|

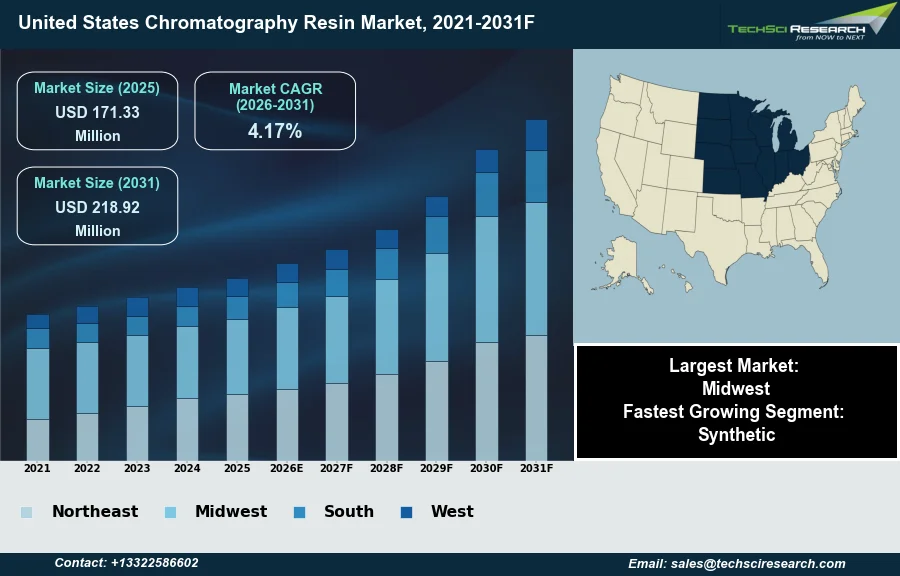

Forecast Period

|

2027-2031

|

|

Market Size (2025)

|

USD 171.33 Million

|

|

CAGR (2026-2031)

|

4.17%

|

|

Fastest Growing Segment

|

Synthetic

|

|

Largest Market

|

Midwest

|

|

Market Size (2031)

|

USD 218.92 Million

|

Market Overview

The United States Chromatography Resin Market will grow from USD 171.33 Million in 2025 to USD 218.92 Million by 2031 at a 4.17% CAGR. The United States Chromatography Resin Market centers on the utilization of specialized porous media, typically polymer or silica-based, designed to separate and purify biomolecules during the development and manufacturing of pharmaceutical products. The primary driver supporting market growth is the rapid expansion of the biopharmaceutical sector, particularly the surging production of monoclonal antibodies and recombinant proteins which necessitate rigorous downstream processing to ensure safety and efficacy. This demand is fundamentally underpinned by the immense scale of domestic capital investment in drug discovery and process development. According to the Pharmaceutical Research and Manufacturers of America, in 2024, the United States biopharmaceutical industry demonstrated a research and development intensity of approximately 34 percent, reflecting a substantial financial commitment that directly sustains the high consumption of purification consumables.

However, market expansion confronts a significant challenge in the form of substantial costs associated with advanced affinity resins, most notably Protein A ligands. The high price point of these critical materials places a considerable financial burden on biomanufacturers, particularly during the scale-up phases of production. This economic pressure is further exacerbated by supply chain complexities that can limit the availability of high-grade raw materials, potentially forcing manufacturers to delay production or seek alternative, less established purification methods which could impede the overall momentum of the chromatography resin sector.

Key Market Drivers

Increasing public and private investment in life sciences R&D is a primary force propelling the United States Chromatography Resin Market, as capital expenditure translates into expanded physical capacity for downstream processing. Biopharmaceutical companies are aggressively constructing large-scale manufacturing campuses equipped with advanced chromatography suites to secure domestic supply. According to Eli Lilly and Company, May 2024, in a corporate press release, the firm increased its manufacturing investment at its Lebanon, Indiana site by $5.3 billion to boost active pharmaceutical ingredient production. This massive capital infusion necessitates substantial procurement of purification media to operationalize new production lines. Furthermore, the infrastructure supporting this market is vast; according to the Pharmaceutical Research and Manufacturers of America, May 2024, in a published industry analysis, the biopharmaceutical sector currently operates more than 1,500 manufacturing facilities across the nation, creating a sustained, high-volume requirement for chromatography consumables to maintain daily operations.

The surging demand for monoclonal antibodies and biosimilars further accelerates market momentum, as these complex biologics rely heavily on specific affinity and ion-exchange resins for purification. As regulatory bodies clear more antibody-based therapies for commercial use, manufacturers must scale up their purification cycles, driving the consumption of high-value Protein A resins. According to the FDA’s Center for Drug Evaluation and Research, January 2024, in the 'Advancing Health Through Innovation' report, the agency approved 55 novel therapeutics in 2023, which included 12 new monoclonal antibodies. Each approval signals a transition from clinical pilot volumes to full-scale commercial manufacturing, thereby permanently increasing the recurring demand for resin media required to meet stringent purity standards for these treatments.

Download Free Sample Report

Key Market Challenges

The United States Chromatography Resin Market confronts a significant impediment in the form of substantial costs associated with advanced affinity resins, specifically Protein A ligands, exacerbated by supply chain intricacies. These specialized media are indispensable for purifying monoclonal antibodies, yet their elevated price point creates a severe financial barrier for biopharmaceutical manufacturers. As companies attempt to transition from development to commercial-scale production, the cumulative expense of these premium consumables places an immense strain on operational budgets. This economic pressure restricts the ability of manufacturers to procure necessary volumes of high-grade resins, forcing them to delay scale-up phases or limit production capacity to preserve capital.

This financial burden is compounded by a heavy reliance on complex global supply networks, which threatens the consistent availability of these critical raw materials. When supply chain disruptions occur, the scarcity of high-quality resins drives prices higher and stalls manufacturing timelines. According to the Biotechnology Innovation Organization, in 2025, nearly 90 percent of United States biotech companies relied on imported manufacturing components for at least half of their approved products, a dependency that significantly heightens exposure to volatile costs and availability shortages. Consequently, these combined economic and logistical hurdles directly reduce the consumption rate of chromatography resins and impede the sector's overall growth momentum.

Key Market Trends

The development of serotype-specific affinity resins for gene therapy is a transformative trend reshaping the sector, driven by the critical need to purify complex viral vectors such as adeno-associated viruses (AAV). Unlike traditional monoclonal antibody processing, gene therapy manufacturing requires specialized media capable of strictly differentiating between full and empty viral capsids to ensure product safety and therapeutic efficacy. This technological evolution is directly responding to the rapid commercialization of genetic medicines, which necessitates high-selectivity consumables that can support industrial-scale viral vector production. According to the Alliance for Regenerative Medicine, January 2025, in the 'State of the Industry Briefing', regulators approved nine new cell and gene therapies in 2024, a significant regulatory surge that is intensifying the domestic demand for these advanced, vector-optimized purification solutions.

Simultaneously, the market is witnessing a decisive integration of single-use chromatography technologies, facilitating the transition toward flexible, multi-modality manufacturing environments. Biopharmaceutical facilities are increasingly replacing fixed stainless-steel infrastructure with disposable flow paths and pre-packed columns to eliminate time-consuming cleaning validation processes and mitigate cross-contamination risks. This operational shift is particularly vital for contract manufacturing organizations and hybrid facilities that must rapidly switch between different therapeutic modalities without long downtime. According to Sartorius AG, February 2025, in the 'Annual Report 2024', the company strategically addressed this demand by announcing the opening of two new multi-modality GMP sites in Marlborough, Massachusetts, underscoring the substantial investment in flexible downstream processing infrastructure within the United States.

Segmental Insights

The Synthetic segment represents the fastest-growing category within the United States Chromatography Resin Market, primarily due to the expanding biopharmaceutical sector. These resins are widely utilized for their high mechanical stability and chemical resistance, which are essential for large-scale purification processes. The increasing production of monoclonal antibodies requires robust separation media to satisfy the stringent purity standards mandated by the United States Food and Drug Administration (FDA). Consequently, pharmaceutical manufacturers prioritize synthetic options to ensure consistent quality and regulatory compliance throughout complex drug manufacturing workflows.

Regional Insights

The Midwest United States maintains a dominant position in the United States Chromatography Resin Market, underpinned by its robust industrial and biopharmaceutical manufacturing sectors. This region serves as a critical production hub where numerous pharmaceutical companies and contract manufacturers utilize substantial quantities of resins for large-scale drug purification and chemical separation. Additionally, the area's extensive food and beverage processing industry drives further demand for these essential materials to ensure product safety and quality. The convergence of established manufacturing infrastructure and high-volume commercial application firmly establishes the Midwest as the primary revenue generator within the national market.

Recent Developments

-

In April 2025, Cytiva expanded its portfolio of protein A chromatography resins with the launch of two next-generation products, MabSelect SuRe 70 and MabSelect PrismA X. These resins were engineered to meet the diverse needs of the biopharmaceutical industry, with one optimized for early-stage clinical development offering cost-efficiency, and the other designed for commercial-scale manufacturing with high dynamic binding capacity and durability. This development reflects the company's commitment to providing scalable and sustainable purification solutions to support the growing pipeline of monoclonal antibodies and biosimilars in the United States.

-

In January 2025, Bio-Rad Laboratories launched a new mixed-mode chromatography resin known as Nuvia wPrime 2A Media, designed to enhance the purification of biomolecules. This scalable resin combines weak anion exchange and hydrophobic interaction mechanisms, facilitating the removal of host cell proteins, aggregates, and DNA from monoclonal and bispecific antibodies. The product was developed to support both laboratory-scale research and large-scale bioproduction, addressing the industry's need for versatile and efficient purification tools that can handle complex therapeutic modalities in the United States bioprocessing sector.

-

In July 2024, Tosoh Bioscience LLC entered into a strategic partnership with ProSep Ltd. to advance chromatography solutions for the biopharmaceutical industry. This collaboration focuses on integrating the company's separation and purification media with advanced equipment to improve downstream processing workflows. The partnership aims to leverage the strengths of both entities to develop innovative solutions that address the evolving needs of biomolecule purification, thereby supporting the United States chromatography resin market by offering enhanced process technologies to drug developers and manufacturers.

-

In June 2024, Ecolab’s Purolite resin business, in collaboration with a prominent life sciences company, announced the commercial launch of a new protein A chromatography resin designed for large-scale biologic manufacturing. Introduced at the BIO International Convention in San Diego, this affinity resin was developed to address the cost and efficiency challenges associated with the commercial production of monoclonal antibodies. The product represents a significant addition to the company’s purification toolkit, aiming to help biologic developers increase manufacturing efficiencies and reduce the cost of goods for complex therapeutics in the United States and global markets.

Key Market Players

- GE Healthcare

- Merck KGaA

- Thermo Fisher Scientific, Inc.

- Pall Corporation

- Purolite Corporation

|

By Type

|

By Application

|

By Region

|

- Natural

- Synthetic

- Inorganic Media

|

- Pharmaceutical

- Food & Beverage

- Others

|

- Northeast

- Midwest

- South

- West

|

Report Scope:

In this report, the United States Chromatography Resin Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

-

United States Chromatography Resin Market, By Type:

-

Natural

-

Synthetic

-

Inorganic Media

-

United States Chromatography Resin Market, By Application:

-

Pharmaceutical

-

Food & Beverage

-

Others

-

United States Chromatography Resin Market, By Region:

-

Northeast

-

Midwest

-

South

-

West

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the United States Chromatography Resin Market.

Available Customizations:

United States Chromatography Resin Market report with the given market data, TechSci Research offers customizations according to a company's specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five).

United States Chromatography Resin Market is an upcoming report to be released soon. If you wish an early delivery of this report or want to confirm the date of release, please contact us at [email protected]