Forecast Period | 2026-2030 |

Market Size (2024) | USD 3.45 Billion |

Market Size (2030) | USD 6.47 Billion |

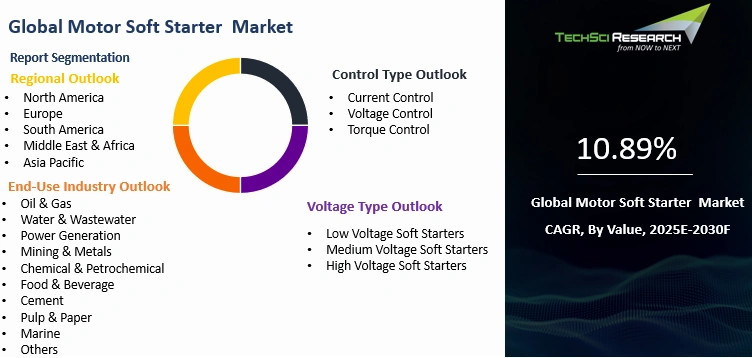

CAGR (2025-2030) | 10.89% |

Fastest Growing Segment | Medium Voltage Soft Starters |

Largest Market | Asia-Pacific |

Market Overview

Global Motor Soft Starter Market was valued at USD 3.45 Billion in 2024 and is expected to reach USD 6.47 Billion by 2030 with a CAGR of 10.89% during the forecast period.

The Motor Soft Starter market refers to the global industry involved in the manufacturing, distribution, and application of electronic devices designed to control the acceleration and deceleration of electric motors. These devices reduce the inrush current and mechanical stress on motors during startup, providing a smoother and more controlled initiation of motor operation compared to traditional methods like direct-on-line (DOL) or star-delta starters. Soft starters are widely used across industries such as oil and gas, water and wastewater treatment, mining, cement, manufacturing, and power generation where electric motors are extensively employed in operations involving pumps, fans, compressors, and conveyors.

The market is witnessing significant growth driven by the increasing focus on energy efficiency and equipment longevity. Industries are gradually shifting towards automation and advanced motor control systems to improve operational efficiency and reduce maintenance costs. The growing need to limit electrical and mechanical stress on motors, coupled with stringent regulations around energy usage and carbon emissions, is further propelling the demand for soft starters. Additionally, the rising adoption of HVAC systems, increasing industrialization, and expansion of water infrastructure projects in developing nations are contributing to market expansion.

Technological advancements such as integration with Internet of Things (IoT), remote monitoring, and compact designs are also enhancing the adoption of soft starters. These features allow predictive maintenance, reduce downtime, and improve productivity, making them more attractive to end users. Furthermore, industries are increasingly preferring soft starters over variable frequency drives (VFDs) in applications where speed control is not necessary, making soft starters a cost-effective alternative.

Asia-Pacific is anticipated to dominate the market due to rapid industrial growth in countries like China and India, government initiatives in infrastructure development, and a booming manufacturing sector. North America and Europe are also expected to show steady growth due to technological advancements and growing emphasis on energy efficiency standards.

Overall, the Motor Soft Starter market is expected to rise steadily in the coming years, driven by industrial automation trends, energy conservation requirements, and the growing demand for reliable motor control solutions across sectors.

Key Market Drivers

Escalating Demand for Energy‑Efficient Motor Control

Industries worldwide are under mounting pressure to reduce operational costs and environmental footprint, prompting them to seek energy‑efficient motor control solutions. Motor soft starters significantly curb inrush currents—often reducing peak power draw during startup by nearly 30 percent—thereby lowering energy consumption and alleviating strain on power infrastructure. In sectors such as water treatment and HVAC, where motors frequently cycle on and off, deploying soft starters can decrease energy use by 10–15 percent annually compared to direct online starts, translating into substantial electricity cost savings over the lifecycle of motor systems.

A mid-sized bottling plant equipped with 50 centrifugal pumps achieved a 12% average reduction in peak electrical demand after installing motor soft starters. This improvement led to annual energy savings of approximately 150,000 kWh. The use of soft starters not only enhanced energy efficiency but also contributed to reduced operational costs and lower stress on electrical infrastructure, demonstrating a practical solution for improving performance in industrial pump systems.

Accelerating Adoption of Industrial Automation

As manufacturing processes evolve toward Industry 4.0 paradigms, the demand for intelligent motor control in automated operations continues to rise. Soft starters deliver smoother acceleration profiles, programmable start modes, and built‑in protection features that harmonize seamlessly with automated systems. Companies deploying multi‑axis conveyor networks, robotic assembly lines, or process‑sensitive operations increasingly specify soft starters to ensure synchronized motor operation and prevent equipment damage, thus enabling higher uptime and process repeatability.

An automotive-focused robotics integrator reported that over 70% of its new robotic platform deployments in the past year featured motor soft starters as standard motor control components. This widespread adoption highlights the growing importance of soft starters in enhancing system reliability, reducing mechanical stress, and improving overall energy efficiency in automated operations—making them a preferred choice in modern industrial robotics installations.

Stringent Regulatory Mandates on Energy Consumption and Emissions

Governments and regulatory bodies are imposing rigorous efficiency standards across industrial sectors, increasing the economic and legal imperative to adopt systems that minimize energy consumption. In Europe, for instance, requirements such as the Ecodesign Directive and enforced IE3 motor efficiency levels indirectly encourage the deployment of soft starters to complement compliance efforts. Similarly, power‑intensive nations have introduced tax rebates and subsidies to promote installation of inrush‑mitigation devices. Soft starters help industrial operators not only meet efficiency thresholds but also optimize CAPEX and OPEX through reduced demand charges and improved power factor management.

After the launch of a national energy-efficiency tax incentive, more than 45% of medium-voltage motor installations in the manufacturing and utilities sectors adopted motor soft starters within six months. This rapid uptake reflects the policy’s strong influence on energy-efficient practices, encouraging industries to integrate soft starters for improved energy savings, reduced wear on equipment, and greater compliance with evolving sustainability and efficiency standard.

Expansion of Renewable and Water Infrastructure Projects

Global investment in renewable energy and water infrastructure creates high‑volume soft starter demand in applications such as pump stations, solar‑trackers, and wind turbine yaw drives. Soft starters protect expensive pumps and actuators from mechanical stress, ensuring smooth commissioning and operational reliability. In desalination plants, where high‑pressure pumps are frequently cycled, soft starter deployment is not just beneficial but often mandatory to avoid pressure surges and equipment wear.

Since 2022, over 1,200 municipal water treatment projects worldwide have specified the use of motor soft starters for all centrifugal pump assemblies rated between 100 and 500 kW. This trend underscores a global shift toward energy-efficient motor control solutions, aiming to reduce mechanical stress, enhance system longevity, and optimize energy usage in critical infrastructure—particularly in large-scale water management operations where reliability and efficiency are key priorities.

.webp)

Download Free Sample Report

Key Market Challenges

Elevated Initial Capital Expenditure Impeding Adoption

The foremost challenge facing the Motor Soft Starter market is the relatively high upfront investment required for procurement and deployment. Compared to legacy technologies—such as direct‑on‑line and star‑delta starters—Motor Soft Starters can exceed initial costs by 30 to 50 percent. For small and medium‑sized enterprises operating under tight capital constraints, this premium presents a tangible financial hurdle.

While the total cost of ownership over the lifecycle—encompassing energy savings and reduced maintenance—typically justifies the investment, this realization occurs post‑installation, making decision‑makers cautious. A recent survey conducted among Southeast Asian manufacturers indicated that 68 percent of facility managers preferred conventional starter systems primarily due to budget limitations, despite being cognizant of longer-term operational savings .

In emerging-market settings with limited access to suitable financing mechanisms, this initial barrier significantly restricts inclusion of Motor Soft Starters in retrofit projects and infrastructure expansions, thereby decelerating broader market penetration.

Technical Complexity and Shortage of Skilled Workforce

A critical impediment is the elevated technical complexity inherent in advanced Motor Soft Starter systems, especially those with digital control, IoT integration, and programmable logic features. Installation, configuration, and ongoing maintenance of these systems demand personnel with specialized knowledge in power electronics, motor behaviour, and control‑system architecture.

However, in several regions—such as Latin America, Southeast Asia, and parts of Africa—a distinct deficit in competent technicians persists. A study of industrial technicians in Brazil revealed that 42 percent reported limited familiarity with electronic motor control systems . This skills gap increases the likelihood of improper setup, misconfiguration, or failure to integrate correctly with existing systems, which can incur operational disruptions and additional costs. Language barriers compounded by poorly translated technical documentation further hinder effective deployment, leading to installation timelines extensions of up to 23 percent in markets like Vietnam. Consequently, manufacturers and integrators must invest in training programs, localization of documentation, and simplified user interfaces to overcome these structural constraints.

Key Market Trends

Rising Demand for Energy-Efficient and Sustainable Motor Control Systems

The global shift toward energy efficiency and sustainability is significantly impacting the Motor Soft Starter market. Industrial sectors are under increasing pressure to reduce their carbon footprint and energy consumption due to stringent government regulations, corporate environmental goals, and rising electricity costs. Motor Soft Starters are gaining prominence in fixed-speed motor applications, where their ability to reduce inrush current, prevent mechanical shock, and improve power factor during startup offers both economic and ecological benefits. By enabling smoother acceleration and deceleration, these systems reduce energy spikes that are otherwise prevalent with traditional starters. Moreover, many manufacturing and infrastructure projects are integrating energy monitoring systems, where Motor Soft Starters equipped with real-time feedback mechanisms and data logging capabilities help optimize motor operations. Industries such as water treatment, cement, and oil and gas are increasingly preferring energy-efficient equipment to qualify for green certification and government subsidies. As the pressure mounts for sustainable industrial practices, Motor Soft Starters will be favored in new projects and retrofit upgrades where simple but efficient motor control is required without the complexity or cost of Variable Frequency Drives.

Advancement in Internet of Things Enabled Motor Soft Starters

The integration of Internet of Things functionality is transforming the capabilities of Motor Soft Starters, making them smarter, more predictive, and more compatible with Industry 4.0 ecosystems. Manufacturers are incorporating advanced diagnostics, condition monitoring, and remote configuration features through Internet of Things modules and cloud-based platforms. This evolution allows operators to collect and analyze motor performance data such as start frequency, voltage imbalance, temperature rise, and fault conditions in real-time. These insights enable predictive maintenance, reduce unscheduled downtime, and extend the operational lifespan of both motors and Motor Soft Starters. Additionally, Internet of Things-enabled systems can be linked to centralized dashboards or mobile devices, allowing plant engineers to monitor multiple motor starters across remote sites with minimal physical intervention. The rise of smart factories and automated infrastructure is accelerating the demand for such intelligent starters in sectors including mining, pharmaceuticals, food processing, and utilities. This trend is expected to grow as digital infrastructure becomes more accessible and as companies strive for operational resilience and responsiveness.

Increased Customization and Industry-Specific Product Development

A key trend shaping the Motor Soft Starter market is the move toward customization and industry-specific product development. Recognizing the diverse operational environments and unique motor loads across industries, manufacturers are developing application-specific Motor Soft Starters that cater to targeted requirements. For example, in the mining and aggregates industry, soft starters are designed with enhanced dust and vibration resistance, whereas in the food and beverage sector, compact and wash-down rated designs are becoming more prevalent. In marine applications, soft starters must comply with international maritime regulations and function in confined spaces with high humidity. To meet these varying demands, manufacturers are offering modular designs, customizable firmware, and application-tuned parameters. This allows for greater adaptability in areas such as pump control, conveyor systems, compressors, and mixers. Custom-built soft starters reduce over-engineering and offer cost-efficient solutions while still meeting performance and safety standards. This trend is being driven by increased collaboration between end users and equipment suppliers, and it reflects a broader industry movement toward precision engineering and tailored automation solutions.

Segmental Insights

Control Type Insights

In 2024, the current control segment dominated the Motor Soft Starter market and is expected to maintain its leading position throughout the forecast period. Current control technology offers superior precision and reliability in managing inrush current during motor startup, making it highly effective in reducing electrical stress on both motors and power systems. This control type is widely adopted across various industrial applications such as pumps, compressors, conveyors, and fans, where managing high starting current is critical to prolong equipment life and ensure stable operation. Industries value current control systems for their ability to provide consistent torque and soft acceleration, which helps in avoiding mechanical shocks and reducing downtime due to wear and tear.

Additionally, current control Motor Soft Starters are favored for their compatibility with a wide range of motor types and their capacity to handle varying load conditions without performance degradation. With increasing emphasis on energy efficiency, power quality, and equipment protection, many end users across sectors including water treatment, oil and gas, manufacturing, and mining are increasingly opting for current-controlled soft starters. Moreover, technological advancements have further enhanced the appeal of current control systems by enabling smoother transitions, better fault diagnostics, and real-time monitoring capabilities, aligning well with digital and smart factory trends.

The dominance of the current control segment is also supported by its cost-effectiveness and ease of integration into both new installations and retrofit projects. As industrial facilities continue to demand reliable motor control solutions that minimize operational risks and energy consumption, the current control segment is expected to maintain its market leadership well into the coming years.

Voltage Type Insights

In 2024, the low voltage soft starters segment emerged as the dominant segment in the Motor Soft Starter market and is projected to maintain its leadership throughout the forecast period. This dominance is primarily attributed to the widespread use of low voltage motors in various industries such as food and beverage, pharmaceuticals, water treatment, textiles, and small to medium-scale manufacturing operations. Low voltage soft starters are particularly suitable for motors rated below 690 volts, which represent the vast majority of industrial motor applications globally.

Their relatively lower cost, compact size, and ease of installation make them the preferred choice for numerous fixed-speed motor applications where smooth start and stop operations are critical. Additionally, advancements in low voltage soft starter technology—such as integrated protection features, enhanced user interfaces, and compatibility with smart monitoring systems—have further strengthened their market appeal. These systems are extensively used in conveyor belts, pumps, compressors, and HVAC systems, which are ubiquitous in light to moderate-duty operations.

The rise in automation across industries and the increasing focus on energy efficiency have led many companies to replace traditional starters with advanced low voltage soft starters, further driving segment growth. Furthermore, low voltage infrastructure is more commonly available across both developed and developing economies, making this segment highly scalable across various geographic regions. With ongoing industrialization, urbanization, and the expansion of small and medium enterprises, the demand for low voltage soft starters is expected to grow steadily. While medium and high voltage soft starters are essential for heavy-duty applications, their market share remains limited due to higher costs and niche usage.

Therefore, the low voltage soft starter segment is set to continue its dominance in the Motor Soft Starter market owing to its versatility, cost-efficiency, and alignment with broad-based industrial requirements.

Download Free Sample Report

Regional Insights

Largest Region

In 2024, the Asia-Pacific region dominated the Motor Soft Starter market and is expected to maintain its leading position throughout the forecast period. This regional dominance is driven by rapid industrialization, infrastructure development, and urban expansion across major economies such as China, India, Japan, and Southeast Asian countries. The manufacturing, water treatment, mining, construction, and oil and gas sectors in this region are experiencing significant growth, resulting in a high demand for efficient motor control solutions like soft starters.

China, being the largest manufacturing hub globally, continues to invest heavily in modernizing its industrial infrastructure, while India’s “Make in India” initiative and rising investments in smart cities, renewable energy, and industrial automation are fueling further adoption of Motor Soft Starters. In addition, the Asia-Pacific region benefits from a large number of small and medium enterprises that seek affordable and reliable motor starting solutions, with low voltage soft starters seeing widespread deployment. Regional governments are also focusing on energy efficiency regulations and grid stability, encouraging industries to shift toward advanced motor control systems that help reduce inrush current and mechanical stress on motors.

Moreover, the availability of cost-effective labor, supportive regulatory frameworks, and the presence of several leading manufacturers and distributors of electrical and automation equipment enhance the regional market dynamics. Technological advancements and the integration of digital monitoring features in Motor Soft Starters are also gaining traction in the region, in line with the broader trend of Industry 4.0 adoption.

While North America and Europe have well-established markets with steady demand, the growth potential and volume of consumption in the Asia-Pacific region are unmatched. Therefore, due to its high industrial activity, expanding infrastructure, and strong push for energy-efficient technologies, the Asia-Pacific region is expected to continue leading the Motor Soft Starter market in the years ahead.

Emerging Region

In the forecast period, the Middle East and Africa regions are emerging as a significant growth area in the Motor Soft Starter market, driven by expanding industrial activities, large-scale infrastructure investments, and increasing focus on power and water utility development. Countries such as the United Arab Emirates, Saudi Arabia, South Africa, and Egypt are experiencing rapid urbanization and industrial diversification, particularly in sectors such as oil and gas, mining, construction, power generation, and water treatment.

These sectors require reliable and efficient motor control systems to support high-load machinery while ensuring operational safety and energy optimization. The ongoing investments under national development strategies such as Saudi Vision 2030 and various African infrastructure growth plans are leading to new installations of electric motors in industrial and municipal facilities, thus propelling the demand for Motor Soft Starters. Additionally, the region faces challenges related to power quality and grid reliability, making soft starters an attractive solution due to their capability to reduce inrush current and avoid voltage dips during motor start-up.

The growing need for water management and desalination plants in arid areas also presents substantial opportunities for the deployment of Motor Soft Starters in pump systems. As the region modernizes its electrical and automation infrastructure, there is an increasing adoption of technologically advanced, Internet of Things-enabled Motor Soft Starters that offer real-time diagnostics and monitoring capabilities.

The presence of international automation and electrical equipment providers who are establishing partnerships and manufacturing units in the region is further expected to boost market penetration. Although the current market size in the Middle East and Africa is smaller compared to more mature regions, its compound annual growth rate is expected to outpace others, making it one of the most promising emerging regions in the Motor Soft Starter market during the forecast period.

Recent Developments

- Schneider Electric launched the Altivar ATS130 soft starter (11–55 kW) in June 2024. The compact unit combines motor protection (thermal, phase loss/unbalance, short-circuit) and Michelin DIN-rail or backplate mounting flexibility, targeting OEMs and panel builders seeking space-efficient and maintenance-friendly solutions .

- The Altivar ATS480 soft starter, tailored for heavy-duty industrial applications (compressors, conveyors, pumps, fans), saw its Indian market debut in late 2024–early 2025. It supports both light- and heavy-duty operations and emphasizes digital motor management from design through maintenance.

- In March 2024, Mitsubishi Electric strengthened collaboration with cybersecurity specialist Nozomi Networks, underlining the rising importance of industrial control system security in soft starter applications.

- Siemens AG increased its stake in its Indian operations to 69% by acquiring shares from Siemens Energy in late 2023, enabling deeper involvement in India’s fast-growing automation and motor control market

Key Market Players

- Schneider Electric SE

- Siemens AG

- ABB Ltd.

- Eaton Corporation plc

- Rockwell Automation, Inc.

- Mitsubishi Electric Corporation

- WEG S.A.

- Larsen & Toubro Limited (L&T)

- Danfoss Group

- Emerson Electric Co.

By Control Type | By Voltage Type | By End-Use Industry | By Region |

- Current Control

- Voltage Control

- Torque Control

| - Low Voltage Soft Starters

- Medium Voltage Soft Starters

- High Voltage Soft Starters

| - Oil & Gas

- Water & Wastewater

- Power Generation

- Mining & Metals

- Chemical & Petrochemical

- Food & Beverage

- Cement

- Pulp & Paper

- Marine

- Others

| - North America

- Europe

- South America

- Middle East & Africa

- Asia Pacific

|

Report Scope:

In this report, the Global Motor Soft Starter Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

- Motor Soft Starter Market, By Control Type:

o Polyolefin

o Fluoropolymer

o PVC

o Elastomer

o Others

- Motor Soft Starter Market, By Voltage Type:

o Low Voltage

o Medium Voltage

o High Voltage

- Motor Soft Starter Market, By End-Use Industry:

o Electrical & Electronics

o Automotive

o Aerospace & Defense

o Telecommunication

o Energy & Utilities

o Railways

o Marine

o Healthcare

- Motor Soft Starter Market, By Region:

o North America

§ United States

§ Canada

§ Mexico

o Europe

§ Germany

§ France

§ United Kingdom

§ Italy

§ Spain

o South America

§ Brazil

§ Argentina

§ Colombia

o Asia-Pacific

§ China

§ India

§ Japan

§ South Korea

§ Australia

o Middle East & Africa

§ Saudi Arabia

§ UAE

§ South Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Motor Soft Starter Market.

Available Customizations:

Global Motor Soft Starter Market report with the given market data, TechSci Research offers customizations according to a company's specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five).

Global Motor Soft Starter Market is an upcoming report to be released soon. If you wish an early delivery of this report or want to confirm the date of release, please contact us at [email protected]