|

Forecast Period

|

2027-2031

|

|

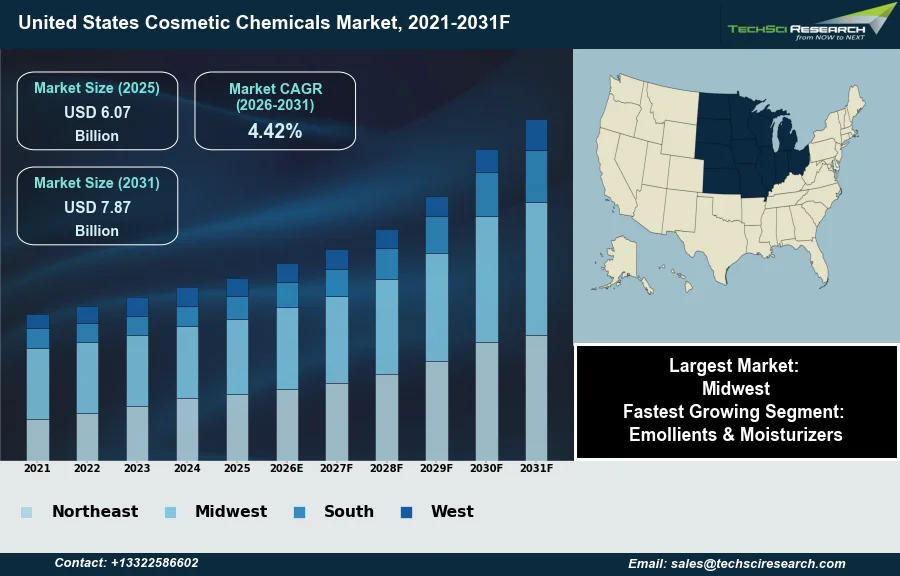

Market Size (2025)

|

USD 6.07 Billion

|

|

CAGR (2026-2031)

|

4.42%

|

|

Fastest Growing Segment

|

Emollients & Moisturizers

|

|

Largest Market

|

Midwest

|

|

Market Size (2031)

|

USD 7.87 Billion

|

Market Overview

The United States Cosmetic Chemicals Market will grow from USD 6.07 Billion in 2025 to USD 7.87 Billion by 2031 at a 4.42% CAGR. The United States Cosmetic Chemicals Market is defined as the sector dedicated to the supply of essential ingredients, such as surfactants, emollients, rheology modifiers, and preservatives, used in the formulation of personal care and hygiene products. The primary drivers supporting the growth of this market include an aging population that necessitates effective anti-aging solutions and rising disposable incomes which facilitate higher expenditure on premium personal care items. Furthermore, a fundamental shift toward chemically safe and scientifically backed formulations drives the demand for high-quality raw materials. According to the American Chemistry Council, in 2025, the production of specialty chemicals in the United States, a category that encompasses cosmetic ingredients, increased by 4.3 percent.

However, a significant challenge that could impede market expansion is the increasing stringency of regulatory frameworks, specifically the Modernization of Cosmetics Regulation Act. This legislation imposes rigorous requirements for safety substantiation, adverse event reporting, and facility registration, which substantially elevate compliance costs and operational complexity for chemical suppliers and formulators. These regulatory hurdles require significant resource allocation and can delay the commercialization of new ingredients, thereby slowing the overall pace of innovation within the industry.

Key Market Drivers

The surge in consumer demand for natural and bio-based ingredients is fundamentally restructuring the United States Cosmetic Chemicals Market, compelling suppliers to transition toward sustainable pharmacognosy and green chemistry. This trend is not merely a preference for organic labeling but drives a rigorous overhaul of supply chains to ensure raw materials are ethically sourced and chemically safe. Formulators are increasingly replacing traditional synthetic petrochemicals with plant-derived alternatives, such as bio-surfactants and botanical emollients, without compromising efficacy. According to L'Oréal, March 2024, in the '2023 Annual Report', 65 percent of the ingredients in its formulas were obtained from biobased sources, derived from abundant minerals, or generated through circular processes, highlighting the industrial scale of this transition.

Simultaneously, the rising popularity of anti-aging and skin rejuvenation formulations is acting as a primary catalyst for volume growth and value generation within the sector. As the demographic profile of the United States shifts, there is a heightened reliance on sophisticated active ingredients, such as peptides, retinoids, and hyaluronic acid, which require advanced chemical synthesis and delivery systems. This focus on dermocosmetics is directly translating into substantial financial gains for brands prioritizing skin health. According to Beiersdorf AG, February 2024, in the 'Annual Report 2023', its dermatological brand Aquaphor achieved outstanding organic sales growth of 36 percent in the United States, underscoring the robust appetite for skin-restorative products. Reflecting this broader manufacturing momentum, according to the American Chemistry Council, in 2024, the production of consumer products utilizing these chemical inputs accelerated by 5.0 percent.

Download Free Sample Report

Key Market Challenges

The implementation of rigorous regulatory frameworks, specifically the Modernization of Cosmetics Regulation Act (MoCRA), stands as a critical impediment to the growth of the United States Cosmetic Chemicals Market. This legislation mandates extensive safety substantiation, mandatory facility registration, and comprehensive adverse event reporting, effectively forcing chemical suppliers to divert substantial financial resources from research and development toward compliance infrastructure. The increased operational complexity creates a bottleneck for ingredient manufacturers, delaying the commercialization of new raw materials and reducing the speed at which innovative formulations can reach personal care brands.

Consequently, this regulatory burden has a tangible impact on the industry's financial dynamism and investment capacity. As companies prioritize adherence to these stringent new standards, funds available for capacity expansion and technological upgrades have diminished. According to the American Chemistry Council, in 2025, the growth in capital spending within the United States chemical industry slowed to 1.6 percent. This deceleration in investment underlines how heightened compliance costs and administrative hurdles are directly restricting the ability of cosmetic chemical suppliers to scale operations and aggressively pursue market expansion opportunities.

Key Market Trends

The Skinification of Hair Care and Scalp Treatment Formulations is fundamentally altering product development logic as consumers increasingly treat scalp health with the same rigor as facial skincare. This paradigm shift has necessitated the cross-pollination of bioactive ingredients traditionally reserved for dermal applications—such as niacinamide, salicylic acid, and peptides—into shampoos, serums, and bond-repair treatments to address issues like follicular strength and microbiome balance. Ingredient suppliers are responding by re-engineering skincare-grade actives for hair fiber compatibility, moving beyond basic cleansing to therapeutic restoration. Highlighting the commercial viability of this hybrid category, according to Unilever, February 2025, in the 'Full Year 2024 Results', its Dove brand delivered high-single digit volume-led growth specifically driven by the successful launch of its Scalp + Hair Therapy line, designed to optimize scalp density.

The Rise of Biotechnology-Derived and Fermentation-Based Active Ingredients represents a critical evolution from simple botanical extraction to precision-engineered biosynthesis. Unlike traditional harvesting, which is subject to supply chain volatility and biodiversity concerns, fermentation allows manufacturers to produce high-purity, bio-identical actives like squalane and polysaccharides in controlled lab environments. This method ensures consistent potency and scalability while drastically reducing land and water usage, appealing to brands seeking rigorous efficacy without environmental compromise. Underscoring the investment momentum in this high-tech segment, according to Cosmetics Business, August 2025, in the article 'Debut secures $20 million to enhance skin longevity ingredient research', the biotech firm raised significant capital to scale its proprietary bio-manufacturing platform, signaling strong industry confidence in lab-grown chemical innovations.

Segmental Insights

The Emollients and Moisturizers segment has emerged as the fastest-growing category within the United States Cosmetic Chemicals Market. This rapid expansion is driven by increasing consumer demand for products that offer enhanced skin hydration and barrier protection. Manufacturers are responding by formulating high-performance ingredients that support anti-aging claims and improve texture. Additionally, the shift toward natural and organic formulations, compliant with United States Food and Drug Administration safety guidelines, further propels the adoption of plant-based emollients. Consequently, these factors collectively stimulate robust demand for moisturizing agents across the personal care sector.

Regional Insights

The Midwest stands as the leading region in the United States Cosmetic Chemicals Market, primarily driven by its robust industrial infrastructure and high concentration of chemical manufacturing facilities. This area serves as a critical production hub, hosting major suppliers that support the mass production of essential ingredients like surfactants and emollients. Its strategic central location offers significant logistical advantages, ensuring efficient distribution throughout the national supply chain. Furthermore, the region benefits from proximity to vast agricultural resources, providing ready access to bio-based feedstocks necessary for natural cosmetic formulations.

Recent Developments

-

In October 2025, BASF Personal Care unveiled Ameriflor Calm, a new botanical active ingredient specifically developed to enhance the resilience of sensitive skin. Sourced and formulated entirely within the United States, this ingredient is derived from a plant traditionally used by Indigenous nations and is harvested from regenerative organic farms in Oregon. The launch addressed the growing market demand for locally sourced, ethical, and traceable cosmetic solutions. Clinical studies demonstrated that the ingredient significantly reduced skin redness and trans-epidermal water loss, reinforcing the company's strategy to provide effective, sustainability-focused innovations for the American personal care market.

-

In May 2025, Dow expanded its presence in the beauty sector by debuting its first portfolio of low-carbon silicone elastomer blends under the Decarbia platform at the New York SCC Suppliers' Day. The United States-based materials science leader introduced these carbon-neutral ingredients to empower formulators to create high-performing, sustainable products for skin and color cosmetics. Alongside this launch, the company unveiled a prototype formulation kit titled "From Shower to Sensational," which included twelve crafted formulas utilizing innovative components such as upcycled rice husk silica. This development highlighted the organization's commitment to decarbonization and delivering versatile, eco-conscious solutions for the domestic market.

-

In May 2024, Ashland highlighted its latest advancements in the United States cosmetic chemicals market by showcasing innovative biofunctional ingredients at the NYSCC Suppliers’ Day in New York City. The company featured Perfectyl biofunctional, a high-tech chamomile extract sustainably sourced from Oregon, which was developed using artificial intelligence-driven technology to target facial relaxation. Additionally, the company presented Sclareance biofunctional, a natural ingredient obtained through fermentation designed to boost skin defenses. These launches underscored the company's focus on renewable, nature-derived, and biodegradable solutions to meet evolving regulatory landscapes and consumer preferences in the personal care industry.

-

In April 2024, Clariant completed the acquisition of Lucas Meyer Cosmetics, a prominent provider of high-value ingredients for the personal care industry, from International Flavors & Fragrances for an enterprise value of $810 million. This strategic transaction significantly strengthened the company's capabilities in the active and functional cosmetic ingredients sector within the United States and the broader Americas region. The President of the company's Care Chemicals business unit emphasized that the integration would accelerate customer-driven innovation. This move allowed the organization to better meet the increasing demand for natural and sustainable specialty chemicals among North American beauty brands and consumers.

Key Market Players

- Dow Inc.

- BASF SE

- Evonik Industries AG

- Clariant AG

- Croda International PLC

- Ashland Global Holdings Inc.

- Solvay S.A.

- Huntsman Corporation

- Eastman Chemical Company

- Lonza Group Ltd.

|

By Type

|

By Application

|

By Region

|

- Emollients & Moisturizers

- Surfactants

- Specialty Additives

- Thickening Agents

- Others

|

- Skin Care

- Hair Care

- Color Cosmetics

- Toiletries

- Oral Care

- Nail Care

- Others

|

- Northeast

- Midwest

- South

- West

|

Report Scope:

In this report, the United States Cosmetic Chemicals Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

-

United States Cosmetic Chemicals Market, By Type:

-

Emollients & Moisturizers

-

Surfactants

-

Specialty Additives

-

Thickening Agents

-

Others

-

United States Cosmetic Chemicals Market, By Application:

-

Skin Care

-

Hair Care

-

Color Cosmetics

-

Toiletries

-

Oral Care

-

Nail Care

-

Others

-

United States Cosmetic Chemicals Market, By Region:

-

Northeast

-

Midwest

-

South

-

West

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the United States Cosmetic Chemicals Market.

Available Customizations:

United States Cosmetic Chemicals Market report with the given market data, TechSci Research offers customizations according to a company's specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five).

United States Cosmetic Chemicals Market is an upcoming report to be released soon. If you wish an early delivery of this report or want to confirm the date of release, please contact us at [email protected]