|

Forecast Period

|

2026-2030

|

|

Market Size (2024)

|

USD 71 Million

|

|

Market Size (2030)

|

USD 244.47 Million

|

|

CAGR (2025-2030)

|

22.7%

|

|

Fastest Growing Segment

|

Cloud

|

|

Largest Market

|

Riyadh

|

Market Overview

Saudi Arabia Internet of Medical Things Market has

valued at USD 71 million in 2024 and is expected to reach USD 244.47 Million in 2030 and project robust growth in

the forecast period with a CAGR of 22.7% through 2030.

The Internet of Medical

Things market in Saudi Arabia is experiencing a notable upsurge driven

by several key factors. The growing adoption of connected healthcare devices

and remote patient monitoring solutions is at the forefront of this expansion.

Patients and healthcare providers are increasingly recognizing the benefits of

real-time health data monitoring and the ability to manage chronic conditions

more effectively. Moreover, the Saudi Arabian government has placed a

significant emphasis on digital healthcare transformation, promoting

initiatives that encourage the integration of IoT technology in the healthcare

sector.

The Vision 2030 program, with its focus on diversifying the economy and

enhancing healthcare services, has further accelerated the IoMT market's

growth. Additionally, the COVID-19 pandemic underscored the importance of

remote healthcare solutions, fostering a more favorable environment for IoMT

solutions. As a result, both domestic and international companies are

capitalizing on these opportunities, leading to a burgeoning IoMT market in

Saudi Arabia with a promising outlook for continued expansion and innovation in

the healthcare sector.

Download Free Sample Report

Key Market Drivers

Government Initiatives and Vision 2030

Saudi Arabia's government has played a pivotal role

in propelling the IoMT market forward. The Vision 2030 program, announced in

2016, seeks to diversify the Saudi economy and improve healthcare services. A

significant part of this vision focuses on the digital transformation of

healthcare through technology adoption. The government's commitment to these

objectives has resulted in various initiatives and policies that create an

environment conducive to the growth of the IoMT market. One such initiative is

the National Transformation Program (NTP), which outlines specific goals for

the healthcare sector, including the incorporation of digital technologies and

IoMT solutions to enhance patient care and healthcare infrastructure.

Furthermore, the government has invested in building a robust healthcare IT

infrastructure and data networks, facilitating the integration of IoMT devices

and platforms. These initiatives not only encourage the development and

adoption of IoMT solutions but also attract domestic and international

investments, driving the market's expansion. Saudi Arabia has committed to investing significantly in healthcare technology under Vision 2030. The government plans to enhance healthcare infrastructure, aiming for a USD 13.8 billion healthcare market by 2030, with a growing emphasis on smart health technologies such as IoMT devices.

Rising Chronic Disease Burden

The rising burden of chronic diseases in Saudi

Arabia is a key driver behind the growth of the Internet of Medical Things market in the country. Chronic diseases, such as diabetes,

cardiovascular diseases, and respiratory conditions, have become increasingly

prevalent, posing significant challenges to the healthcare system. The IoMT

plays a crucial role in addressing these challenges by leveraging connected

devices, data analytics, and remote monitoring capabilities. By enabling remote

patient monitoring, the IoMT allows healthcare providers to continuously

monitor patients' vital signs, medication adherence, and disease progression.

This real-time monitoring enables early detection of potential health issues,

timely interventions, and personalized care management, leading to improved

disease management and better patient outcomes.

Additionally, the IoMT empowers

patients with chronic diseases to actively participate in their own care

through self-monitoring and self-management. Connected devices and mobile

health applications enable patients to track their health metrics, receive

personalized insights, and access educational resources, promoting patient

engagement, adherence to treatment plans, and lifestyle modifications.

Moreover, the IoMT facilitates care coordination and collaboration among

healthcare providers involved in managing chronic diseases. Connected devices

and platforms enable seamless sharing of patient data, facilitating

communication and collaboration between different healthcare stakeholders. This

integrated approach ensures that all relevant parties have access to the same

information, enabling coordinated care plans, reducing medical errors, and

improving care transitions.

As the prevalence of chronic diseases continues to

rise in Saudi Arabia, the demand for IoMT solutions is expected to grow,

presenting significant business opportunities for market players in the Saudi

Arabian healthcare industry. By leveraging the power of connected devices, data

analytics, and remote monitoring capabilities, the IoMT has the potential to

revolutionize chronic disease management, improve patient outcomes, and enhance

the overall healthcare system in Saudi Arabia. The prevalence of chronic diseases in Saudi Arabia is rising rapidly. Around 30% of the adult population is estimated to have diabetes, making Saudi Arabia one of the countries with the highest prevalence rates in the world. Cardiovascular diseases are also a leading cause of death, with heart disease and stroke accounting for over 40% of total deaths.

Private Sector Investment

Private sector investment plays a crucial role in

driving the growth of the Saudi Arabia Internet of Medical Things market. The private sector's investment in IoMT technologies and solutions

brings forth several key benefits that contribute to the advancement of

healthcare delivery in the country. Firstly, private sector investment enables

the development and deployment of innovative IoMT devices, platforms, and

services. Companies investing in the IoMT market bring expertise, resources,

and research and development capabilities that drive technological advancements

and foster innovation.

This leads to the creation of cutting-edge IoMT

solutions that enhance patient care, improve operational efficiency, and drive

digital transformation in the healthcare sector. Secondly, private sector

investment facilitates the expansion of IoMT infrastructure and connectivity.

By investing in the necessary infrastructure, such as robust networks, data

centers, and cloud computing capabilities, private sector entities enable

seamless data transmission, secure communication, and interoperability between

IoMT devices and healthcare systems. This infrastructure investment is crucial

for the scalability and sustainability of IoMT solutions, ensuring that

healthcare providers can effectively leverage the power of connected devices

and data analytics to deliver high-quality care.

Additionally, private sector

investment drives market competition and fosters collaboration between

different stakeholders in the healthcare ecosystem. As private companies invest

in IoMT technologies, they create a competitive environment that encourages

innovation and pushes for continuous improvement. This competition drives the

development of more advanced and cost-effective IoMT solutions, making them

more accessible to healthcare providers and patients. Moreover, private sector

investment often involves partnerships and collaborations with healthcare

providers, research institutions, and government entities. These collaborations

facilitate knowledge sharing, expertise exchange, and the development of

tailored IoMT solutions that address the specific needs and challenges of the

Saudi Arabian healthcare system.

In conclusion, private sector investment is a

key driver of the Saudi Arabia IoMT market, enabling the development of

innovative solutions, expanding infrastructure and connectivity, fostering

competition and collaboration, and ultimately advancing healthcare delivery in

the country. As private companies continue to invest in the IoMT sector, the

market is expected to grow, offering significant opportunities for business

growth and technological advancements in the Saudi Arabian healthcare industry. The rise in obesity, which affects approximately 35% of adults in Saudi Arabia, is a key contributor to the growing chronic disease burden. This has led to higher rates of conditions like Type 2 diabetes, hypertension, and heart disease.

Patient-Centered Care

Patient-centered care is a key driver behind the

growth of the Saudi Arabia Internet of Medical Things market.

Patient-centered care is a healthcare approach that prioritizes the needs,

preferences, and active involvement of patients in their own care. This

approach recognizes that patients are not passive recipients of healthcare

services but active participants in their own health management. The IoMT plays

a crucial role in enabling patient-centered care by leveraging connected

devices, sensors, and data analytics to collect and analyze real-time health

information. The IoMT facilitates remote patient monitoring, allowing

healthcare providers to continuously monitor patients' health conditions

outside of traditional healthcare settings.

Connected devices such as

wearables, smart home devices, and mobile health apps enable the collection of

vital signs, activity levels, medication adherence, and other health-related

data. This real-time monitoring empowers patients to actively participate in

their own care by providing them with insights into their health status and

enabling early detection of potential health issues. It also allows healthcare

providers to intervene proactively, leading to timely interventions, reduced

hospitalizations, and improved patient outcomes.

The IoMT enables personalized healthcare management

by providing patients with access to their health data and personalized

recommendations. Through connected devices and health apps, patients can track

their health metrics, set goals, and receive personalized insights and

recommendations based on their individual health data. This empowers patients

to make informed decisions about their lifestyle, medication adherence, and

preventive measures. By putting patients at the center of their care, the IoMT

fosters a sense of ownership and responsibility for their health, leading to

improved patient engagement and better health outcomes.

Furthermore, the IoMT

enhances care coordination and communication among healthcare providers,

patients, and caregivers. Connected devices and platforms enable seamless

sharing of health information, facilitating collaboration and communication

between different stakeholders involved in a patient's care. This promotes a

holistic and integrated approach to healthcare, ensuring that all relevant

parties are well-informed and can make coordinated decisions. Improved care

coordination leads to reduced medical errors, better care transitions, and

enhanced patient satisfaction.

Key Market Challenges

Data Privacy and Security Concerns

One of the foremost challenges in the Saudi Arabia

IoMT market is the heightened concern over data privacy and security. The

exchange of sensitive health data between connected medical devices, healthcare

providers, and patients raises the risk of data breaches and unauthorized

access. Saudi Arabia has introduced various regulations and frameworks to

address these concerns, such as the Saudi Data and Artificial Intelligence

Authority (SDAIA), which oversees data protection and privacy. However, the

rapid growth of IoMT technologies has made it challenging to implement comprehensive

security measures across all devices and platforms. This poses a significant

barrier to IoMT adoption, as both healthcare organizations and patients are

apprehensive about the potential exposure of their personal health data. Ensuring robust encryption, authentication, and access control measures while staying compliant with evolving regulations is a persistent challenge for IoMT stakeholders.

Interoperability and Standardization

Interoperability, or the ability of different IoMT

devices and systems to seamlessly communicate and exchange data, remains a

substantial challenge in Saudi Arabia's IoMT market. Numerous manufacturers

produce various medical devices, each with its own proprietary protocols and

data formats, making integration and data exchange between devices and

healthcare systems complex. Without a standardized framework, healthcare

providers encounter difficulties in creating a unified ecosystem that can

effectively harness the potential of IoMT. The lack of interoperability hinders

the efficient sharing of patient data, reduces the effectiveness of remote

patient monitoring, and can lead to clinical errors. Addressing this challenge

requires industry-wide collaboration, the development of standardized

protocols, and investments in middleware solutions that can bridge the gap

between different devices and systems.

Limited Healthcare Infrastructure

Saudi Arabia's rapid expansion of IoMT technologies

has exposed limitations in the existing healthcare infrastructure. Many

healthcare facilities struggle to integrate IoMT devices and systems due to

outdated infrastructure and a lack of resources. This poses a challenge in

providing consistent and reliable connectivity, especially in remote areas. The

IoMT market's growth exacerbates the need for scalable and high-speed network

solutions. Additionally, while urban centers may have access to advanced healthcare

facilities, rural areas may lag behind, causing disparities in healthcare

services. As IoMT continues to flourish, ensuring equitable access to

healthcare services and overcoming infrastructure limitations is imperative.

Regulatory Compliance

Compliance with evolving regulatory standards is a

significant challenge in the Saudi Arabia IoMT market. The healthcare industry

is subject to a multitude of regulations, including those that govern data

privacy, medical device certification, and healthcare delivery. Ensuring that

IoMT solutions meet these complex regulatory requirements demands a rigorous

and costly certification process, which can hinder market entry for smaller

IoMT developers. The evolving nature of healthcare regulations further complicates

the landscape, requiring continuous monitoring and adaptation to remain

compliant. Striking a balance between innovation and regulatory compliance

while navigating the complex regulatory framework in Saudi Arabia presents an

ongoing challenge to IoMT companies.

Key Market Trends

Expansion

of Telehealth Services

A prominent trend in the

Saudi Arabia IoMT market is the rapid expansion of telehealth services. The

COVID-19 pandemic accelerated the adoption of telehealth, as patients and

healthcare providers sought alternatives to in-person consultations. Telehealth

platforms, often integrated with IoMT devices, allow for remote diagnosis,

monitoring, and treatment. Patients can now access healthcare services and

consultations from the comfort of their homes, reducing the burden on

healthcare facilities. This trend is expected to continue growing as the

country focuses on improving healthcare accessibility and reducing healthcare

costs. The Saudi government's investments in telehealth infrastructure and

supportive regulatory measures have further fueled the trend's growth.

Remote

Patient Monitoring for Chronic Diseases

Remote patient monitoring

(RPM) for chronic diseases has emerged as a significant trend in the Saudi

Arabia IoMT market. The prevalence of chronic diseases such as diabetes,

hypertension, and cardiovascular conditions has led to increased demand for

continuous monitoring solutions. IoMT technologies, including wearable devices

and smart sensors, enable real-time tracking of patients' vital signs and

health data. Healthcare providers can remotely monitor patients' conditions and

intervene promptly when necessary, resulting in better disease management and

reduced hospitalizations. As the burden of chronic diseases continues to grow,

the RPM trend is expected to gain further momentum, improving the quality of

care for individuals with chronic conditions.

Wearable

Health Devices

Wearable health devices

are gaining popularity as a trend within the Saudi IoMT market. These devices

include smartwatches, fitness trackers, and medical-grade wearables that

monitor various health parameters such as heart rate, activity levels, sleep patterns,

and even ECG data. Individuals are increasingly adopting these wearables to

track and manage their health proactively. Healthcare providers are also

exploring the use of wearables to enhance patient care, as they can provide

valuable, real-time health data that aids in early diagnosis and intervention.

With consumer interest and healthcare integration on the rise, the wearable

health device trend is expected to witness continued growth in the Saudi

market.

Big Data

and Analytics

Big data and analytics

have become a pivotal trend in the Saudi IoMT market, transforming the way

healthcare data is collected, processed, and leveraged. With the extensive data

generated by IoMT devices and systems, healthcare providers and organizations

can employ advanced analytics to gain insights into patient trends, population

health, and treatment outcomes. This trend has the potential to revolutionize

healthcare decision-making, enabling personalized treatments and predictive

analytics to enhance patient care and optimize resource allocation. The Saudi

healthcare sector is increasingly investing in data analytics infrastructure

and expertise to harness the full potential of this trend.

IoMT in

Home Healthcare

The deployment of IoMT in

home healthcare settings is another noteworthy trend in Saudi Arabia. As the

concept of aging in place gains traction, IoMT technologies are being used to

support the elderly and individuals with chronic conditions who prefer to

receive care in their homes. Devices like remote patient monitoring systems,

medication dispensers, and fall detection sensors help ensure the safety and

well-being of patients while reducing the strain on healthcare facilities. This

trend aligns with the government's aim to improve the quality of life for the

aging population and reduce healthcare costs by minimizing hospital stays. The

IoMT in home healthcare trend is anticipated to grow as the need for

personalized, accessible care continues to increase.

Segmental Insights

Component Insights

The Saudi Arabia Internet of Medical Things market was predominantly dominated by the Services segment, and

this dominance is anticipated to continue during the forecast period. The

Services segment encompasses various aspects critical to the successful

implementation and operation of IoMT solutions, including system integration,

consulting, maintenance, and ongoing support services. The significance of

services in the IoMT market lies in their role in ensuring the seamless

integration of IoMT systems into existing healthcare infrastructure,

maintaining the security and compliance of these systems, and providing

necessary training to healthcare professionals for efficient utilization. The dominant position of the Services segment is

attributed to several key factors. First, the complexity of IoMT implementation

often requires specialized expertise to integrate diverse hardware and software

components into existing healthcare networks, ensuring data privacy and

security. Service providers offer healthcare organizations the necessary

guidance and support to navigate these intricacies.

Ongoing maintenance and

support services are essential to guarantee the continuous functionality of IoMT

devices and systems. With the growing reliance on IoMT for patient care and

monitoring, healthcare facilities depend on services to address technical

issues and ensure the seamless operation of these systems.The Saudi Arabian

government's focus on digital healthcare transformation, coupled with the

rising demand for telehealth and remote patient monitoring, has led to

increased adoption of IoMT services to implement and maintain these

technologies effectively. The Services segment is expected to maintain its

dominance in the Saudi Arabia IoMT market during the forecast period. It will

continue to play a crucial role in helping healthcare providers harness the

full potential of IoMT solutions, ultimately enhancing patient care and

healthcare service delivery across the country.

.webp)

Download Free Sample Report

Regional Insights

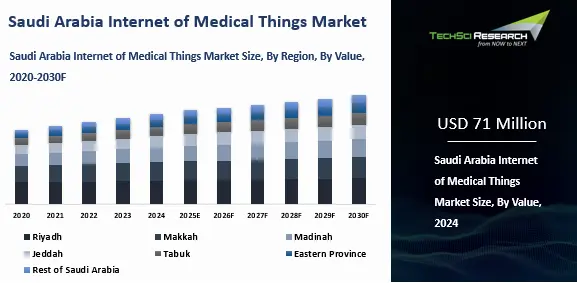

The Riyadh region emerged as the dominant force in

the Saudi Arabia Internet of Medical Things market, and this dominance

is likely to persist throughout the forecast period. Riyadh, the capital city

of Saudi Arabia, is a hub for healthcare facilities, research institutes, and

governmental healthcare initiatives. The region boasts a well-developed

healthcare infrastructure and a high concentration of hospitals, clinics, and

academic institutions, which have been at the forefront of IoMT adoption. The

region's prominence can be attributed to various factors, including extensive

government support for healthcare modernization through the Vision 2030

program, which has prioritized the integration of digital technologies in

healthcare services.

Riyadh also hosts numerous research and academic

institutions, fostering innovation and the development of IoMT applications. As

a result, the region has witnessed significant investment in IoMT technology,

research, and development. Moreover, Riyadh's large and diverse population,

including both urban and suburban areas, offers a vast patient pool for IoMT

applications and telehealth services, further driving the adoption of IoMT

solutions. The COVID-19 pandemic, which accelerated the adoption of telehealth

and remote patient monitoring, played a pivotal role in reinforcing Riyadh's

dominance, as healthcare providers rapidly adopted IoMT technologies to meet

the surging demand for virtual healthcare services. Given these factors, Riyadh

is well-positioned to maintain its leading position in the Saudi Arabia IoMT

market, both as a technology hub and a major healthcare service provider,

during the forecast period.

Recent Developments

- In Jan 2025, Nuffield Health and GE Healthcare have announced a £200 million collaboration to install AI-enabled diagnostic equipment across Nuffield Health’s UK hospital network. This partnership will enhance diagnostic capabilities, improve patient care, and drive healthcare innovation by integrating advanced imaging technology. The initiative underscores both organizations’ commitment to advancing medical diagnostics and ensuring high-quality, efficient healthcare services. By leveraging AI-driven solutions, the collaboration aims to optimize clinical workflows and deliver more accurate, timely results to patients across the UK.

- In Dec 2024, GE Healthcare has unveiled Sonic DL for 3D, a deep learning innovation designed to enhance MRI imaging. This advanced technology leverages AI to improve image quality, reduce scan times, and enhance diagnostic capabilities. Sonic DL for 3D represents a significant advancement in MRI, offering healthcare providers more efficient and accurate tools for patient care. The innovation underscores GE Healthcare's commitment to integrating cutting-edge deep learning technologies to drive advancements in medical imaging and transform clinical workflows.

- In May 2024, GE Healthcare and Tampa General Hospital have expanded their long-term partnership to advance healthcare innovation and improve patient outcomes. This expanded collaboration will focus on leveraging cutting-edge medical technologies, including advanced imaging and diagnostic tools, to enhance clinical care. The agreement underscores both organizations' commitment to driving improvements in healthcare delivery, optimizing operational efficiency, and accelerating the adoption of digital health solutions. The partnership aims to set new standards in patient care and medical technology integration.

Key Market Players

- Koninklijke Philips N.V.

- General Electric Company

- Siemens AG

- Cisco Systems, Inc.

- IBM Corporation

- Honeywell International Inc.

- Microsoft Corporation

- Oracle Corporation

|

By Component

|

By Deployment

|

By End-use

|

By Application

|

By Region

|

|

|

|

- Homecare

- Hospitals

- Clinics

- Research Institutes & Academics

- Others

|

- Telemedicine

- Clinical Operations & Workflow Management

- Connected Imaging

- Medication Management

- Inpatient Monitoring

- Others

|

- Riyadh

- Makkah

- Madinah

- Jeddah

- Tabuk

- Eastern Province

- Rest of Saudi Arabia

|

Report Scope:

In this report, the Saudi Arabia

Internet of Medical Things Market

has been segmented into the following categories, in addition to the

industry trends which have also been detailed below:

- Saudi Arabia Internet of Medical Things

Market, By Component:

o Hardware

o Software

o Services

- Saudi Arabia Internet of Medical Things

Market, By Deployment:

o On-premise

o Cloud

- Saudi Arabia Internet of Medical Things

Market, By End-use:

o Homecare

o Hospitals

o Clinics

o Research Institutes & Academics

o Others

- Saudi Arabia Internet of Medical Things

Market, By Application:

o Telemedicine

o Clinical Operations & Workflow Management

o Connected Imaging

o Medication Management

o Inpatient Monitoring

o Others

- Saudi Arabia Internet of Medical Things

Market, By Region:

o Riyadh

o

Makkah

o

Madinah

o

Jeddah

o

Tabuk

o

Eastern

Province

o

Rest of

Saudi Arabia

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Saudi

Arabia Internet of Medical Things Market.

Available Customizations:

Saudi Arabia Internet of Medical Things Market report

with the given market data, TechSci Research offers customizations according

to a company's specific needs. The following customization options are

available for the report:

Company Information

- Detailed analysis and profiling of additional

market players (up to five).

Saudi Arabia Internet of Medical Things Market is

an upcoming report to be released soon. If you wish an early delivery of this

report or want to confirm the date of release, please contact us at [email protected]