|

Forecast Period

|

2026-2030

|

|

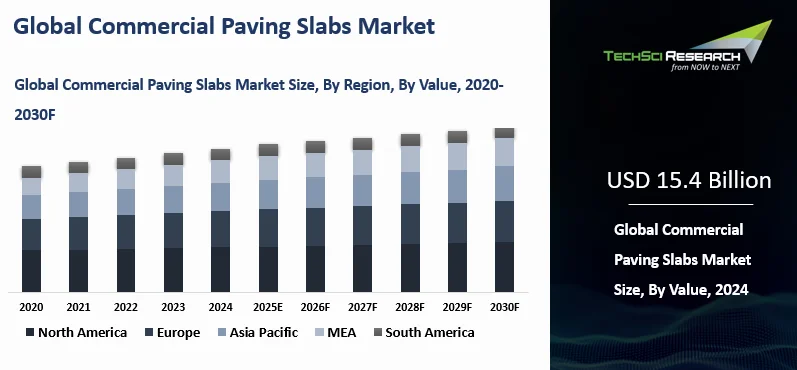

Market Size (2024)

|

USD 15.4 Billion

|

|

Market Size (2030)

|

USD 19.6 Billion

|

|

CAGR (2025-2030)

|

3.9%

|

|

Fastest Growing Segment

|

Concrete

|

|

Largest Market

|

North America

|

Market Overview

The

Global Commercial Paving Slabs Market was valued at USD 15.4 billion

in 2024 and is expected to reach USD 19.6 billion by 2030 with a CAGR of 3.9%

through 2030.

The global commercial paving slabs market is being

driven by rapid urbanization and the expansion of infrastructure projects

across emerging and developed economies. As cities grow, the demand for

aesthetically appealing, durable, and low-maintenance outdoor surfaces in

public spaces, commercial complexes, and transportation hubs increases

significantly. Governments are investing heavily in smart cities and green

infrastructure, which fuels the need for high-quality paving materials.

Sustainability is a major driver, with growing emphasis on environmentally

friendly slabs such as permeable or recycled options that support stormwater

management and reduce environmental impact.

Additionally, commercial and hospitality sectors

are increasingly using paving slabs to enhance the visual appeal and

functionality of outdoor spaces, boosting demand for customizable designs,

textures, and finishes. Technological advancements in manufacturing have

improved product durability and installation efficiency, further encouraging

adoption. Digital tools like Building Information Modeling (BIM) and automation

in production also support better planning and execution. Moreover, rising

awareness of climate-resilient materials is pushing the use of paving slabs in

climate-sensitive regions. Overall, a combination of economic development,

sustainability goals, aesthetic demands, and technological progress continues

to propel the commercial paving slabs market forward across global regions.

Download Free Sample Report

Key Market Drivers

Rapid Urbanization and Infrastructure Development

One of the key drivers of the global commercial paving slabs market is the fast pace of urban growth paired with steady infrastructure expansion. As cities extend and rural zones shift into urban centers, demand has increased in commercial spaces such as airports, malls, hotels, hospitals, business parks, and campuses. Urban projects focus on functional, clean outdoor layouts, and paving slabs support walkways, parking zones, plazas, and landscaped areas.

Governments in China, India, Brazil, and several African countries are raising spending on public assets, smart cities, and transport links. Programs such as India’s Smart Cities Mission and China’s Belt and Road plan include large paving and landscaping work. Developed regions are also upgrading old assets, which keeps demand stable.

Paving slabs offer strong load capacity, weather resistance, simple installation, and flexible design. Their long life and low upkeep suit high-traffic sites. As cities add more sustainable features, slabs made from recycled inputs or with permeable structures are gaining traction because they support better water flow and cleaner construction goals. These factors place paving slabs as a steady, long-term choice for public and commercial buildouts.

Global construction is set to grow at a 6-8 percent CAGR through the next five years. Annual infrastructure spending is projected to cross USD 4 trillion by the mid-2020s. Urban projects make up about 55 percent of the total construction value. Housing builds are rising at 7–9 percent each year, and commercial projects are expanding at 5-7 percent. Asia, Africa, and Latin America contribute nearly 60 percent of the growth in infrastructure development. Smart city and green asset spending is increasing at 12-15 percent per year. PPP projects are growing at about 10 percent annually, and total materials demand is expected to rise 4–6 percent each year over the next decade..

Sustainability Trends and Green Building

Initiatives

The rising focus on sustainability has become a strong growth driver in the commercial paving slabs market. Governments, developers, and builders are moving toward greener construction, which supports demand for slab materials that meet standards such as LEED and BREEAM. Permeable slabs are seeing wider adoption because they help manage stormwater, reduce runoff, and improve groundwater recharge in dense urban zones. Recycled and low-carbon inputs also help cut the environmental impact of new projects.

Developers are using slabs made from reclaimed concrete, natural stone, and by-products like fly ash to align with circular economy goals. Producers are investing in cleaner methods, including energy-efficient kilns and better waste control, to serve clients who prefer sustainable options. Rules in Europe, North America, and parts of Asia-Pacific are adding pressure to choose greener materials, and certifications are giving builders a clear edge in commercial real estate.

Sustainable slabs support technical needs and add to the environmental score of a project, which matters for investors seeking resilient assets. As climate concerns shape planning and procurement choices, demand for green paving slabs is set to rise.

The global green building sector is expanding at about 10-12 percent each year. Green construction makes up 30-35 percent of new projects. Spending on sustainable materials is expected to pass USD 300 billion within five years. Energy-efficient buildings reduce total construction energy use by 20-25 percent worldwide. Certification adoption is rising by about 15 percent per year. Renewable energy use in buildings is growing at 18-20 percent annually. Green retrofits are increasing at roughly 12 percent per year, and water-efficient systems are present in more than 40 percent of new builds..

Key Market Challenges

High Raw Material and Installation Costs

Rising costs remain a major constraint for the global commercial paving slabs market. Prices of cement, aggregates, natural stone, porcelain, and composite materials have increased because of energy costs, inflation, and supply chain issues. Energy-heavy processes, especially for ceramic or stone slabs, raise production expenses and tighten margins for producers.

Installation costs add further pressure. Commercial sites need trained labor, machinery, strict safety compliance, and precise placement to handle high foot and vehicle load, which raises total project spending. These costs discourage buyers in price-sensitive regions, where asphalt or compacted gravel often replace slabs due to lower upfront spend despite higher upkeep over time.

Manufacturing and transport also require high capital because slabs are heavy and costly to move and handle. This reduces profitability for both producers and contractors and slows adoption in public projects and smaller commercial builds. Without advances in low-cost production or support programs for sustainable materials, high expenses will continue to limit wider use of commercial paving slabs.

Environmental and Regulatory Constraints

Environmental and regulatory pressures have become a major challenge for the global commercial paving slabs market. Slab producers face strict rules on carbon output, water use, and waste control. Cement and concrete contribute heavily to global CO₂ emissions, so manufacturers must adopt cleaner processes, emissions systems, and alternative inputs, which raise production costs.

Quarrying for granite, sandstone, and limestone faces growing criticism because it affects landscapes, habitats, and water bodies. Several countries have tightened mining rules, limited licenses, or raised export duties. These steps restrict supply and disrupt trade flows, especially for natural stone from India, China, and Brazil.

Urban heat concerns add further pressure. Standard paving slabs store heat and raise surface temperatures, so many cities now require reflective or cool paving materials. This forces producers to update product lines to meet new planning norms. Longer approval cycles tied to environmental reviews also slow project starts and create uncertainty for contractors. For global suppliers, handling varied compliance rules across regions adds another layer of complexity.

These combined pressures increase costs and require steady innovation, which is difficult for small and mid-sized producers trying to stay competitive..

Key Market Trends

Rising Demand for Sustainable and Permeable Paving

Solutions

One of the strongest trends shaping the global commercial paving slabs market is the shift toward sustainable and permeable paving. As cities face issues such as flooding, water stress, and rising surface temperatures, planners and developers are choosing solutions that support cleaner and safer urban spaces. Permeable slabs help water move through the surface, cut runoff, and support groundwater recharge while easing pressure on drainage systems.

These slabs are gaining use in areas with strict environmental rules or high rainfall. Many are produced with recycled or low-carbon inputs, including reclaimed concrete, crushed glass, fly ash, or rubber composites, which align with LEED and BREEAM goals. Demand is supported by buyers and investors who prefer responsible development, and by government programs that promote green materials.

Producers are raising R&D spending to expand eco-friendly lines. Some now offer slabs with photocatalytic surfaces that help break down harmful gases under sunlight. The wider shift toward sustainability has become a strategic priority, pushing companies to move from traditional products to climate-resilient, recyclable, and durable options. Over time, these solutions will shape how commercial outdoor spaces are planned and maintained..

Integration of Advanced Manufacturing and Design

Technologies

A major trend shaping the global commercial paving slabs market is the use of advanced manufacturing and design technologies. As commercial spaces place more value on both function and appearance, producers are turning to digital tools, automation, and precision methods to raise product quality and meet specific design needs.

Technologies such as 3D printing, robotics, and CNC machining help create detailed textures, patterns, and shapes. These tools allow slabs to mimic natural stone or wood at lower cost with steady output. Digital modeling systems, including BIM, help architects test layouts and performance before installation, which cuts errors and speeds project work.

Smart production methods support modular systems that improve alignment and allow faster installation, which matters in large commercial sites. Surface treatments such as anti-slip coatings, UV protection, and self-cleaning finishes help slabs perform better in varied climates. Customization is also rising. Developers now want designs that match brand goals or landscape themes, and CAD tools help producers offer a wide range of finishes, colors, and formats.

These advances raise efficiency and help manufacturers deliver higher-value, differentiated slabs. This trend will grow further in premium commercial projects where appearance, reliable performance, and innovation guide material choices..

Segmental Insights

Application Insights

Walkways & Pedestrian

Areas segment dominated the Commercial Paving Slabs Market in 2024 and is

projected to maintain its leadership throughout the forecast period, driven by

the increasing need for durable, safe, and visually appealing public spaces.

Urbanization and infrastructure development have led to a surge in the

construction of commercial walkways, plazas, sidewalks, and pedestrian zones

across cities worldwide. These areas not only serve as essential connectors

within commercial environments but also enhance the overall aesthetic and

functionality of outdoor spaces. Commercial paving slabs are widely favored in

such applications due to their strength, longevity, low maintenance, and wide

range of design options.

Governments and

municipalities are placing greater emphasis on creating walkable urban

environments to encourage healthier lifestyles, reduce vehicular traffic, and

promote tourism. This trend is especially strong in regions with active urban

planning initiatives such as Europe, North America, and parts of Asia-Pacific.

The demand for slip-resistant, weather-resistant, and easy-to-install slabs has

risen, particularly in commercial areas like shopping centers, office

complexes, parks, and transport terminals.

Moreover, the push toward

sustainability is influencing the choice of materials for walkways, with

permeable and eco-friendly paving slabs gaining preference to manage stormwater

and reduce urban heat islands. With continuous innovation in design and materials,

the Walkways & Pedestrian Areas segment is expected to maintain its leading

position in the commercial paving slabs market in the foreseeable future.

Download Free Sample Report

Regional Insights

Largest Region

North America dominated the Commercial Paving Slabs

Market in 2024 and is anticipated to maintain its leadership throughout the

forecast period, driven by strong infrastructure development, urban renewal

projects, and the growing focus on sustainable and aesthetic outdoor design.

The United States and Canada have witnessed consistent investment in commercial

construction, including shopping malls, business districts, educational

campuses, and public spaces such as parks and plazas. This has created a high

demand for durable, visually appealing paving solutions suitable for heavy foot

traffic and varying climate conditions.

One of the key reasons for North America's

dominance is its early adoption of innovative construction technologies and

materials. The region has seen a strong shift toward the use of permeable and

eco-friendly paving slabs, which support stormwater management, meet

environmental regulations, and align with LEED and other green building

standards. In addition, local governments and urban planners are placing

increased emphasis on creating walkable cities, leading to more

pedestrian-friendly zones that require high-quality paving materials.

The presence of well-established manufacturers, a

mature construction industry, and widespread availability of advanced design

and installation techniques have further supported the market’s growth.

Moreover, consumer preferences in North America favor customized and

high-performance slab options that complement modern architectural styles. With

continued investments in infrastructure modernization and sustainable urban

design, North America is expected to maintain its leadership position in the

commercial paving slabs market in the coming years, setting benchmarks for

innovation and quality in commercial paving applications.

Emerging Region

South America is the emerging region in the Commercial

Paving Slabs Market, fueled by increasing urbanization, infrastructure

investments, and a growing emphasis on public space enhancement. Countries such

as Brazil, Argentina, Chile, and Colombia are witnessing significant

development in commercial construction, including shopping complexes, business

districts, tourist destinations, and public transport terminals. As these

countries work to modernize their urban infrastructure, the demand for durable

and visually appealing paving solutions is on the rise.

Government-led urban renewal programs and private

sector investments are driving the development of walkways, plazas, and

pedestrian-friendly zones in major cities. There is also an increasing focus on

improving the quality of public spaces to support tourism and local economic

activity, particularly in areas with high foot traffic. As a result, commercial

paving slabs are gaining traction due to their long lifespan, low maintenance,

and design flexibility.

While cost has traditionally been a barrier to

market expansion in the region, the availability of cost-effective materials

and locally produced paving solutions is improving market accessibility. In

addition, there is a growing awareness of environmentally friendly construction

practices, leading to rising interest in permeable and recycled paving slabs.

With economic recovery in progress and

infrastructure funding improving in several South American countries, the

region is positioned to see strong growth in the commercial paving slabs

market. Its untapped potential, combined with shifting construction trends,

makes South America a key emerging market for industry players in the years

ahead.

Recent Developments

- In June 2024, SiteOne Landscape Supply acquired AC Florida Pavers, which operates as Hardscape.com. The deal expands SiteOne’s hardscape reach across the U.S. and Canada through four Florida sites in Boca Raton, Fort Myers, Tampa, and Jupiter, and gives the company exclusive access to Saxa Gres Italian porcelain outdoor pavers.

- In July 2024, Wells acquired GATE Precast to widen its footprint and diversify its prefabricated building lineup. The move strengthens Wells’ ability to deliver complete precast concrete systems, including paving slabs and structural parts across several sectors.

- In August 2024, Oldcastle APG, a CRH company, bought Master Block, Inc., a concrete block producer in El Mirage, Arizona. This deal boosts Oldcastle APG’s masonry and fence block capacity in the Phoenix area and supports rising demand in the fast-growing Southwest region.

- In September 2025, CRH finalized its USD 2.1 billion purchase of Eco Material Technologies, first announced in July 2025. The acquisition brings a leading North American SCM supplier into CRH’s operations and supports its shift toward advanced cement and concrete solutions used in paving and core infrastructure projects.

- In July 2025, Trinity Hunt Partners made a majority investment in DACS Asphalt & Concrete to build a commercial paving services platform. The investment supports expansion plans through strategic deals and organic growth across North America.

- May 2025 – Nicolock Paving Stones, Retaining Walls, and Outdoor Living, a leading provider of premium hardscape solutions, proudly unveils its new Design Studios. These innovative spaces are thoughtfully created to help homeowners bring their outdoor living dreams to life—offering a seamless journey from concept to completion. Far more than traditional showrooms, the Nicolock Design Studios provide an immersive, hands-on experience. Visitors can visualize how Nicolock’s wide selection of products will look once installed, boosting confidence and making decision-making easier and more intuitive.

- February 2024 – Techo-Bloc announces the exciting debut of its Studio Collection for public spaces—a bold, forward-thinking addition to the landscape architecture world. This groundbreaking collection empowers designers to create custom, futuristic paving layouts, offering over 800 unique design combinations across a rich selection of patterns and color palettes. Designed exclusively for commercial and public landscapes, the Studio Collection brings a fresh surge of inspiration to the design community.

Key Market

Players

- Boral Limited

- Wienerberger

AG

- Tobermore

Concrete Products Ltd.

- Marshalls

plc

- Basalite

Concrete Products, LLC

- Paving

Superstore Ltd.

- Techo-Bloc

Inc.

- Brett

Landscaping and Building Products

|

By Material

|

By

Application

|

By Region

|

- Concrete

- Clay

- Stone

- Crushed

Stone

- Others

|

- Walkways

& Pedestrian Areas

- Patios &

Outdoor Living Spaces

- Parking lots

& Driveways

- Pool Decks

& landscaping

- Others

|

- North

America

- Europe

- Asia

Pacific

- South

America

- Middle East

& Africa

|

Report Scope:

In this report, the Global Commercial Paving Slabs

Market has been segmented into the following categories, in addition to the

industry trends which have also been detailed below:

- Commercial Paving Slabs

Market, By Material:

o Concrete

o Clay

o Stone

o Crushed Stone

o Others

- Commercial Paving Slabs

Market, By Application:

o Walkways &

Pedestrian Areas

o Patios & Outdoor

Living Spaces

o Parking lots &

Driveways

o Pool Decks &

landscaping

o Others

- Commercial Paving Slabs Market, By Region:

o North America

§

United

States

§

Canada

§

Mexico

o Europe

§

Germany

§

France

§

United

Kingdom

§

Italy

§

Spain

o Asia Pacific

§

China

§

India

§

Japan

§

South

Korea

§

Australia

o South America

§

Brazil

§

Colombia

§

Argentina

o Middle East & Africa

§

Saudi

Arabia

§

UAE

§

South

Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies

present in the Global Commercial Paving Slabs Market.

Available Customizations:

Global Commercial Paving Slabs Market report

with the given market data, TechSci Research offers customizations according

to a company's specific needs. The following customization options are

available for the report:

Company Information

- Detailed analysis and

profiling of additional market players (up to five).

Global Commercial Paving Slabs Market is an

upcoming report to be released soon. If you wish an early delivery of this

report or want to confirm the date of release, please contact us at [email protected]