's investment in modern healthcare facilities, advanced technologies, and skilled medical professionals positions it as an appealing option for individuals seeking hepatitis treatment. The country has four JCI-accredited hospitals, and its healthcare expenditure is expected to reach $20.3 billion in 2025. Moreover, the country offers competitive pricing for medical treatments, including hepatitis treatment, compared to many other nations. For instance, a heart bypass surgery costs between $10,000 and $15,000 in Vietnam, whereas in Thailand it can cost from $25,000 to $30,000. This combination of cost-effectiveness and quality care makes Vietnam a preferred destination for medical tourists seeking hepatitis treatment.

Healthcare providers in Vietnam specialize in hepatitis treatment and management, boasting expertise in the latest advancements in the field. In 2017, the Ministry of Health approved the use of direct-acting antivirals (DAAs) as the primary treatment for Hepatitis C. There are also pilot programs to improve access to hepatitis C diagnosis and treatment, which are set to expand in 2025.

This specialized knowledge enables medical tourists to benefit from tailored treatment plans and comprehensive care. Additionally, medical tourism in Vietnam allows patients to bypass waiting times, ensuring timely access to treatment. One study at a national hospital's outpatient clinic reported an average total waiting time of 104.1 minutes. The accessibility of healthcare services without significant delays is a key driver for medical tourists seeking hepatitis treatment in Vietnam, thereby fostering growth in the Vietnam Hepatitis Treatment Market.

Key Market Challenges

High Treatment Costs

High treatment costs pose a significant barrier to the growth of the

hepatitis treatment market in Vietnam. The expenses associated with hepatitis

treatment, including medication, diagnostic tests, and hospitalization, can be

prohibitively high for many Vietnamese patients, particularly those from

low-income backgrounds. As a result, a large portion of the population may be

unable to afford the necessary treatment, leading to delays in seeking care, incomplete

treatment regimens, or avoidance of treatment altogether. This not only

adversely affects the health outcomes of individuals but also undermines

efforts to control the spread of hepatitis within the population.

Drug Supply Chain Issues

Drug supply chain issues present a significant challenge to the growth

of the hepatitis treatment market in Vietnam. Challenges in the procurement,

distribution, and availability of hepatitis medications can lead to shortages

and interruptions in treatment, impacting patient care and outcomes. These

issues may arise due to logistical constraints, regulatory hurdles, or

disruptions in the global supply chain. As a result, healthcare facilities may

face difficulties obtaining necessary medications in a timely manner, leading to delays in initiating or discontinuing therapy for patients already receiving treatment.

Key Market Trends

Growing Adoption of Antiviral Therapies

The growing adoption of antiviral therapies is poised to significantly drive growth in Vietnam's hepatitis treatment market. Antiviral

therapies, particularly for hepatitis B and C, offer more effective treatment

options compared to traditional approaches, leading to improved patient

outcomes and reduced disease progression. As awareness of these therapies

increases among healthcare providers and the general population, demand for these medications rises. Moreover, advancements in

treatment protocols and the availability of newer, more efficacious antiviral

drugs are further driving adoption rates. This trend is expected to fuel market

growth as more patients seek treatment and healthcare facilities expand their

capacity to provide antiviral therapy services. Additionally, the availability

of generic versions of these medications at more affordable prices is making

treatment more accessible to a broader segment of the population, further

stimulating market demand and growth.

Integration of Telemedicine and Digital Health

Solutions

The integration of telemedicine and digital health solutions is poised

to revolutionize the hepatitis treatment market in Vietnam. These technologies

offer unprecedented opportunities to improve access to care, enhance patient

monitoring, and facilitate remote consultations, especially in rural and

underserved areas where healthcare infrastructure may be limited. By leveraging

telemedicine platforms, healthcare providers can remotely diagnose hepatitis

cases, monitor treatment progress, and provide timely interventions, thereby

overcoming geographical barriers and reducing healthcare disparities.

Additionally, digital health solutions enable better patient engagement through

educational resources, medication adherence support, and lifestyle management

tools, which can lead to improved treatment outcomes and patient satisfaction.

As the adoption of telemedicine and digital health solutions continues to grow

in Vietnam, driven by technological advancements and increasing internet penetration, these innovations are expected to play a pivotal role in expanding access to hepatitis treatment and driving market growth.

Segmental Insights

Drug Class Insights

Based on drug class,The dominance of the monoclonal antibody segment in the Vietnam

hepatitis treatment market in 2023 can be attributed to several key factors.

Monoclonal antibodies have gained prominence for their targeted treatment of hepatitis, particularly hepatitis B and C. These antibodies are designed to specifically target and neutralize

viral antigens, thereby inhibiting viral replication and reducing the viral

load in patients. Compared to traditional treatment modalities such as

interferon therapy, monoclonal antibodies offer several advantages, including

higher efficacy, lower risk of adverse effects, and improved tolerability,

which have contributed to their widespread adoption by healthcare providers and

patients alike.

Additionally, advances in biotechnology and the increasing availability of monoclonal antibody-based therapies have expanded treatment options for patients with hepatitis in Vietnam. Pharmaceutical companies have been

investing in research and development efforts to develop novel monoclonal

antibodies with enhanced potency and improved pharmacokinetic profiles, further

driving market growth. Additionally, government initiatives to improve access to advanced healthcare services and raise awareness of the benefits of monoclonal antibody therapy have played a significant role in

driving the adoption of these treatments. Overall, the dominance of the monoclonal antibody segment reflects the growing preference for targeted and effective therapies in the management of hepatitis in Vietnam.

Download Free Sample Report

Regional Insights

Southern Vietnam's dominance in the hepatitis treatment market in 2023

can be attributed to several key factors. Southern Vietnam,

particularly major cities like Ho Chi Minh City, has a higher population

density and more developed healthcare infrastructure compared to other regions

in the country. This facilitates greater access to healthcare services,

including specialized treatment for hepatitis, and attracts a larger pool of

healthcare professionals with expertise in managing liver diseases. Moreover,

Southern Vietnam serves as a hub for medical tourism, attracting patients from

other regions seeking advanced treatment options, including hepatitis

management. Additionally, the region's stronger economy and higher healthcare spending increase demand for hepatitis treatment and

drive market growth. Furthermore, Southern Vietnam's strategic location and

well-established transportation networks facilitate the efficient distribution

of pharmaceutical products, ensuring timely access to hepatitis medications.

Recent Developments

- In July 2025, ahead of World Hepatitis Day, the World Health Organization (WHO) called for urgent action in Vietnam to address the country’s high liver cancer burden, noting that nearly 90% of cases are caused by untreated hepatitis B and C.

- In May 2025, the VIETNARMS trial delivered major new evidence supporting more effective and affordable Hepatitis C treatment options. The study explored shorter treatment durations and response-guided strategies, demonstrating comparable effectiveness to standard therapies while cutting costs by half. The results supported the use of sofosbuvir/daclatasvir (SOF/DCV), the world’s lowest-cost option, and are expected to inform updated treatment guidelines from both the WHO and Vietnam’s Ministry of Health.

- In May 2025, VIETNARMS also reported several adherence-supporting strategies that remained non-inferior to standard 12-week therapy, including an “induction–maintenance” approach achieving 99.3% SVR12 and a PEG-IFN plus 4-week DAA strategy achieving 94.1% SVR12.

- In January 2025, the HepLINK Vietnam project concluded, demonstrating the cost-effectiveness of a decentralized and integrated model for delivering viral hepatitis services.

- In November 2024, the Ministry of Health announced a major milestone: the first-ever cure of a Hepatitis C patient under Vietnam’s social health insurance program at a primary healthcare facility, achieved through the Strengthening the Integrated Care and Treatment of Hepatitis (StITCH) project in collaboration with HAIVN, local health departments, and Gilead Sciences.

- In November 2024, StITCH was positioned as a national program to strengthen viral hepatitis screening, diagnosis, care, and treatment at the primary care level, while developing and testing a chronic hepatitis model of care aligned with current Vietnamese regulations.

- In November 2024, the StITCH (Strengthening the Integrated Care and Treatment of Hepatitis) project was confirmed to be implemented from early 2024 to 2026 by HAIVN (Beth Israel Deaconess Medical Center–Harvard Medical School), in partnership with the Thái Bình and Phú Thọ health departments and Gilead Sciences.

Key Market Players

- Gilead Sciences Inc

- AbbVie Inc

- Merck & Co Inc.

- F. Hoffmann-La Roche Ltd

- Novartis AG

- Bristol-Myers Squibb Company

- GlaxoSmithKline Plc

- Sanofi

- Pfizer Inc

- Zydus Lifesciences Limited

|

By Disease Type

|

By Drug

Class

|

By Region

|

- Hepatitis A

- Hepatitis B

- Hepatitis C

- Others

|

- Interferon

- Monoclonal

Antibody

- Non-structural

protein 5A (NS5A) Inhibitors

- Nucleotide

Analog Reverse Transcriptase Inhibitors

- Nucleotide

Analog NS5B Polymerase Inhibitors

- Multi Class

Combination

- Others

|

- Southern

Vietnam

- Northern Vietnam

- Central

Vietnam

|

Report Scope:

In this report, the Vietnam Hepatitis Treatment Market has been

segmented into the following categories, in addition to the industry trends

which have also been detailed below:

- Vietnam Hepatitis Treatment Market,

By Disease Type:

o Hepatitis A

o Hepatitis B

o Hepatitis C

o Others

- Vietnam Hepatitis Treatment Market,

By Drug Class:

o Interferon

o Monoclonal Antibody

o Non-structural protein 5A (NS5A) Inhibitors

o Nucleotide Analog Reverse Transcriptase Inhibitors

o Nucleotide Analog NS5B Polymerase Inhibitors

o Multi Class Combination

o Others

- Vietnam Hepatitis Treatment Market,

By Region:

o Northern Vietnam

o Central Vietnam

o Southern Vietnam

Competitive Landscape

Company Profiles: Detailed analysis of the major companies

present in the Vietnam Hepatitis Treatment Market.

Available Customizations:

Vietnam Hepatitis Treatment Market report with the given market

data, TechSci Research offers customizations according to a company's specific

needs. The following customization options are available for the report:

Company Information

- Detailed analysis and

profiling of additional market players (up to five).

Vietnam Hepatitis Treatment Market is an upcoming

report to be released soon. If you wish an early delivery of this report or

want to confirm the date of release, please contact us at [email protected]