|

Forecast Period

|

2026-2030

|

|

Market Size (2024)

|

USD 389.07 Million

|

|

Market Size (2030)

|

USD 551.97 Million

|

|

CAGR (2025-2030)

|

6.08%

|

|

Fastest Growing Segment

|

Helicopter

|

|

Largest Market

|

West India

|

Market Overview

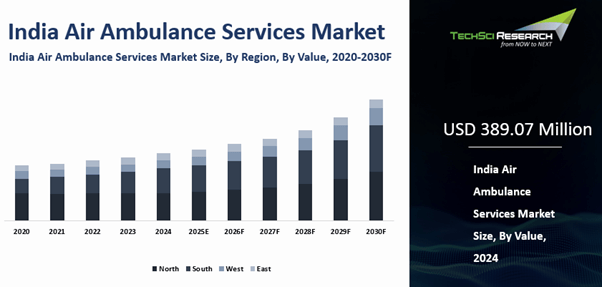

India Air Ambulance Services Market was valued at USD 389.07 Million in 2024 and is anticipated to reach USD 551.97 Million by 2030, with a CAGR of 6.08% during 2025-2030.

Several key factors are driving the India Air Ambulance Services Market. The growing demand for

emergency medical transportation services, particularly in remote or

inaccessible areas, is fueling the expansion of the air ambulance sector. Advancements

in aviation technology and medical equipment have enhanced the capabilities of

air ambulance providers, enabling them to deliver rapid, specialized medical

care during critical emergencies. Increasing awareness about the importance of

timely medical intervention and the availability of air ambulance services for

medical evacuation and repatriation are further driving market growth.

Collaborations

between air ambulance operators, hospitals, and insurance providers to

streamline operations and improve access to emergency medical services are also

contributing to the market's expansion. As the demand for high-quality

emergency medical transportation continues to rise, the India Air Ambulance Services

Market is expected to witness sustained growth in the coming years.

Download Free Sample Report

Key Market Drivers

Growing Demand for Emergency Medical Services

The increasing demand for emergency medical

services, particularly in regions with limited access to advanced healthcare

facilities, is a significant driver of the India Air Ambulance Services Market.

In India, where vast rural areas often lack adequate healthcare infrastructure,

air ambulances play a crucial role in providing timely medical assistance and

transportation for critically ill or injured patients.

The rising awareness

about the importance of prompt medical intervention, especially in cases of

trauma, cardiac emergencies, and obstetric complications, has led to a surge in

demand for air ambulance services across the country. The emergence of India as

a popular medical tourist destination due to the availability of world-class

services at an affordable price is expected to create lucrative opportunities

for the growth of the India Ambulance Service Market for both inbound and outbound

medical tourism, growing adoption of modern technologies, and the implementation

of swift technological developments in such services across the country.

According to the Minister of State for Civil Aviation, India has only 49 air ambulances operated by 19 operators. Out of these 49,

Delhi has 39 air ambulances, followed by Maharashtra with 5. Around 4,100

patients have availed air ambulance services in India in the last two to three years. Over the years, the number of people availing air ambulance services has significantly increased, and this is expected to create huge prospects for market growth in the coming years.

Advancements in Aviation Technology and Medical

Equipment

Technological advancements in aviation and medical equipment have revolutionized the capabilities of air ambulance services in India, propelling them to new heights of efficiency and effectiveness. Modern air ambulances are equipped with state-of-the-art medical equipment that rivals that found in hospital intensive care units, such as infusion pumps, oxygen cylinders, and cardiac monitors.

Advanced life support systems, including ventilators and defibrillators, enable medical personnel to deliver critical care interventions to patients in transit. The next generation of aircraft is also being introduced; for instance, Aeromed International Rescue Services has partnered with Sarla Aviation to deploy Vertical Take-Off and Landing (VTOL) aircraft for emergency medical transport.

The integration of GPS navigation systems, satellite communication, and real-time monitoring technology has transformed the way air ambulance operations are conducted. These cutting-edge technologies enable operators to accurately pinpoint emergency locations and plan optimal flight routes. In a significant move to create a nationwide network, the International Critical-Care Air Transfer Team (ICATT) has partnered with The ePlane Company to procure 788 air ambulances. For ground coordination, services like GoAid have introduced ambulance booking apps that use GPS for live tracking, allowing users to monitor the vehicle's location and get an accurate ETA.

Satellite communication systems enable constant communication among air ambulance crews, medical control centers, and receiving hospitals, facilitating rapid decision-making and real-time medical consultation. This ensures that patients receive the appropriate level of care during transit. Real-time monitoring technology, enhanced by the rollout of 5G, enables medical personnel to continuously assess vital signs and transmit this data to the receiving hospital before arrival, enabling early detection of changes in the patient's condition and prompt intervention.

Increasing Incidence of Road Accidents and Medical

Emergencies

The rising frequency of road accidents, natural disasters, and medical emergencies across India has underscored the critical need for air ambulance services in the country. With one of the highest rates of road traffic accidents globally, India witnessed 461,312 road accidents in 2022, which claimed 168,491 lives and caused injuries to 443,366 people. These incidents, averaging 462 deaths daily, often require immediate, specialized medical attention, underscoring the pivotal role of air ambulances in expediting medical evacuations.

Air ambulances serve as a lifeline in situations where ground transportation may be hindered by traffic congestion or inaccessible terrain. As of recently, India has only 49 air ambulances operated by 19 service providers, which have served approximately 4,100 patients in the last few years. By airlifting patients to specialized trauma centers and hospitals equipped with intensive care units, these services significantly reduce the time taken to receive essential medical interventions, thereby enhancing the prospects of survival and improving patient outcomes.

Air ambulances play a crucial role in responding to medical emergencies such as cardiac arrests, strokes, and obstetric complications, where time is of the essence. This is especially critical given that over 80% of India's population does not have direct access to higher medical centers. In these critical scenarios, rapid transportation to a medical facility capable of delivering specialized care is paramount to mitigating the risk of morbidity and mortality. Air ambulances offer a rapid, efficient mode of transportation, facilitating the timely transfer of patients requiring urgent medical attention to appropriate healthcare facilities.

Increasing Medical Tourism and International

Patient Transfers

India has emerged as a leading destination for

medical tourism, attracting patients from around the world seeking high-quality

healthcare services at affordable prices. The growing medical tourism industry

has driven increased demand for air ambulance services for international

patient transfers and medical repatriation. Air ambulances facilitate the safe

and timely transportation of critically ill or injured patients to and from

India, ensuring continuity of care and access to specialized medical treatment.

Air ambulance operators collaborate with hospitals, travel agencies, and

insurance companies to provide comprehensive medical evacuation services for

international patients, contributing to the growth of the India Air Ambulance

Services Market.

Key Market Challenges

Regulatory Compliance and Licensing

Regulatory compliance and licensing requirements

present significant challenges for air ambulance operators in India. The

Directorate General of Civil Aviation (DGCA) regulates civil aviation

operations in the country and mandates stringent safety standards and licensing

procedures for air ambulance services. Obtaining necessary approvals, permits,

and licenses from regulatory authorities can be a time-consuming and

bureaucratic process, delaying the launch or expansion of air ambulance

operations. Compliance with aviation regulations and adherence to safety

protocols impose additional operational costs and administrative burdens on air

ambulance operators, impacting their profitability and sustainability.

High Operational Costs and Financial Sustainability

The high operational costs associated with air

ambulance services pose a significant challenge for operators in the India Air

Ambulance Services Market. Acquiring and maintaining specialized aircraft,

medical equipment, and trained medical personnel entail substantial capital

investment. Fuel costs, maintenance expenses, insurance premiums, and

regulatory compliance fees contribute to the overall operational expenditure.

Despite high demand for air ambulance services, operators often struggle to achieve financial sustainability and profitability because of significant

overhead costs and limited reimbursement mechanisms. Inadequate insurance

coverage and reimbursement rates for air ambulance services further exacerbate operators' financial challenges, posing a barrier to market growth and expansion.

Key Market Trends

Strategic Partnerships and Collaborations

Strategic partnerships and collaborations among air ambulance operators, hospitals, healthcare providers, and insurance companies are driving growth in the India Air Ambulance Services Market. Air ambulance operators collaborate with hospitals and healthcare facilities to streamline patient transfers, with some offering "bed-to-bed" services. For instance, Aeromed International Rescue Services has partnered with Sarla Aviation to develop Vertical Take-Off and Landing (VTOL) aircraft and integrate this air mobility into hospital emergency protocols. Similarly, Lifesavers has established connections with leading Delhi hospitals like Sir Ganga Ram Hospital and Fortis Escorts Heart Institute to ensure seamless patient transfers.

Partnerships with insurance companies enable air ambulance operators to offer cashless settlement facilities, direct billing, and discounted rates for policyholders. Many health insurance plans in India now include coverage for air ambulance charges. For example, the New India Premier Mediclaim Policy provides up to INR 1,00,000 for air ambulance services for any one illness, while some Care Health Insurance plans offer benefits up to ₹5 lakhs. The government of Madhya Pradesh launched the PM Shri Air Ambulance Service, which is completely free for Ayushman Bharat cardholders. These collaborations enhance the accessibility and affordability of air ambulance services for insured patients.

Technological Innovations and Telemedicine

Integration

Technological innovations and the integration of telemedicine solutions are transforming the India Air Ambulance Services Market. Air ambulance operators are leveraging telemedicine platforms, remote monitoring devices, and teleconsultation services to provide real-time medical assistance and specialist consultation to patients during transit. Telemedicine enables medical personnel on board air ambulances to communicate with healthcare professionals on the ground, share vital patient data, and make informed medical decisions, thereby improving the quality of care and patient outcomes. For example, a study of the Indian Armed Forces found that teleconsultations helped manage 18 casualties per year at peripheral sites, avoiding air evacuation and resulting in an estimated cost savings of Rs. 146,111 per case.

Advancements in drone technology and unmanned aerial vehicles (UAVs) hold the potential to revolutionize medical logistics and emergency response. Drones are being piloted to deliver essential medical supplies like blood and organs to remote areas, addressing logistical challenges posed by difficult terrain or heavy traffic. The Haridwar District Jail in Uttarakhand, for instance, has introduced a drone ambulance service to enhance healthcare access for inmates. These innovations are further enhancing the efficiency and effectiveness of air ambulance services in India.

Segmental Insights

Type Insights

Based on the Type, helicopters currently dominate airplanes due to several factors unique to the

Indian context. Helicopters offer unparalleled versatility and manoeuvrability,

making them well-suited for navigating India's diverse terrain, including

densely populated urban areas, remote rural regions, and mountainous terrain

where access to traditional runways may be limited or non-existent. This

flexibility enables helicopters to reach patients in hard-to-reach locations

quickly and efficiently, providing timely medical evacuation and critical care

services in emergency situations.

Helicopters have a smaller

footprint and can land in confined spaces, such as hospital helipads, open

fields, or makeshift landing zones, allowing for direct access to patients

without the need for additional ground transportation. This capability is

particularly advantageous in densely populated urban areas, where congested

roadways and traffic congestion can impede the timely arrival of ground

ambulances. Helicopters offer rapid response times and can be airborne within

minutes of receiving an emergency call, reducing the time taken to reach

patients and initiate medical interventions. This swift response is crucial in

critical medical emergencies, such as trauma incidents, cardiac arrests, and

obstetric complications, where every minute counts in determining patient

outcomes.

Service Provider Insights

Based on Service Provider, hospital-based

operators currently dominate the landscape, followed closely by independent

operators and government/non-profit organizations. Hospital-based air ambulance

services are typically integrated within established healthcare institutions,

including tertiary care hospitals, trauma centers, and medical colleges. These

operators leverage existing hospital infrastructure, resources, and medical

expertise to provide seamless emergency medical transportation and critical

care services to patients in need. With direct access to hospital facilities,

such as emergency departments, operating theaters, and intensive care units,

hospital-based air ambulance services offer a comprehensive continuum of care,

ensuring patients receive timely and specialized medical treatment from the

moment of retrieval to arrival at the receiving facility.

Hospital-based operators

often collaborate with multidisciplinary healthcare teams, including emergency

physicians, critical care specialists, trauma surgeons, and paramedics, to

deliver advanced medical interventions and ensure optimal patient outcomes.

This integrated approach enables hospital-based air ambulance services to

provide a higher level of medical care, including advanced life support, trauma

management, and specialized interventions such as organ retrieval and neonatal

transport.

Download Free Sample Report

Regional Insights

In the India Air Ambulance Services Market, the

Western region emerges as the dominant force, exerting significant influence

and contributing substantially to market growth and development. Comprising

states such as Maharashtra, Gujarat, Rajasthan, and Goa, the Western region

boasts several factors that underpin its dominance in the air ambulance sector.

The Western region is home to several major

metropolitan cities, including Mumbai, Pune, Ahmedabad, and Surat, which serve

as key hubs of economic activity, commerce, and healthcare infrastructure.

These cities house world-class medical facilities, tertiary care hospitals, and

trauma centers equipped with advanced medical technology and specialized

healthcare services. As a result, the demand for air ambulance services in the

Western region is driven by the need to provide rapid medical evacuation and

specialized critical care to patients requiring urgent medical attention. The

Western region has a well-developed transportation infrastructure, including

airports, helipads, and road networks, facilitating seamless air and ground

transportation for air ambulance operations. This infrastructure enables air

ambulance operators to deploy their fleets quickly and efficiently, minimizing

response times and ensuring timely access to patients in need across urban and

rural areas.

Recent Developments

- In February 2025, a groundbreaking $1 billion deal was signed between the ePlane Company, an IIT-Madras-incubated startup, and the International Critical-Care Air Transport Team (ICATT). The agreement, one of the largest in the global eVTOL industry, is for the supply of 788 electric Vertical Take-Off and Landing (eVTOL) air ambulances. These "flying ambulances" are designed to be deployed across every district in India, revolutionizing emergency medical transport by bypassing traffic congestion with zero emissions.

- In September 2025, Broader plans were announced for the nationwide deployment of Vertical Take-Off and Landing (VTOL) air ambulances. This initiative, advancing India's next-generation medical evacuation ecosystem, aims to make the country one of the few globally with an on-road VTOL air ambulance service.

- In November 2024, the state of Uttarakhand received approval from the central government to launch the country's first state-run helicopter ambulance service. This initiative is crucial for addressing healthcare challenges in the state's difficult geographical terrain.

- In May 2024, In a first for the Indian aviation sector, Air India announced a partnership with MedAire, a leading provider of aviation medical support. This collaboration aims to deliver enhanced in-flight healthcare for passengers and crew across Air India's entire fleet.

- In October 2024, Prime Minister Narendra Modi virtually inaugurated India's first free Helicopter Emergency Medical Services (HEMS) pilot program, named 'Sanjeevani', from the All India Institute of Medical Sciences (AIIMS) in Rishikesh, Uttarakhand.

Key Market Players

- Blade India

- Accretion Aviation

- Air Charter Services Pvt. Ltd.

- Apollo Hospital Enterprise,

Ltd.

- Air Rescuers World Wide Pvt Ltd.

- Flaps Aviation Pvt. Ltd.

- Medanta (Global Health

Limited)

- Vedanta Air Ambulance

- AmbiPalm

- EMSOS Medical Pvt Ltd

|

By Type

|

By Service Provider

|

By Service

|

By Region

|

|

|

- Hospital-Based

- Independent Operators

- Government/Non-Profit Organization

- Others

|

|

|

Report Scope:

In this report, the India Air Ambulance Services

Market has been segmented into the following categories, in addition to the

industry trends which have also been detailed below:

- India Air Ambulance Services

Market, By

Type:

o Aeroplane

o Helicopter

- India Air Ambulance Services

Market, By

Service Provider:

o Hospital-Based

o Independent Operators

o Government/Non-Profit

Organization

o Others

- India Air Ambulance Services

Market, By

Service:

o Domestic

o International

- India Air Ambulance Services

Market, By

Region:

o North

o South

o West

o East

Competitive Landscape

Company Profiles: Detailed analysis of the major companies

present in the India Air Ambulance Services Market.

Available Customizations:

India Air Ambulance Services Market report with

the given market data, TechSci Research offers customizations according to a

company's specific needs. The following customization options are available for

the report:

Company Information

- Detailed analysis and

profiling of additional market players (up to five).

India Air Ambulance Services Market is an upcoming

report to be released soon. If you wish an early delivery of this report or

want to confirm the date of release, please contact us at [email protected]