|

Forecast Period

|

2026-2030

|

|

Market Size (2024)

|

USD 53.2 Billion

|

|

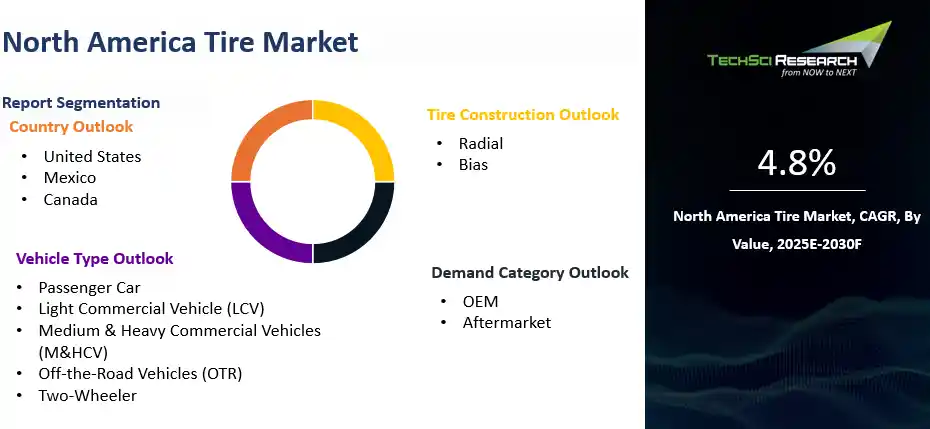

CAGR (2025-2030)

|

4.8%

|

|

Fastest Growing Segment

|

Aftermarket

|

|

Largest Market

|

United States

|

|

Market Size (2030)

|

USD 70.6 Billion

|

Market

Overview

North America Tire Market

was valued at USD 53.2 Billion in 2024 and is projected to reach approximately USD

70.6 Billion by 2030, expanding at a CAGR of 4.8% during the forecast period of

2025–2030. The North America tire market is shaped by the intersection of

automotive innovation and evolving consumer expectations. Demand is surging

across both the OEM and aftermarket segments, with consumers seeking higher

durability, better fuel efficiency, and enhanced safety features. The U.S. Infrastructure Investment and Jobs Act has allocated over USD 100 billion through 2025 for road and bridge improvements, boosting demand for commercial vehicle tires as freight transport increases. The Canadian government is also investing heavily in highway upgrades, supporting tire consumption in logistics sectors. Technological

upgrades such as run-flat tires and low rolling resistance designs are

receiving increased traction due to performance and environmental benefits.

Evolving mobility trends, including ride-sharing and fleet expansion, further

reinforce tire consumption patterns in urban and intercity routes.

North America continues to see steady growth in vehicle registrations. According to the U.S. Department of Transportation, light vehicle registrations in the U.S. reached approximately 280 million units in 2024, marking a 1.5% increase from the previous year. This steady rise is supported by strong economic recovery, growing consumer confidence, and favorable financing options, which encourage both new vehicle purchases and vehicle replacement cycles. The increase is not limited to passenger cars but includes SUVs, trucks, and commercial vehicles, all contributing to heightened demand for tires across various segments. Aging vehicle fleets are also driving replacement tire sales as owners opt to maintain rather than replace older vehicles, especially amid supply chain delays impacting new car availability. This growth in vehicle ownership directly boosts demand for original equipment manufacturer (OEM) tires and aftermarket replacement tires, sustaining the tire market’s expansion.

Market

Drivers

Growth in E-commerce and Last-Mile Delivery

E-commerce sales in North America surpassed USD 1 trillion in 2024, significantly increasing demand for light commercial vehicle (LCV) tires used in last-mile delivery. This sector’s growth, reported by the U.S. Census Bureau, is encouraging fleets to upgrade tires to durable, fuel-efficient models that can withstand frequent stops, variable loads, and urban driving conditions. The rise of same-day and next-day delivery services has further intensified the need for reliable tire performance to minimize downtime and maintenance costs. Additionally, the adoption of advanced telematics and fleet management systems is optimizing tire usage and replacement schedules, contributing to better overall tire lifecycle management. Increasing investments in urban logistics infrastructure and sustainable delivery solutions, such as electric delivery vans, also support demand for specialized tires designed for low rolling resistance and reduced environmental impact. This trend is expected to continue accelerating as consumer preference for online shopping grows and retailers expand their delivery networks across both metropolitan and suburban areas.

Growth in Tire Replacements and Maintenance Awareness

The North American EV market is expanding rapidly, supported by government incentives like the U.S. Inflation Reduction Act, which provides tax credits and rebates encouraging consumers and manufacturers to adopt electric vehicles. EV sales are projected to grow by 30% annually through 2025, according to the Tire Industry Association. This surge is driving demand for specialized EV tires engineered with low rolling resistance to maximize battery efficiency and extended tread life to handle the heavier weight of EVs. Noise reduction technologies are also crucial, as EVs produce less engine noise, making tire noise more noticeable and a key factor in consumer satisfaction. Tire manufacturers are investing in R&D to develop sustainable materials and designs that meet the unique performance needs of EVs while complying with stricter environmental regulations. Additionally, the expanding EV charging infrastructure across major urban and suburban areas is accelerating EV adoption, further supporting growth in the EV tire segment. Fleet operators, including ride-sharing and delivery services, are increasingly electrifying their vehicles, which increases demand for durable, high-performance EV tires capable of withstanding intensive urban use.

Technological Advancements in Tire Manufacturing

Tire manufacturers are investing in innovations such as self-healing

tires, lightweight materials, and noise-reduction technologies. These advancements

are improving the lifespan, comfort, and performance of tires under varying

road and weather conditions. Smart tires equipped with IoT sensors are gaining

acceptance in fleet management and performance tracking. Consumers are increasingly preferring all-season tires due to their

year-round usability and cost efficiency. The ability to perform under diverse

climate conditions without frequent seasonal changes is making them an

attractive option for both individual vehicle owners and fleet operators. Online

tire sales are streamlining consumer access to multiple tire brands and models,

allowing for price comparisons and home delivery. The convenience of digital

purchase channels, supported by reviews, installation services, and warranty

information, is fueling sales in both urban and remote areas.

Download Free Sample Report

Key

Market Challenges

Supply Chain Disruptions and Logistics Costs

Complex global supply chains are vulnerable to delays and increased shipping costs due to port congestion, trade barriers, and geopolitical conflicts. These disruptions affect the timely availability of raw materials and finished products, impacting OEM and aftermarket operations alike. The pandemic’s lingering effects and recent geopolitical tensions continue to cause unpredictable supply fluctuations. Rising fuel prices and labor shortages in the logistics sector further increase transportation costs. Manufacturers are increasingly adopting localized sourcing and inventory diversification strategies to mitigate these risks and improve supply chain resilience.

Rising Competition from Low-Cost Imports

The influx of low-cost tire imports poses a threat to domestic manufacturers. Price-sensitive customers are often drawn to cheaper alternatives, which intensifies price competition and reduces brand loyalty. Regulatory interventions such as anti-dumping duties are sometimes employed, but challenges persist. Low-cost imports can also vary in quality, creating consumer concerns about safety and durability. Domestic manufacturers are responding by focusing on innovation, quality improvements, and value-added services to differentiate their offerings. Building strong distribution networks and enhancing brand reputation remain key strategies to compete effectively.

Key

Market Trends

Rising Demand for Sustainable and Green Tires

Regulatory pressures and consumer demand are pushing tire manufacturers to develop sustainable products. According to the Environmental Protection Agency (EPA), tire manufacturers are adopting more eco-friendly materials, recycling programs, and producing tires with up to 20% improved fuel efficiency through low rolling resistance technology. These innovations help reduce carbon footprints and comply with increasingly strict environmental regulations. Growing consumer awareness about climate change also drives market preference for green tires. Collaboration between tire makers and automotive companies is accelerating to integrate sustainability throughout the vehicle lifecycle.

Focus on Lightweight and Fuel-Efficient Designs

Automotive OEMs are seeking tire solutions that reduce vehicle weight and improve mileage. Lightweight tires contribute to reduced rolling resistance, improved acceleration, and lower emissions. Manufacturers are incorporating advanced materials like aramid and Kevlar to achieve these efficiencies. These materials not only reduce tire weight but also enhance durability and safety. Regulatory incentives for fuel efficiency and emissions reduction encourage OEMs to prioritize these technologies. The trend aligns with the broader automotive industry push toward lightweight components and electrification.

Integration of AI and Predictive Analytics in Tire Management

Artificial intelligence is being employed to analyze tire performance data and predict maintenance schedules. Predictive analytics helps prevent tire-related failures and reduces operational costs. This trend is particularly valuable in commercial fleets where uptime is critical. Advanced sensors and IoT devices provide real-time tire condition monitoring, enabling proactive replacements and reducing downtime. Such technologies also improve fleet safety and optimize tire life cycles, contributing to overall operational efficiency. The growing adoption of connected vehicles accelerates integration of these smart tire management solutions.

Rise in Customization and Performance-Based Tire Demand

Consumers are showing interest in performance tires suited to specific driving needs such as off-road, high-speed, or winter conditions. The customization trend allows buyers to choose tire specifications that match their usage patterns, lifestyle, and aesthetic preferences. This demand is fueled by greater vehicle personalization options and increasing participation in motorsports and outdoor activities. Retailers and manufacturers are responding with expanded product portfolios and digital tools that assist customers in selecting the perfect tire fit. Customization also extends to eco-friendly and technology-enhanced tire options, appealing to diverse consumer segments.

Segmental

Insights

Vehicle Type Insights

The North America tire market is segmented by vehicle type into

passenger cars, light commercial vehicles, medium and heavy commercial

vehicles, two-wheelers, and off-the-road (OTR) vehicles. Tire

requirements vary significantly across these vehicle categories depending on

the load capacity, driving conditions, and usage intensity. Passenger car tires

are tailored for urban commuting and highway comfort, with an emphasis on fuel

efficiency, noise control, and seasonal adaptability. Light commercial vehicle

tires are engineered for last-mile deliveries and urban cargo transportation,

offering a balance between durability and fuel savings. Medium and heavy commercial vehicles operate in more demanding

environments, requiring tires capable of withstanding higher loads, extended

mileage, and all-weather conditions. These tires often feature reinforced

sidewalls, deeper treads, and enhanced puncture resistance. Two-wheeler tires are designed for maneuverability and grip in urban areas,

supporting quick acceleration and braking. This segment often Favors

cost-effective tire options that deliver reliability on variable road surfaces. OTR tires cater to construction, agriculture, and mining vehicles,

emphasizing traction, cut resistance, and longevity in extreme conditions. The

design of OTR tires includes unique tread patterns and robust casing structures

to perform efficiently in off-road terrains. Each vehicle category shapes tire

performance expectations and influences purchasing decisions across both

replacement and original equipment sectors.

Download Free Sample Report

Country

Insights

United States

In 2024, the United States remains the largest market due to its vast automotive base, high vehicle ownership rates, and significant aftermarket demand. The country’s diverse geography and climate conditions, ranging from snowy northern states to hot southern regions, drive demand for a wide variety of tires, including all-season, winter, and high-performance models. Increasing sales of light vehicles and commercial trucks, supported by a recovering economy and consumer confidence, sustain strong tire replacement cycles. Growth in electric vehicle adoption further propels demand for specialized tires designed to enhance efficiency and noise reduction, while infrastructure investments under federal programs are increasing freight activity, boosting demand for durable commercial vehicle tires.

Canada

Canada’s tire market, while smaller than that of the United States, plays a critical role in the region’s overall tire industry. The country experiences harsh winter conditions that necessitate specialized winter tires, which form a significant segment of the Canadian tire market. The mandatory use of winter tires in several provinces during colder months drives consistent seasonal demand, complemented by growing interest in all-season and performance tires suited for Canada’s diverse terrain. Vehicle sales and registrations are steadily increasing, supported by economic growth and expanding urbanization, which fuel aftermarket tire replacement needs. Canadian consumers and fleet operators are increasingly adopting sustainable tire options, influenced by environmental policies and rising fuel costs. The government’s investments in road infrastructure improvements also support tire demand across commercial and passenger vehicle segments. Growth in electric vehicle adoption is slower compared to the United States but is gaining momentum, encouraging tire manufacturers to introduce products aligned with EV performance requirements. Retail trends in Canada show increasing acceptance of online tire retailing, offering convenience and expanded product choice to consumers in both urban and remote areas.

Recent

Developments

- In 2024, Michelin announced over USD 300 million in investments at its Nova Scotia and Kansas-based Camso-branded operations. This strategic move aims to bolster production capabilities for electric vehicle (EV) tires and larger rim diameter tires, aligning with the growing demand for sustainable and high-performance tire solutions. The investment underscores Michelin's commitment to serving high-value segments, including EVs and the agricultural market, by enhancing manufacturing capacity and technological advancements.

- In 2024, The Goodyear Tire & Rubber Company announced a strategic

collaboration with Monolith, a U.S.-based clean materials company, to source

carbon black produced using renewable electricity. This partnership supports

Goodyear’s sustainability goals, as carbon black is a key ingredient in tires.

The cleaner production method significantly reduces CO₂ emissions compared to

conventional processes, helping Goodyear move toward net-zero manufacturing and

more eco-friendly tire solutions.

- Bridgestone Americas, Inc. invested approximately USD 550 million in

2023 to expand and modernize its Warren County, Tennessee plant. The expansion

focuses on producing tires tailored for electric vehicles (EVs), including

those with higher load capacities and lower rolling resistance. The move aims

to meet growing demand for EV-compatible tires in North America while aligning

with Bridgestone’s broader digital and sustainable transformation strategy.

- In 2023, Michelin North America, Inc. unveiled the Uptis (Unique

Puncture-Proof Tire System) airless tire prototype designed for commercial

vehicle fleets. This innovation eliminates the risk of flats and blowouts,

significantly reducing downtime and maintenance costs. Michelin initiated pilot

testing with delivery fleets, aiming to roll out commercial applications in the

coming years. This aligns with Michelin’s commitment to smarter, safer, and

more sustainable mobility.

Key

Market Players

- The Goodyear Tire & Rubber Company

- Michelin North America, Inc.

- Bridgestone Americas, Inc.

- Continental Tire the Americas, LLC

- Pirelli Tire LLC

- Hankook Tire America Corp.

- Yokohama Tire Corporation

- Toyo Tire U.S.A. Corp.

- Kumho Tire U.S.A., Inc.

- Sumitomo Rubber North America, Inc.

|

By Vehicle Type

|

By Tire

Construction

|

By Demand

Category

|

By Country

|

- Passenger Car

- Light Commercial Vehicle (LCV)

- Medium & Heavy Commercial Vehicles

(M&HCV)

- Off-the-Road Vehicles (OTR)

- Two-Wheeler

|

|

|

- United States

- Mexico

- Canada

|

Report

Scope:

In this

report, the North America Tire Market has been segmented into the following

categories, in addition to the industry trends which have also been detailed

below:

- North America Tire Market, By Vehicle Type:

o

Passenger Car

o

Light Commercial Vehicle (LCV)

o

Medium & Heavy Commercial Vehicles (M&HCV)

o

Off-the-Road Vehicles (OTR)

o

Two-Wheeler

- North America Tire Market, By Tire Construction:

o

Radial

o

Bias

- North America Tire Market, By Demand Category:

o

OEM

o

Aftermarket

- North America Tire Market, By Country:

o

United States

o

Mexico

o

Canada

Competitive

Landscape

Company

Profiles: Detailed

analysis of the major companies presents in the North America Tire Market.

Available

Customizations:

North

America Tire Market report with the given market data, TechSci

Research offers customizations according to the company’s specific needs. The

following customization options are available for the report: -

Company

Information

- Detailed analysis and profiling of additional

market players (up to five).

North

America Tire Market is an upcoming report to be released soon. If you wish an

early delivery of this report or want to confirm the date of release, please

contact us at [email protected]