|

Forecast Period

|

2026-2030

|

|

Market Size (2024)

|

USD 6.1 billion

|

|

Market Size (2030)

|

USD 9.13 billion

|

|

CAGR (2024-2030)

|

6.8%

|

|

Fastest Growing Segment

|

Decorative Plywood

|

|

Largest Market

|

South India

|

Market Overview

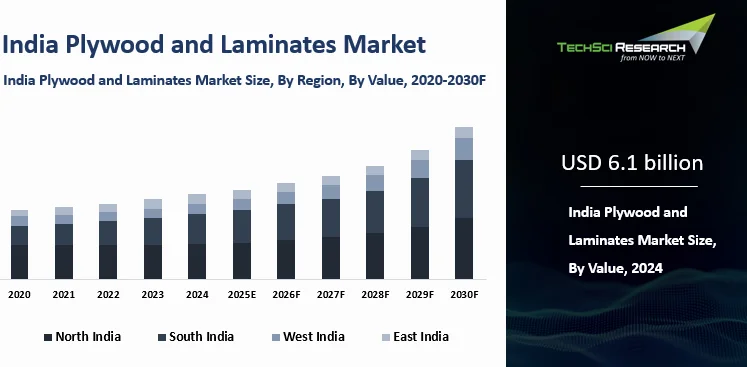

India Plywood and Laminates Market was valued at USD 6.1 billion in 2024 and is expected to reach USD 9.13 billion in 2030 in the forecast period with a CAGR of 6.8% through 2030.

The India Plywood and Laminates Market is

experiencing robust growth driven by several key factors. Rapid urbanization

and the burgeoning construction sector have significantly increased the demand

for plywood and laminates in the country. The growing trend towards modern and

aesthetically appealing interior designs has further propelled market

expansion. The rise in disposable income among the Indian

population has led to an increased willingness to invest in high-quality,

durable construction materials.

The versatility of plywood and laminates in

various applications, including furniture, flooring, and interior decoration,

contributes to their widespread adoption. Furthermore, the emphasis on

sustainable and eco-friendly building materials has prompted a shift towards

environmentally responsible choices in the market. As a result, the India

Plywood and Laminates Market continue to exhibit promising growth, offering

lucrative opportunities for manufacturers and stakeholders in the construction

and interior design sectors.

Download Free Sample Report

Key Market Drivers

Growing Demand for Premium Interiors in the Fashion Industry

The increasing emphasis on creating visually appealing and luxurious retail spaces in the fashion industry is a key driver for the India Plywood and Laminates Market in Fashion. Fashion brands are investing heavily in store aesthetics to create immersive shopping experiences, with retail leasing activity showing significant year-on-year growth across India's top seven cities. Plywood and laminates are widely used in the design of retail interiors, including display units, shelves, and furniture. These materials provide a combination of durability and style, with manufacturers offering thousands of designs to meet the industry's need for high-quality finishes.

As fashion brands expand into urban and semi-urban areas, with over 3 million square feet of retail space leased in the first quarter of 2025 alone, the demand for innovative and premium plywood and laminates continues to rise. The growing trend of concept stores, which focus on thematic interior designs, has further fueled the need for customized materials that can cater to specific design requirements. The increasing purchasing power of consumers amplifies this driver; average quarterly household spending in urban India rose to over ₹73,000 in March 2025. The ongoing evolution of retail spaces into experiential hubs is driving sustained demand for plywood and laminates in this market.

- The fashion segment within this luxury market is projected to grow at a 12-15% CAGR over the next five years.

Rapid Growth of Organized Retail and E-commerce Platforms

The rapid expansion of organized retail and e-commerce platforms in India has created a substantial boost for the India Plywood and Laminates Market in Fashion. Organized retail, which is projected to comprise 25–30% of India's total retail market by 2025, relies extensively on premium plywood and laminates to maintain brand consistency. Similarly, e-commerce platforms, some of which are establishing physical experience centers, demand durable and visually striking materials for their interiors to attract customers and build brand loyalty.

The increasing penetration of international fashion brands, with the number of new entrants nearly doubling to 27 in 2024, has also contributed to the growth of organized retail, driving the demand for high-quality plywood and laminates. These brands often adhere to stringent global standards for store design. Moreover, the growing influence of e-commerce has led to a rise in warehousing and storage facilities, with leasing reaching a record 27.1 million square feet in the first half of 2025. E-commerce firms accounted for a quarter of this space, where plywood and laminates are utilized for functional and decorative purposes. This shift has strengthened the role of these materials, especially as 30–40% of consumers in India are actively seeking environmentally responsible options.

- The demand for premium retail spaces, particularly in Tier 1 cities like Mumbai, Delhi, Bengaluru, and Hyderabad, has seen a surge. Retailers are increasingly focusing on high-end interior designs to create immersive and aspirational shopping experiences. As of 2024, the premium retail real estate sector in India is expected to account for over 25% of total retail space, with brands investing heavily in well-designed stores to match their high-end products.

Advancements in Manufacturing Technology and Product Innovation

Advancements in manufacturing technology and continuous product innovation are significant drivers of the India Plywood and Laminates Market in Fashion. The introduction of technologies like synchronized embossing allows the production of high-quality laminates that mimic natural wood with enhanced durability and moisture resistance. These innovations cater specifically to the fashion industry, where design precision and material performance are critical.

Technological advancements have also facilitated the development of eco-friendly plywood and laminates, with major manufacturers investing in zero-emission technology and sustainable forestry. This aligns with the increasing demand for sustainable materials, as consumers and builders prioritize FSC-certified and low-VOC products. Products with anti-bacterial surfaces and fire-retardant properties, offering protection for over 30 minutes, have gained popularity among fashion retailers who prioritize safety.

Furthermore, high-resolution digital printing technologies have expanded the possibilities for customization, allowing manufacturers to offer thousands of textures, patterns, and finishes that meet the specific design themes of fashion brands. The integration of such technologies enhances the value of plywood and laminates, positioning them as indispensable materials in the evolving landscape of the fashion industry. Nearly 30-40% of the plywood products sold in India are now certified as eco-friendly, reflecting the market's shift toward sustainability.

- Sustainability is becoming a significant focus in premium interiors for fashion, with 40-50% of high-end fashion brands opting for eco-friendly and sustainable design elements in their stores.

Key Market Challenges

Fluctuating Raw Material Costs and Supply Chain Disruptions

The India Plywood and Laminates Market in Fashion is significantly impacted by the volatility in raw material costs and the challenges posed by supply chain disruptions. Plywood and laminates production depends heavily on raw materials such as wood, resins, and adhesives, the costs of which are influenced by factors like deforestation regulations, import restrictions, and global market trends. Variations in these costs often lead to unpredictable pricing structures, making it difficult for manufacturers to maintain competitive pricing while ensuring profitability. Additionally, supply chain inefficiencies, including delays in raw material procurement and transportation, further exacerbate the problem. These disruptions, often caused by infrastructure bottlenecks and logistical challenges, create barriers to timely production and delivery of high-quality laminates and plywood, which are integral to the fashion industry’s requirements for aesthetics and functionality in retail spaces and design elements. Addressing these issues demands better resource management, investment in local sourcing, and technological advancements to streamline the supply chain.

Intense Competition and Price Sensitivity

The India Plywood and Laminates Market in Fashion faces intense competition from both organized players and unorganized local manufacturers. The presence of a large number of small-scale enterprises offering low-cost alternatives creates a highly competitive market environment. While organized players focus on delivering superior quality and innovative designs, the unorganized sector competes aggressively on price, often compromising on quality and regulatory compliance. For the fashion industry, which relies heavily on high-grade materials to create visually appealing interiors and displays, this price sensitivity poses a challenge. Balancing cost-effectiveness with quality requirements becomes a critical issue for manufacturers aiming to meet the fashion sector’s expectations. Moreover, the entry of international brands and products has intensified the competitive landscape, pushing local players to innovate while dealing with slim profit margins. Navigating this competitive environment requires strategic positioning, investment in branding, and a focus on value-added products that cater to the unique needs of the fashion industry.

Key Market Trends

Growing Demand for Sustainable and Eco-Friendly Products

A prominent

trend in the India Plywood and Laminates Market is the increasing demand for

sustainable and eco-friendly products. With environmental consciousness on the

rise, consumers are seeking construction materials that adhere to green

building standards. This has led to the adoption of plywood and laminates

produced from responsibly sourced wood and eco-friendly manufacturing

processes. Manufacturers are responding to this trend by obtaining

certifications for sustainable forestry practices and incorporating recycled

and environmentally friendly materials in laminates. The integration of

sustainability into product offerings not only aligns with consumer preferences

but also positions companies favorably in an industry where eco-conscious

choices are gaining prominence.

Digitalization and Online Sales Channels

The industry

is experiencing a shift towards digitalization, with online sales channels

playing an increasingly significant role in the distribution of plywood and

laminates. Digital platforms offer a convenient way for consumers and

businesses to explore product options, compare prices, and make informed

decisions. E-commerce platforms provide a diverse range of choices, enabling

customers to access a broader market without geographical constraints. This

trend has prompted manufacturers and distributors to enhance their online

presence, invest in user-friendly websites, and explore digital marketing

strategies. The convenience of online transactions and the ability to reach a

wider audience make digitalization a key trend reshaping the distribution

landscape of plywood and laminates in India. 68% of urban consumers in India now prefer buying plywood and laminates online, particularly for convenience, price comparison, and variety. The ease of browsing and selecting products without visiting physical stores is a major driving factor.

Customization and Personalization

A growing

trend in the Plywood and Laminates Market is the demand for customized and

personalized solutions. Consumers are seeking products that cater to their

unique design preferences and requirements. Plywood and laminates, with their

versatility, lend themselves well to customization, allowing for a wide range

of finishes, textures, and colors. Manufacturers are responding to this trend

by offering a variety of customization options, enabling customers to create

bespoke interiors. This trend not only caters to individual tastes but also

reflects the desire for distinctive and aesthetically pleasing spaces, driving

innovation and creativity within the industry. Around 20-30% of overall plywood and laminates sales in India are now transacted through online channels, especially in urban areas. This is a notable shift from the traditional brick-and-mortar sales model. The trend has been particularly driven by B2B online platforms, where businesses procure large quantities of plywood and laminates for construction projects.

Innovation in Design and Materials

The market is

witnessing a trend of continuous innovation in both design and materials.

Manufacturers are exploring new materials, finishes, and textures to meet the

evolving preferences of consumers and interior designers. Advanced printing

technologies allow for realistic wood grain patterns in laminates, providing

cost-effective alternatives to natural wood. Innovations in

plywood manufacturing processes are leading to enhanced durability and

strength. The push for innovative designs and materials reflects the industry's

commitment to staying ahead of trends and offering solutions that cater to the

dynamic needs of the market.

Rise in Prefabricated and Modular Construction

Another

notable trend in the Plywood and Laminates Market is the increasing adoption of

prefabricated and modular construction methods. These methods offer efficiency,

cost-effectiveness, and reduced construction time. Plywood and laminates play a

crucial role in these construction approaches, providing versatile and

lightweight materials that are well-suited for prefabrication. As the

construction industry embraces these modern methods, the demand for plywood and

laminates is expected to grow further. Manufacturers are aligning their product

offerings to cater to the specific requirements of prefabricated and modular

construction, contributing to the evolution of construction practices in India.

Segmental Insights

Product

Type Insights

The product type segment that has

exhibited dominance in the India Plywood and Laminates Market is the

"Decorative Plywood" category. Characterized by its aesthetic appeal,

versatility, and ability to enhance interior design, decorative plywood has

experienced substantial demand, making it the leading segment in the market.

The surge in urbanization and the evolving preferences of consumers towards

visually appealing interiors have propelled the popularity of decorative

plywood. This segment offers a wide range of finishes, colors, and textures,

allowing for creative and customized designs in furniture, wall paneling, and

other interior applications.

The decorative plywood market has seen a notable

uptick due to the growing emphasis on modern and aesthetically pleasing living

spaces, driving its dominance in 2024. Moreover, as the construction and

interior design industries continue to prioritize innovative and stylish

solutions, decorative plywood is expected to maintain its stronghold during the

forecast period. The versatility of this product type, catering to both

residential and commercial applications, positions it as a preferred choice for

architects, designers, and homeowners alike.

Manufacturers within

this segment are likely to focus on sustainable and eco-friendly practices,

aligning with the broader market trend, further solidifying the dominance of

decorative plywood in the India Plywood and Laminates Market. The combination

of functionality and visual appeal makes decorative plywood a key driver of

market growth, and its sustained popularity is anticipated to contribute

significantly to the overall expansion of the industry in the coming years.

Download Free Sample Report

Regional Insights

The "South" region has emerged as the dominant force in the India Plywood and Laminates Market. This regional supremacy is driven by robust economic development, rapid urbanization, and a surge in construction activities. States such as Karnataka, Tamil Nadu, and Kerala are among the fastest-urbanizing in the country, witnessing substantial growth in infrastructure and housing projects. For example, Bengaluru alone saw the launch of nearly 33,500 new residential units in 2024, with other major southern cities like Hyderabad and Chennai also experiencing a construction boom.

The South's dominance can be attributed to its proactive approach to adopting modern construction practices and interior design trends. The region's strong presence of manufacturing hubs, such as the well-developed wood processing industries in Kerala and major ports in Chennai and Kochi, has facilitated easy access to raw materials and streamlined distribution networks. The increasing preference for aesthetically pleasing interiors aligns well with the versatile applications of plywood and laminates, further propelling their demand in the South. As the region continues to witness ongoing and upcoming urbanization projects, the demand for these materials is anticipated to remain high.

Recent Developments

- In June 2025, India's domestic manufacturing capacity for acrylic laminates was on track for significant expansion, with five new production lines expected to become operational within six months

- In October 2024, CenturyPly announced a major investment plan of ₹2,000 crore to be utilized by 2025 for enhancing production capacity across its plywood, laminates, MDF, and particle board segments.

- In 2024 Century Plyboards announced a ₹140 crore investment to expand its plywood production capacity by 30% through a mix of greenfield and brownfield projects.

- In December 2024, SkyDecor Laminates Pvt. Ltd. recently unveiled its latest offerings, 'Design Master 1 MM+ Decorative Laminates' and 'Acrylish - Volume 2', during a dealership event in Indore. The new Design Master 1 MM+ collection features over 300 distinct laminate designs that enhance both the aesthetics and functionality of any space. Additionally, Acrylish - Volume 2, the latest version of high-gloss laminates, is crafted from 100% virgin PMMA, ensuring superior surface stability and resistance to scratches.

- In November 2024, Rushil Decor Limited shared an optimistic forecast for the upcoming financial year, emphasizing the strategic launch of its Jumbo Laminate Project and its expansion into the plywood market. These initiatives underscore the company’s dedication to diversifying its product range and tapping into new growth opportunities across different market segments.

- In August 2024, Greenlam Industries, a global leader in surfacing solutions, unveiled an exclusive display center for its flagship brands at SpeluX, a unit of M/s Sree Sai Plywood LLP, in Hyderabad. The showroom, situated on Pan Mandi Road near Aghapura, Gyan Bagh Colony, Goshamahal, and Namphally, showcases an impressive collection of Decowood Veneers, Mikasa Floors, NewMika Laminates, and MikasaPly.

Key Market Players

- Greenply Industries Ltd.

- Century Plyboards (India) Ltd.

- Kitply Industries Ltd.

- Merino Industries Ltd.

- Archidply Industries Ltd.

- National Plywood Industries Ltd.

- Sarda Plywood Industries Ltd.

- EURO PRATIK SALES PVT LTD

- Duroply Industries Limited

- AICA Kogyo Company Ltd

|

By Product Type

|

By Application

|

By Region

|

- Hardwood

Plywood

- Softwood

Plywood

- Decorative

Plywood

- Tropical

Plywood

- Others

|

- Construction

- Furniture

- Packaging

- Transportation

- Flooring

- Others

|

- North India

- South India

- West India

- East India

|

Report Scope:

In this report, the India Plywood and Laminates Market

has been segmented into the following categories, in addition to the industry

trends which have also been detailed below:

- Plywood and Laminates

Market, By Product Type:

o Hardwood Plywood

o Softwood Plywood

o Decorative Plywood

o Tropical Plywood

o Others

- Plywood and Laminates

Market, By Application:

o Construction

o Furniture

o Packaging

o Transportation

o Flooring

o Others

- Plywood and Laminates

Market, By Region:

o North India

o South India

o West India

o East India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies

present in the India Plywood and Laminates Market.

Available Customizations:

India Plywood and Laminates Market report

with the given market data, TechSci Research offers customizations according

to a company's specific needs. The following customization options are

available for the report:

Company Information

- Detailed analysis and

profiling of additional market players (up to five).

India Plywood and

Laminates Market is an upcoming report to be released soon. If you wish an

early delivery of this report or want to confirm the date of release, please

contact us at [email protected]