|

Forecast Period

|

2026-2030

|

|

Market Size (2024)

|

USD 2.85 Billion

|

|

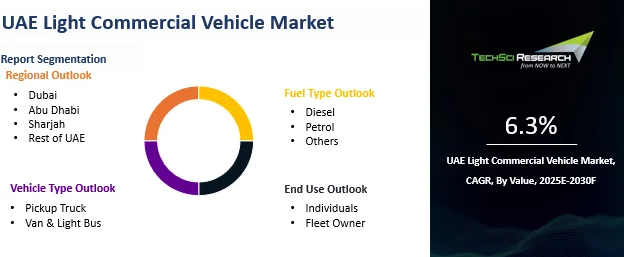

CAGR (2025-2030)

|

6.3%

|

|

Fastest Growing Segment

|

Petrol

|

|

Largest Market

|

Dubai

|

|

Market Size (2030)

|

USD 4.12 Billion

|

Market

Overview

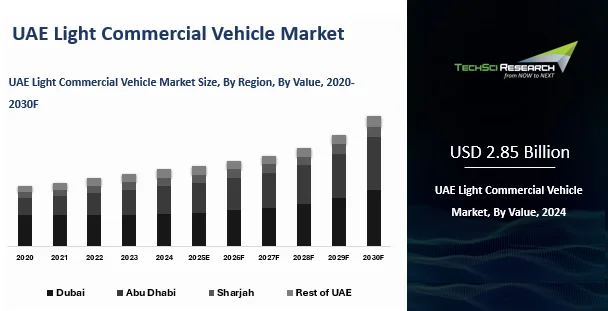

The UAE Light Commercial Vehicle

Market was valued at USD 2.85 Billion in 2024 and is expected to reach USD 4.12

billion by 2030 with a CAGR of 6.3% during the forecast period. The UAE Light Commercial Vehicle (LCV) market is undergoing dynamic

transformation due to the increasing emphasis on urban freight movement and the

expansion of e-commerce. Light commercial vehicles have become integral for

last-mile delivery networks, enabling efficient transport within congested

urban spaces. As consumer habits shift toward on-demand services, retail and

logistics providers are enhancing their fleets with compact, fuel-efficient

LCVs to optimize delivery timelines and reduce operational costs. These market

conditions are encouraging fleet modernization, further boosting demand across

the segment. Technological evolution and infrastructure development are playing a

pivotal role in shaping the market. LCV manufacturers are integrating advanced

telematics, navigation tools, and driver-assist systems to enhance fleet safety

and efficiency. Coupled with growing investment in electric mobility, these

technological strides are opening opportunities for alternative-fuel LCVs.

Furthermore, vehicle leasing and rental models are becoming popular among SMEs

seeking to avoid large upfront investments. Shifts in consumer mobility and

digital platforms enabling logistics coordination are collectively enhancing

the adoption rate of LCVs

Market

Drivers

Rise of Last-Mile Delivery Services

The expansion of e-commerce and on-demand delivery platforms is

transforming urban transportation needs. Light commercial vehicles are

increasingly used for last-mile delivery operations across cities, serving

customers who expect fast and efficient service. E-commerce platforms in the

UAE rely on agile logistics networks capable of handling both volume and speed.

LCVs are preferred due to their ability to navigate dense urban environments

and deliver across diverse zones. This shift toward micro-fulfillment centers

and quick-commerce hubs is leading to the procurement of versatile LCVs that

offer flexible loading and mileage. Furthermore, the emergence of same-day

delivery as a standard service level is fueling investments in fleet expansion

among logistics providers. As retail formats grow increasingly digitized,

reliance on compact and fuel-efficient LCVs for final-stage delivery is

expected to intensify.

Construction and Infrastructure Development

Ongoing infrastructure development and construction projects in the UAE

require robust transportation solutions for materials and labor. LCVs,

particularly pickup trucks and vans are extensively used in these projects due

to their load-carrying flexibility and operational efficiency. With the

government launching projects tied to Vision 2030 and Expo legacy expansions,

there is heightened demand for commercial transport in sectors such as real

estate, civil works, and utilities. These vehicles are also used to shuttle

maintenance teams and service crews across construction zones. Their utility in

urban and semi-urban transport conditions supports their sustained adoption.

The cyclical nature of infrastructure expansion projects ensures that

commercial fleets, especially in the light vehicle category, remain a

foundational component of industrial mobility in the country. For instance, In 2025, Dubai allocated 46% of its AED86.26 billion (USD 23.5 billion) budget approximately AED39.68 billion (USD 10.6 billion) to infrastructure projects including roads, bridges, transportation, sewage systems, and major developments like the Al Maktoum Airport expansion. This record three-year budget cycle (2025–2027), totaling AED272 billion (USD 75 billion), supports the Dubai Plan 2030 and D33 Agenda, with a focus on sustainable growth, smart mobility, and quality-of-life enhancements.

Electric Vehicle Policy Support and Incentives

Government-backed efforts to promote electric vehicles are beginning to

influence the LCV market. Policy incentives such as import duty exemptions,

green fleet targets, and public-private partnerships aimed at infrastructure

development are nudging fleet owners toward cleaner alternatives. Though

electric LCV adoption is still nascent in the UAE, advancements in battery

technology and declining EV costs are contributing to growing interest. The

push for sustainable urban mobility and the presence of pilot EV fleet programs

in cities indicate strong future potential. As emission norms tighten and EV

support policies expand, light commercial vehicles are poised to be a focal

point of electrification strategies in the logistics sector. For instance, Dubai’s electric vehicle count jumped from 15,100 in 2022 to 25,929 by end-2023, marking a 71.6% growth. DEWA aims to increase public Green Charging Stations from 370 to 1,000 by 2025—an expansion of 170%—under Dubai’s Clean Energy Strategy 2050 and Green Mobility Strategy 2030.

Key

Market Challenges

Inadequate Charging Infrastructure for Electric LCVs

One of the key barriers to electric light commercial vehicle adoption is

the limited availability of public and private charging infrastructure. While

interest in electrified mobility is growing, the current network of EV chargers

is insufficient to support widespread LCV fleet operations. Delivery routes

often span urban and suburban areas, where charging points may be scarce. This

raises concerns about vehicle downtime, range anxiety, and route planning

inefficiencies. The lack of fast-charging stations further complicates rapid

fleet rotation. Without accelerated investment in infrastructure, the

transition from conventional to electric LCVs will remain sluggish, especially

for fleet operators relying on time-sensitive logistics.

Volatile Fuel Prices

Light commercial vehicle operators are significantly affected by

fluctuating fuel prices, which directly impact operating costs. While LCVs

offer relatively better fuel efficiency than larger commercial vehicles, high

fuel expenses can erode profit margins, especially for businesses dependent on

large fleets. Sudden spikes in oil prices, driven by global geopolitical

tensions or supply disruptions, cause unpredictability in logistics budgeting.

Fleet managers often need to revise service pricing or cut operational expenses

during such periods. The price volatility can deter small business owners from

expanding their LCV fleets, particularly when cost predictability is a

priority.

Key

Market Trends

Shift Toward Electrification of Light Commercial Fleets

Fleet electrification is emerging as a prominent trend in the UAE’s LCV

market. Logistics and retail companies are conducting pilot programs with

electric vans and pickup trucks to evaluate performance, charging requirements,

and cost savings. Advances in battery technology are addressing previous

limitations related to range and charging times. Combined with supportive

government initiatives, such as green fleet procurement guidelines, this trend

is gaining traction. Early movers are capitalizing on branding opportunities

linked to sustainable practices. Over time, fleet electrification is expected

to align with broader urban decarbonization goals and contribute to a greener

logistics ecosystem. For instance, As per the International Trade Administration, the United Arab Emirates is actively investing in electric vehicle (EV) charging infrastructure as part of its broader transition to sustainable transportation, targeting 50% EVs in commercial fleets, 70% electric buses, and 40% plug-in and hybrid trucks by 2050.

Increased Demand for Telematics and Fleet Monitoring Tools

Fleet operators are increasingly investing in telematics systems to

optimize operations and improve driver behavior. Tools such as GPS tracking,

fuel usage monitoring, predictive maintenance alerts, and route optimization

are helping companies enhance efficiency and reduce costs. Real-time visibility

into vehicle performance and delivery timelines supports faster

decision-making. Telematics data is also being used to manage insurance claims,

assess compliance, and monitor sustainability goals. As competition

intensifies, companies view connected vehicle solutions as a strategic

differentiator for customer service and operational control.

Rising Popularity of Vehicle Customization

There is a growing trend among commercial users to customize their LCVs

based on specific operational needs. This includes modular cargo spaces,

refrigerated units for perishables, and integrated shelving for tool storage.

Businesses involved in repair, catering, medical transport, and other

specialized services are leveraging customization to improve utility.

Custom-built LCVs support brand identity while ensuring functional excellence.

Manufacturers and upfitting companies are offering flexible solutions tailored

to sectors such as HVAC, telecom, and mobile retail, making customized LCVs a

practical and competitive choice in the commercial segment.

Segmental

Insights

Vehicle Type Insights

The UAE Light Commercial Vehicle market features a diverse mix of

vehicle types including pickup trucks, vans, and light buses, each catering to

distinct business and utility functions. Pickup trucks are commonly used across

construction sites, agricultural transportation, and by service contractors who

require open cargo beds for carrying tools, machinery, or raw materials. These

vehicles offer flexibility for operations that involve mixed terrain and

varying cargo sizes. Vans are widely utilized by logistics firms, courier companies, and

small businesses for transporting goods in urban and suburban areas. Their

enclosed cargo space provides better protection for transported items, making

them ideal for delivering parcels, electronics, groceries, and fragile

products. Refrigerated and multi-compartment variants are also available for

sectors that handle perishable goods or temperature-sensitive materials. Light buses fulfill the demand for short-distance public transportation

and employee mobility across industrial zones, schools, and corporate campuses.

Their seating capacity and fuel efficiency make them suitable for regular

commuting routes, especially in metropolitan and semi-urban areas. Light buses

are also favored by hotels and event organizers for group transfers. This

vehicle mix collectively supports the UAE's diverse commercial and operational

needs.

Download Free Sample Report

Regional

Insights

In 2024, Dubai held the largest share of the UAE Light Commercial Vehicle market due to its dense urban layout and strong commercial activity. As the nation’s logistics and financial hub, Dubai sees high demand for LCVs in e-commerce, courier services, and goods distribution from its ports and free zones. Its advanced road network supports efficient operations, while population density and fast delivery expectations drive van and pickup usage. Ongoing retail, hospitality, and construction projects sustain demand, and the city is advancing in smart mobility through electric LCV trials, telematics, and fleet digitization.

In 2024, Abu Dhabi remained a key player in the UAE’s LCV market, supported by infrastructure, construction, and logistics projects. Demand is driven by utility services, material transport, and intercity mobility, with durable LCVs favored for long-distance travel. Industrial growth and government diversification into tourism and real estate further boost usage. Abu Dhabi is also piloting clean mobility solutions, encouraging hybrid and electric LCV adoption in public fleets. For instance, Electric vehicles make up less than 1.3% of Abu Dhabi’s fleet, but the emirate targets 70,000 EV charging points by 2030, up from about 250 in 2024. This is driven by the E2GO joint venture between ADNOC Distribution and TAQA, aiming to accelerate EV adoption in line with national carbon neutrality goals.

Sharjah’s strategic position between Dubai and the Northern Emirates fuels its LCV market through strong demand from industrial zones and cost-effective logistics operations. Its growing role in e-commerce, SME logistics, and short-haul transport supports high use of fuel-efficient vans and pickups. With increasing focus on fleet efficiency and sustainability, Sharjah is gradually seeing a shift toward modernized, eco-friendly commercial vehicle fleets.

Recent

Developments

- In 2023, Ford Motor Company introduced its electric version of the

Transit van in the UAE through its Ford Pro division. The launch is part of

Ford’s global strategy to electrify commercial fleets. The model features

connected fleet management tools, lower emissions, and improved energy

efficiency. The UAE launch aligned with the government's push for sustainable

transport and provided fleet operators with an alternative to internal

combustion LCVs.

- Al-Futtaim Toyota inaugurated a state-of-the-art service center in Dubai

dedicated to commercial and light-duty vehicles. Opened in 2024, the facility

offers specialized maintenance services for pickup trucks and vans. This

investment supports growing LCV adoption in the region and reflects Toyota’s

commitment to enhancing aftersales infrastructure for fleet operators,

logistics firms, and SMEs in the UAE.

- In 2023, Nissan collaborated with UAE-based fleet management firms to

introduce advanced telematics solutions in their LCV offerings. This initiative

enabled real-time tracking, fuel consumption monitoring, and predictive

maintenance for commercial users. The move aimed to improve operational

efficiency and driver safety, positioning Nissan as a tech-forward competitor

in the UAE's evolving commercial vehicle market.

- In 2025, BYD and Dubai-based Al-Futtaim Industrial Equipment launched four electric commercial vehicles in the UAE—including the ETM6, T5, ETH8 trucks, and B12 electric bus—featuring BYD’s Blade Battery, fast charging, and up to 550 km range, supporting the country’s green mobility push.

Key

Market Players

- Toyota Motor Corporation

- Nissan Motor Co., Ltd.

- Hyundai Motor Company

- Isuzu Motors Limited

- Ford Motor Company

- Mitsubishi Motors Corporation

- Mercedes-Benz Group AG

- Peugeot S.A.

- Renault S.A.

- FCA Italy S.p.A. (Stellantis

N.V.)

|

By Vehicle Type

|

By Fuel Type

|

By End Use

|

By Region

|

- Pickup Truck

- Van & Light Bus

|

|

|

- Dubai

- Abu Dhabi

- Sharjah

- Rest of UAE

|

Report

Scope:

In this

report, the UAE Light Commercial Vehicle Market has been segmented into the

following categories, in addition to the industry trends which have also been

detailed below:

·

UAE Light Commercial Vehicle Market, By Vehicle

Type:

o

Pickup Truck

o

Van & Light Bus

·

UAE Light Commercial Vehicle Market, By Fuel Type:

o

Diesel

o

Petrol

o

Others

·

UAE Light Commercial Vehicle Market, By End Use:

o

Individuals

o

Fleet Owner

·

UAE Light Commercial Vehicle Market, By Region:

o

Dubai

o

Abu Dhabi

o

Sharjah

o

Rest of UAE

Competitive

Landscape

Company

Profiles: Detailed

analysis of the major companies presents in the UAE Light Commercial Vehicle

Market.

Available

Customizations:

UAE Light

Commercial Vehicle Market report with the given market data,

TechSci Research offers customizations according to the company’s specific

needs. The following customization options are available for the report:

Company

Information

- Detailed analysis and profiling of additional

market players (up to five).

UAE Light

Commercial Vehicle Market is an upcoming report to be released soon. If you

wish an early delivery of this report or want to confirm the date of release,

please contact us at [email protected]