|

Forecast Period

|

2026-2030

|

|

Market Size (2024)

|

USD 75.16 Billion

|

|

CAGR (2025-2030)

|

3.55%

|

|

Fastest Growing Segment

|

E-Gift Vouchers

|

|

Largest Market

|

West

|

|

Market Size (2030)

|

USD 92.32 Billion

|

Market Overview

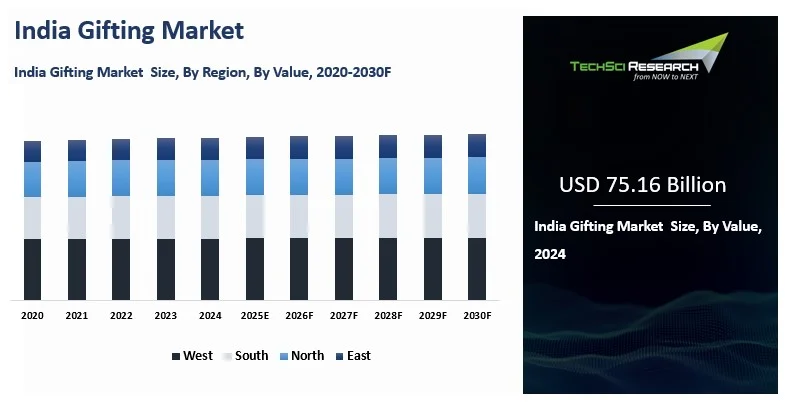

The India Gifting Market was valued at USD 75.16 billion in 2024 and is expected to reach USD 92.32 billion by 2030 with a CAGR of 3.55% during the forecast period.

The gifting market size in India reflects a diverse and evolving landscape, encompassing a wide range of products, including gift cards, flowers, chocolates, jewellery, and personalised gifts. The online gifting market in India is also growing rapidly, with many e-commerce platforms offering a variety of gifting options. The convenience of online shopping, coupled with the availability of a wide range of products, has led to the growth of this segment.

Overall, the gifting market size in India highlights its immense potential, driven by changing consumer preferences and increasing awareness of gifting etiquette. The market offers significant opportunities for both domestic and international players, especially in personalisation, innovation, and digitalisation. As cultural and festive gifting becomes more prominent and corporate gifting gains traction, the India gifting market is expected to continue its upward trajectory in the coming years.

Download Free Sample Report

Key Market Drivers

Rising Disposable Incomes and Premiumization

As India’s middle and upper-middle classes continue to expand, rising disposable incomes are significantly reshaping gifting behavior toward premium, luxury, and status-oriented products. A consumer economy study by PRICE, cited by India Brand Equity Foundation, projects that India’s middle class will grow from 432 million in 2020–21 to 715 million by 2030–31. This expanding consumer base is increasingly willing to trade up to imported gourmet assortments, premium beauty products, and branded electronics, particularly during festivals and wedding seasons.

This premiumization trend is evident in the shift from quantity-driven gifting to curated selections emphasizing craftsmanship, brand value, exclusivity, and superior packaging.

E-Commerce and Quick Commerce Expansion

The rapid growth of digital platforms and quick commerce has fundamentally transformed gifting logistics in India, enabling faster discovery, seamless payments, and near-instant delivery of non-grocery gift items.

For example, Swiggy has stated that Instamart has expanded to 76 cities, offering 10-minute deliveries and a catalog of nearly 50,000 products, making last-minute gifting more accessible across multiple categories. Similarly, Blinkit has expanded beyond traditional grocery offerings into electronics, beauty and makeup, pet care, toys, and games, with up to 25,000 unique SKUs available in select locations.

Such platform-led assortment expansion is pushing gifting beyond conventional sweets and flowers, diversifying both product choice and delivery expectations.

Surge in Corporate Gifting Initiatives

Corporate gifting in India has evolved from a seasonal activity into a year-round strategy focused on relationship building, employee engagement, and retention. Organizations are increasingly investing in onboarding kits, milestone recognition awards, festive hampers, and wellness-oriented packages for employees, clients, and partners.

According to the Employees' Provident Fund Organisation (EPFO), net payroll additions reached 17.89 lakh members in January 2025, reflecting the continued expansion of India’s formal workforce. This growth underpins the scaling of structured corporate-led gifting and rewards programs.

The emphasis is shifting toward higher-quality, customized items that align with corporate brand values, moving away from generic, easily discarded promotional merchandise.

High Demand for Hyper-Personalization

Consumers increasingly expect gifts tailored to the recipient, driving strong demand for customization features such as engraving, monograms, curated gift boxes, and personalized packaging.

India’s large digital ecosystem facilitates personalization at the discovery and checkout stages through algorithm-driven recommendations and seamless customization workflows. The Telecom Regulatory Authority of India (TRAI) reported 969.10 million internet subscribers as of 31 March 2025, supporting high-frequency browsing, targeted engagement, and scalable personalization across gifting platforms.

This trend spans both premium and mass-market segments, enabling brands to offer individualized gifting solutions without reliance on offline artisan coordination.

Growth of Experiential and Digital Gifting

Younger, digitally native consumers are accelerating the shift toward experiential gifts and digital formats such as e-gift cards, subscriptions, and online services that can be delivered instantly across geographies.

The Press Information Bureau (PIB) reported that UPI processed approximately 172 billion transactions in 2024, including 16.73 billion transactions in December 2024 alone. This scale of instant, low-friction digital payments is enabling seamless last-minute gifting and real-time transfers.

Payment convenience, combined with flexibility for recipients, is making digital gifting increasingly mainstream—allowing senders to complete transactions in seconds while giving recipients greater choice and control..

Key Market Challenges

Cultural Sensitivity and Diverse

Preferences

India’s vast cultural diversity poses a significant

challenge in the gifting market. With numerous states, religions, languages,

and traditions, gift preferences vary widely across the country. What

may be considered an ideal gift in one region or community could be

inappropriate or unwanted in another. For example, in some regions, traditional

gifts like sweets, clothing, or religious artifacts are preferred, while in

urban areas, gadgets, luxury goods, and experience-based gifts may be more popular.

For businesses, this creates a challenge in curating gift options that appeal

to a broad audience.

Gifting companies must understand the diverse cultural

nuances and tailor their offerings accordingly. Failing to do so could lead to customer dissatisfaction or even offend them if the gift choice is

culturally inappropriate. Moreover, retailers and e-commerce platforms need to

stock a variety of products to cater to diverse preferences, which increases inventory management complexity. To effectively address this, brands often

need localized strategies, promotional campaigns, and culturally relevant

product assortments, which adds to operational costs.

High Competition and Market

Fragmentation

The India gifting market is highly fragmented, with

both organized players and a large number of local, unorganized sellers. This

creates intense competition, particularly for gift retailers and e-commerce

platforms. While major players such as Amazon, Flipkart, and local specialty

stores are dominating the market, smaller and local businesses also offer

competitive pricing and unique regional products. As a result, it becomes

challenging for new entrants or smaller companies to differentiate themselves

and build a loyal customer base.

Additionally, consumers in India are

increasingly price-sensitive, particularly in the mass-market segment. With a

variety of options available, buyers often compare prices, promotions, and perceived value. As the market grows, the emphasis on competitive

pricing intensifies, forcing brands to reduce profit margins. To stay

competitive, businesses need to constantly innovate their product offerings,

improve customer service, and differentiate themselves from the growing number

of players in the market. Without strong branding and value proposition,

smaller companies or those without significant financial backing may struggle

to thrive.

Key Market Trends

Personalized and Customized Gifts

One of the most significant trends in the India gifting market is the growing demand for personalized, customized gifts, as consumers move away from generic, off-the-shelf options toward unique gifts with a personal touch. This trend has been fueled by the desire to create deeper emotional connections and make special occasions like Mother's Day and Friendship Day more memorable. Personalized gifts such as custom-engraved jewelry, photo albums, bespoke art, and monogrammed home decor are gaining popularity across consumer segments, including Tier 2 and Tier 3 cities.

The rise of 24/7 online gifting platforms and e-commerce has further accelerated this trend, as many platforms now offer easy customization tools using innovations like laser engraving and 3D printing that allow customers to upload images up to 10 MB and add names or personal messages to products. These personalized options allow consumers to select items that feel more thoughtful and meaningful, whether for a birthday, wedding, anniversary, or a corporate gift.

The growing culture of celebrating milestones with bespoke gifts has expanded the gifting market, especially for online platforms that cater to diverse tastes and occasions. Additionally, the rise of social media and influencer culture has contributed to the desire for more "Instagram-worthy" customized gifting, as consumers seek unique items that reflect their personality or social status.

Sustainable and Eco-Friendly Gifting

Sustainability is becoming an increasingly important

consideration for Indian consumers when purchasing gifts. As

awareness of environmental issues grows, more people are opting for

eco-friendly, sustainable gifts. This trend includes gifts made from organic,

biodegradable, or recycled materials, as well as products that promote

sustainability, such as reusable shopping bags, bamboo home goods, or natural

beauty products. Eco-conscious consumers are particularly drawn to brands that

offer products that have a minimal environmental footprint. Companies are

responding by designing gifts made from sustainable materials, such as wooden or metal items instead of plastic, and by adopting eco-friendly packaging, such as recyclable or reusable wrapping paper.

This shift is most

evident during major gifting seasons like Diwali and Christmas, where there is

a growing demand for gifts that align with values of sustainability. The rise

of ethical and socially responsible brands has further accelerated this shift,

as consumers increasingly seek products that not only serve a functional

purpose but also reflect their values. Additionally, corporate gifting is also

leaning toward sustainable gifts, as companies aim to align their practices

with environmental and social responsibility. Businesses are now selecting

gifts that reflect their commitment to sustainability, reinforcing their brand

image while appealing to eco-conscious consumers.

Segmental Insights

Purpose Insights

Personal gifting was the dominant segment of the India

gifting market, accounting for a substantial share of overall demand. This

segment includes gifts given for personal celebrations such as birthdays,

anniversaries, weddings, and other milestone events. As personal gifting is deeply

embedded in Indian culture, it plays a vital role in maintaining and

strengthening social bonds. The desire to celebrate relationships and

commemorate significant moments with thoughtful gifts has led to a continuous

rise in this segment. Personal gifting encompasses a wide range of products,

from traditional items like jewelry and apparel to modern gifts such as

gadgets, books, and personalized home decor.

The growing trend of personalized

gifts, in which consumers opt for customized products with a personal touch,

is further propelling this segment's growth. Moreover, the rise in disposable

income, especially among India’s urban population, has made consumers more

willing to spend on high-quality or luxury personal gifts. The ease of

purchasing gifts through e-commerce platforms has also increased the

accessibility of personal gifting, making it more convenient and diverse. With

festivals, celebrations, and occasions happening year-round, personal gifting

continues to dominate the Indian market, contributing significantly to its

expansion.

Download Free Sample Report

Regional Insights

In the India Gifting Market, the West region stands

out as the dominant region, accounting for a significant share of overall gifting

demand. This region includes key states such as Maharashtra, Gujarat,

Rajasthan, and Madhya Pradesh, which are not only economically developed but

also culturally rich, making them prime areas for gifting. Mumbai, in

particular, acts as a hub for luxury gifting, with a large urban population and

a high concentration of corporate offices. The region’s cosmopolitan nature,

coupled with a growing middle class, drives rising demand for both

personal and corporate gifts, from luxury goods to customized items. Cultural

festivals like Diwali, Ganesh Chaturthi, and weddings are major occasions that

boost gifting activity in the West.

Additionally, the growing trend of gifting in the corporate sector in cities like Ahmedabad and Pune, where business activity thrives, further bolsters the market. E-commerce has further

amplified gifting trends in this region by providing easy access to both local and global options, offering personalized and premium gifts. The West’s

blend of affluence, modernity, and tradition continues to make it the largest

and fastest-growing market in India’s gifting sector, setting the tone for emerging

trends in gifting preferences.

Recent Developments

- In February 2026, IGP rolled out its new product collections and a major campaign titled "In My Lover Era" to capture the evolving, contemporary demand during the Valentine's Day gifting season.

- In September 2025, IGP launched a first-of-its-kind 30-minute delivery service for over 600 hyper-personalized products across 30+ Indian cities, utilizing proprietary technology and custom-built machinery.

- In November 2025, IGP expanded its brand collaborations by partnering with Tim Hortons India for a specialized product and gifting activation to celebrate International Men's Day.

- In December 2025, The Aroma Aisle launched a new premium product, the Glyder Car Aroma Diffuser, aiming specifically at the high-end corporate gifting segment for the 2026 new year.

- In August 2025, India's gifting startups raised only $115.9 million between 2015 and 2025 year-to-date, according to Tracxn's Gifting Platforms Wrap Report released in August 2025. In 2025 alone, Indigifts was the only domestic startup to secure funding, raising just $57,600 from investors Ritesh Agarwal (OYO founder) and Vineeta Singh (Sugar Cosmetics). This marked a steep 98% decline from the $1.3 million raised in 2024, continuing a sharp downturn from the $63.9 million peak in 2022.

- In September 2024, Archies announced a deeper push into quick commerce for gifting/souvenirs, highlighting sales via Blinkit, Zepto and Swiggy Instamart and stating it was in talks to partner with BigBasket and Flipkart’s 10-minute delivery service.

- In August 2024, Aditya Birla Capital Digital launched new digital gifting products, including "DigiGold Gifting," which allows for the seamless gifting of digital gold.

- In July 2025, Messe Frankfurt and MEX Exhibitions formed a strategic alliance to build a pan‑India integrated business platform for the gifting and stationery ecosystem, aligning Paperworld India, Corporate Gifts Show, and allied fairs to scale brand–buyer dealmaking nationwide

Key Market Players

- Archies Limited

- Ferns N Petals

Pvt Ltd.

- Miniso Life

Style Private Limited

- Sparket

Marketing Pvt Ltd

- Bansal Importer

Pvt. Ltd. (Beccos)

- FA Gifts Private

Limited (FlowerAura)

- Hallmark India

Pvt. Ltd.

- Chumbak Design

Pvt. Ltd.

- Join Ventures

Private Limited (IGP)

- GiftstoIndia24x7.com

|

By Purpose

|

By Type

|

By Sales Channel

|

By Region

|

- Corporate Gifting

- Personal Gifting

|

- Souvenirs

- Personal Accessories

- Decorative Items

- Greeting Cards

- E-Gift Vouchers

- Others

|

- Local Shops

- Exclusive Outlets

- Multi Branded Shops

- Online

- Others

|

|

Report Scope:

In this report, the India Gifting Market has been

segmented into the following categories, in addition to the industry trends

which have also been detailed below:

- India Gifting Market, By

Purpose:

o Corporate Gifting

o Personal Gifting

- India Gifting Market, By

Type:

o Souvenirs

o Personal Accessories

o Decorative Items

o Greeting Cards

o E-Gift Vouchers

o Others

- India Gifting Market, By Sales

Channel:

o Local Shops

o Exclusive Outlets

o Multi Branded Shops

o Online

o Others

- India Gifting Market, By

Region:

o North

o West

o South

o East

Competitive Landscape

Company Profiles: Detailed analysis of the major companies presents

in the India Gifting Market.

Available Customizations:

India Gifting Market report with the given market

data, TechSci Research offers customizations according to a company's specific

needs. The following customization options are available for the report:

Company Information

- Detailed analysis and

profiling of additional market players (up to five).

India Gifting Market is

an upcoming report to be released soon. If you wish an early delivery of this

report or want to confirm the date of release, please contact us at [email protected]