Forecast Period | 2026-2030 |

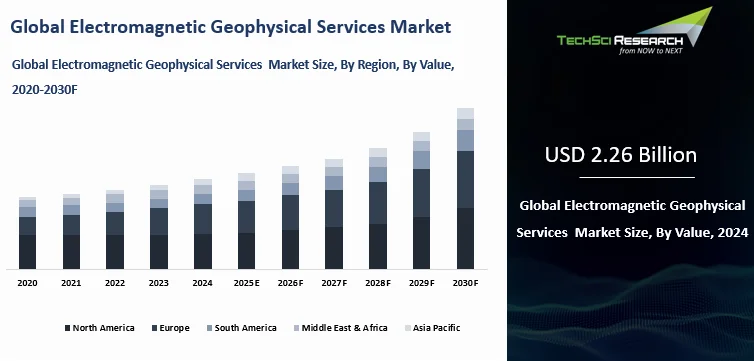

Market Size (2024) | USD 2.26 Billion |

Market Size (2030) | USD 3.46 Billion |

CAGR (2025-2030) | 7.19% |

Fastest Growing Segment | Time-Domain Electromagnetic |

Largest Market | North America |

Market Overview

Global Electromagnetic Geophysical Services Market was valued at USD 2.26 Billion in 2024 and is expected to reach USD 3.46 Billion by 2030 with a CAGR of 7.19% during the forecast period.

The global Electromagnetic (EM) Geophysical Services Market is witnessing steady growth, driven by the rising demand for accurate subsurface imaging technologies across various industries such as mining, oil and gas, groundwater exploration, environmental monitoring, and geothermal energy. Electromagnetic geophysical methods—such as Time-Domain Electromagnetics (TDEM), Frequency-Domain Electromagnetics (FDEM), Magnetotellurics (MT), and Controlled Source Electromagnetics (CSEM)—are gaining popularity due to their ability to map geological formations based on conductivity contrasts, which is particularly valuable for detecting resources like hydrocarbons, minerals, and groundwater reservoirs. These methods offer a non-invasive, cost-effective, and environmentally friendly alternative to traditional drilling and exploration practices.

One of the key market drivers is the increasing focus on mineral exploration, spurred by the global demand for critical raw materials such as lithium, copper, and rare earth elements. This is particularly evident in regions such as Africa, Australia, and Latin America, where government initiatives are promoting exploration investments. Similarly, the oil and gas sector—especially offshore exploration—is adopting marine EM techniques like CSEM and MT to improve pre-drill accuracy and reduce exploration risks. This is being complemented by growing interest in alternative energy sources such as geothermal, where EM surveys are used to locate high-conductivity geothermal fluids and heat reservoirs.

Technological advancements in airborne and ground-based EM systems are further enhancing the efficiency and depth penetration of surveys, making them more attractive for large-scale and deep geological mapping. Companies are investing in multi-parameter data integration and advanced software for better inversion modeling and interpretation. The market is also supported by government-backed geological surveys and academic research projects, especially in developed economies, contributing to technology adoption and data standardization.

Key Market Drivers

Growing Energy Demand and Offshore Hydrocarbon Exploration

The global push for energy security is intensifying exploration activities, especially offshore oil and gas reserves. Electromagnetic (EM) surveys, particularly Controlled Source Electromagnetics (CSEM) and Magnetotellurics (MT), are essential in identifying hydrocarbon-rich zones with improved accuracy. Global oil consumption has increased by over 1.2 million barrels per day in the past year, and more than 60% of new exploration activity is focused offshore. In recent years, offshore hydrocarbon discoveries have accounted for over 70% of newly identified reserves. EM surveys reduce drilling risks by nearly 30% and can lower exploration costs by up to 25%. The average size of offshore exploration contracts now exceeds USD 500 million, with integrated geophysical packages often including EM components. Furthermore, over 80% of major oil and gas companies have adopted EM surveys in pre-drill analysis for deep-sea prospects. These factors are driving a surge in demand for EM geophysical services in offshore energy sectors.

Accelerating Demand for Critical Minerals and Rare Earth Elements

The increasing global demand for clean energy and high-tech manufacturing is leading to a sharp rise in the exploration of critical minerals such as lithium, cobalt, copper, and rare earth elements. Global electric vehicle (EV) production rose by over 35% in the past year, pushing lithium demand up by 22%. Over 75 countries are now actively exploring critical mineral reserves, with government-backed exploration programs providing financial support exceeding USD 3 billion globally. Electromagnetic surveys have proven effective in detecting conductive ore bodies, especially sulfide and graphite-rich zones. In airborne mineral exploration, EM methods are used in over 65% of new surveys. Additionally, more than 400 helicopter-based EM surveys were conducted globally in the past two years. The average depth resolution of advanced airborne EM systems has improved by 40%, allowing exploration up to 500 meters below the surface. These trends are directly contributing to the increased reliance on EM services for mineral exploration.

Stricter Environmental Regulations and Need for Non-Invasive Mapping

Environmental monitoring is becoming a key driver for EM geophysical services as governments enforce stricter regulations for land use, groundwater protection, and contamination assessment. Over 90 countries have implemented updated environmental protection laws in the last five years. Non-invasive EM methods are now used in over 65% of groundwater studies due to their ability to detect changes in electrical conductivity related to water saturation and salinity. Nearly 50% of landfill sites in urban areas are now required to undergo periodic EM-based surveys. Environmental remediation projects using EM surveys have reported a 35% improvement in site characterization accuracy. The average cost reduction in contamination mapping using EM techniques is around 20% compared to invasive drilling. Furthermore, over 70% of geophysical contractors now include environmental and hydrogeological applications as core service areas. As awareness of ecological sustainability grows, EM services are becoming the preferred method for low-impact subsurface analysis.

Technological Advancements and Integration of AI in EM Surveys

The adoption of advanced technologies is revolutionizing EM geophysical services by improving data acquisition, processing, and modeling capabilities. Over the past five years, more than 60 new EM survey instruments and software platforms have entered the market, many featuring AI-driven inversion models. The integration of artificial intelligence has reduced data processing time by 40% and increased survey accuracy by approximately 30%. More than 75% of leading geophysical firms now use machine learning algorithms in EM data interpretation. Additionally, real-time data acquisition platforms have improved field efficiency by 25%, reducing downtime during survey operations. The use of 3D and 4D inversion modeling has grown by 50% in large-scale projects. High-resolution EM systems can now achieve subsurface penetration depths of over 1,000 meters. These technological enhancements are making EM surveys faster, deeper, and more precise, increasing their appeal across a broader range of industries.

Infrastructure Development and Urban Expansion Driving Subsurface Surveys

Global urbanization and infrastructure expansion projects are boosting demand for subsurface geophysical surveys, including EM services. Over 70% of infrastructure projects in developing economies now incorporate geophysical risk assessments during planning phases. EM methods are used in over 60% of new metro rail and highway projects to detect subsurface voids, water tables, and geological hazards. Asia-Pacific alone is expected to add more than 400 major infrastructure projects over the next five years, many of which require extensive geophysical pre-assessments. The average contract value for EM-based surveys in infrastructure projects has increased by 30% since 2020. Survey efficiency improvements have enabled coverage of up to 200 square kilometers in a single airborne EM campaign. More than 50% of urban development authorities now require non-invasive surveys before construction permitting. These trends demonstrate how infrastructure-driven needs are significantly contributing to the demand for EM geophysical services globally.

Download Free Sample Report

Key Market Challenges

High Initial Capital Investment and Equipment Costs

One of the foremost challenges in the electromagnetic geophysical services market is the significant upfront investment required in advanced survey equipment, data acquisition systems, and processing software. EM surveys rely on highly sensitive and often specialized instruments such as transmitter-receiver arrays, magnetometers, time-domain and frequency-domain systems, and aircraft-mounted platforms for airborne operations. These instruments can cost hundreds of thousands of dollars, and upgrading to the latest generation further inflates budgets. Additionally, maintenance and calibration of these tools demand skilled technicians and regular expenditure. Small and mid-sized geophysical service providers often face financial constraints in acquiring these systems, which limits their competitiveness. Airborne systems are especially cost-prohibitive due to the need for helicopters or fixed-wing aircraft, licensed pilots, and operational permits. Furthermore, many survey projects require bespoke equipment configurations, which drive up costs through customization and integration. These high costs result in long payback periods, discouraging new entrants and slowing innovation cycles. Without shared access to survey tools or equipment leasing models, smaller companies struggle to scale. The need for parallel investments in data interpretation software and secure storage infrastructure adds further to the total cost of ownership. Consequently, the barrier to entry remains high, and market concentration favors a limited number of well-capitalized firms with the ability to continuously invest in their technological capabilities.

Data Interpretation Complexity and Limited Standardization

While EM geophysical methods offer excellent subsurface imaging, interpreting the data remains a significant challenge due to its complexity, volume, and sensitivity to subsurface heterogeneities. Raw EM data often exhibit noise, distortions, and inconsistencies due to terrain, cultural interference (e.g., power lines, pipelines), and geological variability. Processing this data requires specialized knowledge in physics, geophysics, and numerical modeling—skills that are not widely available across all regions. The lack of universally accepted standards or protocols for EM survey design, acquisition, and interpretation further complicates matters. Different service providers may use varied software platforms and inversion algorithms, resulting in discrepancies in output even for the same survey area. In multi-client projects, inconsistency in deliverables hinders comparability and long-term data integration. Additionally, integrating EM data with other geophysical methods such as seismic, gravity, or resistivity demands sophisticated workflows and cross-disciplinary expertise, which is often in short supply. In developing markets, the absence of trained geophysicists or experienced consultants delays project execution and increases dependency on foreign expertise. Moreover, manual interpretation processes are time-consuming and prone to human error. Although AI and machine learning are emerging to streamline this task, their adoption is still limited, particularly among smaller firms. Without standardization and accessible training programs, data interpretation will continue to be a technical bottleneck, affecting the scalability and reliability of EM services.

Shortage of Skilled Workforce and Technical Training

The electromagnetic geophysical services industry faces a persistent shortage of trained professionals capable of managing the full life cycle of EM survey projects—from planning and data acquisition to modeling and final interpretation. This talent gap is especially acute in emerging economies and remote locations, where much of the untapped resource potential lies. Universities and technical institutes often do not include advanced EM geophysics in their core curriculum, leading to a lack of early exposure. Additionally, on-the-job training is limited and expensive, given the complexity of the technology and the proprietary nature of many survey systems. As experienced geophysicists retire, there is a growing generational gap with fewer young professionals entering the field. Survey operators, drone pilots, and instrument technicians also require specialized certifications, further narrowing the talent pool. Language barriers, high turnover rates, and the physical demands of fieldwork add to recruitment challenges. This shortage not only delays project timelines but also affects the quality and accuracy of data processing. For companies operating globally, the inability to quickly mobilize trained teams across borders creates logistical complications. Efforts to automate interpretation and simplify equipment operations have yielded some efficiency gains, but they cannot fully compensate for human expertise in designing surveys and understanding site-specific anomalies. Without targeted investments in education, cross-border training programs, and knowledge transfer initiatives, the skills gap will remain a structural challenge that hampers market expansion.

Regulatory and Environmental Constraints

While EM geophysical surveys are generally considered environmentally friendly, obtaining permits for survey operations—especially airborne or marine—can be complex and time-consuming due to stringent environmental and aviation regulations. In protected ecological zones or densely populated areas, regulatory bodies often impose restrictions on survey timing, frequency, and altitude, which can delay or disrupt project schedules. In offshore areas, marine surveys may be constrained by fishing seasons, marine mammal migration, or naval activity. Regulatory approval for flying low-altitude EM surveys with helicopters or fixed-wing aircraft is particularly difficult in jurisdictions with strict airspace rules. Additionally, different countries have inconsistent or ambiguous policies regarding geophysical surveys, requiring firms to navigate a web of bureaucratic procedures. This not only leads to delays but increases legal and administrative costs. Environmental impact assessments, stakeholder consultations, and public hearings are often mandated before launching surveys, adding to the complexity. In some regions, indigenous land rights and community resistance can further impede access to key exploration zones. As governments tighten environmental standards to mitigate climate risks and protect biodiversity, EM service providers will need to adapt to evolving compliance frameworks. Failure to do so may result in legal penalties, reputational risks, or project cancellations. Thus, navigating the regulatory landscape remains a major operational hurdle, especially for multinational firms conducting cross-border projects.

Market Fragmentation and Pricing Pressure

The global EM geophysical services market is fragmented, with a mix of multinational service providers, regional specialists, and small local firms competing for similar contracts. This fragmentation often leads to intense price competition, especially in regions where clients prioritize cost over service depth or technology sophistication. Many junior mining companies, groundwater authorities, and small oil and gas operators operate with limited exploration budgets, pushing service providers to offer lower-cost solutions even at the expense of margins. In public tenders, the lowest-bidder approach is still common, which discourages innovation and long-term service contracts. Additionally, there is often limited differentiation among providers in terms of service offering, which drives commoditization. Despite the growing complexity of EM surveys, clients may underestimate the value of high-resolution data or advanced interpretation tools, leading to underinvestment in quality services. This trend is more pronounced in developing markets where awareness of geophysical survey benefits is still growing. Pricing pressure also limits providers' ability to invest in R&D, training, and equipment upgrades, creating a vicious cycle. Larger players may be able to bundle services and cross-subsidize losses, but smaller firms face sustainability issues. As a result, some are exiting the market or merging with competitors to maintain scale. Without industry-wide standards, service-level benchmarking, or client education on quality metrics, the pricing war will continue to pose a long-term challenge for EM geophysical service providers.

Key Market Trends

Growing Adoption of Airborne EM Surveys

Airborne EM (AEM) surveys are witnessing a surge in adoption, driven by their ability to cover large and remote areas quickly and cost-effectively. Unlike ground-based surveys, AEM techniques allow high-resolution mapping over challenging terrains such as mountains, deserts, wetlands, and dense forests. Recent advances in helicopter-borne and fixed-wing EM systems have significantly improved depth penetration (up to 500 meters or more), data accuracy, and spatial resolution. AEM surveys are particularly popular in mineral exploration, especially for base metals and conductive sulfide bodies, as well as for groundwater mapping in arid regions. Many national geological agencies and international mining companies are increasingly relying on AEM for regional-scale resource assessments. The trend is further fueled by the growing demand for critical minerals like lithium and cobalt, often located in inaccessible terrains. Lightweight, low-noise sensors and modular airborne platforms have reduced operational costs by 20–25% over the past five years. Additionally, drone-mounted EM systems are emerging as a cost-effective alternative for medium-scale surveys, offering maneuverability and real-time data transmission. This trend is transforming exploration strategies by reducing survey timelines, enhancing safety, and improving efficiency in resource identification across various sectors.

Expansion of EM Services in Groundwater and Environmental Applications

While EM surveys have traditionally been used in mining and oil & gas sectors, their application is rapidly expanding into groundwater mapping, environmental monitoring, and infrastructure development. EM techniques are highly sensitive to conductivity variations in the subsurface, making them ideal for delineating aquifers, identifying saltwater intrusion zones, and detecting pollution plumes from landfills or industrial discharge. Governments and municipalities are increasingly using EM surveys to improve water resource management, especially in drought-prone and densely populated areas. Environmental agencies favor EM due to its non-invasive and environmentally friendly nature, especially when compared to traditional drilling-based methods. Recent reports indicate that nearly 40% of EM contracts globally are now for water-related or environmental studies. In urban areas, EM surveys are also being employed to detect buried infrastructure and assess geotechnical conditions prior to construction. In coastal regions, the technology is being used to track saline intrusion caused by over-extraction of groundwater. Moreover, EM surveys help industries monitor contamination and assess the effectiveness of remediation efforts. With increasing regulatory pressure and a global emphasis on sustainable resource use, EM’s role in environmental diagnostics is expected to grow substantially, making it a key pillar in future geophysical survey portfolios.

Increasing Use of Multi-Method Geophysical Integration

Another growing trend in the EM geophysical services market is the integration of EM data with other geophysical methods such as seismic, resistivity, gravity, and magnetics. No single method provides a complete picture of the subsurface, so combining data from multiple geophysical techniques allows for higher-resolution and more reliable interpretations. For instance, while seismic methods provide excellent structural information, EM methods reveal variations in electrical conductivity that often correlate with fluid content, mineralization, or salinity. This complementary information is especially valuable in hydrocarbon and mineral exploration, where identifying both structural traps and conductive ore bodies is essential. Integrated interpretation is also beneficial in geothermal exploration and groundwater studies, where accurate mapping of heat sources and aquifer boundaries is critical. The growing availability of software platforms capable of handling multi-physics data is facilitating this trend. These platforms enable the co-visualization and co-interpretation of data, improving confidence in the results. Additionally, advancements in joint inversion techniques are allowing service providers to build unified 3D subsurface models from diverse datasets. This approach reduces exploration risks, improves drilling success rates, and enhances the return on investment. As clients increasingly demand comprehensive and reliable insights, the trend toward integrated geophysical solutions is expected to gain further momentum across industries.

Rising Demand from Renewable Energy and Geothermal Sectors

As the global transition toward renewable energy accelerates, EM geophysical surveys are finding increasing application in the exploration and development of geothermal energy resources. EM methods, particularly magnetotellurics (MT) and time-domain electromagnetics (TDEM), are highly effective in identifying conductive zones associated with hot fluids and geothermal reservoirs. With more than 80 countries now investing in geothermal development, the need for accurate and non-invasive subsurface imaging is higher than ever. EM surveys allow developers to map geothermal systems with minimal environmental impact and greater cost efficiency compared to extensive drilling. Additionally, the growing offshore wind and subsea cable sectors are also creating demand for EM surveys, particularly in seabed characterization and route planning. In regions like East Africa, Southeast Asia, and parts of Latin America, governments are partnering with multilateral agencies to fund geothermal resource assessments that often rely on EM services. The integration of EM data with temperature and seismic data is further enhancing exploration success. The increasing number of carbon capture and storage (CCS) and hydrogen storage projects is also expected to leverage EM technologies to monitor subsurface containment. As the renewable sector continues to expand, EM geophysics will play a pivotal role in de-risking projects and ensuring long-term sustainability of energy infrastructure.

Segmental Insights

Technique Insights

Frequency-Domain Electromagnetic segment dominated in the Global Electromagnetic Geophysical Services market in 2024 due to its broad applicability, cost-efficiency, and technological maturity. FDEM techniques are especially preferred in near-surface investigations, offering high sensitivity to conductivity contrasts at shallow to moderate depths, typically up to 100 meters. This makes it ideal for groundwater mapping, environmental assessments, archaeological studies, and geotechnical site evaluations — applications that have seen rising demand globally due to urbanization, environmental regulations, and infrastructure development.

One key reason for the segment’s dominance is its low operational cost compared to time-domain systems. FDEM equipment is typically lighter, easier to deploy, and requires less energy, which makes it suitable for rapid surveys over large areas with minimal logistical burden. The method's ability to operate in continuous mode allows high-speed data acquisition, reducing field time and project turnaround. These features are especially valuable in developing countries and smaller-scale projects where budgets and timelines are constrained.

In 2024, global infrastructure projects — including smart city developments, transportation corridors, and underground utilities — are driving demand for quick and reliable subsurface mapping, which FDEM effectively supports. Additionally, portable and drone-mounted FDEM systems have gained traction, enabling greater accessibility in rugged or remote terrains. The method’s non-invasive and environmentally friendly nature aligns with global sustainability goals and regulatory standards, encouraging broader adoption.

Furthermore, advancements in data inversion algorithms and multi-frequency instruments have enhanced the resolution and depth penetration of FDEM surveys, increasing their relevance in more complex geological settings. The increasing integration of FDEM with GIS and AI-based interpretation tools also boosts its usability across sectors. Collectively, these advantages make Frequency-Domain Electromagnetic methods the go-to solution for a wide range of geophysical applications, securing its leadership in the market for 2024.

Application Insights

Mineral Exploration segment dominated the Global Electromagnetic Geophysical Services market in 2024 due to rising global demand for critical minerals like lithium, copper, and rare earth elements essential for electric vehicles, batteries, and renewable technologies. Electromagnetic (EM) methods, particularly airborne and ground-based surveys, are highly effective in detecting conductive ore bodies such as sulfides and graphite. Their non-invasive nature, depth penetration, and efficiency in remote terrains make them ideal for large-scale mineral exploration. With governments and private firms investing heavily in securing mineral supply chains, EM surveys have become a core component of modern mineral exploration strategies.

Download Free Sample Report

Regional Insights

Largest Region

North America dominated the Global Electromagnetic Geophysical Services market in 2024 due to its mature exploration ecosystem, strong industrial base, and significant investments in natural resource development. The region, particularly the United States and Canada, hosts a large number of mineral exploration, oil and gas, and environmental projects that rely heavily on EM geophysical techniques for accurate and efficient subsurface mapping. With heightened demand for critical minerals such as lithium, cobalt, and nickel — essential for clean energy and electric vehicle production — North American exploration companies have ramped up activities, using EM surveys as a primary tool for identifying conductive ore bodies.

Canada, a global leader in mining exploration, conducts hundreds of EM-based airborne and ground surveys annually, driven by supportive government policies, geological potential, and a strong network of service providers. In the U.S., the surge in oil and gas exploration, particularly shale and offshore projects, continues to drive the use of advanced EM techniques like Controlled Source Electromagnetics (CSEM) and Magnetotellurics (MT) for reservoir characterization and risk reduction. Additionally, environmental monitoring and groundwater mapping are gaining importance due to stricter environmental regulations, further boosting EM survey demand.

The region also benefits from technological leadership, with many EM equipment manufacturers and software developers headquartered in North America. This ensures faster access to cutting-edge innovations like AI-integrated inversion modeling, real-time data visualization, and drone-based EM systems. Academic institutions and government agencies like the USGS (United States Geological Survey) play a key role in funding geophysical research and public data acquisition, creating a robust ecosystem for EM service providers.

Emerging Region

Europe was the emerging region in the Global Electromagnetic Geophysical Services market in the coming period due to its strategic push toward energy transition, critical mineral independence, and environmental monitoring. The European Union’s Green Deal and Critical Raw Materials Act are driving increased exploration for lithium, rare earths, and cobalt, particularly in countries like Finland, Sweden, and Portugal. Additionally, the region’s focus on geothermal energy, sustainable groundwater management, and low-impact infrastructure development supports the adoption of non-invasive EM surveys. With growing public and private investments, advanced research capabilities, and a focus on climate-resilient technologies, Europe is poised for rapid growth in EM geophysical services.

Recent Developments

- In January 2024, Bengaluru-based Squadrone Infra and Mining Pvt Ltd has entered into a strategic alliance with Guyana’s Industrias Geodia to target a USD3–4 billion opportunity across India, the Middle East, and South Asia. Known for its Silkyara tunnel mission, Squadrone will leverage this partnership to advance airborne geophysical intelligence in mineral exploration and infrastructure. The collaboration focuses on integrating advanced technologies to transform sustainable development practices and redefine geophysical prospecting across key emerging markets.

- In February 2025, The Society of Exploration Geophysicists (SEG) has partnered with GeoScienceWorld (GSW) to manage its publishing operations, enhancing operational efficiency and extending global reach. SEG retains full ownership and editorial control while leveraging GSW’s infrastructure and expertise. This collaboration enables SEG to streamline processes and allocate greater focus to strategic initiatives that serve its global geophysics community, aligning with evolving industry dynamics and ensuring the sustainability and quality of its publishing ecosystem.

- In April 2024, Khanij Bidesh India Limited (KABIL) signed an MoU with CSIR-National Geophysical Research Institute (NGRI) to advance geophysical investigations focused on critical and strategic minerals. Backed by public sector entities NALCO, HCL, and MECL under the Ministry of Mines, this partnership aims to strengthen mineral exploration projects through collaborative scientific research and advanced survey capabilities, reinforcing India’s resource security and supporting strategic initiatives in the mineral and metals sector.

- In April 2025, India’s Ministry of Coal has unveiled key policy reforms to boost underground coal mining. Measures include reducing the floor revenue share from 4% to 2% and waiving upfront payment requirements. Combined with an existing 50% rebate on performance security, these incentives enhance financial viability, attract private participation, and expedite project execution. The initiative underscores the government’s commitment to modernizing the coal sector while aligning with long-term goals for energy security and sustainable development.

Key Market Players

- CGG

- Schlumberger

- EMGS ASA

- Fugro

- Geotech Ltd.

- SkyTEM Surveys

- ABEM Instrument

- Geophex Ltd.

- Zonge International

- Phoenix Geophysics

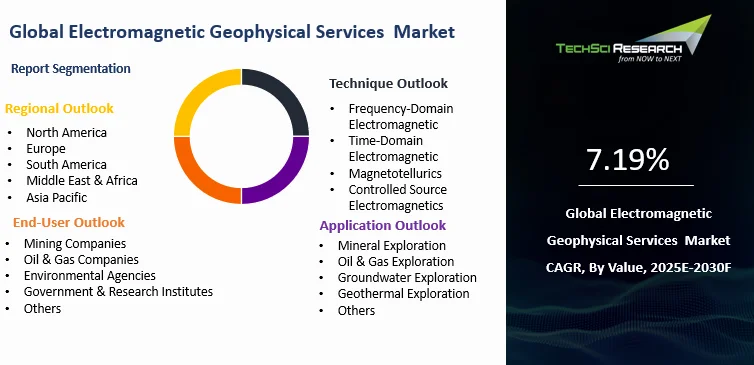

By Technique | By Application | By End-User | By Region |

- Frequency-Domain Electromagnetic

- Time-Domain Electromagnetic

- Magnetotellurics

- Controlled Source Electromagnetics

| - Mineral Exploration

- Oil & Gas Exploration

- Groundwater Exploration

- Geothermal Exploration

- Others

| - Mining Companies

- Oil & Gas Companies

- Environmental Agencies

- Government & Research Institutes

- Others

| - North America

- Europe

- South America

- Middle East & Africa

- Asia Pacific

|

Report Scope:

In this report, the Global Electromagnetic Geophysical Services Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

- Electromagnetic Geophysical Services Market, By Technique:

o Frequency-Domain Electromagnetic

o Time-Domain Electromagnetic

o Magnetotellurics

o Controlled Source Electromagnetics

- Electromagnetic Geophysical Services Market, By Application:

o Mineral Exploration

o Oil & Gas Exploration

o Groundwater Exploration

o Geothermal Exploration

o Others

- Electromagnetic Geophysical Services Market, By End-User:

o Mining Companies

o Oil & Gas Companies

o Environmental Agencies

o Government & Research Institutes

o Others

- Electromagnetic Geophysical Services Market, By Region:

o North America

§ United States

§ Canada

§ Mexico

o Europe

§ Germany

§ France

§ United Kingdom

§ Italy

§ Spain

o South America

§ Brazil

§ Argentina

§ Colombia

o Asia-Pacific

§ China

§ India

§ Japan

§ South Korea

§ Australia

o Middle East & Africa

§ Saudi Arabia

§ UAE

§ South Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Electromagnetic Geophysical Services Market.

Available Customizations:

Global Electromagnetic Geophysical Services Market report with the given market data, TechSci Research offers customizations according to a company's specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five).

Global Electromagnetic Geophysical Services Market is an upcoming report to be released soon. If you wish an early delivery of this report or want to confirm the date of release, please contact us at [email protected]