Forecast Period | 2026-2030 |

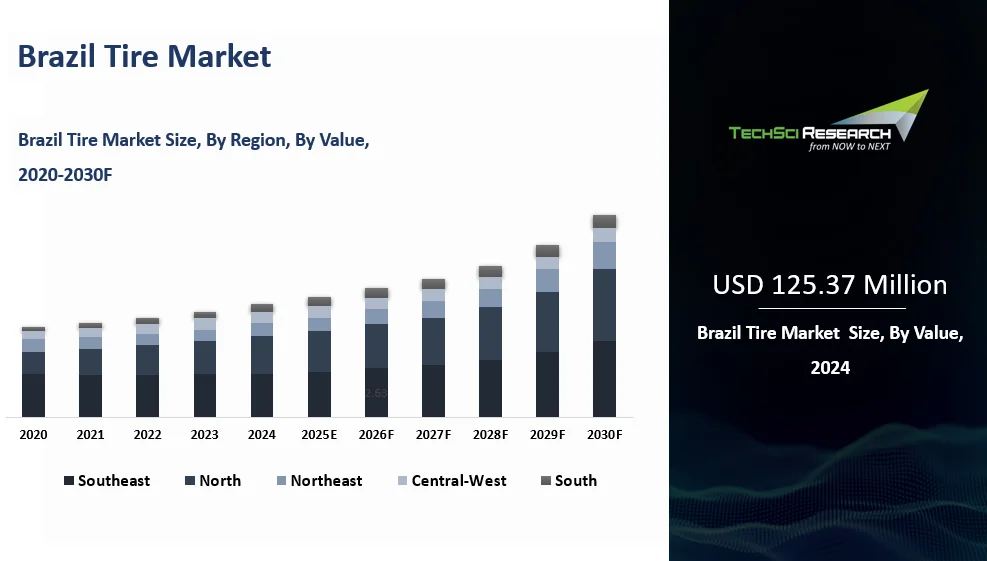

Market Size (2024) | USD 125.37 Million |

CAGR (2025-2030) | 5.51% |

Fastest Growing Segment | Passenger Cars |

Largest Market | Southeast |

Market Size (2030) | USD 172.96 Million |

Brazil Tire Market Overview:

Brazil Tire Market was valued at

USD 125.37 Million in 2024 and is expected to reach USD 172.96 Million by 2030

with a CAGR of 5.51% during the forecast period. The prospects of the

Brazilian tire market are bright due to a well-developed automotive industry as

well as the previously mentioned history of market growth. The case of market

has recorded massive growth in the past few years attributed to the following

factors which depicts the growth potential of the market. The sales of

automobiles have increased greatly due to an increase in the middle class

population and better standard of living which has in turn created a huge

market for tires. As a part of this, as of October 2024, Brazil's new

vehicle market expanded dramatically in September 2024, with sales up 19.57

percent over the previous year. The National Federation of Motor Vehicle

Distribution (ANFAVEA) reported 236,353 units sold. With increasing

number of car owners as more Brazilians are able to afford cars, there will be

demand for new tires as well as replacement ones. As such, this trend generates

a constant stream of demand for tire manufacturing companies and distributors, which

forms a stable market base. The growth of the vehicle population guarantees an

ever-growing market for both the original equipment and replacement tires.

Key Report Takeaways

- Rising vehicle ownership and expanding middle-class population driving sustained OE and replacement tire demand, supported by over 2 million registered freight trucks nationwide.

- Passenger car segment leading 2024 market share fueled by consumer preference for durability, fuel efficiency, low noise, and safety, alongside EV growth (+91% sales increase to 93,927 units in 2023 per Brazilian Electric Vehicle Association).

- Commercial vehicle and logistics expansion strengthening tire consumption with road freight accounting for over 60% of total cargo transport (per Ministry of Infrastructure), increasing demand for heavy-duty, long-haul tires.

- Southeast Brazil dominating regional demand driven by dense urbanization, strong automotive production, major freight corridors linking São Paulo and Rio de Janeiro, expanding e-commerce fleets, and presence of key players such as Bridgestone Corporation, Michelin Group, and Continental AG.

Brazil Tire Market Drivers

Growing Automotive Industry

A major factor that influences

the Brazil tire market greatly is the growth of cars and the automotive

industry in the country. Since Brazil is one of the biggest automotive markets

in Latin America, the need for the both passenger and commercial vehicles

remains high. This growth is as a result of rising middle income earners who

have a higher purchasing power as well as higher demand for personal transport.

Automotive production capacity and new car models in Brazil also boost the tire

demand as new plants are established. Also, expansion of the automotive

industry leads to demand for replacement tires because of the wear and tear of

vehicles, thus boosting the demand for tires. This has led to manufacturers

raising their production capacities and their portfolios to accommodate various

car models, right from the compact ones to the large trucks.

Infrastructure Development

One of the major driver is the

construction-related projects which are ongoing in Brazil such as road

construction and rehabilitation which are aiding the tire market. Investments

in infrastructure such as highways, urban roads, and rural roads is increasing

the consumption of commercial as well as heavy-duty tires driven by the

government. Improved access and roads ensure that the transportation is easier

and safer hence promoting the use of vehicles and in extension tires hence

increased demand. Commercial vehicle related infrastructure projects not only

help expand the commercial vehicle industry but also the demand for

long-wearing and highly-performing tires that can handle different

terrains. According to the Brazilian Institute of Geography and

Statistics (IBGE), the country’s road network extends 1.72 million km, with

more than 65% unpaved, increasing tire wear rates and replacement

frequency. Outlays for infrastructure are expected to persist, which

would complement tire market development as new and improved roads improve

supply chain and transportation.

Technological Advancements

The Brazil tire market is

growing due to the innovations in technology used in manufacturing and

designing of tires. Technological developments of new materials for tires,

better patterns of treads, and efficient methods of construction of tires are

resulting in ever improving high performing, economical, and durable tires.

These technological enhancements ensure that some of the major issues that

concern the consumer like safety, performance, and cost, are well catered for.

For instance, the incorporation of smart tire technologies that enable

monitoring of pressure and temperature of the tires improves the safety and

precision of vehicles. Thus, as consumers and businesses in Brazil get informed

on such developments, the market call for technologically superior tires rises.

Manufacturers are inbound in their tire research and development endeavors to

be able to produce better solutions that can meet the needs of the market and

this has created a constant flood of new tires into the market.

Download Free Sample Report

Brazil Tire Market Challenges

Economic Instability

Fluctuations in the economic

status of Brazil is an issue that affects the tire market. High inflation

rates, volatilities in the exchange rate and changes in economic cycles depress

the consumers’ purchasing power and therefore affect the sales of vehicles. In

the course of economic crisis, people as customers and automotive companies may

decide to postpone or even cancel purchases of new tires thus resulting to cost

cutting. This reduced demand has an impact on tire manufacturers and

distributors who may stand to lose their revenues and face market

instabilities. Also, economic instabilities can disrupt supply channels,

increase cost of production, and thus reduce the profitability of tyre

manufacturing firms in Brazil. These economic risks have to be managed by

employing business model adaptability and venturing into new markets among

other activities.

Competition from Imported Tires

There is strong competition from

imported tires which create problems to the Brazil tire manufacturers and their

profit margins. Tires that are imported may be cheaper than locally produced

tires because of the lower cost of production or subsidies offered to exporters

in the source countries may pull price-sensitive customers and organisations.

Its outcome is that local manufacturers are forced to lower their prices so as

to match that of imported products without compromising the quality and

performance of the products. Also, the increased imports of tires may affect

the production capacity of the tires and may reduce the market share of the

domestic players. To overcome this challenge, Brazilian tire manufacturers have

to work on the differentiation strategies such as innovation in product and

services, effective operation management and improving the market coverage and

services.

Brazil Tire Market Trends

Rise of Eco-Friendly Tires

The globalization of

eco-friendly tires is gradually rising in Brazil due to more awareness on the

environment and the pressure from laws. Green tires, that are developed with

low rolling resistance, increase fuel economy and thus decrease the emissions of

carbon dioxide and other greenhouse gases into the atmosphere. The consumers

and organizations in Brazil are now developing a sensitivity to the environment

and they want to use tires that support their green initiative. As a result,

tire makers are on the lookout for new products and materials that can be used

in the production of tires which are eco-friendly, for instance, recycled

rubber and bio-based compounds. Further, the advancements in the tires which

help in improving the efficiency in energy usage and recycling of the wastes

are also being developed, which depicts the companies’ concern towards the

environment.

Increase in the Sales of Tires

through E-commerce Channels

The development in the internet

shopping is rapidly shaping the Brazilian tire industry and the growing

customer base and companies are opting to buy tires online. This he says is due

to the ease of shopping online and the added factor of comparing prices and

product varieties. Online platforms also have other related services like tire

delivery and appointment for installation thus improving the experience of the

customers. Tire retailers and manufacturers are also focusing on the

digitalization of the market and creating easy-to-use web interfaces to reach

this emerging demographic. It is anticipated that the trend of selling tires

online is gradually increasing, primarily due to the factors such as

development in technology and the growing preference of customers for ease of

access.

Focus on Tire Retreading

The tendency of retreading is

growing in Brazil due to its effectiveness and environmental friendliness as a

solution to getting more use from the tires. Retreading is a process by which

the usable tread of the used tire is revived and restored by putting a new

tread on the tire. These steps not only present a vast amount of savings than

buying new tires but also contribute to the conservation of the planet by

minimizing the use of new products. In the past decade, a number of companies,

especially in Brazil, have shifted to this process in the management of their

operations costs and sustainability, especially those in the transport and

logistics industries. A continuous technological progress with regard to the

retreading technologies and the enhancements of the quality requirements are

additional factors supporting this development, which makes retreaded tires

suitable and competitive for various applications.

Segmental

Insights

Vehicle

Type Insights

In 2024, the market is led by

the passenger car tire segment due to its huge share and acceptance by

consumers. Nevertheless, the commercial vehicle tire segment is also

significant here, which indicates the variety of vehicles in Brazil, ranging

from personal automobiles to trucks. According to Brazil’s National

Land Transport Agency (ANTT), there are over 2 million registered freight

trucks operating nationwide, creating sustained demand for heavy-duty truck and

bus tires. The passenger car segment due to the demand for tires

that would last longer, consume less fuel, and ensure the safety of the driver

and passengers is constantly growing in Brazil. The observed preferences of

Brazilian consumers are directed to tires providing a comfortable ride,

comfort, and low noise. Thus, tire manufacturers are trying to adapt to such

changes by introducing new technologies that enhance performance and feel.

Features like noise canceling designs and material that improve fuel economy are

now emerging to fit the expectation of Brazilian consumers.

Light trucks and heavy-duty

freight carriers are also a part of the commercial vehicles that are widely

used in the country and contribute to the growth of the tire market in Brazil.

These are mainly used in the transport of goods and people in the country and

are expected to cover long distances and carry heavy loads hence the need for

strong tires. According to the Ministry of Infrastructure, road freight

accounts for over 60% of total cargo transported in Brazil, sustaining high

consumption of commercial vehicle tires. The main strategic priority

of manufacturers is the development and creation of high-quality tires that are

safe and effective for the transportation processes. The improvements like

deeper tread patterns and stronger shoulder protectors are vital for the

commercial application, especially for the Brazilian terrain. Motor

cycles, used for transport and sporting purposes, is another main category. The

Brazilian terrain ranges from city streets to country tracks and thus requires

tires with excellent adhesion, solidity and flexibility. Motorcycle tires

should be designed to perform on a variety of surfaces including wet roads,

city roads, off-road among others. Manufacturers are thus targeting tire

designs that would offer safety and better performance to the motorcyclists in

dynamic terrains of Brazil. New dynamics emerge from the growing adoption

of electric vehicles (EVs) in Brazil which have added a new twist to the demand

of tires. According to the Brazilian Electric Vehicle Association

(ABVE), EV sales in Brazil rose 91% in 2023, reaching 93,927 units, creating

demand for low-rolling-resistance and specialized EV-compatible tires.

Download Free Sample Report

Regional

Insights

The Southeast region of Brazil

represents the dominating tire market in 2024, driven by its dense

urbanization, strong industrial presence, and concentration of automotive

production facilities. The region accounts for a large share of the nation’s vehicle

ownership, supported by higher disposable incomes and better road

infrastructure compared to other parts of the country. Growing demand from

passenger cars and light commercial vehicles plays a critical role in pushing

tire sales upward, as the region experiences a continuous rise in personal

mobility and logistics requirements. Expanding fleets serving e-commerce and

retail distribution channels are also creating steady replacement demand,

further reinforcing market momentum.

The region benefits from

significant infrastructure development and investment in transport

connectivity, encouraging higher vehicle utilization and accelerating tire

consumption. Road freight corridors that connect major urban centers such as

São Paulo and Rio de Janeiro continue to generate strong demand for truck and

bus tires, while the expansion of ride-hailing and delivery services is

increasing the need for durable tires in the two-wheeler and light commercial

segment. Growth in electric vehicle adoption in metropolitan areas is also

expected to influence the preference for advanced tire technologies, adding

further layers to market expansion.

Recent

Developments

- At Agrishow 2025, Ascenso unveiled the

FTB 190 HD (I-3), Brazil’s first and only 600/50-22.5 high-flotation tire

with 20 plies, designed for sugarcane trailers and wagons. Capable of

carrying 1,000 kg more than similar-sized conventional tires, it offers

high load capacity, durability in severe conditions, and reduced soil

compaction. The model features a reinforced casing, larger contact patch

for stability, and a tread compound resistant to cuts and stubble damage.

With over 35 years of expertise, Ascenso is expanding in Brazil to meet

local agricultural needs, highlighting the country’s strong growth

potential in heavy-duty agricultural machinery applications.

- In 2023, Mitas introduced its AGRITERRA

02 SP “Soil Protector” tire to the Brazilian market at Agrishow 2023,

designed for modern agricultural vehicles. Featuring Very High Flexion

(VF) technology, it boosts load capacity by 40% while minimizing soil compaction.

The tire’s low inflation pressure improves traction, ground protection,

and durability, aided by hexa-core construction and steel breakers.

Alongside, Mitas also showcased the AGRITERRA 04 for non-driven wheels and

the HC 3000 range with Cyclical Field Operation (CFO) technology, both

popular in Brazil’s agricultural sector for enhancing performance, fuel

efficiency, and reducing wear in demanding field conditions.

- In 2022, Bridgestone Brazil has announced

an additional investment in its tire production plant in Camacari, in the

state of Bahia. The company has invested more than USD 14.7 million in the

modernization and expansion of the factory, which brings the company's

total investments announced since 2021 to more than USD 53.1 million for

the Bahia plant.

- In 2023, an agreement has been signed by

Pirelli for the acquisition of 100% of Hevea-Tec which is Brazil’s largest

independent processor of natural rubber holding an enterprise value of

approximately USD 22.8 million. The acquisition has enabled Pirelli to

significantly increase its natural rubber supply in Latin America and

ensure continuity in the region, and Pirelli also has plans to increase

production volumes at Hevea-Tec.

Key

Market Players

- Bridgestone Corporation

- Continental AG

- Goodyear Tire & Rubber Company

- Sumitomo Rubber Industries, Ltd

- Michelin Group

- Pirelli & C. S.p.A.

- Yokohama Rubber Company Limited

- Kumho Tire Co. Inc.

- Hankook Tire & Technology Co., Ltd

- Toyo Tires Brasil

|

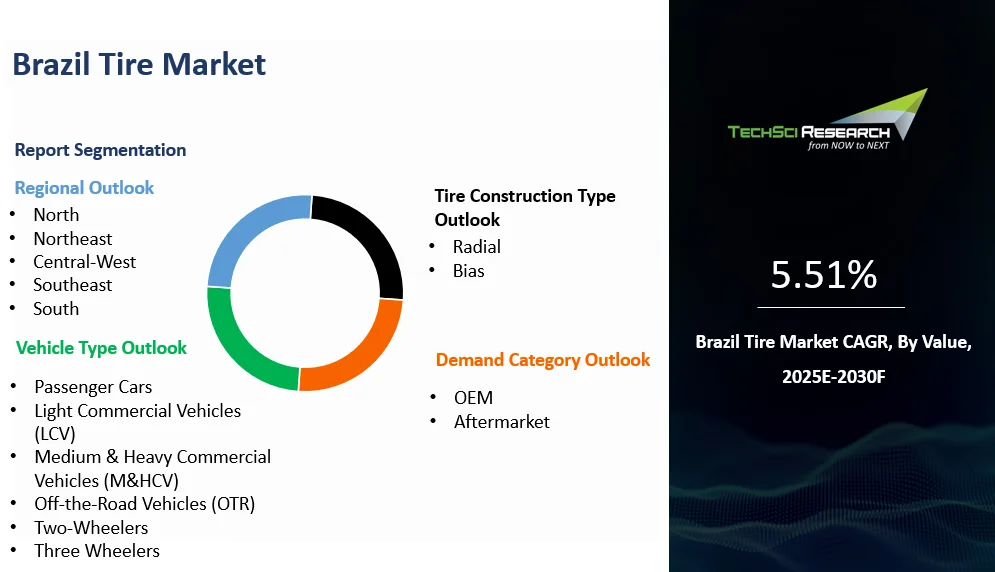

By

Vehicle Type

|

By

Tire Construction Type

|

By

Demand Category

|

By

Region

|

- Passenger Cars

- Light Commercial Vehicles (LCV)

- Medium & Heavy Commercial Vehicles (M&HCV)

- Off-the-Road Vehicles (OTR)

- Two-Wheelers

- Three Wheelers

|

|

|

- North

- Northeast

- Central-West

- Southeast

- South

|

Report

Scope:

In this

report, Brazil Tire Market has been segmented into the following

categories, in addition to the industry trends which have also been detailed

below:

- Brazil Tire Market, By

Vehicle Type:

o Passenger

Car

o Light

Commercial Vehicle (LCV)

o Medium

& Heavy Commercial Vehicles (M&HCV)

o Off-the-Road

Vehicles (OTR)

o Two-Wheeler

o Three

Wheelers

- Brazil Tire Market, By Tire

Construction Type:

o Radial

o Bias

- Brazil Tire Market, By

Demand Category:

o OEM

o Replacement

- Brazil Tire Market, By

Region:

o North

o Northeast

o Central-West

o Southeast

o South

Competitive

Landscape

Company

Profiles: Detailed

analysis of the major companies present in the Brazil Tire Market.

Available

Customizations:

Brazil

Tire Market report with the given market data, TechSci Research

offers customizations according to a company's specific needs. The following

customization options are available for the report:

Company

Information

- Detailed analysis and profiling of additional

market players (up to five).

Brazil

Tire Market is an upcoming report to be released soon. If you wish an early

delivery of this report or want to confirm the date of release, please contact

us at [email protected]